AAA vs State Farm automotive insurance coverage – a head-to-head comparability. Choosing the proper auto insurance coverage generally is a daunting activity, however this complete evaluation will assist you to navigate the choices. This comparability explores the strengths and weaknesses of each AAA and State Farm, taking a look at protection, pricing, and customer support to offer a clearer image of which may be the higher match to your wants.

Each AAA and State Farm are main gamers within the insurance coverage market, recognized for his or her intensive protection and dependable service. Nonetheless, they differ of their method to insurance coverage, and understanding these variations is essential for making an knowledgeable determination. This comparability goals to make clear these distinctions, providing a beneficial information for shoppers.

Overview of AAA and State Farm Insurance coverage

AAA and State Farm are two of the biggest and most well-known suppliers of automotive insurance coverage in america. Understanding their protection choices, enterprise fashions, and buyer bases is essential for shoppers searching for the perfect match for his or her wants. This comparability will discover their similarities and variations that can assist you make an knowledgeable determination.Each firms provide a variety of automotive insurance coverage merchandise, however their approaches to the market and their core buyer bases differ.

This evaluation will Artikel their histories, reputations, providers, and monetary strengths that can assist you decide which firm aligns greatest together with your necessities.

Protection Choices and Enterprise Fashions, Aaa vs state farm automotive insurance coverage

AAA and State Farm each provide complete insurance coverage packages. AAA primarily focuses on its membership-based mannequin, offering numerous providers past insurance coverage, together with roadside help, journey providers, and reductions. State Farm, alternatively, operates as a standard insurance coverage firm, primarily specializing in insurance coverage merchandise. This distinction in enterprise fashions impacts the providers and advantages included with their respective insurance policy.

Buyer Profiles

AAA’s buyer base sometimes contains drivers who worth the excellent providers and reductions provided by means of their membership program. This usually contains frequent vacationers and those that prioritize roadside help and journey providers. State Farm, with its broad attain and various product choices, caters to a wider vary of drivers, together with these searching for easy insurance policy with wonderful claims dealing with.

Historical past and Popularity

AAA, based in 1902, has a protracted and established historical past in offering roadside help and journey providers. Their status is constructed on reliability and customer support. State Farm, established in 1922, has persistently been a significant participant within the insurance coverage business, recognized for its intensive community and nationwide attain. Each firms have robust reputations for monetary stability and reliability.

Providers Provided

AAA offers a wider vary of providers, together with roadside help, journey providers, and reductions on accommodations and leases, as a part of their membership. State Farm’s choices are primarily centered on insurance coverage services and products.

Monetary Strengths

| Function | AAA | State Farm |

|---|---|---|

| Monetary Stability | AAA is a well-established, financially steady group with a protracted historical past. They’ve a confirmed observe file of sustaining robust monetary reserves. | State Farm is without doubt one of the largest and most financially safe insurance coverage firms within the U.S. Their monetary power is persistently rated extremely. |

| Buyer Service | AAA’s status for customer support is powerful, significantly within the areas of roadside help and journey providers. | State Farm’s customer support is mostly well-regarded, with a robust emphasis on claims dealing with and environment friendly decision. |

| Claims Dealing with | Claims dealing with varies relying on the particular coverage and scenario. Their method usually prioritizes service as a part of the membership expertise. | State Farm’s claims dealing with course of is mostly environment friendly and well-organized, recognized for its nationwide attain and standardized procedures. |

| Premiums | Premiums might fluctuate primarily based on the particular protection choices and membership degree. | State Farm premiums usually examine favorably to these of different main suppliers. Components like driver profile and placement play a major function. |

Protection Comparability

Evaluating customary and non-obligatory protection packages between AAA and State Farm insurance coverage is essential for knowledgeable decision-making. Understanding the specifics of legal responsibility, collision, complete, and extra coverages is important to choosing the right coverage for particular person wants and danger profiles. Totally different ranges of protection and deductibles straight influence premiums, influencing the general value of insurance coverage.Complete comparisons of protection packages reveal nuanced variations between AAA and State Farm insurance policies.

Every insurer provides quite a lot of choices, from primary legal responsibility protection to complete packages with added extras. Understanding these choices permits shoppers to tailor their protection to their distinctive conditions and monetary conditions.

Legal responsibility Protection

Legal responsibility protection protects policyholders from monetary duty within the occasion of inflicting harm or property injury to others. Each AAA and State Farm provide various ranges of legal responsibility protection, together with bodily harm and property injury. The boundaries of those coverages fluctuate considerably, influencing the quantity of monetary safety. For instance, a coverage with a $100,000 bodily harm legal responsibility restrict can pay as much as $100,000 per particular person injured if the policyholder is at fault in an accident inflicting harm.

Equally, a coverage with a $25,000 property injury legal responsibility restrict can pay as much as $25,000 for injury to a different particular person’s property. Policyholders ought to fastidiously think about the bounds to make sure ample safety.

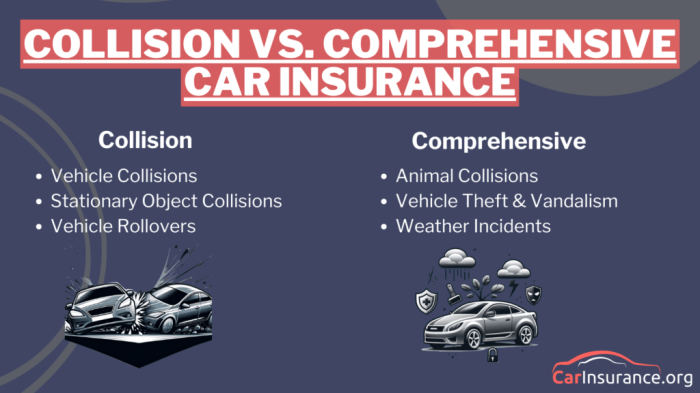

Collision and Complete Protection

Collision protection pays for damages to a policyholder’s automobile if it is concerned in an accident, no matter fault. Complete protection pays for damages to a policyholder’s automobile from occasions aside from accidents, akin to theft, vandalism, or climate injury. Each insurance policies are essential for safeguarding in opposition to monetary loss from these unexpected occasions. Variations exist within the particular sorts of occasions lined and the protection limits provided by every firm.

For instance, a complete coverage won’t cowl injury attributable to a pre-existing situation within the automobile, however might cowl injury from a hailstorm. Policyholders ought to scrutinize the main points of every coverage to make sure they perceive the protection scope.

Deductibles and Premiums

Deductibles considerably affect insurance coverage premiums. The next deductible often ends in decrease premiums, however the policyholder bears the monetary burden of the deductible quantity if a declare arises. For example, a coverage with a $500 deductible will lead to decrease premiums in comparison with a coverage with a $1000 deductible. Nonetheless, if a declare happens, the policyholder might want to pay $500 or $1000 out-of-pocket, respectively.

The selection of deductible will depend on the policyholder’s monetary scenario and danger tolerance.

Protection Comparability Desk

| Protection | AAA | State Farm |

|---|---|---|

| Legal responsibility | Customary bodily harm and property injury legal responsibility limits. Optionally available upgrades out there. | Customary bodily harm and property injury legal responsibility limits. Optionally available upgrades out there. |

| Collision | Totally different protection choices with various deductibles. | Totally different protection choices with various deductibles. |

| Complete | Totally different protection choices with various deductibles. | Totally different protection choices with various deductibles. |

| Uninsured/Underinsured | Customary protection included. | Customary protection included. |

| Roadside Help | Included in some packages. | Included in some packages. |

Pricing and Worth

Pricing for automotive insurance coverage usually displays danger assessments. Each AAA and State Farm make the most of refined actuarial fashions to guage elements impacting potential claims. Understanding these fashions and the elements influencing them is essential for shoppers searching for essentially the most cost-effective protection.

Pricing Fashions

Each AAA and State Farm make use of a mixture of actuarial fashions and knowledge evaluation to find out premiums. These fashions think about a variety of things, and pricing is not merely a hard and fast fee primarily based on protection ranges. As an alternative, it is dynamic, adjusting primarily based on particular person danger profiles. This method permits insurers to raised handle danger and provide aggressive pricing whereas making certain monetary stability.

Components Influencing Premiums

Quite a few elements affect automotive insurance coverage premiums. These elements are essential for understanding the potential value of protection and assist shoppers make knowledgeable selections.

- Driving Document: A clear driving file with few or no accidents or visitors violations considerably lowers premiums for each firms. Accidents, transferring violations, and even dashing tickets enhance premiums. This displays the insurer’s danger evaluation; a driver with a historical past of accidents is statistically extra more likely to file a declare.

- Car Kind: The make, mannequin, and yr of a automobile considerably influence premiums. Excessive-performance automobiles, sports activities vehicles, or automobiles susceptible to theft or injury might have increased premiums than customary fashions. That is because of the inherent danger related to these automobiles. For example, a sports activities automotive may be concerned in additional high-speed accidents in comparison with a compact sedan.

- Location: Geographic location performs a essential function. Areas with increased accident charges or increased ranges of theft can have increased premiums. It is a direct reflection of the danger degree in particular areas.

Reductions and Incentives

Each firms provide numerous reductions to incentivize buyer loyalty and reward good driving habits.

- AAA Reductions: AAA usually offers reductions for members, protected driving applications, and anti-theft gadgets. These reductions replicate the insurer’s acknowledgment of protected driving habits and proactive safety measures.

- State Farm Reductions: State Farm provides reductions for a number of automobiles, good pupil reductions, and defensive driving programs. These replicate the insurer’s dedication to rewarding accountable driving and lowering danger.

Examples of Premium Variations

A younger driver with a current dashing ticket in a sports activities automotive in a high-accident space would possible have considerably increased premiums in comparison with an older driver with a clear file driving a compact automotive in a lower-risk location. The mixture of things drastically influences the premium.

Pricing Tiers

| Issue | AAA | State Farm |

|---|---|---|

| Driving Document (Clear) | Decrease premiums | Decrease premiums |

| Driving Document (Violations) | Increased premiums | Increased premiums |

| Car Kind (Customary) | Average premiums | Average premiums |

| Car Kind (Excessive-performance) | Increased premiums | Increased premiums |

| Location (Low-accident space) | Decrease premiums | Decrease premiums |

| Location (Excessive-accident space) | Increased premiums | Increased premiums |

| Reductions (A number of automobiles) | Decreased premiums | Decreased premiums |

| General Price | Variable; will depend on particular person elements | Variable; will depend on particular person elements |

Buyer Service and Claims Course of

Assessing customer support and claims dealing with is essential when evaluating insurance coverage suppliers. A easy claims course of and responsive customer support are important for policyholders in instances of want. This part examines the out there channels for contacting every firm, particulars the claims decision timeframes, analyzes buyer satisfaction rankings, and evaluates the status every firm has in dealing with claims.

Buyer Service Channels

Customer support channels present avenues for policyholders to work together with the insurance coverage firm. Understanding the accessibility and effectivity of those channels is vital. AAA and State Farm provide numerous strategies to contact their respective customer support departments.

- AAA provides a number of contact choices, together with a 24/7 claims hotline, an internet site with intensive FAQs and on-line declare submitting, and in-person help at their native branches. The provision of those choices offers flexibility for policyholders to deal with their wants.

- State Farm additionally offers a complete vary of customer support channels. These embrace a 24/7 claims hotline, a user-friendly web site with intensive on-line sources, and in-person help at their quite a few native workplaces. The number of choices allows policyholders to pick the tactic that most accurately fits their wants and circumstances.

Claims Decision Time

Claims decision time is a key indicator of an insurance coverage firm’s effectivity. A well timed decision is important for policyholders searching for compensation or help. Variances in decision instances can stem from elements such because the complexity of the declare, the supply of supporting documentation, and the amount of claims processed.

- AAA sometimes goals for immediate declare decision, with goal instances various primarily based on the character of the declare. The corporate strives to offer environment friendly processing to facilitate a smoother restoration course of for policyholders.

- State Farm additionally prioritizes swift declare processing. Nonetheless, the precise time to decision can differ primarily based on the particular declare particulars and the amount of claims dealt with at any given time. This variability might be influenced by numerous elements such because the complexity of the declare, the quantity of supporting documentation, and the demand on their claims dealing with groups.

Buyer Satisfaction

Buyer satisfaction rankings present a broader perspective on the standard of service provided by insurance coverage suppliers. These rankings replicate the general expertise of policyholders interacting with the corporate.

- AAA’s buyer satisfaction rankings have been usually optimistic, reflecting the corporate’s dedication to immediate service and environment friendly claims dealing with. Nonetheless, particular outcomes might fluctuate primarily based on the particular kind of service or declare obtained. On-line evaluations present perception into the various experiences of policyholders.

- State Farm persistently maintains excessive buyer satisfaction scores. The corporate’s efforts to streamline the claims course of and supply numerous customer support channels contribute to those optimistic evaluations. The provision of a number of contact choices permits for a extra customized and environment friendly expertise for every policyholder.

Buyer Opinions

Buyer evaluations provide beneficial insights into the experiences of policyholders with every insurance coverage firm. These evaluations present a various vary of views on the service and claims dealing with course of.

| Facet | AAA | State Farm |

|---|---|---|

| Buyer Service Channels | On-line, telephone, in-person | On-line, telephone, in-person |

| Claims Decision Time | Usually immediate, varies by declare kind | Usually swift, varies by declare kind |

| Buyer Satisfaction | Usually optimistic, with potential variations | Excessive, with optimistic evaluations |

| Buyer Opinions | Optimistic suggestions on effectivity and responsiveness | Optimistic suggestions on claims dealing with and repair |

Protection Examples and Situations

Understanding the nuances of protection is essential when evaluating insurance coverage suppliers. Each AAA and State Farm provide complete insurance policies, however the particular conditions the place one may be extra advantageous than the opposite depend upon particular person wants and circumstances. This part examines particular situations for instance potential advantages and limitations of every firm’s protection.

AAA Protection Benefits

AAA usually excels in area of interest areas, offering tailor-made protection for particular wants. Their experience in automotive providers usually interprets to specialised automobile safety.

Instance AAA situation: A buyer with a high-value traditional automotive. AAA may provide complete protection for traditional automobiles, together with potential restoration prices if the automotive is broken. They could additionally present entry to a community of specialised restore outlets skilled in dealing with vintage and classic automobiles. Moreover, AAA’s roadside help might be extra intensive for uncommon conditions, akin to helping with traditional automotive begins.

State Farm Protection Benefits

State Farm, with its intensive community and broad attain, usually provides aggressive pricing and protection for extra customary wants. Their give attention to broader protection usually makes them an acceptable alternative for people with newer automobiles in high-risk areas.

Instance State Farm situation: A buyer with a more moderen automobile in a high-risk space. State Farm’s protection could also be preferable for increased accident charges or high-theft zones, providing extra complete legal responsibility safety and doubtlessly decrease premiums as a consequence of their widespread community. Their broad protection might be extra advantageous for extra widespread automobile injury situations, particularly when coping with typical repairs.

Declare Dealing with Variations

The declare dealing with course of varies between insurers. AAA’s method usually prioritizes the experience of its community, whereas State Farm’s method usually leans on its intensive claims processing community.

- Accidents: AAA might have faster entry to their most popular restore outlets, resulting in doubtlessly sooner turnaround instances, particularly in conditions the place specialised automobile repairs are required. State Farm might have a bigger community, providing extra choices for restore outlets and doubtlessly faster claims processing for widespread automobile repairs. The precise velocity and high quality of claims processing will fluctuate considerably relying on the particular circumstances of every declare.

- Theft: Each firms usually have comparable processes for dealing with theft claims, involving reporting, documentation, and investigation. State Farm’s widespread community may make it simpler to get better a stolen automobile if it is present in a special state. AAA might have specialised partnerships for recovering traditional vehicles, doubtlessly offering distinctive help in such instances.

Protection Limitations

No insurance coverage coverage covers each potential situation. Understanding the constraints of every firm’s protection is important.

- Unexpected Circumstances: Pure disasters or catastrophic occasions can exceed the protection limits of any insurance coverage coverage. The extent of protection in such instances might fluctuate considerably between insurers and needs to be reviewed fastidiously.

- Protection Gaps: Particular add-ons or endorsements could also be essential to deal with specific wants. Some conditions, akin to specialised automobile injury or uncommon incidents, is probably not absolutely lined below customary insurance policies.

Particular Situations The place Protection Might Be Inadequate

It is essential to acknowledge that no protection is complete. Particular conditions might require supplemental safety.

- Complete protection for unusually extreme climate occasions: Protection might not absolutely account for the intense injury attributable to uncommon and intense climate occasions.

- Intensive modifications to automobiles: Modifications might have an effect on the extent of protection if the modifications alter the automobile’s worth or use. Particular endorsements may be essential to deal with these situations.

Abstract

In conclusion, the perfect automotive insurance coverage for you’ll rely in your particular person wants and preferences. Whereas each AAA and State Farm provide complete protection, variations in pricing, customer support, and particular protection choices may make one a greater match than the opposite. Fastidiously think about your priorities and evaluation the detailed comparability to find out the optimum alternative to your driving wants.

Detailed FAQs: Aaa Vs State Farm Automobile Insurance coverage

What are the standard reductions provided by every firm?

Each firms provide numerous reductions, together with these for good driving information, protected driver applications, and a number of automobiles. Particular reductions and their availability might fluctuate primarily based on location and particular person circumstances.

How does every firm deal with claims for accidents?

Each AAA and State Farm have established claims processes. Customer support and determination instances can fluctuate. Verify current buyer evaluations and testimonials to evaluate the corporate’s dealing with of previous claims.

What are the monetary stability rankings for every firm?

Unbiased ranking businesses present monetary stability rankings for insurers. This info is essential for understanding every firm’s monetary power and skill to deal with claims.

Does AAA provide roadside help?

Sure, AAA is famend for its complete roadside help program, usually included as part of its membership advantages.