Greatest automotive insurance coverage for undocumented immigrants. Navigating the treacherous terrain of auto insurance coverage with out the standard paperwork and legalities generally is a actual headache. It is a minefield of hoops to leap by way of, with hidden pitfalls and complicated laws lurking round each nook. However concern not, intrepid drivers! This information will demystify the method, serving to you discover one of the best insurance policies to fit your wants and preserve you on the street safely.

Discovering dependable automotive insurance coverage is not straightforward while you’re undocumented. Conventional strategies might sound unimaginable. However do not despair. This complete information dives deep into the choices obtainable, analyzing totally different methods and insurance coverage suppliers who may cater to this distinctive demographic. We’ll uncover the hidden gems, the potential roadblocks, and the methods to get the absolute best protection on the most cheap worth.

Put together to be enlightened!

Understanding the Challenges

Securing auto insurance coverage presents distinctive obstacles for undocumented immigrants. Navigating the authorized and regulatory panorama, coupled with potential misconceptions about protection, usually results in difficulties in acquiring appropriate insurance policies. This part explores the particular challenges confronted by this inhabitants and the implications of driving with out insurance coverage.

Insurance coverage Obstacles for Undocumented Immigrants

The shortage of authorized documentation considerably impacts entry to conventional insurance coverage suppliers. Many insurance coverage corporations function beneath the belief that proof of authorized residency is critical for protection, which regularly excludes undocumented immigrants from the usual insurance coverage market. This can be a important barrier to making sure private and monetary safety.

Authorized and Regulatory Complexities

The authorized and regulatory framework surrounding auto insurance coverage for undocumented immigrants is complicated and varies throughout states. Some states have particular legal guidelines that both prohibit or permit insurance coverage for this inhabitants. This complexity makes it difficult to navigate the method, usually resulting in confusion and problem in acquiring appropriate protection.

Misconceptions about Insurance coverage Availability

A standard false impression is that undocumented immigrants can’t receive auto insurance coverage. Whereas acquiring customary protection by way of main insurers will be troublesome, specialised suppliers and packages exist to handle the wants of this inhabitants. Moreover, acquiring insurance coverage by way of a trusted dealer can assist circumvent a number of the obstacles.

Restricted or Unavailable Protection Sorts

Undocumented immigrants might face limitations in accessing particular forms of protection, equivalent to uninsured/underinsured motorist protection. Restricted availability of complete and collision protection can also be a priority. These limitations spotlight the necessity for specialised insurance coverage options that deal with the particular circumstances of this inhabitants.

Penalties of Driving With out Insurance coverage, Greatest automotive insurance coverage for undocumented immigrants

Driving with out insurance coverage carries extreme penalties for undocumented immigrants, no matter their authorized standing. These penalties can vary from important monetary penalties to authorized repercussions. The potential for hefty fines and even doable deportation or felony expenses underscores the significance of acquiring applicable protection. Moreover, if concerned in an accident, the dearth of insurance coverage can result in substantial monetary burdens and private legal responsibility points.

For instance, a driver with out insurance coverage is perhaps responsible for the complete value of damages incurred in an accident.

Exploring Insurance coverage Choices

Securing automotive insurance coverage generally is a important hurdle for undocumented immigrants. Navigating the complexities of the insurance coverage market with out correct documentation can really feel daunting. Nonetheless, numerous methods exist to acquire protection, and understanding these choices can ease the method.This part delves into numerous insurance coverage methods, highlighting the crucial position of licensed brokers and the particular forms of suppliers that cater to this inhabitants.

A comparative evaluation of insurance coverage suppliers can also be included, offering insights into premium charges and protection choices.

Methods for Acquiring Automotive Insurance coverage

A number of methods can assist undocumented immigrants safe automotive insurance coverage. These methods usually contain leveraging current documentation, exploring various choices, and using the providers of licensed brokers.

- Utilizing a licensed insurance coverage dealer:

- Licensed brokers usually possess a deep understanding of the insurance coverage panorama and may navigate the particular necessities of undocumented immigrants. They will establish insurance coverage suppliers keen to work with this demographic and assist them tailor a coverage that meets their wants. In addition they can present priceless recommendation on navigating the paperwork and procedures concerned.

- Exploring various insurance coverage suppliers:

- Some insurance coverage suppliers focus on offering protection to people who might not have conventional documentation. These suppliers might have particular processes for verifying id and assessing danger. Researching these suppliers and understanding their standards is essential.

- Using short-term or short-term protection choices:

- Short-term or short-term insurance coverage choices is perhaps obtainable for particular conditions. These choices can present protection for a restricted interval and could also be useful for individuals who want insurance coverage for a particular journey or occasion.

Function of Licensed Brokers or Brokers

Licensed insurance coverage brokers play an important position in serving to undocumented immigrants receive automotive insurance coverage. Their experience in navigating the complicated insurance coverage market is invaluable.

- Navigating insurance coverage complexities:

- Brokers have in-depth data of the insurance coverage trade and the nuances of working with numerous insurance coverage suppliers. They will establish these suppliers who usually tend to settle for purposes from undocumented immigrants.

- Tailoring insurance policies to particular wants:

- A dealer can work with a person to know their particular wants and tailor an insurance coverage coverage that addresses these wants, even with no conventional driver’s license.

- Advocating for shoppers:

- Licensed brokers can act as advocates for his or her shoppers, guaranteeing that their rights and desires are thought-about all through the insurance coverage course of. This consists of guaranteeing that the method is dealt with pretty and effectively.

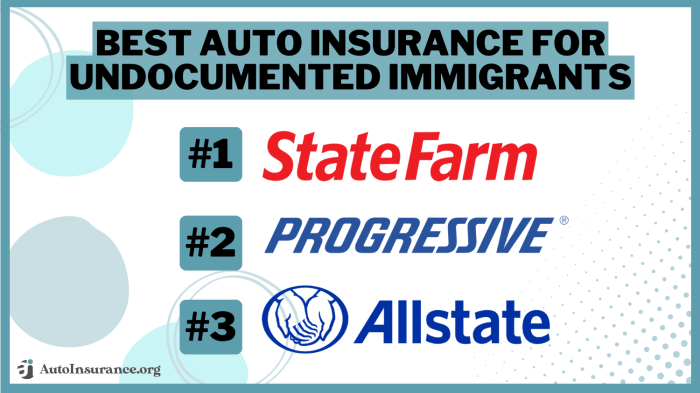

Insurance coverage Suppliers Catering to Undocumented Immigrants

Not all insurance coverage suppliers cater equally to undocumented immigrants. Understanding which suppliers are keen to work with this demographic is vital.

Whereas a complete listing of particular suppliers is troublesome to compile as a result of dynamic nature of the insurance coverage market and ranging state laws, some common observations will be made.

- Some specialised insurance coverage corporations could also be extra receptive to purposes from people with out conventional documentation.

- The willingness of suppliers to work with undocumented immigrants can range drastically relying on elements like the particular state’s laws, the kind of coverage, and the supplier’s inside tips.

Comparative Evaluation of Insurance coverage Suppliers

A comparative desk outlining numerous insurance coverage suppliers, their premium charges, protection sorts, and buyer evaluations can present a clearer image.

| Insurance coverage Supplier | Premium Charges | Protection Sorts | Buyer Opinions |

|---|---|---|---|

| Instance Supplier 1 | $150/month | Legal responsibility, Collision, Complete | Constructive suggestions on responsiveness and ease of claims course of. Some point out barely increased premiums in comparison with different choices. |

| Instance Supplier 2 | $125/month | Legal responsibility, Collision, Complete | Clients spotlight aggressive pricing and simple coverage phrases. Some point out longer wait instances for declare decision. |

Evaluating Insurance coverage Merchandise

Navigating the insurance coverage panorama can really feel daunting, particularly when going through distinctive circumstances. Understanding the specifics of assorted insurance policies and their implications for undocumented immigrants is essential for making knowledgeable selections. This part delves into the intricacies of various insurance coverage merchandise, specializing in their potential limitations for this demographic.

Evaluating Insurance coverage Insurance policies

Totally different insurance coverage insurance policies supply various ranges of protection and prices. A vital step is evaluating insurance policies to seek out one of the best match to your wants. The desk beneath illustrates a primary comparability of widespread insurance coverage sorts, highlighting potential limitations for undocumented immigrants.

| Protection Kind | Description | Potential Limitations for Undocumented Immigrants | Instance Coverage Price |

|---|---|---|---|

| Legal responsibility | Covers injury to different folks’s property or accidents brought on by your car. That is necessary in most states. | Protection limits could also be fastened at a minimal quantity, usually inadequate for important claims. Discovering a supplier that accepts undocumented immigrants as drivers could also be troublesome, limiting entry to aggressive charges. | $500 – $1500 yearly |

| Collision | Covers injury to your personal car in an accident, no matter who’s at fault. | Insurance coverage suppliers might require increased deductibles, growing out-of-pocket bills in case of an accident. The shortage of documentation may complicate the declare course of. | $500 – $1000 yearly |

| Complete | Covers injury to your car from occasions apart from collisions, equivalent to theft, vandalism, or climate injury. | Much like collision protection, the dearth of documentation might have an effect on the declare course of, and better deductibles is perhaps required. | $200 – $500 yearly |

Understanding Coverage Phrases and Situations

Fastidiously reviewing coverage phrases and circumstances is crucial. Insurance policies usually embrace exclusions and limitations which may have an effect on your protection. Understanding these phrases is vital to avoiding surprises. For instance, some insurance policies might exclude protection for accidents involving automobiles that are not correctly registered.

Protection Limitations or Exclusions

Undocumented immigrants may face distinctive challenges in securing insurance coverage. Coverage exclusions will be notably necessary to know. For instance, a coverage may exclude protection for accidents that happen whereas driving with no legitimate driver’s license or car registration. These particular exclusions can have an effect on protection for undocumented drivers. It is necessary to seek the advice of with an insurance coverage skilled to totally perceive these exclusions.

Significance of Coverage Comparability

Evaluating coverage prices and protection ranges is significant. The price of insurance coverage can range drastically primarily based on elements like the kind of car, driving historical past, and protection limits. Undocumented immigrants may face increased prices resulting from restricted choices.

Discovering Inexpensive Choices: Greatest Automotive Insurance coverage For Undocumented Immigrants

Securing reasonably priced automotive insurance coverage generally is a important hurdle for undocumented immigrants. Navigating the complicated panorama of insurance coverage suppliers and eligibility standards requires cautious analysis and understanding of accessible choices. This part explores methods for locating reasonably priced options tailor-made to the particular wants of this neighborhood.Discovering reasonably priced automotive insurance coverage requires a proactive strategy, understanding potential reductions, and using assets obtainable to undocumented immigrants.

Methods for Discovering Inexpensive Choices

Varied methods can assist undocumented immigrants find reasonably priced insurance coverage choices. Understanding eligibility necessities, exploring totally different insurance coverage suppliers, and leveraging neighborhood assets are key elements of this course of. Many elements affect insurance coverage prices, equivalent to the kind of car, driving file, and site.

Reductions and Applications

Many insurance coverage suppliers supply reductions for numerous elements. Some reductions can be found to all drivers, whereas others could also be particular to sure demographics or teams. For instance, some suppliers supply reductions for good scholar drivers, defensive driving programs, or for individuals who preserve a clear driving file. Moreover, sure insurance coverage suppliers might supply packages tailor-made to particular wants of communities or particular teams.

Group Sources

Group organizations and non-profits play an important position in helping undocumented immigrants with accessing insurance coverage. These organizations usually present data, steerage, and doubtlessly monetary help to assist navigate the complicated course of. They are often invaluable in offering assets and help tailor-made to the particular challenges confronted by this inhabitants.

Evaluating Quotes and Studying Superb Print

Evaluating insurance coverage quotes from a number of suppliers is crucial to discovering probably the most reasonably priced choice. Fastidiously reviewing the high-quality print of every coverage is essential to know the protection, exclusions, and any further charges. Understanding the specifics of every coverage is significant to creating an knowledgeable determination. This meticulous comparability course of is vital to discovering the absolute best deal.

Negotiating Insurance coverage Premiums

Negotiating insurance coverage premiums is feasible and may usually end in decrease prices. By contacting the insurance coverage supplier straight, highlighting any elements which may qualify for a reduction (equivalent to a secure driving file), and understanding the coverage phrases, it might be doable to safe a extra reasonably priced premium. Direct communication and an intensive understanding of the coverage are necessary elements of this course of.

Understanding Documentation Necessities

Securing automotive insurance coverage as an undocumented immigrant presents distinctive challenges. Insurers want verifiable proof of id and deal with to evaluate danger and fulfill regulatory necessities. This part explores various types of identification and documentation methods to navigate these complexities.Various types of identification are essential for navigating the insurance coverage course of. Insurers might settle for documentation past customary government-issued IDs, recognizing that particular challenges exist for this demographic.

The power to supply complete and correct data is paramount.

Various Types of Identification

Insurers might contemplate numerous types of identification past conventional driver’s licenses or state-issued IDs. This may occasionally embrace international passports, delivery certificates from nations of origin, and even long-term residency paperwork from different jurisdictions. The acceptance of those various paperwork varies considerably by insurer.

Verifying Deal with Info

Constant and dependable proof of deal with is crucial for insurance coverage functions. Past utility payments, different types of documentation could also be acceptable. Financial institution statements, lease agreements, and even employment data, displaying constant residency over time, can confirm deal with. These paperwork assist confirm the person’s connection to a particular location.

Utilizing Trusted References and Group Verification

Some insurers might settle for references from neighborhood organizations or trusted people who can attest to the applicant’s id and deal with. This strategy acknowledges the distinctive circumstances and should present further verification. Group leaders, landlords, or long-term employers who can vouch for the person’s id and deal with are essential. The validity and acceptance of such a verification range considerably.

Significance of Correct Info

Offering correct data is paramount for profitable insurance coverage utility processing. Inaccuracies, even seemingly minor ones, can result in delays, denial, and even future issues. The necessity for precision and meticulous record-keeping is essential for navigating the insurance coverage course of easily. Fastidiously reviewing all paperwork earlier than submission, and guaranteeing all data is verifiable, will assist guarantee the method is profitable.

Desk of Accepted Doc Sorts

| Doc Kind | Description | Acceptance Chance |

|---|---|---|

| Utility Payments (Gasoline, Electrical, Water) | Demonstrates constant residence at a particular deal with over a time frame. | Excessive |

| Financial institution Statements (Checking or Financial savings) | Exhibits constant banking exercise linked to an deal with, providing a historic perspective on residency. | Medium |

| Passport | Legitimate worldwide passport issued by a international authorities. | Excessive (Relying on the nation of origin and passport validity) |

| Start Certificates (Overseas) | Offers proof of delivery, usually required along side different identification. | Medium (Relying on nation and verification course of) |

| Lease Agreements | Formal documentation of rental agreements displaying deal with and period of keep. | Excessive |

| Employment Information | Documentation from an employer confirming work historical past and deal with, notably for long-term employment. | Medium |

| Group References | Letters of reference from trusted neighborhood members verifying id and deal with. | Low to Medium (Depending on insurer coverage and reference verification) |

Illustrating Sensible Implications

Navigating the complexities of automotive insurance coverage will be daunting for anybody, however for undocumented immigrants, the challenges are amplified. Understanding the sensible implications of those insurance policies, notably within the occasion of accidents, is essential to creating knowledgeable selections. This part will spotlight real-world eventualities for example the potential difficulties and hurdles these people face.

Influence of Accidents on Undocumented Immigrants

Accidents can have a big impression on people’ lives, no matter immigration standing. For undocumented immigrants, the implications prolong past the rapid bodily and emotional misery. The concern of authorized repercussions and the uncertainty surrounding the declare course of can create a traumatic and overwhelming state of affairs. Monetary instability and potential deportation are important considerations.

Challenges in Submitting Claims

Submitting insurance coverage claims will be difficult for anybody, however undocumented immigrants usually face further obstacles. Lack of documentation and concern of authorized penalties can deter them from pursuing claims. Insurance coverage corporations might require particular documentation that undocumented immigrants might not possess, main to say denial or delayed processing.

Illustrative Situations

- Situation 1: Maria, an undocumented immigrant, is concerned in a automotive accident. She is injured and her automotive is broken. She fears reporting the accident resulting from potential authorized repercussions. Even when she does report it, the insurance coverage firm might demand particular documentation that she can’t present, doubtlessly leading to denial of her declare. The delay in acquiring medical care and repairing her car can result in important monetary hardship.

- Situation 2: Jose, an undocumented immigrant, is driving when he’s rear-ended. He sustains minor accidents and his car requires repairs. Because of the lack of correct documentation, he faces important challenges in submitting a declare along with his insurance coverage firm. The insurance coverage firm might not acknowledge his coverage, and if he makes an attempt to file a declare, it is perhaps rejected as a result of lack of documentation.

He may very well be left with the price of repairs and medical bills, in addition to potential authorized issues.

Potential Obstacles to Insurance coverage After an Accident

Even after an accident, acquiring insurance coverage will be troublesome for undocumented immigrants. Insurance coverage corporations will not be keen to challenge new insurance policies, or they could impose restrictive phrases and circumstances. The shortage of a secure authorized standing can have an effect on their eligibility for protection.

Examples of Insurance coverage Coverage Limitations

- Restricted protection: Some insurance coverage corporations might supply insurance policies with restricted protection for undocumented immigrants, or refuse to supply protection in any respect. This may go away people susceptible within the occasion of an accident.

- Greater premiums: Insurance coverage corporations might cost increased premiums for undocumented immigrants resulting from perceived increased danger elements, regardless of elements equivalent to driving historical past being just like that of authorized residents.

Ultimate Assessment

In conclusion, securing automotive insurance coverage as an undocumented immigrant requires cautious consideration and resourceful analysis. Whereas the challenges might sound daunting, there are viable choices and techniques to navigate this complicated panorama. By understanding the nuances of the insurance coverage market and the potential limitations, you can also make knowledgeable selections and discover protection that protects each you and your car.

Bear in mind to prioritize transparency and accuracy in your dealings with insurance coverage suppliers. This information acts as your compass, main you thru the maze of paperwork and bureaucratic hurdles.

Solutions to Frequent Questions

Q: Can I get insurance coverage if I haven’t got a driver’s license?

A: Sure, although the method is perhaps barely extra difficult. Some insurers may require various types of identification and documentation to confirm your id and deal with. All the time inquire with potential suppliers about their particular necessities.

Q: What are the widespread misconceptions about insurance coverage for undocumented immigrants?

A: Many consider insurance coverage is unavailable. That is merely not true. Whereas sure insurance policies might need distinctive limitations, many suppliers are keen to work with people who’ve legitimate documentation, even when they do not have a driver’s license. Analysis is vital.

Q: What if I get into an accident?

A: The implications of an accident with out insurance coverage are important, no matter your immigration standing. Perceive your coverage’s protection limits and what to do instantly after an accident to keep away from additional issues. The insurance coverage firm is your accomplice in a disaster. Report promptly.

Q: How can I discover reasonably priced insurance coverage choices?

A: Comparability purchasing is crucial. Do not accept the primary quote you get. Look into reductions, discover neighborhood assets, and be ready to barter. Usually, insurers are open to negotiation, particularly in case you exhibit monetary accountability.