Are pressing care visits lined by insurance coverage? This can be a essential query for anybody needing fast medical consideration. Understanding your insurance coverage plan’s protection is essential to avoiding shock medical payments. We’ll dive into the small print, from primary insurance coverage plan varieties to potential out-of-pocket prices and the right way to discover solutions in your coverage.

Insurance coverage typically have particular guidelines about pressing care, with some overlaying visits extra readily than others. Various kinds of plans, like HMOs and PPOs, have completely different approaches to pressing care. Realizing the ins and outs of your coverage can prevent a ton of money down the highway.

Insurance coverage Protection Fundamentals

Yo, fam! Insurance coverage could be a whole maze, however figuring out how pressing care visits work along with your plan is essential. This lowdown will break it down, so you are not left at the hours of darkness. Whether or not you are rocking an HMO, a PPO, or one thing else, understanding your protection is essential.Insurance coverage typically cowl pressing care visits, however the specifics rely in your plan sort and whether or not the supplier is in-network or out-of-network.

Consider it like a VIP move—in-network suppliers get you precedence remedy and infrequently higher charges.

Totally different Varieties of Insurance coverage Plans

Totally different insurance coverage have other ways of dealing with pressing care. Some frequent varieties embrace HMOs (Well being Upkeep Organizations) and PPOs (Most well-liked Supplier Organizations). HMOs normally require you to decide on a major care physician, who then refers you to specialists, together with pressing care. PPOs provide you with extra flexibility to see any physician, however it typically comes with increased out-of-pocket prices if you happen to do not use in-network suppliers.

Different plans like POS (Level of Service) plans fall someplace in between these two.

In-Community and Out-of-Community Suppliers

The phrases “in-network” and “out-of-network” are tremendous necessary. In-network suppliers are a part of your insurance coverage plan’s community. They’ve agreed to sure cost phrases along with your insurer. Utilizing in-network suppliers normally means decrease prices for you. Out-of-network suppliers aren’t a part of your plan’s community.

They’re typically costlier.

Frequent Insurance coverage Phrases

Understanding some key phrases in your insurance coverage coverage will show you how to navigate the method. “Copay” is a hard and fast quantity you pay every time you go to pressing care. “Coinsurance” is a share of the associated fee that you simply pay after assembly your deductible. Your “deductible” is the quantity you pay out-of-pocket earlier than your insurance coverage begins overlaying prices. These phrases will likely be in your plan’s paperwork, and you may as well ask your insurance coverage supplier for clarification.

Protection Comparability Desk

| Issue | In-Community | Out-of-Community |

|---|---|---|

| Copay | Often decrease, typically $25-$50 | Larger, typically $50-$100+ |

| Coinsurance | Decrease share, typically 20% | Larger share, typically 50% or extra |

| Deductible | Applies towards your whole deductible | Applies towards your whole deductible |

This desk offers you a basic thought of the distinction in prices. Actual prices can fluctuate drastically relying on the precise plan and the companies rendered. At all times verify your coverage paperwork for actual particulars.

Elements Affecting Protection

Yo, fam! Insurance coverage protection for pressing care ain’t at all times an easy factor. It relies on a bunch of things, like your particular plan and thewhy* behind your journey to pressing care. Let’s break it down, so you realize your rights and duties.

Insurance coverage Plan Particulars

Totally different insurance coverage have completely different guidelines, so it is essential to know your plan inside and outside. Some plans supply higher protection than others, particularly in relation to out-of-pocket prices. Your plan’s particular coverage particulars dictate how a lot it’s going to cowl and what your copay could be. Look into your plan’s “in-network” suppliers; pressing care services may be both in-network or out-of-network.

This impacts your potential out-of-pocket bills. Should you’re not sure, name your insurance coverage firm or verify their web site for detailed information.

Pre-Present Situations

Pre-existing circumstances can affect pressing care protection. Some plans may need limitations or exclusions, which means they may not cowl care associated to a pre-existing situation. For instance, when you’ve got bronchial asthma and wish pressing look after an bronchial asthma assault, the protection could depend upon how your plan handles pre-existing circumstances. Learn the nice print, or higher but, ask a specialist to make clear your protection choices.

Purpose for Go to

The rationale on your pressing care go to may have an effect on protection. Routine stuff like a sprained ankle may need completely different protection than one thing extra critical like a suspected coronary heart assault. If it is a frequent situation, like a sore throat, your plan may need completely different cost buildings. If it is one thing extra critical, like suspected appendicitis, your plan may need extra intensive protection.

Your plan will possible have particular pointers.

Routine vs. Emergency

Routine pressing care visits, like a sore throat or a nasty minimize, are typically dealt with in a different way than emergencies. Routine visits typically have set copay limits or require a previous authorization out of your insurer. Emergencies, however, are sometimes dealt with extra shortly, with protection normally extra complete, though the precise particulars of your plan will decide the precise procedures and protection.

Frequent Pressing Care Causes & Protection Implications

| Purpose for Go to | Potential Protection | Attainable Limitations |

|---|---|---|

| Sprained ankle | Possible lined, relying on plan particulars | Potential copay, deductible, or out-of-pocket maximums |

| Extreme headache/migraine | Possible lined, relying on plan particulars | Potential copay, deductible, or out-of-pocket maximums; could require prior authorization |

| Suspected appendicitis | Possible lined, doubtlessly with excessive cost-sharing for superior diagnostics | Attainable prior authorization necessities; potential limitations on hospital keep protection |

| Bronchial asthma assault | Possible lined, relying on plan and pre-existing situation protection | Potential copay, deductible, or out-of-pocket maximums |

| Allergic response | Possible lined, relying on severity and plan particulars | Potential copay, deductible, or out-of-pocket maximums |

Understanding Out-of-Pocket Bills: Are Pressing Care Visits Lined By Insurance coverage

Yo, fam, so you bought insurance coverage, however what concerning the money you gotta cough up? This ain’t rocket science, however it’s essential to know your out-of-pocket prices for pressing care visits. Realizing the sport is half the battle, proper?Understanding your insurance coverage plan’s guidelines about out-of-pocket bills is essential to avoiding surprises on the pressing care clinic. Totally different plans have completely different guidelines, so that you gotta dig into the small print.

It is like determining a code; when you crack it, you are good to go.

Potential Out-of-Pocket Prices

Your out-of-pocket prices for pressing care can embrace a number of various things, they usually can fluctuate wildly relying in your plan. It isn’t at all times only one factor; it is a combine.

- Copay: This can be a flat charge you pay every time you see a physician or get pressing care. Consider it as a small entry charge to get within the door. Some plans have a copay, some do not. For instance, a typical copay could possibly be $25 or $50.

- Coinsurance: This can be a share of the price of your pressing care go to that you simply’re answerable for after you have met your deductible. As an instance your plan has 20% coinsurance; if the go to prices $100, you may pay $20.

- Deductible: That is the quantity you need to pay out-of-pocket for medical companies earlier than your insurance coverage begins overlaying a good portion. You gotta meet your deductible earlier than your insurance coverage kicks in. For instance, in case your deductible is $1,500, you pay that quantity first. When you hit that threshold, your plan normally covers an even bigger chunk of the associated fee.

Elements Affecting Prices, Are pressing care visits lined by insurance coverage

Your out-of-pocket prices are like a shifting goal. A number of issues can have an effect on the ultimate price ticket.

- Insurance coverage Plan: Totally different plans have completely different copay quantities, coinsurance percentages, and deductibles. Some plans are extra beneficiant than others. One plan may need a $20 copay and 20% coinsurance, whereas one other has a $50 copay and 10% coinsurance.

- Supplier: Pressing care facilities, like hospitals, typically have completely different pricing buildings. The precise clinic you go to may have an effect on the whole value.

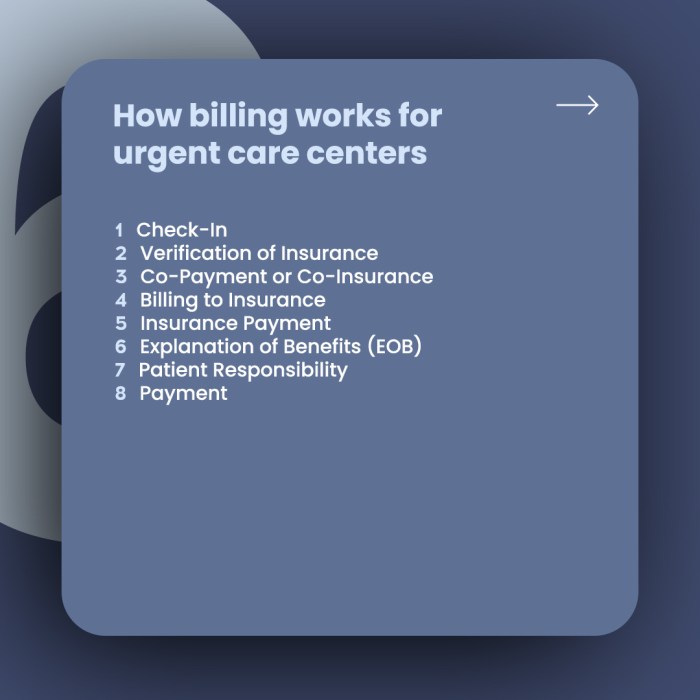

Declare Course of

So, how does this complete declare factor work? It isn’t as difficult because it sounds.

- Submitting the Declare: Your pressing care supplier will usually submit a declare to your insurance coverage firm in your behalf. That is a part of the conventional course of.

- Ready for Fee: Your insurance coverage firm will course of the declare and ship you a cost or modify your account steadiness, which normally takes a number of days or perhaps weeks.

- Receiving Clarification of Advantages (EOB): Your insurance coverage firm will ship you an EOB detailing the declare’s standing, the quantity they paid, and your remaining steadiness. That is important for understanding your out-of-pocket prices.

Calculating Estimated Prices

As an instance your pressing care go to prices $300. Your plan has a $25 copay, a 20% coinsurance, and a $500 deductible. You have not met your deductible but.

Estimated Value = Copay + (Coinsurance %

Go to Value)

Estimated Value = $25 + (0.20 – $300) = $25 + $60 = $85

You’d pay $85 out-of-pocket for this go to. Understand that that is an estimate, and the precise quantity would possibly differ primarily based on any further expenses or if you happen to’ve already hit your deductible.

Accessing Data and Sources

Yo, fam! Determining your insurance coverage protection for pressing care visits could be a whole headache. However do not stress, we’re about to interrupt it down so you may completely deal with it. Realizing the place to search out information and the right way to discuss to your insurance coverage is essential to avoiding any surprises.

Discovering Data in Your Coverage

Your insurance coverage coverage is principally your bible for protection particulars. It is full of information on what’s lined and what’s not. Search for sections particularly devoted to pressing care companies. Pay shut consideration to the specifics; some insurance policies have completely different guidelines for various kinds of pressing care, like ER vs. walk-in clinics.

Your coverage may even clarify what sort of pre-authorization, if any, is required for pressing care visits.

Contacting Your Insurance coverage Supplier

Do not be afraid to hit up your insurance coverage firm for clarification. They’re the consultants, they usually can completely reply your questions on pressing care. Use their web site or name their customer support line. Bear in mind to have your coverage quantity and any related medical information useful. This makes the method method smoother.

Affected person Sources for Understanding Protection

Loads of sources are on the market that can assist you perceive your insurance coverage. Web sites just like the healthcare supplier’s website, the insurance coverage firm’s website, and shopper safety businesses can supply tons of useful info. Additionally, take a look at any supplies your healthcare supplier would possibly provide you with about insurance coverage protection.

Ceaselessly Requested Questions About Pressing Care Insurance coverage Protection

Here is the lowdown on some frequent questions:

- What if my pressing care go to is not lined? Some plans could have limitations on lined companies, or there could also be out-of-pocket bills you want to deal with. Overview your coverage to know your plan’s limits. Remember that some insurance coverage firms will present a abstract of what is not lined.

- Can I get a pre-authorization for pressing care? Typically, you would possibly want pre-authorization for pressing care. Examine your coverage for particulars. Some plans could not require pre-authorization, however it’s at all times a good suggestion to ask.

- What paperwork do I have to submit for a declare? Your coverage ought to clearly Artikel the paperwork required for submitting a declare. Usually, this contains particulars concerning the go to, together with the date, time, purpose for go to, and companies offered. Your supplier ought to offer you an in depth bill.

- How lengthy does it take for insurance coverage to course of a declare? Processing instances fluctuate, relying on the insurance coverage firm and the precise declare. Your coverage ought to present an estimate. In case you are unsure, contact the corporate immediately to search out out extra concerning the course of.

Web sites and Sources for Insurance coverage Analysis

- Insurance coverage firm web sites: Every insurance coverage firm has an internet site with coverage particulars, FAQs, and declare procedures. That is your first cease for correct and up-to-date info. You must verify the corporate web site to substantiate essentially the most present insurance policies.

- Healthcare supplier web sites: Many healthcare suppliers have web sites with details about insurance coverage protection and billing procedures. They’re a wonderful useful resource to search out extra detailed details about what’s lined and what is not. It is necessary to evaluate this info fastidiously.

- Shopper safety businesses: Companies just like the Shopper Monetary Safety Bureau (CFPB) present details about insurance coverage rights and duties. This can be a nice useful resource to search out extra basic details about your insurance coverage rights. Use this useful resource to lookup extra details about insurance coverage.

Extra Concerns

Yo, fam, let’s speak about some further stuff you gotta find out about pressing care insurance coverage protection. It isn’t all the identical in every single place, and the nice print may be tough. Understanding these further particulars will show you how to get essentially the most bang on your buck.Geographic variations in pressing care protection are an actual factor. Insurance coverage firms typically have completely different agreements with pressing care services relying on the place you reside.

So, what works in a single state won’t fly in one other. For instance, a plan would possibly cowl pressing care visits in-network at a clinic in your metropolis, however out-of-network at a clinic in a distinct state. It is all concerning the native offers the insurance coverage firm has.

Location-Primarily based Variations in Protection

Insurance coverage typically have completely different agreements with pressing care services relying in your location. This will have an effect on your out-of-pocket prices and whether or not the go to is taken into account in-network or out-of-network. Elements influencing these agreements embrace the prevalence of pressing care services in a selected space, competitors amongst suppliers, and native market charges for healthcare companies.

Significance of Reviewing Coverage Effective Print

Do not simply skim the coverage; learn the nice print! It is essential to know the precise particulars about pressing care protection. Issues just like the definitions of “pressing care,” “in-network,” and “out-of-network” suppliers may be completely different for every plan. For instance, some insurance policies could have particular ready instances earlier than a go to is taken into account “pressing” or exclude sure sorts of companies from protection.

You would possibly assume it is lined, however the nice print would possibly say in any other case.

Pressing Take care of Kids and Dependents

Insurance coverage insurance policies typically have particular guidelines for kids and dependents. For instance, they may have separate deductibles or copays, or sure companies could also be lined in a different way. It is also frequent for pediatric pressing care visits to have completely different guidelines for remedy than these for adults. Plus, if you happen to’re a dad or mum, ensure your coverage covers your children’ pressing care visits.

It isn’t at all times automated.

Interesting a Denied Declare

In case your pressing care declare will get denied, do not panic. Most insurance coverage firms have a course of for interesting the choice. You normally want to offer supporting documentation, like medical information and receipts. Comply with the steps Artikeld in your coverage to submit the enchantment. They may ask for further particulars, like particular causes for the denial.

Pattern Coverage Excerpt (Pressing Care Protection)

Pressing care companies are lined when offered by a taking part supplier within the community. Out-of-network pressing care visits could also be topic to increased cost-sharing quantities, together with however not restricted to, the next copay and/or coinsurance. Overview the listing of in-network suppliers in your plan doc for particulars. Appeals have to be submitted inside 60 days of the denial discover.

Ending Remarks

Navigating pressing care protection can really feel overwhelming, however hopefully, this information has given you the instruments to know your choices. Bear in mind to at all times verify your particular coverage particulars and get in touch with your insurance coverage supplier when you’ve got questions. Realizing your protection is essential for making knowledgeable choices about your healthcare wants. Finally, being ready for pressing care means much less stress and extra give attention to getting the care you want.

Important FAQs

Does my insurance coverage cowl pressing care visits if I am out of community?

Protection for out-of-network pressing care visits is often extra restricted than in-network visits. Count on increased copays and coinsurance quantities, and also you may need to pay extra upfront.

What if my pressing care go to is for a pre-existing situation?

Pre-existing circumstances do not normally exclude pressing care protection, however your particular plan may need limitations. Examine your coverage for particulars.

How do routine pressing care visits differ from emergencies?

Routine pressing care visits typically have extra simple protection, whereas emergencies may need extra intensive protection, however this varies by coverage. Your plan’s specifics will element the variations.

What are frequent out-of-pocket bills for pressing care?

Frequent out-of-pocket bills embrace copays, coinsurance, and deductibles. These fluctuate primarily based in your plan and the supplier you see.