Do I want complete insurance coverage on financed automotive? This significant query arises when buying a automotive utilizing a mortgage. Understanding the nuances of financing, insurance coverage sorts, and potential eventualities is vital to creating an knowledgeable resolution. Navigating the complicated panorama of automotive insurance coverage can really feel overwhelming, however this exploration will information you thru the important components to think about.

The financing course of, encompassing mortgage phrases, down funds, and automobile worth, immediately influences the necessity for complete insurance coverage. Completely different insurance coverage sorts, from legal responsibility to collision and complete, provide various ranges of safety. This detailed evaluation will illuminate the intricacies of every sort, highlighting their particular protection and limitations.

Understanding Financing and Insurance coverage

Buying a automotive entails a posh interaction of financing and insurance coverage. Understanding the method, varied sorts of insurance coverage, and native laws is essential for making knowledgeable selections. This part delves into the intricacies of automotive financing, the various kinds of auto insurance coverage out there, and the authorized necessities in several areas, serving to you navigate the complexities of automotive possession.

Automobile Financing Course of

The financing course of sometimes begins with a pre-approval from a lender. This pre-approval establishes a borrowing restrict and rate of interest. The client then selects a automobile and negotiates the value with the vendor. The lender verifies the client’s creditworthiness and approves the mortgage. As soon as authorized, the client indicators the mortgage paperwork, and the funds are transferred to the vendor.

The client assumes the accountability of creating month-to-month funds till the mortgage is absolutely repaid.

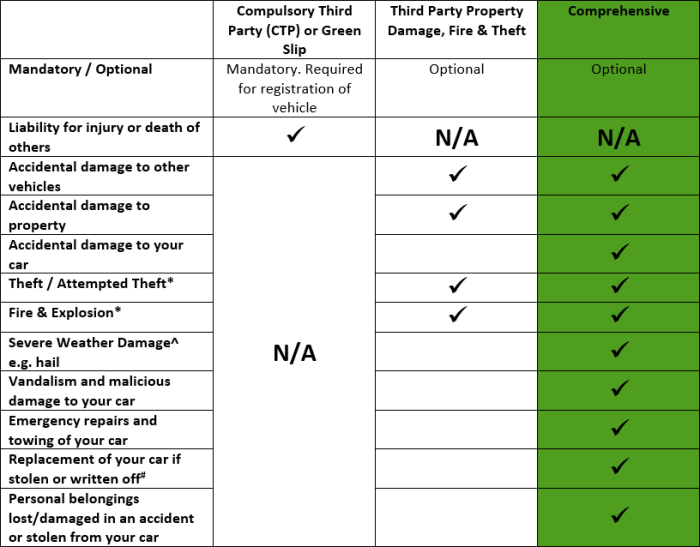

Varieties of Automobile Insurance coverage

Numerous sorts of automotive insurance coverage can be found to guard drivers and their automobiles. The commonest sorts embrace complete, collision, and legal responsibility protection. Every sort gives distinct safety towards completely different potential dangers.

Complete Insurance coverage

Complete insurance coverage covers harm to your automobile brought on by occasions past collisions, reminiscent of vandalism, theft, fireplace, hail, or pure disasters. It offers a significant security internet towards surprising and sometimes pricey damages.

Collision Insurance coverage

Collision insurance coverage covers harm to your automobile in an accident, no matter who’s at fault. That is important as a result of even when you’re not at fault in an accident, you’ll be able to nonetheless incur vital restore prices.

Legal responsibility Insurance coverage

Legal responsibility insurance coverage protects you when you trigger an accident and are deemed at fault. It covers the opposite celebration’s damages, together with medical bills and property harm. It is a legally mandated type of protection in most jurisdictions.

Authorized Necessities for Automobile Insurance coverage

Completely different jurisdictions have particular authorized necessities for automotive insurance coverage. These necessities range by way of minimal protection ranges, and drivers ought to seek the advice of their native motorcar departments or insurance coverage suppliers to grasp the precise legal guidelines of their space. Failing to adjust to these laws can result in penalties and authorized ramifications.

Comparability of Complete and Different Insurance coverage Sorts, Do i want complete insurance coverage on financed automotive

Complete insurance coverage differs from different sorts in its scope of protection. Whereas legal responsibility insurance coverage focuses on defending you if you’re at fault, and collision insurance coverage protects you no matter fault in an accident, complete insurance coverage offers broader safety towards a wider vary of potential dangers, reminiscent of theft or pure disasters.

Protection Abstract Desk

| Insurance coverage Sort | Protection Particulars |

|---|---|

| Complete | Covers harm to your automobile from non-collision occasions (e.g., vandalism, fireplace, hail, theft, pure disasters). |

| Collision | Covers harm to your automobile in an accident, no matter who’s at fault. |

| Legal responsibility | Covers damages to others’ property or accidents to others if you’re at fault in an accident. |

Complete Insurance coverage Protection

Past the fundamentals of legal responsibility insurance coverage, complete protection offers a vital security internet on your financed automotive. It safeguards your funding towards unexpected occasions that customary insurance coverage insurance policies won’t cowl. Understanding these protections is vital to creating knowledgeable selections about your automobile’s insurance coverage wants.Complete insurance coverage goes past defending you from the fault of others. It steps in when harm arises from incidents not associated to a different driver’s negligence.

This proactive safety considerably reduces the monetary burden of surprising occasions.

Particular Eventualities Lined

Complete insurance coverage sometimes covers a variety of harm eventualities, providing peace of thoughts in varied conditions. These coverages lengthen past the standard accidents involving different drivers.

- Climate harm, reminiscent of hail, flood, or fireplace, can severely harm a automobile. Complete insurance coverage protects towards these pure disasters, making certain your automobile is repaired or changed. For instance, a extreme hailstorm can go away a automotive with dents and scratches requiring substantial repairs. Complete insurance coverage would cowl these damages.

- Vandalism, theft, or vandalism incidents could cause substantial hurt to your automobile. Complete insurance coverage offers monetary safety towards such malicious acts. A vandalized automotive would possibly want vital bodywork and even substitute of broken elements. Complete insurance coverage would cowl these bills.

- Unintentional collisions with animals or objects, reminiscent of bushes or utility poles, are incidents typically not lined by legal responsibility insurance coverage. Complete protection offers safety towards a majority of these damages, offering monetary help for repairs or substitute.

- Sure sorts of accidents, reminiscent of falling objects or particles, are additionally lined below complete insurance coverage. These unexpected incidents could cause appreciable harm, highlighting the significance of complete protection.

How Complete Insurance coverage Protects In opposition to Unexpected Occasions

Complete insurance coverage acts as a protect towards unexpected circumstances that would considerably influence your automobile’s worth. This safety is especially important in conditions past typical collisions.

Complete protection ensures that repairs or replacements are lined, mitigating the monetary burden of surprising harm. This safety considerably reduces the chance of monetary loss in unexpected circumstances. As an illustration, a sudden hail storm can result in substantial harm to your automobile. Complete insurance coverage would cowl the restore prices.

Potential Conditions Requiring Complete Insurance coverage

Complete insurance coverage is helpful in lots of conditions, offering important monetary safety towards unexpected occasions. It gives extra safety than simply the usual legal responsibility protection.

- Parking in a high-crime space will increase the chance of vandalism or theft. Complete insurance coverage offers safety towards these potential dangers.

- Dwelling in an space susceptible to pure disasters, reminiscent of floods or hailstorms, necessitates complete insurance coverage to safeguard your automobile from harm.

- Automobiles parked outdoor are extra weak to climate harm and vandalism. Complete insurance coverage is essential for safeguarding your automobile from these dangers.

Limitations of Complete Insurance coverage Protection

Complete insurance coverage, whereas helpful, has limitations. Understanding these limitations is essential for knowledgeable decision-making.

- Put on and tear, regular deterioration of the automobile, or pre-existing harm are typically not lined. Complete insurance coverage focuses on unexpected occasions, not routine upkeep or gradual deterioration.

- Sure exclusions could apply, reminiscent of harm brought on by struggle or nuclear incidents. These exclusions are sometimes Artikeld within the coverage phrases and circumstances.

- Deductibles apply, which means you are liable for a specific amount of the restore prices earlier than the insurance coverage protection kicks in. The deductible quantity varies primarily based on the coverage.

Frequent Misconceptions About Complete Insurance coverage

Understanding the info about complete insurance coverage helps keep away from frequent misconceptions.

- Complete insurance coverage isn’t just for luxurious automobiles. It’s useful for all automobiles, no matter their make, mannequin, or worth.

- Complete insurance coverage doesn’t solely defend towards theft. It offers a broader vary of safety towards unexpected damages.

- Complete insurance coverage is elective. Nevertheless, it is extremely really helpful for full monetary safety of your automobile.

Elements Influencing the Want for Complete Insurance coverage

Deciding whether or not complete insurance coverage is critical on your financed automotive entails contemplating varied components past simply the mortgage quantity. Understanding these components may help you make an knowledgeable resolution about your protection wants, making certain your monetary well-being is protected.Complete insurance coverage, in contrast to collision insurance coverage, covers harm to your automobile brought on by occasions past your management, reminiscent of theft, vandalism, weather-related incidents, or accidents with animals.

Whereas collision insurance coverage covers harm from accidents you trigger or are concerned in, complete insurance coverage offers a further layer of safety towards surprising perils.

Impression of Down Cost Quantity

The down cost quantity considerably influences the quantity you owe on the mortgage, and consequently, the monetary implications of a declare. A bigger down cost reduces the excellent mortgage stability, lessening the monetary burden in case your automotive is broken or stolen. In the event you make a considerable down cost, the necessity for complete insurance coverage may appear much less crucial as a result of you’ve gotten a larger stake in defending the automobile’s worth.

Nevertheless, even with a considerable down cost, complete insurance coverage nonetheless safeguards your funding from unexpected occasions.

Car Worth and Situation

A automobile’s worth and situation immediately influence the necessity for complete insurance coverage. A high-value automobile, reminiscent of a luxurious automotive or a more moderen mannequin, necessitates a better degree of safety. The larger the automobile’s worth, the extra substantial the monetary loss if it is broken or stolen. Moreover, a automobile’s situation—its age, upkeep historical past, and any present harm—additionally impacts the need of complete insurance coverage.

A automobile with pre-existing harm would possibly require greater protection to compensate for potential restore prices. A more recent, meticulously maintained automobile could require much less intensive protection.

Function of Mortgage Phrases

Mortgage phrases, together with the mortgage quantity, rate of interest, and mortgage length, play a pivotal position in figuring out the necessity for complete protection. The next mortgage quantity means a larger monetary publicity if the automobile is broken or totaled. This necessitates a extra sturdy insurance coverage coverage to cowl the remaining mortgage stability. The size of the mortgage additionally impacts your monetary publicity, as longer loans typically imply a bigger excellent stability, and thus, a larger want for complete protection to safeguard your monetary funding.

Elements Influencing the Value of Complete Insurance coverage

A number of components decide the price of complete insurance coverage, influencing the general premium. These components embrace the automobile’s make, mannequin, and 12 months; the motive force’s driving historical past; the situation the place the automobile is garaged; and any extra add-ons, reminiscent of roadside help. The insurer assesses these components to find out the chance related to insuring the automobile, affecting the premium quantity.

- Car Make, Mannequin, and Yr: Completely different makes, fashions, and years of automobiles range of their susceptibility to break and theft. This impacts the probability of claims and, consequently, the price of insurance coverage. For instance, luxurious automobiles typically entice greater premiums in comparison with extra reasonably priced fashions.

- Driver’s Driving Historical past: A driver with a historical past of accidents or site visitors violations is perceived as a better danger by insurers. This greater danger interprets to greater insurance coverage premiums. A secure and accountable driving historical past, however, can result in decrease insurance coverage prices.

- Location: Areas with greater crime charges or inclement climate circumstances typically have greater complete insurance coverage premiums. The frequency of claims and the potential for harm in particular areas affect the premiums charged.

- Add-ons: Sure add-ons, like roadside help, would possibly improve the general price of complete insurance coverage.

Impression of Automobile Age on Complete Protection

The age of a automobile considerably impacts the necessity for complete insurance coverage. Older automobiles typically depreciate quicker, lowering their market worth and thus, the monetary influence of harm or theft. The price of repairs and replacements on older automobiles may be lower than on newer ones, besides, complete insurance coverage protects towards unexpected occasions. Whereas older automobiles may appear to necessitate much less protection, complete insurance coverage safeguards towards potential vital monetary losses.

Alternate options to Complete Insurance coverage

Choosing the proper insurance coverage protection on your financed automotive is essential. Whereas complete insurance coverage gives broad safety, understanding options may help you tailor your protection to your particular wants and price range. This part explores choices past complete insurance coverage, highlighting their benefits and drawbacks, and after they may be a extra appropriate alternative.Defending your financed automobile requires cautious consideration of assorted components, together with your driving habits, the automotive’s age and situation, and your monetary state of affairs.

Completely different insurance coverage choices cater to completely different danger profiles and budgets, providing flexibility in choosing the proper protection.

Different Insurance coverage Choices

A number of various insurance coverage choices exist in addition to complete protection. These choices typically present a less expensive resolution whereas nonetheless providing some degree of safety.

- Collision Insurance coverage: This kind of insurance coverage covers harm to your automobile brought on by a collision with one other automobile or object. It doesn’t, nonetheless, cowl harm brought on by different occasions like vandalism or climate. It’s a extra targeted type of safety, notably appropriate for drivers with a better danger of accidents or these in areas susceptible to accidents.

As an illustration, drivers dwelling in densely populated city areas could profit extra from collision insurance coverage as a result of elevated danger of collisions. In distinction, drivers in rural areas with fewer automobiles on the street could discover it much less vital, and complete insurance coverage would possibly provide higher total safety.

- Uninsured/Underinsured Motorist Protection: This protection protects you if you’re concerned in an accident with a driver who would not have insurance coverage or would not have sufficient insurance coverage to cowl the damages. It’s important in areas with a better incidence of uninsured drivers, the place the chance of encountering an accident with such a driver is larger. For instance, areas with greater charges of uninsured drivers would discover this protection extra useful.

- Legal responsibility Insurance coverage: That is probably the most fundamental type of automotive insurance coverage, masking harm you trigger to a different particular person’s automobile or property in an accident. It is sometimes required by legislation, providing minimal safety for the insured celebration’s personal automobile, specializing in the safety of different events within the occasion of an accident. Legal responsibility insurance coverage alone could not present sufficient safety on your financed automobile, particularly if the accident results in vital harm.

- Hole Insurance coverage: Hole insurance coverage covers the distinction between the precise money worth of your automobile and the excellent mortgage quantity in your financing. That is useful in case your automotive is totaled or considerably broken, making certain you do not have to bear the monetary burden of the excellent mortgage. This selection is especially related in case your automobile depreciates quickly or is concerned in a catastrophic accident.

Comparability of Insurance coverage Choices

The next desk summarizes the professionals and cons of complete insurance coverage and a few various choices, aiding within the decision-making course of.

| Insurance coverage Sort | Professionals | Cons |

|---|---|---|

| Complete | Protects towards a variety of damages (fireplace, vandalism, theft, climate). Supplies most safety for the insured automobile. | Typically the most costly choice. Might not be vital for all conditions. |

| Collision | Covers harm to your automobile in a collision, no matter fault. Usually extra reasonably priced than complete. | Would not cowl harm from different occasions like vandalism or climate. |

| Uninsured/Underinsured Motorist | Protects towards accidents with drivers missing enough insurance coverage. Supplies essential protection in high-risk areas. | Would not cowl harm to your automobile from different occasions. |

| Legal responsibility | Required by legislation in most jurisdictions. Comparatively cheap. | Supplies minimal safety on your automobile. Would not cowl harm to your automobile in an accident. |

| Hole Insurance coverage | Covers the distinction between the automotive’s worth and the mortgage quantity in case of whole loss or vital harm. Protects towards monetary loss. | Not required, however might be essential in instances of high-value automobiles or substantial depreciation. |

Sensible Issues and Eventualities: Do I Want Complete Insurance coverage On Financed Automobile

Understanding the nuances of complete insurance coverage for a financed automotive requires inspecting real-world conditions. This part delves into eventualities the place complete protection is important, pointless, or financially useful, providing a sensible framework for making knowledgeable selections.Complete insurance coverage, whereas typically considered as an additional expense, can present crucial safety on your financed automobile. Analyzing the potential prices and advantages in varied conditions is vital to understanding its position in safeguarding your monetary funding and avoiding surprising bills.

Essential State of affairs for Complete Insurance coverage

A younger skilled, Sarah, financed a brand new sports activities automotive. Her automotive is parked on a busy metropolis road, making it vulnerable to vandalism, theft, or unintended harm. Complete insurance coverage is essential on this state of affairs. If her automotive is broken in an accident involving one other automobile, complete insurance coverage will cowl the repairs, no matter who’s at fault.

If her automotive is vandalized, complete protection steps in to pay for the damages, even when there is not any different celebration accountable. Moreover, if the automotive is stolen, complete insurance coverage helps get well the monetary loss related to the automobile. On this case, complete protection mitigates the chance of great monetary burden from unexpected occasions.

Pointless State of affairs for Complete Insurance coverage

A retired couple, Mr. and Mrs. Johnson, finance a used sedan with a low-value mortgage. They stay in a quiet suburban neighborhood with low crime charges and park their automotive in a safe storage. Their automotive shouldn’t be more likely to be stolen or vandalized.

Moreover, they drive cautiously and are unlikely to be concerned in an accident. On this case, complete insurance coverage won’t be vital. The price of complete insurance coverage may very well be higher utilized elsewhere, reminiscent of financial savings or different monetary wants. The low danger of harm, theft, or vandalism justifies the absence of complete insurance coverage.

Financially Helpful State of affairs for Complete Insurance coverage

A small enterprise proprietor, David, funds a supply van for his rising firm. His van is used every day for enterprise functions and is steadily uncovered to dangers, reminiscent of collisions with different automobiles, street hazards, or harm from accidents. Complete insurance coverage offers peace of thoughts, because it covers repairs or substitute prices, minimizing disruptions to his enterprise operations.

The protection gives safety towards unexpected occasions that would result in pricey repairs or replacements, defending his enterprise from monetary setbacks. On this case, the advantages of complete insurance coverage considerably outweigh the fee when contemplating the monetary implications of potential automobile harm.

Potential Prices and Advantages of Complete Insurance coverage

| State of affairs | Value of Complete | Advantages |

|---|---|---|

| Younger skilled with a brand new sports activities automotive in a high-crime space | Doubtlessly greater | Protects towards theft, vandalism, and accidents, essential for a high-value asset |

| Retired couple with a low-value used sedan in a secure neighborhood | Doubtlessly decrease | Might not be vital; funds might be higher allotted elsewhere |

| Small enterprise proprietor with a supply van | Doubtlessly greater | Covers repairs/replacements, minimizing enterprise disruptions, and defending towards monetary losses |

Interplay with Mortgage Phrases and Obligations

Complete insurance coverage interacts with mortgage phrases by making certain the financed automobile is satisfactorily protected. If the automobile is broken or stolen, complete insurance coverage helps preserve the worth of the asset, lowering the chance of defaulting on the mortgage. The mortgage settlement sometimes Artikels the lender’s necessities for insurance coverage protection. Failing to take care of the required insurance coverage protection would possibly result in penalties or repossession of the automobile.

The borrower is liable for making certain the great insurance coverage stays legitimate all through the mortgage interval.

Resolution-Making Framework

Deciding whether or not complete insurance coverage is critical for a financed automotive entails a cautious evaluation of assorted components. This framework offers a structured strategy to guage the dangers and potential advantages, enabling a well-informed resolution. In the end, the selection hinges on particular person circumstances, monetary state of affairs, and danger tolerance.

Step-by-Step Resolution Course of

A scientific strategy is essential in figuring out the necessity for complete insurance coverage. This course of entails evaluating components just like the automotive’s worth, the mortgage quantity, and the potential for harm or theft. Following a step-by-step strategy ensures a well-reasoned alternative, balancing monetary concerns with potential dangers.

- Assess the Car’s Worth and Mortgage Quantity:

- Consider Potential Dangers:

- Analyze Complete Insurance coverage Prices:

- Take into account Monetary State of affairs and Danger Tolerance:

- Weigh the Advantages and Drawbacks:

- Make an Knowledgeable Resolution:

Decide the precise money worth (ACV) of the automobile and the excellent mortgage stability. This step establishes the monetary stake within the automobile and helps quantify potential losses. Evaluating the automobile’s worth to the mortgage quantity is an important preliminary step.

Take into account the probability of accidents, theft, or harm. Elements like driving habits, location, and the automobile’s age play a vital position. A radical evaluation of potential dangers helps quantify the necessity for insurance coverage safety.

Acquire quotes from a number of insurance coverage suppliers. Examine the price of complete insurance coverage with different out there choices, reminiscent of hole insurance coverage or different supplemental protection. Understanding the pricing construction and protection particulars is paramount.

Consider your private monetary capability to soak up potential losses. Assess your consolation degree with danger. A sensible evaluation of your monetary state of affairs and danger tolerance influences the choice.

Examine the price of complete insurance coverage to the potential monetary penalties of a lined incident. Assess whether or not the insurance coverage premium outweighs the potential loss safety. A radical understanding of each side of the equation is important.

Based mostly on the earlier steps, make a well-informed resolution about whether or not or to not buy complete insurance coverage. Doc the rationale behind the choice for future reference. A remaining resolution ought to contemplate all elements and result in a transparent alternative.

Guidelines for Complete Insurance coverage

This guidelines offers a concise overview of key inquiries to ask earlier than buying complete insurance coverage. A radical self-assessment may help guarantee the choice aligns with private wants and monetary objectives.

- What’s the present market worth of my automobile?

- What’s the excellent mortgage stability on my automobile?

- What are my driving habits and the standard site visitors circumstances in my space?

- What’s the probability of accidents, theft, or harm to my automobile?

- What are the prices of complete insurance coverage from varied suppliers?

- Can I afford the potential prices of an incident with out insurance coverage?

- What are the potential advantages and downsides of complete insurance coverage protection?

- Are there any various choices to complete insurance coverage that would meet my wants?

Resolution-Making Flowchart

The flowchart illustrates a visible illustration of the decision-making course of. It guides customers by means of a collection of decisions primarily based on their particular person circumstances.

Remaining Wrap-Up

In the end, deciding whether or not complete insurance coverage is critical for a financed automotive hinges on cautious consideration of particular person circumstances. Elements just like the automobile’s worth, the mortgage phrases, and private danger tolerance all play a vital position. The offered eventualities and decision-making framework will empower you to make the only option, making certain your monetary well-being and peace of thoughts.

FAQ Compilation

Is complete insurance coverage obligatory for a financed automotive?

No, complete insurance coverage is not obligatory. Nevertheless, it is typically a crucial element of a complete monetary plan. Lenders could require it as a situation for the mortgage, and with out it, you possibly can face monetary repercussions if one thing occurs to the automobile.

What are the frequent misconceptions about complete insurance coverage?

A typical false impression is that complete insurance coverage solely covers harm from pure disasters. It additionally protects towards vandalism, theft, and different unexpected circumstances.

How does the down cost have an effect on the necessity for complete insurance coverage?

A bigger down cost could cut back the perceived want for complete insurance coverage. Nevertheless, the worth of the automotive and the mortgage phrases nonetheless want consideration.

What are some options to complete insurance coverage?

Hole insurance coverage and different elective protection can fill gaps in complete protection or function options relying on the monetary state of affairs and danger tolerance.