The right way to write a letter stating deductible to employer? This complete information gives a step-by-step method to efficiently submitting deductible claims to your employer. It delves into the intricacies of understanding deductible claims, from the basic definitions to the essential documentation wanted for a clean reimbursement course of. We’ll discover the required letter construction, supporting documentation necessities, and techniques for dealing with potential objections.

Navigating the method of claiming reimbursements may be tough, however this information simplifies the process. From understanding the authorized framework to avoiding frequent errors, this detailed Artikel empowers you with the information and instruments to maximise your probabilities of success.

Understanding Deductible Claims

A deductible, within the context of employer reimbursements, is a certain amount of bills an worker should pay out-of-pocket earlier than the employer begins to cowl the prices. This threshold is commonly a vital ingredient in understanding and managing healthcare bills. Understanding the deductible helps staff finances and anticipate the monetary dedication required for varied medical or different lined companies.Deductibles are designed to encourage cost-consciousness and handle the general value of healthcare or different eligible bills.

They supply a transparent boundary between the worker’s duty and the employer’s reimbursement dedication. Correct record-keeping and understanding the specifics of your employer’s plan are important for claiming reimbursements successfully.

Definition of Deductible Bills

A deductible represents the quantity of bills an worker should pay earlier than their employer begins protecting medical, dental, or different eligible bills. It acts as a monetary threshold, making certain staff share a portion of the prices. Employers usually set completely different deductibles for varied classes of bills.

Kinds of Deductible Claims

Varied kinds of bills qualify for employer reimbursements, usually with distinct deductibles. These classes generally embrace medical bills, dental bills, imaginative and prescient care, and even some over-the-counter drugs relying on the employer’s plan. It is important to grasp the particular kinds of claims your employer covers to make sure correct documentation and declare processing.

Significance of Correct Documentation

Correct documentation is crucial when claiming reimbursements for deductible bills. This ensures correct categorization and approval of the bills. Clear and detailed data of bills, together with dates, descriptions, receipts, and any required supporting paperwork, are important for processing the claims effectively and avoiding delays. Thorough documentation minimizes potential points throughout the declare assessment course of.

Widespread Deductible Bills

This desk Artikels frequent deductible bills for varied classes, providing a fast reference for workers. Observe that particular quantities and protection fluctuate considerably primarily based on the employer’s plan. At all times seek the advice of your employer’s coverage for essentially the most up-to-date data.

| Class | Examples of Bills |

|---|---|

| Medical | Physician visits, hospital stays, prescription drugs, lab assessments, bodily remedy |

| Dental | Examine-ups, cleanings, fillings, crowns, bridges |

| Imaginative and prescient | Eye exams, eyeglasses, contact lenses |

| Different | Eligible over-the-counter drugs (confirm along with your employer), some preventive care (test your plan particulars) |

Letter Construction and Format

Crafting a transparent {and professional} letter requesting a deductible declare out of your employer is essential for a clean and environment friendly course of. This structured method ensures your declare is known and processed promptly. The letter’s format and language instantly impression its effectiveness.Understanding the particular format and language components for this letter is paramount. A well-structured letter will expedite the processing of your declare and guarantee your employer absolutely understands your request.

The following sections will element the construction and language components to make use of for optimum effectiveness.

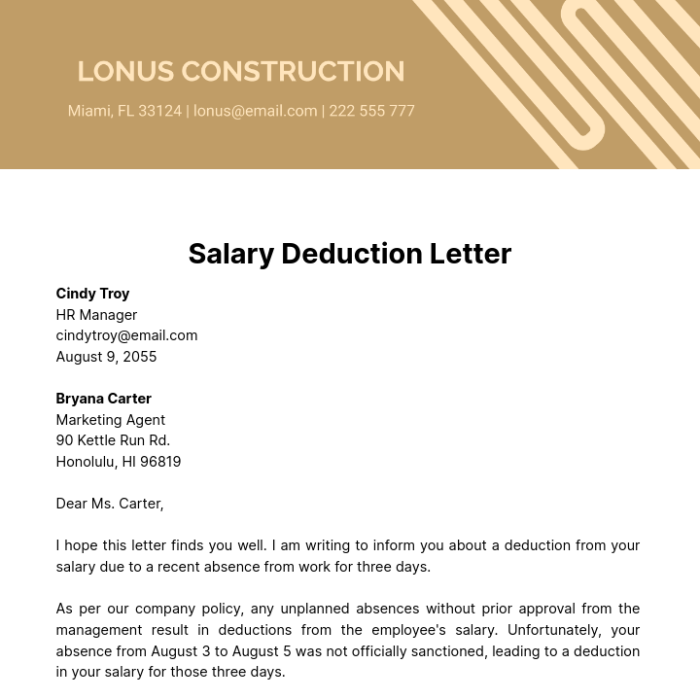

Letter Template, The right way to write a letter stating deductible to employer

This template gives a structured format for requesting a deductible declare out of your employer. The organized structure ensures readability and completeness.

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Employer Name] [Employer Address] Topic: Deductible Declare Request - [Your Name] -[Policy Number, if applicable] Pricey [Employer Contact Person, if known, otherwise use title like "Dear HR Department"], This letter formally requests the processing of my deductible declare for [brief description of deductible, e.g., medical expenses, accident claim]. Related documentation, together with [list key documents, e.g., medical bills, receipts, accident report], is connected on your assessment. [Optional: Briefly explain the reason for the claim, e.g., "I incurred these expenses as a result of a recent accident."]. I request that you simply course of my declare in accordance with the phrases Artikeld in our [Policy Name or Company Policy Document].Please advise on the following steps for processing my declare. Thanks on your time and a focus to this matter. Sincerely, [Your Signature] [Your Typed Name]

Parts of the Letter

The letter ought to embody a number of key components offered in a logical order, making certain readability and conciseness. Every part contributes to an entire and comprehensible declare.

- Header: Contains your contact data and the employer’s contact data. The date is crucial. The topic line ought to clearly state the aim of the letter.

- Introduction: Clearly state the aim of the letter, requesting a deductible declare. Point out the kind of deductible declare, utilizing exact language.

- Particulars: Present a concise abstract of the bills. Connect supporting paperwork like receipts and payments to substantiate your declare. Clarify the rationale for the declare, if applicable.

- Request: State your request for processing in accordance with firm coverage, and inquire in regards to the subsequent steps.

- Closing: Categorical gratitude and reiterate your dedication to the declare course of.

Skilled Language Examples

Utilizing exact {and professional} language all through the letter enhances its credibility and effectivity. The next examples show this.

- As a substitute of: “I had some medical payments.”

Use: “I incurred medical bills totaling [amount] as a result of [brief reason].” - As a substitute of: “I am asking for the deductible.”

Use: “I request the processing of my deductible declare in accordance with our firm coverage.” - As a substitute of: “The papers are connected.”

Use: “Supporting documentation, together with medical payments and receipts, is connected on your assessment.”

Formatting for Readability

Correct formatting enhances the letter’s readability and professionalism.

- Use a transparent and constant font.

- Keep correct spacing between paragraphs.

- Use bullet factors or numbered lists for complicated data.

- Make sure the letter is concise and avoids pointless jargon.

Supporting Documentation

Offering satisfactory supporting documentation is essential for efficiently processing deductible claims. This meticulous documentation verifies the bills incurred and ensures the employer’s honest and correct reimbursement. Thoroughness on this step is essential to minimizing delays and potential disputes.

Supporting documentation serves because the bedrock of a legitimate deductible declare. It acts as irrefutable proof, substantiating the incurred bills and demonstrating their direct connection to the worker’s want. With out correct documentation, the declare could also be rejected or considerably delayed.

Kinds of Supporting Paperwork

Correct documentation entails varied kinds of supporting supplies. These embrace, however usually are not restricted to, receipts, invoices, and medical payments. These paperwork are basic to the verification course of and must be collected diligently.

- Receipts: Receipts function tangible proof of cost for the incurred bills. They usually embrace particulars like date, time, quantity, and outline of the acquisition. They need to clearly point out the connection between the expense and the worker’s deductible declare.

- Invoices: Invoices are important when the bills are incurred from a vendor or service supplier. These paperwork element the service rendered, portions, charges, and complete quantities owed. Make sure the bill aligns with the deductible declare’s scope.

- Medical Payments: Medical payments are essential for demonstrating the price of medical therapies, procedures, or consultations. They usually embrace particulars such because the date of service, prognosis, procedures carried out, and the full quantity charged.

Format and Group of Paperwork

The format of supporting paperwork must be constant and simply comprehensible. A structured method to organizing paperwork will considerably facilitate the assessment course of. It will streamline the declare and forestall any pointless delays.

- Receipt Group: Set up receipts chronologically, grouping them by the date of buy. Label every receipt clearly, together with the date, description, and quantity. Think about using a spreadsheet to record these particulars for simpler referencing.

- Bill Group: Invoices must be organized in an identical method to receipts, grouping them by the date of service or buy. Every bill must be accompanied by a short description of how the service or product pertains to the deductible declare.

- Medical Invoice Group: Medical payments must be organized chronologically, itemizing every invoice by date of service. Embrace a short clarification of how every service or process is expounded to the worker’s deductible declare. If doable, prepare these payments in a logical order, resembling by process, prognosis, or therapy plan.

Compilation Process

A well-defined process for compiling these paperwork will forestall omissions and guarantee all needed components are included. This systematic course of is significant for the correct and environment friendly processing of deductible claims.

- Collect All Paperwork: Accumulate all related receipts, invoices, and medical payments associated to the deductible declare. Be meticulous in gathering all paperwork, even when they appear insignificant.

- Set up Chronologically: Organize the paperwork chronologically by the date of the service or buy. This gives a transparent and concise presentation of the bills.

- Doc Verification: Completely assessment all paperwork to make sure accuracy. Cross-check particulars like dates, quantities, and descriptions to forestall errors.

- Keep Documentation: Retailer the compiled paperwork securely and guarantee they’re simply accessible for reference if wanted. Keep copies of those paperwork in a secure place for future reference.

Addressing Potential Objections

Navigating employer responses to deductible claims requires a proactive and well-structured method. A preemptive technique, outlining potential considerations and providing options, can streamline the method and facilitate a smoother decision. Understanding frequent objections and formulating efficient counterarguments is essential to efficiently asserting your declare.

Potential Employer Objections

Employers might elevate varied objections to deductible claims. These objections usually stem from differing interpretations of coverage phrases, lack of supporting documentation, or perceived misuse of advantages. Thorough preparation and a transparent articulation of your declare are essential to addressing these considerations.

Methods for Addressing Objections

An expert and diplomatic method is significant when confronting potential employer objections. Emphasize the significance of correct record-keeping and the necessity for readability in profit administration. A well-organized presentation, coupled with concise and factual arguments, will strengthen your place.

- Documentation Points: Employers may request extra documentation to validate your declare. Having complete data, together with receipts, invoices, and medical reviews, is crucial. An in depth clarification of the incurred bills and their relation to the coverage’s stipulations will bolster your case. Offering a complete abstract of the bills and their supporting documentation, demonstrating a transparent understanding of the coverage, will alleviate considerations.

- Coverage Interpretation Discrepancies: Variations in interpretation of coverage phrases can result in objections. Familiarize your self with the exact wording of your deductible coverage. If ambiguity exists, check with official documentation, clarifying the particular phrases that relate to your scenario. Exactly outlining how your bills fall below the outlined phrases of the coverage will resolve any misunderstandings. Highlighting particular clauses and their applicability to your case strengthens your declare.

- Timeliness Considerations: Delays in submitting or processing claims can result in objections. Adhere to deadlines Artikeld in your employer’s coverage. If delays happen as a result of unexpected circumstances, talk these points promptly to the related personnel. Guarantee all correspondence is meticulously documented and timed for future reference, which may mitigate considerations associated to timing.

Resolving Disputes

Disputes regarding deductible claims must be approached with a collaborative spirit. Sustaining open communication along with your employer’s advantages division is crucial. A proactive method, emphasizing understanding and a want for decision, will facilitate a smoother course of.

- In search of Clarification: For those who encounter ambiguities, request clarification relating to the coverage’s stipulations. Formal written requests, clearly outlining the areas of uncertainty, will keep away from misinterpretations and pave the way in which for a extra correct evaluation of your declare.

- Negotiation Methods: A constructive dialogue along with your employer’s advantages consultant can assist discover a mutually acceptable answer. Highlighting the reasonableness of your declare and demonstrating your understanding of the coverage will strengthen your case. Current a transparent abstract of your declare, specializing in the proof and the way it aligns with the coverage’s phrases, selling mutual understanding and cooperation.

- Formal Grievance Procedures: If negotiations fail, pay attention to the formal grievance procedures established by your employer or the insurance coverage supplier. Following these established procedures will present a structured method to handle the difficulty and probably escalate it if needed. Thorough documentation and adherence to the outlined grievance decision course of will facilitate a more practical decision.

Authorized Issues

Navigating the authorized panorama surrounding worker deductions requires a meticulous understanding of the related legal guidelines and laws. This part delves into the authorized framework, highlighting key facets of reimbursement insurance policies, and evaluating varied firm insurance policies to offer a complete overview. Cautious consideration to those particulars is essential to make sure a clean and compliant course of for each the worker and the employer.

Understanding the authorized framework surrounding worker deductions is crucial to keep away from potential conflicts and guarantee a good course of. This entails comprehending the particular legal guidelines and laws governing reimbursements, recognizing the nuances in firm insurance policies, and in the end, presenting a declare that aligns with established authorized precedents.

Authorized Framework for Worker Deductions

The authorized framework for worker deductions is multifaceted, encompassing varied federal and state legal guidelines. Laws usually Artikel the permissible deductions, required documentation, and procedures for processing claims. This framework goals to guard worker rights and guarantee honest therapy.

Related Legal guidelines and Laws Relating to Reimbursements

A number of legal guidelines and laws govern reimbursement claims, significantly these associated to enterprise bills. Inner Income Service (IRS) tips usually outline the appropriate bills and the required supporting documentation. State legal guidelines may impose particular necessities, and a complete understanding of those numerous laws is significant.

Comparability of Firm Insurance policies

Totally different corporations usually have various insurance policies relating to worker reimbursements. Some corporations might have stricter tips relating to the kinds of bills lined or the required documentation, whereas others might provide extra versatile approaches. Inspecting these variations is essential to grasp the potential scope of claims and the way they might fluctuate primarily based on the particular employer’s insurance policies.

Laws and Examples

| Regulation Space | Description | Instance |

|---|---|---|

| IRS Publication 502 | Gives steerage on enterprise bills and deductions. | Describes the kinds of business-related bills which might be deductible, resembling journey, meals, and leisure. |

| State Tax Laws | Could impose particular necessities on reimbursement claims, probably differing from federal laws. | A state might have particular guidelines for meal bills incurred whereas touring for enterprise functions. |

| Firm Insurance policies | Inner insurance policies that Artikel procedures and documentation for worker reimbursements. | An organization might require receipts for all bills exceeding a sure threshold. |

| Labor Legal guidelines | Laws that defend worker rights and guarantee honest therapy within the office. | Legal guidelines might prohibit discrimination in reimbursement practices primarily based on worker demographics. |

Addressing Potential Discrepancies

Figuring out and addressing potential discrepancies between firm insurance policies and authorized laws is crucial. This requires a radical understanding of each the employer’s inner insurance policies and the related authorized framework. Discrepancies may come up from ambiguities in insurance policies or the particular necessities of sure laws.

Finest Practices and Ideas: How To Write A Letter Stating Deductible To Employer

Submitting a deductible declare successfully requires cautious planning and execution. A well-structured and clearly offered letter considerably will increase the chance of a swift and optimistic decision. Following finest practices ensures a clean course of for each the worker and the employer. Clear communication and meticulous consideration to element are essential components for achievement.

Thorough preparation and adherence to the employer’s particular declare procedures are paramount for a optimistic consequence. A well-written letter, accompanied by the required supporting documentation, demonstrates a proactive method to resolving the declare.

Submitting the Declare Letter

Cautious consideration of the letter’s construction, language, and presentation enhances the probabilities of a immediate and optimistic response. This part particulars key components for an efficient declare submission.

- Skilled Tone and Readability: Keep an expert tone all through the letter. Keep away from ambiguity or emotional language. Use exact language and make sure the letter’s message is well understood. Readability and conciseness are key. As an example, as a substitute of “I imagine my deductible is…” write “My deductible declare is calculated as…” This method fosters readability and avoids potential misunderstandings.

- Correct and Full Data: Present all needed particulars precisely. Incorrect or incomplete data can delay or reject the declare. Double-check all figures, dates, and different pertinent data to make sure accuracy. This contains particulars in regards to the deductible quantity, the dates of service, and any related medical codes.

- Exact and Particular Language: Use particular and exact language to explain the deductible declare. Obscure language can result in confusion and delays. For instance, as a substitute of “vital medical bills,” state the precise quantity and the rationale for the expense.

Supporting Documentation

The energy of a declare usually rests on the supporting documentation. This part highlights the significance of offering related supplies.

- Complete Documentation: Guarantee all required supporting paperwork are included. This will embrace receipts, invoices, payments, medical reviews, or some other related supplies. Set up these paperwork chronologically for readability.

- Correct Formatting: Set up supporting paperwork neatly and logically. Quantity or label every doc for straightforward reference. Embrace an in depth record of the paperwork connected to the letter. A well-organized presentation demonstrates a critical {and professional} method to the declare.

- Copies and Originals: Submit each copies and originals of essential paperwork, as requested by the employer. Retain copies on your data. This ensures a transparent file for each events.

Communication Methods

Efficient communication performs a significant function within the declare course of. This part Artikels methods for clear and well timed communication.

- Proactive Communication: Keep open communication with the employer relating to the declare standing. Request updates or clarifications when needed. This proactive method exhibits your dedication to resolving the declare promptly.

- Following Up: Observe up with the employer if there’s a delay in processing the declare. This proactive follow-up ensures the declare isn’t ignored.

- Addressing Considerations: Be ready to handle any potential objections from the employer. This proactive method can assist forestall pointless delays or issues.

Dealing with Rejection and Appeals

Navigating the rejection of a deductible declare may be irritating, however a scientific method and understanding of the method can considerably improve your probabilities of success. A transparent and well-documented enchantment, supported by compelling proof, is essential for efficient advocacy. This part will Artikel the process for dealing with a rejected declare, and the steps concerned in interesting the choice.

A rejected declare does not essentially imply the tip of the method. Understanding the explanations for rejection and learn how to handle them, coupled with a robust enchantment, can usually result in a good consequence. This information gives sensible methods for crafting an efficient enchantment letter and navigating the enchantment course of.

Process for Dealing with a Rejected Declare

The preliminary step upon receiving a rejection discover is cautious assessment. Completely study the rejection letter, noting the particular causes cited for denial. Establish any supporting documentation you may must counter the objections. This contains reviewing the declare kind, medical data, and any correspondence associated to the declare. Understanding the grounds for rejection is crucial for crafting a compelling enchantment.

Technique of Submitting an Enchantment

The enchantment course of usually entails following a selected protocol Artikeld by the insurance coverage supplier or employer. This usually entails submitting a written enchantment inside a prescribed timeframe. The enchantment ought to clearly state the explanations for the unique declare, the particular factors of disagreement with the rejection, and the supporting documentation. Be meticulous in documenting every step of the method, together with dates, names of people contacted, and copies of all correspondence.

Widespread Causes for Rejection and The right way to Deal with Them

- Inadequate Documentation: Guarantee all required medical data, payments, and supporting proof are included within the authentic declare. If there are gaps within the documentation, get hold of any lacking data and clearly clarify the rationale for the delay or absence of the doc.

- Incorrect Prognosis or Process Codes: Evaluate the prognosis and process codes used within the declare kind. If needed, seek the advice of with a healthcare skilled to acquire corrected codes and/or extra documentation. Present proof to assist the correct coding and the medical necessity of the companies.

- Exclusions or Limitations: If the declare is rejected as a result of protection limitations or exclusions, totally assessment your coverage doc. If the exclusion is unclear, request clarification from the insurer. Spotlight particular provisions that may enable for protection.

- Failure to Meet Ready Intervals or Eligibility Necessities: Make sure you perceive the eligibility standards and ready durations. Present any needed documentation that satisfies the circumstances for protection, resembling pre-authorization approvals or proof of eligibility.

- Denial of Medical Necessity: If the declare is rejected primarily based on the medical necessity of the therapy, present extra medical documentation and/or professional opinions to justify the necessity for the service. Spotlight the skilled suggestions and any related scientific tips that assist the therapy.

Format of an Enchantment Letter

A well-structured enchantment letter is essential to success. Embrace a transparent and concise introduction, an in depth clarification of the rejected declare, and a request for reconsideration.

- Heading: Embrace the date, recipient’s title, and make contact with data.

- Assertion of the Declare: Briefly reiterate the main points of the unique declare.

- Causes for Rejection: Clearly state the insurer’s causes for rejection.

- Counterarguments: Present compelling proof and arguments addressing the insurer’s objections. For instance, if the insurer questioned the medical necessity of a service, embrace supporting documentation from a healthcare skilled.

- Supporting Documentation: Connect all related paperwork to assist your declare.

- Request for Reconsideration: Clearly state your request for the declare to be reconsidered.

- Closing: Finish the letter professionally, thanking the recipient for his or her time and a focus.

Avoiding Widespread Errors

Submitting a deductible declare entails meticulous consideration to element. Errors, nevertheless seemingly minor, can result in delays, rejections, and in the end, the denial of your declare. Understanding the potential pitfalls and using preventative measures is essential for a profitable consequence.

Inaccurate Declare Data

Offering incorrect or incomplete data is a standard pitfall. This contains misrepresenting the medical bills, dates of service, or the character of the therapy. Errors in figuring out the right medical suppliers or therapy codes also can trigger delays or rejection. Exact and correct data is paramount. Guarantee all particulars are double-checked for accuracy earlier than submitting.

Fastidiously assessment the documentation offered by the healthcare supplier. If any particulars are unclear, contact the supplier instantly to get the right data.

Lacking or Inadequate Documentation

Failure to offer the required supporting documentation can lead to declare rejection. This usually entails lacking receipts, payments, or different proof of cost. This might additionally embrace missing the required pre-authorization or referrals. Completely collect all related paperwork, together with invoices, receipts, and medical reviews. Set up them chronologically and clearly label every merchandise.

A transparent and complete file of supporting proof is crucial for a clean declare course of.

Late Submission of Claims

Assembly deadlines is crucial for profitable declare processing. Submitting the declare after the stipulated timeframe might result in computerized rejection. Employers usually have particular deadlines for the submission of deductible claims. Repeatedly assessment the employer’s coverage relating to the declare submission deadlines. Set reminders and keep a system to trace essential dates and deadlines.

If unexpected circumstances forestall you from assembly the deadline, promptly contact your employer’s claims division to elucidate the scenario.

Failure to Observe Declare Process

Not adhering to the required declare procedures and codecs can result in delays or rejections. Employers have particular kinds, directions, and tips that should be adopted exactly. Fastidiously assessment the employer’s declare kind and directions. If there are any ambiguities, contact the claims division to hunt clarification. Make sure that the submitted declare adheres to the particular format and necessities Artikeld by the employer.

Ignoring Declare Rejection Notifications

Ignoring rejection notices can hinder your means to enchantment or resubmit a corrected declare. Rejection notices often clarify the rationale for rejection. If the declare is rejected, rigorously assessment the explanations offered. Addressing the problems promptly and resubmitting a corrected declare with the required supporting documentation is crucial.

Lack of Communication

Failing to speak with the employer’s claims division about any points or clarifications can impede the declare course of. In case you have any questions or considerations, contact the claims division instantly. Sustaining open communication with the claims division helps to keep away from misunderstandings and expedite the processing of your declare.

Pattern Letters

Understanding the nuances of a profitable deductible declare, a rejected declare, and an enchantment is essential for navigating the method successfully. These pattern letters illustrate the suitable construction and tone for every situation. They spotlight key components to incorporate, making certain readability and professionalism.

Profitable Declare Letter

This letter demonstrates the construction and content material for a declare that was efficiently processed.

| Part | Content material |

|---|---|

| Date | October 26, 2023 |

| Recipient | Human Sources Division, Acme Company |

| Topic | Deductible Declare – John Smith – Worker ID: 12345 |

| Salutation | Pricey Human Sources Division, |

| Declare Assertion | I’m writing to formally submit my declare for the deductible bills incurred throughout the interval of [Start Date] to [End Date]. These bills relate to [briefly describe the medical expenses]. An in depth breakdown of the bills is connected. |

| Supporting Paperwork |

|

| Supporting Documentation Rationalization | The connected paperwork clearly Artikel the incurred bills and the need of the medical companies rendered. |

| Request | I request reimbursement for the deductible quantity of $[Amount]. |

| Closing | Thanks on your immediate consideration to this matter. Sincerely, John Smith |

Rejected Declare Letter

This letter demonstrates the construction for a rejected declare, outlining the required steps to handle the rejection.

| Part | Content material |

|---|---|

| Date | November 15, 2023 |

| Recipient | Worker Advantages Administrator, ABC Firm |

| Topic | Enchantment of Deductible Declare – Jane Doe – Worker ID: 67890 |

| Salutation | Pricey Worker Advantages Administrator, |

| Declare Abstract | My declare for deductible bills, submitted on [Date of Original Claim], was just lately denied. |

| Causes for Rejection | The denial letter cited [specific reason for rejection, e.g., insufficient documentation, exceeding the coverage limit]. |

| Request for Evaluate | I respectfully request a assessment of my declare, as I imagine the rejection was primarily based on a misunderstanding of the coverage phrases. I’ve connected extra supporting documentation to show the validity of my bills. |

| Supporting Paperwork |

|

| Closing | Thanks on your time and consideration. Sincerely, Jane Doe |

Enchantment Letter

This letter exhibits the suitable format for interesting a rejected declare, emphasizing the significance of addressing the rejection’s particular factors.

| Part | Content material |

|---|---|

| Date | December 5, 2023 |

| Recipient | Worker Advantages Appeals Board, XYZ Company |

| Topic | Enchantment of Deductible Declare – David Lee – Worker ID: 90123 |

| Salutation | To the Worker Advantages Appeals Board, |

| Declare Abstract | My authentic declare for deductible bills, submitted on [Date of Original Claim] and subsequently rejected on [Date of Rejection], is being appealed. |

| Causes for Rejection | The denial letter cited [specific reason for rejection, e.g., insufficient documentation, exceeding the coverage limit]. |

| Addressing the Objections | I imagine the rejection was primarily based on an incomplete understanding of the coverage. The connected documentation clearly demonstrates [explain why the objection is unfounded]. |

| Supporting Paperwork |

|

| Closing | Thanks for contemplating my enchantment. Sincerely, David Lee |

Finish of Dialogue

In conclusion, submitting deductible claims to your employer does not need to be daunting. By meticulously following the Artikeld steps, you’ll be able to guarantee a transparent and concise presentation of your bills. Thorough documentation and understanding the potential objections out of your employer are key. Bear in mind to keep up clear communication and professionalism all through your complete course of. This information gives the required information to navigate the reimbursement course of successfully, permitting you to confidently submit your deductible claims and obtain well timed reimbursements.

FAQ Useful resource

What kinds of paperwork are required to assist a deductible declare?

Supporting paperwork usually embrace receipts, invoices, medical payments, and different related documentation to substantiate the bills claimed.

What ought to I do if my deductible declare is rejected?

Evaluate the explanations for rejection and handle any considerations raised by your employer. If needed, submit an enchantment with extra supporting documentation.

How can I guarantee my letter is straightforward to learn and perceive?

Use clear and concise language, set up the data logically, and format the letter for straightforward readability. Keep away from jargon or overly technical phrases.

What are some frequent errors individuals make when submitting deductible claims?

Widespread errors embrace submitting incomplete or inaccurate documentation, failing to satisfy deadlines, or not following the employer’s particular declare process. Cautious assessment of the employer’s tips earlier than submission is essential.