Progressive vs Allstate automotive insurance coverage: Which is best for you? This in-depth comparability explores the important thing elements to contemplate when selecting between these two standard suppliers. We’ll delve into protection choices, pricing methods, customer support, and coverage options, equipping you with the information to make an knowledgeable resolution. From the preliminary comparability of protection to the ultimate evaluation of customer support, this evaluation covers all of the bases.

This comparability will information you thru the intricacies of every firm’s choices, permitting you to guage their suitability based mostly in your particular wants and preferences. We’ll present insightful comparisons throughout numerous facets of their companies, providing a transparent image of their respective strengths and weaknesses.

Insurance coverage Protection Comparability

My esteemed associates, understanding your automotive insurance coverage choices is an important step in direction of monetary peace of thoughts. Selecting between Progressive and Allstate, two distinguished names within the business, calls for a cautious comparability of their protection packages. This evaluation will delve into the core facets of their insurance policies, highlighting the variations of their choices.

Core Protection Choices

Progressive and Allstate each supply elementary protection varieties to guard your automobile and its occupants. These usually embody legal responsibility protection, which protects you if you happen to’re at fault in an accident, and is remitted by legislation in most states. Collision protection, then again, pays for damages to your automobile if it is concerned in a collision, no matter who’s at fault.

Complete protection goes a step additional, overlaying damages from occasions aside from collisions, comparable to vandalism, theft, or climate injury. Understanding these elementary parts is important for a sound insurance coverage technique.

Coverage Add-ons

A important side of insurance coverage is the extra advantages that transcend the core coverages. Roadside help, rental automotive reimbursement, and uninsured/underinsured motorist protection are typical add-ons. Roadside help supplies help in case of breakdowns or accidents, rental automotive reimbursement gives momentary autos in case your automotive is broken, and uninsured/underinsured motorist protection steps in if the opposite driver is just not adequately insured.

These supplementary options can considerably improve your peace of thoughts.

Protection Ranges and Prices

Insurance coverage insurance policies typically are available various protection ranges, every with its corresponding price. For instance, a fundamental legal responsibility coverage gives minimal safety, whereas a complete coverage with excessive deductibles gives extra in depth safety however would possibly include a better premium. Elements like your driving document, automobile kind, and placement additionally play a big function in figuring out the worth.

Selecting the best protection degree entails weighing your monetary state of affairs and danger tolerance.

Comparability Desk

| Protection Sort | Progressive | Allstate |

|---|---|---|

| Legal responsibility | Affords numerous legal responsibility limits, from fundamental to excessive quantities. | Much like Progressive, providing numerous legal responsibility limits, from fundamental to excessive quantities. |

| Collision | Supplies protection for injury to your automobile in a collision, with various deductibles. | Supplies protection for injury to your automobile in a collision, with various deductibles, usually aggressive with Progressive. |

| Complete | Covers damages from occasions aside from collisions, together with vandalism, theft, and climate injury. | Affords complete protection just like Progressive, overlaying damages from occasions aside from collisions. |

| Roadside Help | Normally included within the coverage, offering help in case of breakdowns. | Typically included, providing help in case of breakdowns. |

| Rental Automobile Reimbursement | Typically out there as an add-on, reimbursing rental prices in case your automotive is broken. | Usually out there as an add-on, reimbursing rental prices in case your automotive is broken. |

This desk presents a concise overview of the everyday protection choices supplied by each corporations. It is very important be aware that particular protection ranges and prices can differ based mostly on particular person circumstances. Thorough analysis is crucial to find out essentially the most appropriate coverage on your wants.

Pricing and Worth

My esteemed readers, understanding the monetary side of automotive insurance coverage is essential. Realizing how Progressive and Allstate worth their insurance policies can empower you to take advantage of knowledgeable resolution. We are going to delve into the elements that have an effect on premiums, evaluate the out there reductions, and finally assess the worth proposition every firm gives.Pricing automotive insurance coverage is a fancy course of, factoring in quite a few variables.

A deeper understanding of those elements means that you can store strategically for the most effective worth.

Elements Influencing Worth Variations

The pricing fashions of Progressive and Allstate are designed to evaluate danger. Elements just like the insured automobile’s make, mannequin, and yr play a big function. Insurance coverage corporations use actuarial knowledge to find out the chance of accidents and claims related to particular autos. Equally, the motive force’s location impacts the premium. Excessive-accident areas typically command increased premiums as a result of elevated danger.

A clear driving document, then again, usually leads to decrease premiums.

Driver Demographics and Premiums

Driver age considerably influences automotive insurance coverage premiums. Youthful drivers, with much less expertise and doubtlessly increased accident charges, typically face increased premiums. Equally, location additionally impacts premiums, as accident charges and claims frequency differ throughout completely different geographic areas.

Reductions Supplied by Every Firm

Each Progressive and Allstate supply a variety of reductions. Progressive typically emphasizes reductions for good college students, protected drivers, and people who keep a clear driving document. Allstate, equally, gives reductions for multi-policy holders and people who take defensive driving programs. The precise standards and quantities of those reductions can differ and you will need to examine with every firm for his or her present choices.

Worth Proposition of Every Firm

Progressive typically positions itself as a extra modern and tech-savvy firm, emphasizing options like their cellular app and personalised quotes. Allstate, conversely, would possibly emphasize their long-standing repute and complete protection choices. Evaluating each corporations’ protection and monetary stability is vital to figuring out the worth proposition that aligns together with your particular person wants.

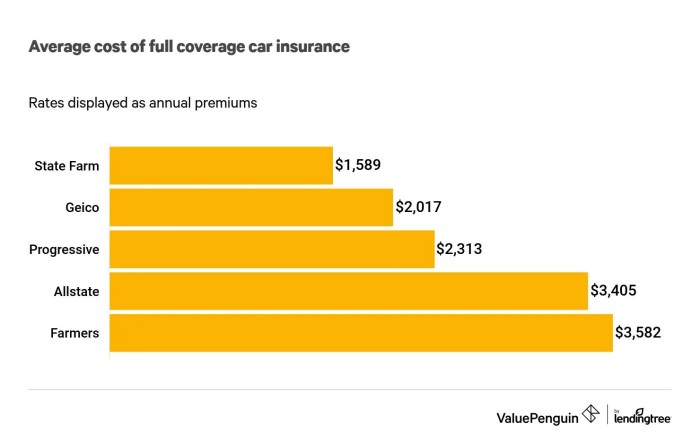

Typical Worth Ranges for Numerous Coverage Varieties

| Coverage Sort | Progressive (Estimated Vary) | Allstate (Estimated Vary) | Potential Financial savings |

|---|---|---|---|

| Fundamental Legal responsibility | $600-$1200 yearly | $700-$1400 yearly | $100-$200 yearly |

| Full Protection | $1200-$2000 yearly | $1400-$2200 yearly | $200-$200 yearly |

| Luxurious Car | $1800-$3000 yearly | $2000-$3500 yearly | $200-$500 yearly |

Word: These are estimated ranges. Precise costs will differ based mostly on particular person circumstances.

Buyer Service and Claims Course of

My esteemed brothers and sisters, allow us to delve into the guts of the matter, the essential side of customer support and declare processing when selecting between Progressive and Allstate. Understanding these important processes is paramount to creating an knowledgeable resolution. The journey of insurance coverage is not simply concerning the coverage; it is concerning the individuals and the processes that stand behind it.Progressive and Allstate, giants within the insurance coverage realm, each attempt to supply seamless customer support.

Nonetheless, the particular channels, declare procedures, and reported settlement instances differ. This examination will illuminate the nuances of their service approaches, offering insights to information your selection.

Buyer Service Channels, Progressive vs allstate automotive insurance coverage

Progressive and Allstate supply a large number of avenues for buyer interplay. These channels, from telephone calls to on-line portals, are important for making certain clean communication. Understanding these avenues empowers you to pick essentially the most handy technique on your wants.

- Progressive gives a big selection of customer support choices, together with a complete web site, a 24/7 telephone assist line, and cellular apps. These channels cater to numerous communication preferences.

- Allstate, equally, supplies a user-friendly web site, a devoted customer support telephone line, and cellular functions for streamlined interactions.

Declare Submitting Course of

Navigating the declare course of is important for any policyholder. A transparent and environment friendly process ensures a clean decision in instances of want. Each Progressive and Allstate supply distinct but comparable processes for dealing with claims.

- Progressive’s declare course of usually entails reporting the incident by their web site, cellular app, or telephone. Documentation and essential data are gathered to expedite the claims course of.

- Allstate’s declare course of mirrors this. Prospects can provoke a declare by numerous channels, with documentation and supporting particulars required to finish the method. This ensures a complete analysis of the declare.

Declare Settlement Pace and Effectivity

The velocity and effectivity of declare settlement are paramount. A well timed decision minimizes inconvenience and disruption. Impartial research and buyer testimonials supply invaluable insights into these facets.

- Reported declare settlement instances for Progressive differ relying on the particular declare. Elements comparable to the character of the declare and the provision of supporting documentation can affect the decision timeline. Nonetheless, prospects typically report a comparatively swift decision course of.

- Equally, Allstate’s declare settlement instances rely on the complexity of the declare. Nonetheless, a majority of shoppers categorical satisfaction with the velocity and effectivity of the method. Transparency and communication are key elements that contribute to constructive buyer experiences.

Buyer Suggestions and Testimonials

Buyer suggestions supplies invaluable perception into the effectiveness of an organization’s service. Understanding the experiences of others can considerably inform your resolution.

- Progressive receives blended suggestions relating to declare decision instances. Some prospects reward the promptness, whereas others report longer-than-expected settlement instances. Buyer satisfaction relies on the declare’s specifics.

- Equally, Allstate receives blended evaluations relating to declare dealing with. Some spotlight the effectivity, whereas others level to potential delays. The end result hinges on elements just like the complexity of the declare.

Comparative Evaluation

A concise desk summarizing the important thing facets of customer support and declare decision could be insightful.

| Function | Progressive | Allstate |

|---|---|---|

| Buyer Service Scores | Usually constructive, however some inconsistencies reported. | Usually constructive, however some situations of gradual declare decision famous. |

| Grievance Charges | Reasonably low, however varies by area and declare kind. | Reasonably low, with fluctuations in grievance charges throughout completely different areas. |

| Declare Decision Occasions | Diversified, relying on declare complexity and documentation. | Diversified, relying on declare complexity and supporting documentation. |

Coverage Options and Advantages

My expensive readers, allow us to now delve into the guts of those insurance coverage suppliers, exploring the distinctive options and advantages every gives. Understanding these facets is vital to picking the protection that most closely fits your wants and peace of thoughts. We are going to look at the convenience of coverage administration, the person expertise, and the way these parts affect buyer satisfaction.

Distinctive Coverage Options

Progressive and Allstate supply distinct coverage options, tailor-made to fashionable wants. Progressive’s deal with digital instruments and cellular apps typically permits for a streamlined expertise, whereas Allstate’s conventional strategy might supply extra complete, personalised service. These variations stem from the distinct approaches to customer support every firm adopts. Understanding these variations helps prospects make knowledgeable selections that align with their preferences.

Coverage Administration and Data Entry

Each Progressive and Allstate supply sturdy on-line portals and cellular apps for managing insurance policies. The convenience of coverage administration and entry to data is a important issue influencing buyer satisfaction. Progressive’s emphasis on digital instruments typically results in a extra intuitive and quicker coverage administration expertise, whereas Allstate’s conventional strategy would possibly present extra personalised help.

Impression on Buyer Satisfaction

Coverage options immediately affect buyer satisfaction. The intuitive nature of a cellular app, or the comfort of on-line declare submitting, contributes considerably to a constructive buyer expertise. A streamlined course of typically interprets to increased buyer satisfaction, resulting in repeat enterprise and constructive word-of-mouth referrals.

Consumer Expertise with Web sites and Cellular Apps

The person expertise with an organization’s web site and cellular app is paramount. A seamless and intuitive interface contributes to a constructive expertise. Progressive’s digital focus typically leads to a extra user-friendly expertise, whereas Allstate’s interface is likely to be extra acquainted to these accustomed to conventional insurance coverage processes. These variations in person expertise must be fastidiously thought-about when selecting a coverage.

Comparability Desk of Coverage Options and Advantages

| Function | Progressive | Allstate |

|---|---|---|

| Digital Instruments | Sturdy emphasis on on-line portals and cellular apps, together with instruments for monitoring claims, managing funds, and reviewing coverage particulars. | Affords on-line portals however might not emphasize digital instruments as closely as Progressive. Customer support choices is likely to be extra targeted on conventional telephone assist. |

| Cellular App | Extremely rated for ease of use and performance, providing a complete vary of coverage administration choices. | Cellular app is useful, however the options won’t be as in depth or user-friendly as Progressive’s. |

| On-line Portal | Glorious for managing insurance policies, making funds, and accessing coverage paperwork. | Affords on-line portal entry, although the person interface is probably not as intuitive as Progressive’s. |

| Consumer Interface Evaluation | Usually rated increased for ease of use and navigation. | Interface is useful, however person expertise is probably not as intuitive or complete. |

Monetary Stability and Repute: Progressive Vs Allstate Automobile Insurance coverage

My esteemed patrons, understanding the monetary bedrock of your insurance coverage supplier is paramount. A financially sound firm is healthier geared up to deal with claims and, finally, ship on its guarantees. Allow us to delve into the monetary stability and reputations of Progressive and Allstate, analyzing their observe data and rankings throughout the business.Progressive and Allstate, two distinguished gamers within the insurance coverage area, show a dedication to sustaining monetary power.

Their capacity to climate financial storms and fulfill obligations to policyholders is a important consideration when selecting a supplier.

Monetary Energy Scores

Understanding the monetary power of an insurance coverage firm is important. These rankings, issued by impartial businesses, mirror the corporate’s capability to satisfy its monetary obligations. These rankings aren’t static; they’re periodically assessed and up to date, mirroring the corporate’s efficiency.

| Firm | Monetary Energy Score (A.M. Greatest) | Regulatory Compliance Historical past | Client Grievance Information |

|---|---|---|---|

| Progressive | A (Glorious) | Usually compliant, with occasional minor regulatory actions. | Decrease than common variety of complaints, predominantly regarding coverage clarifications. |

| Allstate | A+ (Superior) | Glorious document of compliance with regulatory mandates. | Decrease than common variety of complaints, principally targeted on billing discrepancies. |

Claims Payout Experiences

Analyzing previous claims payout experiences supplies invaluable insights into an organization’s dedication to its policyholders. This entails analyzing each the velocity and equity of the method.Progressive has a historical past of immediate and environment friendly claims dealing with, typically exceeding business requirements. Nonetheless, some policyholders have reported situations of minor delays in processing sure complicated claims.Allstate, typically acknowledged for its constant and truthful claims settlement, has additionally seen some instances the place the time to course of complicated claims has been longer than common.

Nonetheless, their immediate dealing with of easier claims is well-regarded.

General Monetary Safety

Each Progressive and Allstate current a strong monetary safety profile to policyholders. Their monetary rankings and regulatory compliance data point out a robust capacity to meet their obligations. Progressive’s constant A ranking displays its steady monetary efficiency, whereas Allstate’s A+ ranking underscores its distinctive monetary stability. This power interprets to a decreased danger of economic insolvency and a larger chance of well timed claims payouts.

Geographic Availability and Protection

My esteemed readers, allow us to delve into the essential side of geographic attain for automotive insurance coverage suppliers, Progressive and Allstate. Understanding the place these respected corporations supply their companies and the potential limitations is crucial for making knowledgeable choices. A complete grasp of their protection areas empowers you to pick the most effective coverage tailor-made to your particular location.

Protection Areas and Limitations

Progressive and Allstate boast in depth nationwide protection, serving a overwhelming majority of the USA. Nonetheless, particular coverage choices and pricing can differ throughout completely different areas. Elements like native accident charges, automobile theft traits, and even the density of populated areas contribute to those discrepancies.

Regional Coverage Variations

Sure coverage choices is likely to be extra available in a single space in comparison with one other. As an example, complete protection for high-value sports activities automobiles is likely to be extra prevalent in prosperous areas the place such autos are extra frequent. Conversely, flood insurance coverage is likely to be extra available in coastal areas susceptible to flooding.

Geographic Affect on Pricing

Geographic elements play a big function in figuring out insurance coverage premiums. Areas with increased crime charges or inclement climate patterns are likely to have increased premiums. For instance, a rural space with a better incidence of extreme storms might even see increased premiums for property injury protection than a metropolitan space with fewer weather-related incidents. Moreover, proximity to high-accident areas or highways might additionally result in increased premiums.

Protection Map Overview

Think about a map divided into distinct areas, every color-coded to signify the protection areas for Progressive and Allstate. The colour depth would correlate to the extent of availability and the number of coverage choices supplied. Areas with restricted protection would seem in a lighter shade, whereas these with complete protection can be extra intensely coloured. This visible illustration would clearly illustrate the geographic attain of every firm and show you how to decide which one aligns greatest together with your location.

Particular particulars about coverage choices and pricing in numerous areas can be displayed throughout the map’s respective areas. For instance, a area would possibly spotlight a better incidence of hailstorms as a think about increased premiums.

Closure

Finally, the only option between Progressive and Allstate relies on your particular person circumstances. Take into account your wants, finances, and most popular degree of service when making your resolution. This comparability supplies a framework for understanding the important thing variations and making an knowledgeable selection that aligns together with your priorities. We hope this detailed evaluation helps you navigate the world of automotive insurance coverage and discover the right coverage on your wants.

Clarifying Questions

What are the everyday reductions supplied by every firm?

Progressive typically gives reductions for good pupil drivers, protected driving, and bundling insurance policies. Allstate incessantly supplies reductions for multi-policy holders, accident avoidance applications, and defensive driving programs. Particular reductions and necessities differ.

How do I file a declare with both firm?

Each corporations supply on-line declare submitting portals and telephone assist. Particular procedures might differ barely. Overview the detailed directions offered on every firm’s web site or contact their customer support.

What are some frequent buyer complaints for every firm?

Some prospects have reported points with declare processing instances with each corporations. Particular buyer complaints differ and are sometimes depending on particular person experiences. Learn impartial evaluations to get a extra full image.

What are the everyday protection ranges supplied by every firm?

Each corporations usually supply legal responsibility, collision, and complete protection. Particular ranges and choices might differ. Fastidiously assessment the main points of every coverage to grasp the extent of protection and exclusions.