Low-cost automobile insurance coverage Gainesville FL is a important consideration for drivers on this vibrant metropolis. Navigating the native market can really feel daunting, however understanding the elements influencing premiums and the methods for securing inexpensive charges is empowering. This complete information unveils the secrets and techniques to discovering the perfect offers on automobile insurance coverage, offering insights into supplier comparisons, protection choices, and essential ideas for accountable driving.

Achieve beneficial information concerning the nuances of automobile insurance coverage in Gainesville, FL, enabling you to make knowledgeable choices and safe essentially the most appropriate protection to your wants. Uncover how driving document, car sort, and site straight influence your insurance coverage prices, alongside the importance of credit score historical past and the function of age and gender in charge calculations.

Overview of Low-cost Automobile Insurance coverage in Gainesville, FL

Unlocking the secrets and techniques to inexpensive automobile insurance coverage in Gainesville, FL, is simpler than you assume! This vibrant metropolis, like many others, has a aggressive insurance coverage market. Understanding the elements driving prices and customary misconceptions can empower you to seek out the perfect deal.The automobile insurance coverage market in Gainesville, FL, is a dynamic enviornment the place numerous elements interaction to find out premiums.

From town’s demographic profile to its driving situations, these parts collectively form the panorama of insurance coverage prices. Navigating this advanced interaction is essential for securing inexpensive protection.

Value Elements Influencing Insurance coverage Premiums

Understanding the weather that contribute to your automobile insurance coverage premiums is paramount. Elements like your driving document, car sort, and site all play a task. Your historical past of accidents or visitors violations considerably impacts your charge. A clear driving document usually interprets to decrease premiums. The worth and make of your automobile are additionally vital concerns.

Luxurious autos typically include greater premiums as a result of their perceived greater threat of harm or theft. Your Gainesville handle additionally issues, as sure neighborhoods could have the next incidence of accidents or theft.

Frequent Misconceptions about Low-cost Automobile Insurance coverage

Many myths encompass the pursuit of low-cost automobile insurance coverage. One prevalent false impression is {that a} single quote is the definitive reply. Evaluating quotes from a number of suppliers is essential for figuring out essentially the most aggressive charges. One other false impression is that greater deductibles at all times result in decrease premiums. Whereas true in some circumstances, a excessive deductible typically means you are accountable for a bigger out-of-pocket expense within the occasion of an accident.

Lastly, there’s the assumption that reductions are irrelevant; nonetheless, reductions for good pupil standing, defensive driving programs, or a number of autos can considerably decrease your premiums.

Historical past of Automobile Insurance coverage Pricing Traits in Gainesville

Gainesville, like different areas, has seen fluctuations in automobile insurance coverage pricing. The introduction of recent security rules and the evolution of expertise have generally led to a downward pattern in general prices. Conversely, will increase in claims frequency or severity can drive up premiums. Total, the pattern demonstrates a dynamic market the place understanding present charges is important for reaching the absolute best worth.

Common Insurance coverage Charges for Totally different Car Varieties

This desk shows estimated common insurance coverage charges for numerous car varieties in Gainesville, FL. These figures are approximate and may fluctuate based mostly on particular person circumstances.

| Car Kind | Estimated Common Premium (USD/yr) |

|---|---|

| Compact Automobile | 1,200 – 1,500 |

| Mid-size Sedan | 1,500 – 1,800 |

| SUV | 1,600 – 2,000 |

| Sports activities Automobile | 1,800 – 2,500 |

| Luxurious Automobile | 2,000 – 3,000 |

Figuring out Insurance coverage Suppliers Providing Inexpensive Charges

Unlocking the key to saving massive on automobile insurance coverage in Gainesville, FL begins with savvy analysis. This significant step includes figuring out respected suppliers who persistently supply aggressive charges, tailor-made reductions, and a clean claims course of. By understanding these parts, you may confidently select the best insurance coverage plan that balances affordability and peace of thoughts.Discovering the best insurance coverage supplier is akin to discovering the right match to your automobile.

Similar to a meticulously chosen car fits your wants, the perfect insurance coverage supplier enhances your monetary state of affairs and driving profile. This includes not solely the value but additionally the extent of buyer help and the convenience of submitting a declare.

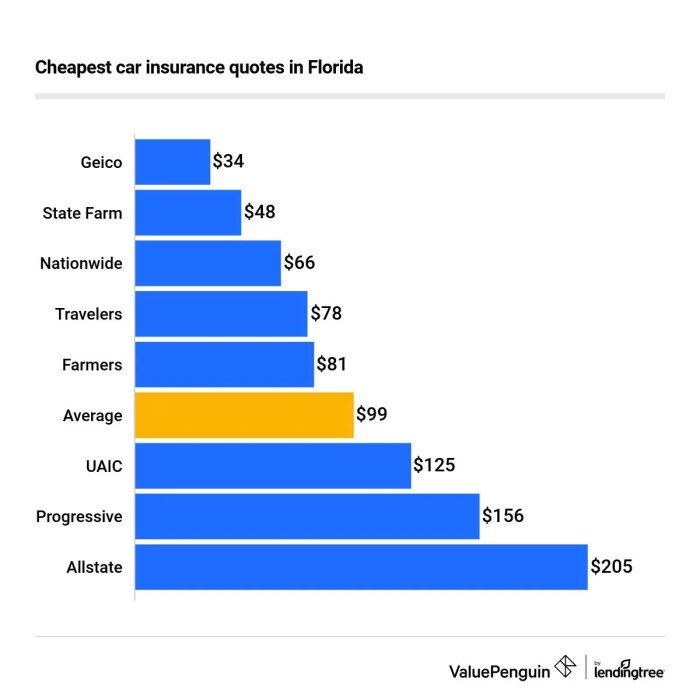

Insurance coverage Suppliers Identified for Aggressive Charges

A number of insurance coverage suppliers stand out for his or her aggressive charges in Gainesville, FL. They’ve established a status for offering inexpensive premiums whereas sustaining a sturdy help system.

- State Farm: Identified for its in depth community and big selection of reductions, State Farm ceaselessly affords aggressive charges. Their customer support is usually thought of dependable, they usually present a complete vary of insurance coverage merchandise, together with auto insurance coverage.

- Geico: Geico is well-regarded for its progressive strategy to insurance coverage, typically resulting in enticing pricing. Their digital platform and numerous reductions, together with multi-policy reductions, contribute to their affordability.

- Progressive: Progressive typically stands out with aggressive charges, notably by means of its usage-based insurance coverage packages and reductions for protected driving habits. Their on-line instruments and cell apps make declare submitting and coverage administration simple.

- Allstate: Allstate supplies a big selection of insurance coverage merchandise, together with auto insurance coverage, and sometimes affords aggressive charges, particularly when mixed with different insurance policies. Their claims dealing with course of is usually environment friendly and well-structured, permitting for a smoother expertise.

- Nationwide: Nationwide is acknowledged for its aggressive charges, notably for drivers with a powerful driving document. They typically present enticing reductions for protected drivers, good college students, and those that take part in defensive driving programs.

Reductions Supplied by Suppliers, Low-cost automobile insurance coverage gainesville fl

Insurance coverage suppliers ceaselessly supply reductions to incentivize policyholders to pick out their providers. These reductions can considerably scale back your general premium prices.

- Multi-Coverage Reductions: Many suppliers supply reductions if you bundle a number of insurance policies (house, auto, and so forth.) with them.

- Good Pupil Reductions: College students with good grades or enrollment in a good establishment can typically safe reductions.

- Secure Driver Reductions: Insurance coverage suppliers typically reward drivers with a clear driving document and a low accident historical past with discounted premiums.

- Defensive Driving Programs: Finishing defensive driving programs can typically result in decrease premiums, as these programs reveal dedication to protected driving practices.

- Reductions for Bundled Insurance policies: Some suppliers supply decreased premiums in the event you mix a number of insurance policies beneath one supplier.

Claims Dealing with Procedures

Claims dealing with is a important side of the insurance coverage expertise. A clean and environment friendly claims course of can prevent time and stress throughout a difficult interval.

- State Farm: State Farm typically receives excessive scores for the velocity and effectivity of their claims dealing with processes. They sometimes have a well-established course of for submitting and resolving claims.

- Geico: Geico has streamlined its claims course of by means of its digital platform. This typically results in a sooner decision time.

- Progressive: Progressive is understood for its complete on-line sources and instruments to facilitate the claims course of, typically offering a straightforward and accessible approach to file and monitor claims.

- Allstate: Allstate usually has a well-structured claims dealing with process, guaranteeing an affordable decision time and constant communication.

- Nationwide: Nationwide typically employs a well-organized strategy to claims processing, with a give attention to immediate communication and backbone.

Comparability Desk

The next desk supplies a concise comparability of the suppliers, their common charges, and out there reductions. Understand that common charges can fluctuate based mostly on particular person elements.

| Supplier | Common Fee (Estimated) | Reductions Obtainable | Buyer Service Ranking (Common) |

|---|---|---|---|

| State Farm | $1,500-$2,000 per yr | Good Pupil, Secure Driver, Multi-Coverage | 4.5 out of 5 |

| Geico | $1,300-$1,800 per yr | Good Pupil, Secure Driver, Multi-Coverage, Bundled Insurance policies | 4.3 out of 5 |

| Progressive | $1,400-$1,900 per yr | Good Pupil, Secure Driver, Utilization-Based mostly | 4.4 out of 5 |

| Allstate | $1,550-$2,100 per yr | Good Pupil, Secure Driver, Multi-Coverage | 4.2 out of 5 |

| Nationwide | $1,450-$1,950 per yr | Good Pupil, Secure Driver, Defensive Driving | 4.3 out of 5 |

Customer support scores are based mostly on aggregated buyer suggestions. Particular person experiences could fluctuate.

Elements Influencing Low-cost Automobile Insurance coverage Charges in Gainesville

Unlocking the secrets and techniques to inexpensive automobile insurance coverage in Gainesville, FL begins with understanding the important thing elements that form your premiums. Figuring out these parts empowers you to make knowledgeable decisions and doubtlessly safe substantial financial savings. Elements like your driving document, the kind of car you personal, and even your location all play an important function in figuring out your insurance coverage prices.

Understanding these influences is step one in direction of discovering essentially the most appropriate and budget-friendly automobile insurance coverage coverage.Gaining a complete grasp of those influencing elements means that you can successfully navigate the complexities of the insurance coverage market. By understanding the elements that drive up or down your premiums, you may take proactive steps to doubtlessly decrease your insurance coverage prices and safe a extra favorable charge.

Driving Report

Driving historical past is a major determinant in your insurance coverage premiums. A clear driving document, freed from accidents and visitors violations, sometimes interprets to decrease insurance coverage prices. Insurance coverage firms assess your driving historical past to judge your threat profile. Accidents, dashing tickets, and different violations sign the next threat, resulting in greater premiums. A historical past of accountable driving, then again, demonstrates a decrease threat, leading to decrease premiums.

Insurance coverage firms use this information to foretell future threat.

Car Kind

The kind of car you drive considerably impacts your insurance coverage prices. Sports activities vehicles, high-performance autos, and luxurious vehicles typically have greater premiums than commonplace sedans or compact vehicles. That is largely as a result of elements equivalent to the upper chance of accidents and restore prices related to these autos. The worth and age of the car are additionally vital elements.

The upper the worth and the newer the car, the upper the price of changing or repairing it within the occasion of an accident, which frequently interprets into greater premiums.

Location

Your location in Gainesville, FL, additionally performs a task in your insurance coverage premiums. Areas with greater accident charges or better publicity to extreme climate occasions could have greater insurance coverage prices. That is as a result of elevated threat of accidents or damages in these areas. Insurance coverage firms modify their charges to mirror these native elements. For instance, areas with greater charges of theft or vandalism might need greater premiums in comparison with safer neighborhoods.

Credit score Historical past

Surprisingly, your credit score historical past can have an effect on your automobile insurance coverage premiums in Gainesville, FL. Insurance coverage firms typically use credit score scores as an indicator of your general accountability and monetary stability. A decrease credit score rating typically correlates with the next threat profile, doubtlessly resulting in greater insurance coverage premiums. This issue is vital to think about when evaluating your insurance coverage choices.

People with glorious credit score scores typically qualify for decrease charges.

Age and Gender

Age and gender are additionally elements thought of in figuring out automobile insurance coverage charges. Youthful drivers and males are sometimes seen as higher-risk drivers, leading to greater premiums in comparison with older drivers and females. That is attributed to elements like expertise degree and driving habits. Insurance coverage firms have in depth information on accident patterns throughout totally different demographics. This information helps them precisely assess threat.

Native Legal guidelines and Laws

Native legal guidelines and rules in Gainesville, FL, can affect insurance coverage premiums. As an example, particular visitors legal guidelines, parking rules, or different guidelines can have an effect on insurance coverage prices. Insurance coverage firms consider these native nuances to make sure correct threat evaluation. The presence of particular ordinances or restrictions can influence charges.

Driving Habits and Insurance coverage Premiums

Driving habits considerably influence insurance coverage premiums. Secure driving practices like sustaining a protected following distance, avoiding aggressive driving, and adhering to hurry limits usually result in decrease premiums. Insurance coverage firms reward accountable driving behaviors with decrease charges. The alternative can also be true, as irresponsible driving behaviors enhance the premium.

| Driving Behavior | Influence on Insurance coverage Premium |

|---|---|

| Secure Following Distance | Decrease Premium |

| Aggressive Driving | Increased Premium |

| Dashing | Increased Premium |

| Defensive Driving | Decrease Premium |

| Avoiding Distracted Driving | Decrease Premium |

Methods for Acquiring Inexpensive Automobile Insurance coverage

Unlocking the perfect automobile insurance coverage offers in Gainesville, FL requires a strategic strategy. Savvy buyers can considerably scale back their premiums by using sensible methods and leveraging out there sources. This part Artikels confirmed strategies for locating the absolute best charges, empowering you to make knowledgeable choices and lower your expenses.

Discovering the Greatest Automobile Insurance coverage Offers

Discovering essentially the most aggressive automobile insurance coverage charges includes a multi-faceted strategy. Begin by researching respected insurance coverage suppliers in Gainesville, FL, evaluating their insurance policies and protection choices. On-line comparability instruments are invaluable sources for this job, offering a handy platform to shortly collect quotes from a number of firms.

Evaluating Quotes Successfully

Evaluating quotes from a number of suppliers is essential for securing essentially the most inexpensive insurance coverage. Use on-line comparability instruments to enter your car particulars, driving historical past, and desired protection. Make sure you rigorously evaluation the positive print of every coverage to grasp the precise protection and exclusions. Keep in mind to consider any reductions chances are you’ll qualify for.

The Energy of Bundling

Bundling your insurance coverage insurance policies, equivalent to combining your automobile insurance coverage with your house or renters insurance coverage, is a strong approach to obtain substantial financial savings. Insurance coverage firms typically supply bundled reductions to incentivize clients to mix their insurance policies beneath one supplier. For instance, a buyer who bundles their automobile insurance coverage with their householders insurance coverage might doubtlessly see a discount of their general premiums.

Understanding Insurance coverage Coverage Terminology

Insurance coverage insurance policies can comprise advanced terminology. Familiarizing your self with widespread phrases like “deductible,” “premium,” “legal responsibility protection,” and “complete protection” is important for making knowledgeable choices. Understanding these phrases means that you can tailor your protection to your particular wants and price range. By understanding coverage phrases, you’re empowered to keep away from misunderstandings and profit from your insurance coverage.

A Information to Frequent Insurance coverage Reductions

Insurance coverage firms supply a spread of reductions to incentivize coverage purchases. These reductions can fluctuate based mostly on elements such nearly as good driving data, anti-theft gadgets, and security options. Understanding these reductions might help you considerably scale back your premiums.

| Low cost Kind | Description | Instance |

|---|---|---|

| Good Driver Low cost | For drivers with clear driving data. | A driver with no accidents or violations could qualify for a reduction. |

| Security Characteristic Low cost | For autos geared up with security options. | Vehicles with anti-theft gadgets or superior security methods, like airbags, typically qualify for reductions. |

| Bundled Insurance policies Low cost | For combining a number of insurance policies with one supplier. | Combining automobile insurance coverage with householders insurance coverage typically qualifies for a bundled low cost. |

| A number of Autos Low cost | For insuring a number of autos with the identical supplier. | A buyer with two vehicles insured beneath the identical coverage typically qualifies for this low cost. |

| Pupil Low cost | For college students with a clear driving document. | College students enrolled in class could qualify for this low cost. |

Understanding Insurance coverage Coverage Protection

Unlocking the secrets and techniques to inexpensive automobile insurance coverage in Gainesville, FL, hinges on a deep understanding of your coverage’s protection. Navigating the world of insurance coverage can really feel daunting, however worry not! This part will demystify the several types of protection out there, serving to you make knowledgeable choices to safeguard your car and your monetary well-being.

Kinds of Automobile Insurance coverage Protection in Florida

Florida mandates particular minimal protection ranges, however choosing further safety is very advisable. Understanding the varied choices empowers you to tailor your coverage to your distinctive wants and price range.

Legal responsibility Insurance coverage: Defending Others

Legal responsibility insurance coverage is the bedrock of any automobile insurance coverage coverage in Florida. It covers damages you trigger to different individuals or their property in an accident. Whereas essential, it has limitations. For instance, in case your damages exceed your coverage limits, you will be personally accountable for the remaining prices. A coverage of $100,000 in bodily damage legal responsibility per particular person and $300,000 in complete bodily damage legal responsibility is the advisable minimal, however take into account rising this protection to higher shield your self and others.

Increased limits present a security internet, guaranteeing you are financially ready for severe accidents.

Complete and Collision Insurance coverage: Defending Your Car

Complete and collision insurance coverage present additional layers of safety to your automobile. Complete insurance coverage covers injury from occasions not involving a collision, equivalent to theft, vandalism, hearth, hail, or falling objects. Collision insurance coverage covers injury to your car brought on by a collision with one other car or an object, no matter who’s at fault. These coverages are important if you wish to restore or substitute your car with out incurring vital out-of-pocket bills.

Uninsured/Underinsured Motorist Protection: A Crucial Security Internet

Uninsured/underinsured motorist protection is paramount in Florida. This protection steps in in the event you’re concerned in an accident with a driver who lacks insurance coverage or whose insurance coverage limits are inadequate to cowl the damages. With out this protection, you possibly can be left to bear the monetary burden of considerable damages, doubtlessly jeopardizing your monetary stability.

Abstract Desk of Automobile Insurance coverage Coverages

| Protection Kind | Description | Advantages |

|---|---|---|

| Legal responsibility Insurance coverage | Covers injury you trigger to others in an accident. | Protects you from monetary accountability for damages triggered to others, as much as coverage limits. |

| Complete Insurance coverage | Covers injury to your car from non-collision occasions (theft, vandalism, hearth, and so forth.). | Protects your car from injury brought on by occasions past your management. |

| Collision Insurance coverage | Covers injury to your car in a collision, no matter fault. | Protects your car from injury in collisions, no matter who’s at fault. |

| Uninsured/Underinsured Motorist Protection | Covers damages in the event you’re concerned in an accident with an uninsured or underinsured driver. | Protects you financially in the event you’re in an accident with a driver missing sufficient insurance coverage. |

Suggestions for Selecting the Proper Coverage: Low-cost Automobile Insurance coverage Gainesville Fl

Navigating the world of automobile insurance coverage can really feel like deciphering a posh code. Choosing the proper coverage is not nearly discovering the most cost effective charge; it is about guaranteeing you are adequately protected and ready for unexpected circumstances. Understanding the nuances of your coverage is essential to creating an knowledgeable resolution.Choosing the proper automobile insurance coverage coverage includes cautious consideration of a number of elements, from protection choices to coverage exclusions and deductibles.

This complete information supplies beneficial insights that can assist you make your best option to your particular wants and monetary state of affairs.

Elements to Take into account When Selecting a Coverage

Understanding your wants and the out there choices is important. Take into account your driving habits, car sort, and monetary state of affairs. Elements like your driving document, location, and the worth of your car will all affect the price and protection you will want. An intensive evaluation of those elements will allow you to establish the best coverage match.

- Driving Report: A clear driving document typically interprets to decrease premiums. Accidents and violations will seemingly enhance your insurance coverage prices. Evaluation your driving historical past and perceive the potential influence in your charges.

- Car Kind: The make, mannequin, and yr of your car play a task. Excessive-value autos may command greater insurance coverage premiums, whereas older autos might need totally different protection necessities.

- Location: Your location inside Gainesville, Florida, and the encompassing space can have an effect on your insurance coverage charges. Areas with greater accident charges usually have greater premiums.

- Protection Wants: Assess your monetary state of affairs and determine on the extent of protection you want. Take into account legal responsibility protection, complete protection, and collision protection. Consider the potential dangers you face and decide the safety degree obligatory.

Understanding Insurance coverage Coverage Paperwork

Insurance coverage insurance policies are sometimes dense and complicated. Taking the time to totally evaluation your coverage doc is important. Search for clear explanations of protection, exclusions, and limits.

- Learn Fastidiously: Do not simply skim the doc. Pay shut consideration to the phrases and situations. Understanding the language utilized in your coverage is important to keep away from any misunderstandings.

- Search Clarification: If you happen to do not perceive one thing, do not hesitate to contact your insurance coverage supplier for clarification. Asking questions is essential to totally greedy the implications of your coverage.

- Evaluation Exclusions: Fastidiously study the exclusions listed in your coverage. Understanding what is not lined is as vital as understanding what’s.

Implications of Coverage Exclusions

Coverage exclusions Artikel conditions the place your insurance coverage will not cowl damages or losses. These exclusions shield the insurance coverage firm from extreme claims. Understanding them is important to avoiding sudden prices.

- Pre-existing Circumstances: Some insurance policies exclude protection for pre-existing injury to your car, equivalent to rust or body injury. Evaluation your coverage to make sure it covers one of these injury.

- Particular Circumstances: Exclusions may apply to particular circumstances, equivalent to injury brought on by intentional acts, or use of the car for unlawful actions. Familiarize your self with the specifics to keep away from surprises.

- Exclusions of Legal responsibility: Legal responsibility protection could exclude sure varieties of claims, equivalent to these arising from intentional acts or use of the car in unlawful actions. Understanding these exclusions is essential to stopping surprises in case of an accident.

The Significance of Coverage Deductibles

Deductibles are the quantity you pay out-of-pocket earlier than your insurance coverage firm covers the remaining value. Decrease deductibles usually imply decrease premiums, however you will pay extra when making a declare.

- Influence on Premiums: Increased deductibles typically end in decrease premiums. It’s because the insurance coverage firm bears much less monetary accountability. Perceive the connection between your deductible and premium prices.

- Declare Prices: When submitting a declare, you will must pay the deductible quantity first. This can be a essential side to think about when assessing your monetary accountability.

- Balancing Act: Selecting a deductible includes balancing the potential prices of a declare with the influence in your premium funds. A cautious analysis of your wants is vital to keep away from overpaying or under-protecting your self.

Submitting a Declare with an Insurance coverage Firm

Submitting a declare is a course of that requires cautious consideration to element and adherence to the insurance coverage firm’s tips.

- Report Instantly: Report any accidents or damages to your insurance coverage firm promptly. That is essential for sustaining a clean declare course of.

- Collect Documentation: Acquire all related paperwork, together with police stories, witness statements, and restore estimates. This documentation will help your declare.

- Comply with Directions: Comply with the insurance coverage firm’s directions rigorously. This contains offering obligatory data and finishing required kinds.

Illustrative Examples of Insurance coverage Insurance policies

Unveiling the world of automobile insurance coverage insurance policies can really feel daunting, however understanding the different sorts and their protection is essential for making knowledgeable choices. These examples will illustrate the various ranges of safety out there, empowering you to decide on the coverage that most closely fits your wants and price range in Gainesville, FL.Choosing the proper automobile insurance coverage coverage is an important step in defending your monetary well-being and belongings.

Totally different coverage varieties supply various levels of protection, and understanding these nuances is vital to discovering the perfect worth to your cash.

Legal responsibility-Solely Coverage Instance

A liability-only coverage is essentially the most primary sort of protection. It protects you financially in the event you’re at fault for an accident and trigger hurt to a different particular person or their property. This coverage sometimes covers the price of damages to different autos and accidents to others, however

doesn’t* cowl damages to your individual car or your accidents.

This coverage is commonly essentially the most inexpensive choice, however it supplies minimal safety in case of an accident.

For instance, think about you are concerned in a fender bender the place you are deemed at fault. A liability-only coverage would cowl the opposite driver’s restore prices and medical bills, however your individual car repairs and medical payments can be your accountability.

Complete Coverage Instance

A complete coverage supplies broader safety than a liability-only coverage. It covers damages to your car from perils past accidents, equivalent to theft, vandalism, hearth, hail, and climate occasions.

Complete protection considerably enhances your monetary safety by masking a wider vary of potential damages.

As an example, in case your automobile is stolen, broken by a falling tree throughout a storm, or vandalized, a complete coverage would assist cowl the repairs. One of these coverage typically features a deductible, which is the quantity you pay out-of-pocket earlier than the insurance coverage firm steps in.

Collision and Complete Coverage Instance

A collision and complete coverage affords the best degree of safety. It covers injury to your car in an accident (collision) and likewise injury from numerous perils (complete), as mentioned above.

This coverage supplies essentially the most in depth protection and monetary safety, safeguarding you towards a big selection of potential damages.

For instance, in case your automobile is broken in an accident or by a tree department falling on it throughout a storm, a collision and complete coverage would cowl the restore prices.

Coverage with Add-ons (e.g., Roadside Help)

Many insurance coverage insurance policies may be enhanced with add-ons. Roadside help is a well-liked instance. This characteristic supplies assist in conditions equivalent to a flat tire, a useless battery, or a car lockout.

Including roadside help to your coverage supplies handy help in emergency conditions.

As an example, in case your automobile breaks down on a distant freeway, roadside help would supply towing, jump-starting, or different obligatory providers to get you again on the highway.

Key Variations Abstract Desk

| Coverage Kind | Protection | Value | Safety Stage |

|---|---|---|---|

| Legal responsibility-Solely | Covers damages to others | Lowest | Minimal |

| Complete | Covers injury from non-collision occasions | Reasonable | Medium |

| Collision and Complete | Covers each collision and non-collision injury | Highest | Most |

| Coverage with Add-ons (e.g., Roadside Help) | Provides further options like roadside help | Variable | Enhanced |

Sustaining a Constructive Driving Report in Gainesville

A pristine driving document is paramount to securing inexpensive automobile insurance coverage in Gainesville, FL. Secure driving habits not solely shield you and others on the highway but additionally straight influence your insurance coverage premiums. By adhering to visitors legal guidelines and working towards defensive driving methods, you may considerably scale back your threat of accidents and luxuriate in decrease insurance coverage charges.Secure driving practices are essential for accountable drivers and have a direct influence on insurance coverage premiums.

A clear driving document demonstrates your dedication to protected driving, which insurers worth extremely. This dedication can translate to substantial financial savings in your automobile insurance coverage coverage.

Significance of Secure Driving Practices

Secure driving practices are important for decreasing accidents and selling highway security. These practices embody sustaining a protected following distance, obeying visitors legal guidelines, and avoiding distractions. By being conscious of different drivers and highway situations, you considerably lower your threat of inflicting an accident. This proactive strategy demonstrates accountable driving and may prevent cash on insurance coverage premiums.

Steps to Keep away from Visitors Violations

Avoiding visitors violations is important to sustaining a optimistic driving document. This includes adhering to hurry limits, utilizing flip alerts, and observing visitors legal guidelines. Figuring out and respecting the foundations of the highway can stop pricey violations and keep a clear driving document.

- Obey Pace Limits: Strict adherence to posted velocity limits is important. Exceeding the restrict considerably will increase the chance of accidents. Driving at acceptable speeds permits for higher response time and reduces the severity of collisions.

- Use Flip Alerts Accurately: Correct use of flip alerts clearly communicates your intentions to different drivers, decreasing the chance of confusion and potential accidents.

- Keep away from Distractions: Driving whereas utilizing a cellular phone, consuming, or partaking in different distracting actions is extraordinarily harmful. Focusing solely on driving maximizes security and prevents violations.

- Preserve Correct Following Distance: Sustaining a protected following distance supplies essential response time in case of sudden stops or emergencies. This reduces the chance of rear-end collisions.

Significance of Sustaining a Clear Driving Report

A clear driving document displays your dedication to protected driving practices. Insurance coverage firms view drivers with a historical past of accountable driving as decrease threat. This notion straight interprets to decrease insurance coverage premiums. Sustaining a clear driving document is an funding in your monetary well-being.

Examples of How Secure Driving Practices Can Positively Influence Insurance coverage Premiums

Insurance coverage firms use driving data to evaluate threat. Drivers with fewer violations and accidents are categorized as decrease threat, resulting in decrease premiums. This straight demonstrates the worth of protected driving practices.

- Diminished Accidents: By adhering to protected driving practices, drivers considerably scale back the chance of accidents. Diminished accidents straight influence insurance coverage premiums.

- Fewer Violations: Avoiding visitors violations like dashing or operating purple lights demonstrates a dedication to accountable driving. Fewer violations translate to decrease premiums.

- Improved Insurance coverage Charges: Insurance coverage firms reward drivers who prioritize security. A clear driving document can lead to substantial financial savings on insurance coverage premiums.

Illustrative Situation of Driver Bettering Their Report and Seeing a Decrease Insurance coverage Fee

Think about a driver in Gainesville, FL, named Sarah, who persistently made errors that affected her insurance coverage premiums. She acknowledged the significance of protected driving practices and actively labored on enhancing her document. Sarah actively targeted on following velocity limits, utilizing flip alerts, and avoiding distractions. After six months of constant protected driving, Sarah noticed a noticeable lower in her automobile insurance coverage premium.

This illustrates the direct correlation between protected driving practices and decrease insurance coverage charges. By prioritizing protected driving, Sarah was ready to save cash on her insurance coverage, showcasing the worth of accountable driving habits.

Final Phrase

In conclusion, securing low-cost automobile insurance coverage in Gainesville, FL, requires a strategic strategy encompassing analysis, comparability procuring, and understanding your particular wants. By rigorously contemplating the varied elements influencing premiums and adopting sensible methods, you may navigate the complexities of the native market and procure essentially the most advantageous insurance coverage insurance policies. This information serves as your compass, empowering you to make knowledgeable choices and discover the perfect protection to your monetary well-being.

FAQ

What are the commonest reductions supplied by insurance coverage suppliers in Gainesville, FL?

Many suppliers supply reductions for protected driving data, pupil standing, and bundling a number of insurance policies. Some insurers additionally supply reductions based mostly on car sort or anti-theft gadgets.

How does my credit score historical past have an effect on my automobile insurance coverage charges in Gainesville?

A poor credit score historical past can negatively influence your automobile insurance coverage charges, because it signifies the next threat of economic irresponsibility. Conversely, a great credit score rating could result in decrease premiums.

What varieties of automobile insurance coverage protection can be found in Florida?

Florida mandates legal responsibility insurance coverage, however complete and collision protection, together with uninsured/underinsured motorist safety, are further choices.

What’s the significance of bundling insurance coverage insurance policies?

Bundling insurance coverage insurance policies, equivalent to automobile and residential insurance coverage, can typically result in discounted charges as a result of a perceived decrease threat.