Low earnings automobile insurance coverage NJ presents distinctive challenges for a lot of drivers. Navigating the complexities of insurance coverage can really feel overwhelming, particularly when affordability is a main concern. This information offers a complete overview of the obtainable choices, serving to you perceive your rights and tasks inside the NJ insurance coverage panorama. It particulars the particular laws and legal guidelines governing automobile insurance coverage in NJ, specializing in affordability choices.

Understanding the elements influencing the price of automobile insurance coverage in NJ is essential. This information examines the particular challenges confronted by low-income people, explores obtainable packages, and compares pricing buildings of normal insurance policies with these designed for low-income drivers. We additionally discover authorities help packages and insurance coverage suppliers specializing in low-income automobile insurance coverage.

Insurance coverage Suppliers in NJ

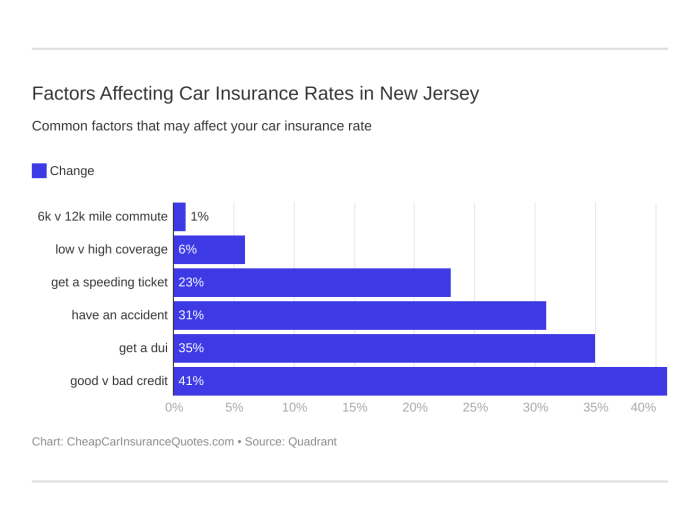

Marga ni sima, di na laho ni sima, di na marsirang ni sima. Discovering reasonably priced automobile insurance coverage in New Jersey could be a difficult process, particularly for low-income people. Understanding the obtainable suppliers and their particular approaches to danger evaluation is essential for navigating this course of successfully.Insurance coverage suppliers in New Jersey make the most of varied strategies to evaluate danger for low-income drivers, together with however not restricted to, credit score historical past, driving report, and site of residence.

Elements like accident historical past and claims frequency additionally play a job. These elements are assessed to find out the suitable premium and protection choices for every driver.

Insurance coverage Suppliers Providing Reductions for Low-Revenue Drivers

A number of insurance coverage suppliers in New Jersey acknowledge the necessity for accessible insurance coverage choices for low-income drivers. These corporations usually provide reductions or specialised packages tailor-made to this demographic. It is very important analysis these suppliers to find out the specifics of their packages and the factors for eligibility.

- State Farm: State Farm usually provides varied reductions, together with reductions for secure driving and multi-car insurance policies, that may doubtlessly cut back premiums for low-income drivers. Their eligibility standards for these reductions might fluctuate, and it is essential to inquire instantly with the corporate about potential reductions.

- Progressive: Progressive has packages aimed toward rewarding secure driving habits, which can translate to decrease premiums for low-income drivers with clear data. Their customer support and particular packages must be investigated.

- Allstate: Allstate would possibly provide reductions for bundling insurance coverage merchandise, equivalent to combining automobile insurance coverage with residence insurance coverage, which might be helpful for low-income drivers searching for complete protection at lowered prices. Examine their particular insurance policies for low-income reductions.

- NJ-based Mutual Corporations: A number of smaller, locally-owned insurance coverage corporations in New Jersey might provide tailor-made packages for low-income drivers. These packages might embody particular reductions or extra versatile protection choices. Direct inquiries and analysis into these corporations’ particular choices are important.

Strategies of Danger Evaluation for Low-Revenue Drivers

Insurance coverage suppliers make the most of quite a lot of elements to evaluate danger for all drivers, together with low-income drivers. These elements might embody, however usually are not restricted to, credit score historical past, driving report, location of residence, and claims historical past. These strategies assist insurers decide the chance of a driver submitting a declare, which instantly impacts the premium calculation. Insurance coverage suppliers usually take into account these elements within the context of a driver’s general monetary profile.

- Credit score Historical past: Credit score scores, whereas controversial, could be a consider figuring out premiums. Decrease credit score scores would possibly point out greater danger, doubtlessly leading to greater premiums. This evaluation shouldn’t be all the time express and is often a part of the general danger evaluation.

- Driving Document: Accidents, dashing tickets, and different violations considerably influence danger evaluation. Drivers with clear data are likely to have decrease premiums. A historical past of secure driving is strongly related to decrease premiums.

- Location of Residence: The placement of a driver’s residence can affect danger evaluation. Areas with greater charges of accidents or theft might lead to greater premiums. Location-based danger elements can fluctuate considerably based mostly on native information.

Buyer Service Experiences of Low-Revenue Drivers

Customer support experiences fluctuate amongst insurance coverage suppliers. It is vital for low-income drivers to completely analysis completely different suppliers and evaluate their customer support insurance policies. Reviewing buyer testimonials or on-line critiques can present insights into the experiences of different low-income drivers with particular suppliers.

Comparability of Reductions and Particular Applications

| Insurance coverage Supplier | Reductions/Applications for Low-Revenue Drivers |

|---|---|

| State Farm | Potential reductions for secure driving and multi-car insurance policies |

| Progressive | Applications rewarding secure driving habits |

| Allstate | Reductions for bundling insurance coverage merchandise |

| NJ Mutual Corporations | Tailor-made packages, doubtlessly together with particular reductions or versatile protection |

Discovering an Insurer for Low-Revenue Automotive Insurance coverage

Discovering the correct insurer for low-income automobile insurance coverage in New Jersey includes cautious analysis and direct communication. Evaluate insurance policies, reductions, and customer support experiences to decide on the most suitable choice. It’s important to be proactive in searching for out these choices and never assume a single supplier will match all wants.

Eligibility Standards and Utility Course of

Marga ni, torop na angka sipaingot taringot tu asuransi mobil di NJ. Ikkon ingotkon, angka syarat-syaratna jala proses aplikasi na, ase dapotkon asuransi na pas. Nanggo on, marendehononkonon hita taringot tu angka syarat-syarat na.

Eligibility Necessities

Angka syarat-syarat na ringkot laho dapotkon asuransi mobil di NJ, na mungkin do berbeda sian perusahaan tu perusahaan. Ikkon hita mangalului angka syarat-syarat na ringkot sian perusahaan asuransi na dipilih. Di na ummuli, hita patut mandapot angka informasi na jelas taringot tu syarat-syarat na.

Utility Course of

Proses aplikasi na ringkot diulahon, jala ikkon hita mangalului angka informasi na ringkot. Angka langkah-langkah na ringkot diulahon laho dapotkon asuransi mobil di NJ, on ma angka na dibahen:

- Manguji angka syarat-syarat na patut dipenuhi. Ikkon hita manghilala na mampu do hita mamenuhi angka syarat-syarat na dipatutor.

- Mandapothon perusahaan asuransi. Manghilala na patut do perusahaan asuransi na dipilih.

- Mamelehon angka dokumen na patut. Ikkon hita mangalului angka dokumen na patut sian perusahaan asuransi na dipilih.

- Manghilala na tepat do angka dokumen na dilehon.

- Mangalehon informasi na lengkap jala na tepat. Ikkon hita mangalehon angka informasi na tepat jala lengkap.

Step-by-Step Utility Information

Ikkon hita mamperhatikan angka langkah-langkah na ringkot dibahen. On ma langkah-langkah na ringkot laho mambuat aplikasi asuransi mobil di NJ:

- Manguji angka syarat-syarat na patut dipenuhi.

- Mangalului perusahaan asuransi na patut.

- Mamelehon informasi na lengkap, sian angka dokumen na patut.

- Mamelehon angka dokumen na dipatutor.

- Mangalehon informasi na tepat jala lengkap, ikkon hita manghilala na akurat do informasi na dilehon.

- Mangikuti proses aplikasi na dipatutor.

Eligibility Standards Comparability Desk, Low earnings automobile insurance coverage nj

Angka perusahaan asuransi mobil di NJ, mungkin do berbeda angka syarat-syaratna. On ma tabel na mambahen angka perbandingan:

| Perusahaan Asuransi | Pendapatan Tahunan | Sejarah Mengemudi | Jenis Kendaraan |

|---|---|---|---|

| Asuransi A | Rp. 100.000.000 | 3 tahun tanpa pelanggaran | Mobil pribadi |

| Asuransi B | Rp. 80.000.000 | 2 tahun tanpa pelanggaran | Mobil pribadi |

| Asuransi C | Rp. 90.000.000 | 2 tahun tanpa pelanggaran | Mobil pribadi |

Significance of Correct Documentation

Angka dokumen na akurat jala lengkap, na ringkot do laho manggarami proses aplikasi asuransi. Ikkon hita mangalului angka dokumen na akurat jala lengkap, jala ikkon hita mamperhatikan angka informasi na patut.

Required Paperwork

Angka dokumen na patut ikkon hita perhatikan. On ma contoh na:

- Surat keterangan pendapatan

- Surat keterangan tempat tinggal

- Surat izin mengemudi

- Informasi taringot tu mobil na dipangke

Choice Timeframe

Waktu na dipikirhon laho mandapot keputusan taringot tu aplikasi asuransi mobil di NJ, mungkin berbeda sian perusahaan asuransi tu perusahaan asuransi. Tapi, biasanya dibutuhkan beberapa minggu.

Insurance coverage Claims and Disputes

Marhitean na, dibagasan ni pelean ni asuransi mobil di NJ, di ingot do pambahenan na mangalusi angka tuduan na gabe parsalisian. Penting do padan na mardomu tu aturan na mardomu tu asuransi na huaso ni orang na margaji na porsuk di NJ, gabe marsipadan ma tu angka peraturan na mardomu tu asuransi.

Procedures for Submitting Claims

Angka aturan na mardomu tu pambahenan ni tuduan asuransi di NJ ima patut diingot do tung man sada na patut diingot tu angka na margaji na porsuk. Pambahenan na man sada ima mambahen tuduan, mambahen surat tuduan, marsirang do angka surat na mambahen pambahenan na man sada tu parsioran na marsirang ma tu angka peraturan na mardomu tu pambahenan ni tuduan. Mangalusi tuduan ima patut do marsipadan ma tu angka peraturan na mardomu tu asuransi di NJ.

Resolving Disputes

I patut do marsipadan ma tu angka aturan na mardomu tu parsalisian di NJ. Patut do marsipadan ma tu aturan na mardomu tu asuransi, gabe patut do mangalusi tuduan na gabe parsalisian ma tu aturan na mardomu tu asuransi di NJ. Mambahen surat na mangalusi tuduan ima patut do marsipadan ma tu angka peraturan na mardomu tu pambahenan ni tuduan na gabe parsalisian.

Assets for Low-Revenue Drivers

Angka parsioran na marsirang ma tu angka peraturan na mardomu tu asuransi di NJ ima patut diingot do tung man sada na patut diingot tu angka na margaji na porsuk. Patut do marsipadan ma tu angka peraturan na mardomu tu asuransi, gabe patut do mangalusi tuduan na gabe parsalisian ma tu aturan na mardomu tu asuransi di NJ. Mambahen surat na mangalusi tuduan ima patut do marsipadan ma tu angka peraturan na mardomu tu pambahenan ni tuduan na gabe parsalisian. Mambahen surat na mangalusi tuduan ima patut do marsipadan ma tu angka peraturan na mardomu tu pambahenan ni tuduan na gabe parsalisian.

Typical Declare Course of for Low-Revenue Drivers

Marhitean na man sada ima mambahen tuduan, mambahen surat tuduan, marsirang do angka surat na mambahen pambahenan na man sada tu parsioran na marsirang ma tu angka peraturan na mardomu tu pambahenan ni tuduan.

I patut do marsipadan ma tu angka peraturan na mardomu tu asuransi di NJ ima patut diingot do tung man sada na patut diingot tu angka na margaji na porsuk. Mambahen surat na mangalusi tuduan ima patut do marsipadan ma tu angka peraturan na mardomu tu pambahenan ni tuduan na gabe parsalisian.

Pattern Declare Type (Simplified)

Formulir Tuduan Asuransi Mobil Nomer Tuduan: _______________ Tanggal Kajadian: _______________ Namo Panguasai Mobil: _______________ Nomer Mobil: _______________ Deskripsi Kajadian: _______________ Angka Kerugian: _______________ Nomer Kontak: _______________

Widespread Points Confronted by Low-Revenue Drivers Concerning Insurance coverage Claims

| Masalah | Penjelasan |

|---|---|

| Ketidakpahaman tentang proses tuduan | Marhitean na man sada ima mambahen tuduan, mambahen surat tuduan, marsirang do angka surat na mambahen pambahenan na man sada tu parsioran na marsirang ma tu angka peraturan na mardomu tu pambahenan ni tuduan. |

| Kesulitan mendapatkan informasi | Marhitean na man sada ima mambahen tuduan, mambahen surat tuduan, marsirang do angka surat na mambahen pambahenan na man sada tu parsioran na marsirang ma tu angka peraturan na mardomu tu pambahenan ni tuduan. |

| Biaya proses tuduan na mahal | Marhitean na man sada ima mambahen tuduan, mambahen surat tuduan, marsirang do angka surat na mambahen pambahenan na man sada tu parsioran na marsirang ma tu angka peraturan na mardomu tu pambahenan ni tuduan. |

Options and Further Assets

Di dunia asuransi mobil di New Jersey, pilihan selain program khusus berpenghasilan rendah tersedia untuk para pengemudi. Memahami alternatif dan sumber daya tambahan ini dapat membantu pengemudi berpenghasilan rendah dalam menavigasi proses mendapatkan asuransi mobil yang terjangkau.

Pengemudi dapat menyelidiki berbagai strategi untuk mendapatkan asuransi mobil yang terjangkau, di luar program khusus berpenghasilan rendah, dan tetap terlindungi di jalan raya.

Different Options for Inexpensive Automotive Insurance coverage

Beberapa pilihan alternatif untuk asuransi mobil terjangkau di New Jersey meliputi perbandingan dari beberapa perusahaan asuransi, negosiasi dengan perusahaan asuransi, dan mempertimbangkan pilihan asuransi mobil yang lebih sederhana. Pengemudi dapat mengakses berbagai perusahaan asuransi melalui web dan membandingkan harga dan fitur untuk mendapatkan asuransi terbaik dengan harga yang terjangkau. Negosiasi dengan perusahaan asuransi, jika memungkinkan, dapat menghasilkan diskon atau harga yang lebih rendah.

Terkadang, pilihan asuransi mobil yang lebih sederhana, dengan cakupan yang lebih terbatas, dapat memberikan biaya yang lebih terjangkau.

Assets for Low-Revenue Drivers

Sumber daya untuk pengemudi berpenghasilan rendah untuk mempelajari lebih lanjut tentang asuransi mobil di New Jersey meliputi situs net Departemen Keuangan New Jersey dan berbagai organisasi nirlaba. Situs net tersebut memberikan informasi tentang program asuransi, bantuan keuangan, dan proses pengajuan klaim. Organisasi nirlaba seringkali menyediakan layanan konsultasi dan dukungan kepada pengemudi berpenghasilan rendah untuk menavigasi proses asuransi mobil.

Client Safety Companies’ Position

Badan perlindungan konsumen di New Jersey dapat membantu pengemudi berpenghasilan rendah dengan masalah asuransi. Badan-badan ini dapat memberikan bantuan dalam menyelesaikan sengketa asuransi, menyelesaikan klaim, dan memberikan informasi tentang hak-hak konsumen. Pengemudi dapat mencari informasi kontak dan proses pengajuan keluhan melalui situs net resmi badan perlindungan konsumen di New Jersey.

Monetary Help for Insurance coverage Premiums

Beberapa organisasi di New Jersey menawarkan bantuan keuangan untuk premi asuransi mobil. Organisasi ini mungkin memberikan subsidi, diskon, atau program bantuan lain untuk membantu pengemudi berpenghasilan rendah memenuhi kewajiban pembayaran premi asuransi mereka. Informasi lebih lanjut tentang organisasi tersebut dapat ditemukan melalui pencarian on-line atau kontak langsung dengan organisasi-organisasi tersebut.

Contacting Client Safety Companies

Untuk menghubungi badan perlindungan konsumen di New Jersey untuk mendapatkan bantuan, pengemudi perlu mencari informasi kontak dan proses pengajuan keluhan di situs net resmi badan tersebut. Seringkali, ada formulir on-line atau jalur telepon yang tersedia untuk dihubungi. Penting untuk mengumpulkan informasi yang relevan, seperti nomor polis, tanggal klaim, dan rincian masalah asuransi.

Assist Providers for Low-Revenue Drivers

Layanan dukungan untuk pengemudi berpenghasilan rendah yang menavigasi proses asuransi mobil di New Jersey dapat ditemukan melalui berbagai organisasi nirlaba dan badan pemerintahan. Layanan ini dapat berupa konsultasi, informasi, dan dukungan selama proses klaim atau sengketa. Pengemudi dapat menemukan daftar kontak dan element kontak melalui pencarian on-line dan menghubungi organisasi-organisasi yang relevan untuk meminta bantuan.

Consequence Abstract: Low Revenue Automotive Insurance coverage Nj

In conclusion, securing reasonably priced automobile insurance coverage in NJ, significantly for low-income drivers, requires a proactive method. This information has offered a roadmap for understanding the choices, eligibility standards, and the claims course of. Bear in mind, assets can be found, and you aren’t alone on this journey. By understanding the obtainable packages, suppliers, and assist methods, you possibly can navigate the complexities of low-income automobile insurance coverage in NJ with better confidence.

Clarifying Questions

What are some widespread elements influencing the price of automobile insurance coverage in NJ?

A number of elements contribute to automobile insurance coverage premiums in NJ. These embody driving report, automobile sort, location, and the particular protection chosen. Low-income drivers would possibly face extra challenges if their driving report or automobile sort is taken into account greater danger. Nonetheless, many packages are designed to mitigate these elements.

What paperwork are usually required for making use of for low-income automobile insurance coverage in NJ?

Required paperwork usually embody proof of earnings, identification, and doubtlessly proof of residency. Particular necessities might fluctuate between suppliers, so it is best to seek the advice of instantly with the insurance coverage supplier.

Are there any particular reductions or packages for low-income drivers in NJ?

Sure, some insurers provide reductions or specialised packages designed to make automobile insurance coverage extra reasonably priced for low-income drivers. Authorities help packages may additionally present premium subsidies. This information will element particular suppliers and their packages.

What are the everyday eligibility standards for low-income automobile insurance coverage in NJ?

Eligibility standards usually contain demonstrating a sure stage of earnings or monetary want. This would possibly contain offering documentation equivalent to pay stubs, tax returns, or different monetary data. Seek the advice of the particular insurer or program for particulars.