Finest automotive insurance coverage in Pittsburgh is not nearly discovering the bottom value; it is about safeguarding your property and peace of thoughts. Pittsburgh’s distinctive driving panorama, from town’s congested streets to the encompassing suburbs, calls for tailor-made insurance coverage options. This complete information delves into the intricacies of the Pittsburgh automotive insurance coverage market, equipping you with the information to navigate the method and safe essentially the most appropriate protection to your wants.

We’ll discover the varied varieties of insurance coverage insurance policies obtainable, from fundamental legal responsibility protection to complete safety. Understanding the elements influencing premiums, corresponding to your driving historical past and car sort, is essential to securing the very best charges. This exploration additionally highlights the position of respected insurance coverage suppliers, providing insights into their strengths and weaknesses. In the end, we’ll arm you with the instruments to match quotes successfully, perceive coverage phrases, and make an knowledgeable determination that matches your funds and circumstances.

Introduction to Automobile Insurance coverage in Pittsburgh

The Pittsburgh automotive insurance coverage market is formed by a novel mix of things, impacting premiums and coverage decisions. Elements corresponding to town’s geography, site visitors patterns, and accident charges play a major position in figuring out the price and availability of insurance coverage. Understanding these influences helps drivers in Pittsburgh make knowledgeable selections about their insurance coverage wants.The market gives a spread of insurance coverage insurance policies tailor-made to varied driving conditions and funds constraints.

Drivers can select from totally different protection ranges, making certain they’ve ample safety towards potential monetary losses. This selection permits people to pick one of the best match for his or her private danger tolerance and monetary state of affairs.

Key Elements Influencing Automobile Insurance coverage Premiums in Pittsburgh

Pittsburgh’s geographic traits and site visitors patterns are essential determinants in insurance coverage premiums. The hilly terrain and dense city areas contribute to particular driving challenges, doubtlessly influencing accident charges and related declare prices. Demographic elements, corresponding to age, driving file, and car sort, additionally considerably influence the price of insurance coverage.

Forms of Automobile Insurance coverage Insurance policies Out there in Pittsburgh

Numerous varieties of insurance policies cater to totally different wants and dangers. Legal responsibility insurance coverage is a basic protection sort, offering monetary safety towards damages brought about to others in an accident. Collision protection compensates for harm to the insured car no matter who brought about the accident. Complete protection protects towards damages from occasions past collisions, corresponding to vandalism, theft, or weather-related incidents.

Uninsured/Underinsured Motorist (UM/UIM) safety is crucial, making certain protection if concerned in an accident with a driver missing ample insurance coverage.

Typical Prices Related to Numerous Insurance coverage Ranges in Pittsburgh, Finest automotive insurance coverage in pittsburgh

Insurance coverage prices in Pittsburgh differ considerably primarily based on the chosen protection stage and particular person circumstances. Premiums for complete protection, together with safety towards vandalism or theft, are usually greater than liability-only insurance policies. Elements like the motive force’s historical past, car sort, and chosen deductibles additional affect the ultimate premium. A driver with a clear file and a more recent, inexpensive car may anticipate decrease premiums in comparison with a driver with a historical past of accidents or an older, costlier car.

Comparability of Widespread Insurance coverage Protection Sorts

| Protection Kind | Description | Typical Price (Instance) |

|---|---|---|

| Legal responsibility | Covers damages to others in an accident. | $1,000 – $2,000 yearly |

| Collision | Covers harm to the insured car, no matter fault. | $500 – $1,500 yearly |

| Complete | Covers harm to the insured car from occasions past collisions (e.g., vandalism, theft, hail). | $200 – $1,000 yearly |

| Uninsured/Underinsured Motorist (UM/UIM) | Offers protection if concerned in an accident with a driver missing ample insurance coverage. | $100 – $500 yearly |

Notice: These are estimated prices and may differ primarily based on particular person circumstances.

Elements Affecting Automobile Insurance coverage Prices in Pittsburgh

Automobile insurance coverage premiums in Pittsburgh, like in different places, are influenced by a mess of things. Understanding these elements is essential for customers to make knowledgeable selections about their protection and doubtlessly decrease their prices. Elements corresponding to driving historical past, car sort, location, and driver age all play vital roles in figuring out the premium quantity.The prices of automotive insurance coverage in Pittsburgh usually are not static; they’re dynamic and influenced by numerous interconnected components.

Every issue contributes to a composite danger evaluation, which insurance coverage firms use to calculate premiums. A complete understanding of those elements permits people to proactively handle their insurance coverage prices.

Driving Historical past

Driving historical past is a crucial consider figuring out automotive insurance coverage premiums. A clear driving file, free from accidents and violations, usually leads to decrease premiums. Conversely, accidents, site visitors violations, or at-fault incidents will enhance premiums considerably. It’s because these incidents exhibit a better danger of future claims for the insurance coverage firm. As an example, a driver with a historical past of rushing tickets or accidents could anticipate a considerable enhance of their premium in comparison with a driver with no such historical past.

Automobile Kind

The kind of car considerably impacts insurance coverage prices. Automobiles perceived as higher-risk, like sports activities automobiles or luxurious automobiles, sometimes have greater premiums. That is typically on account of elements such because the car’s worth, potential for harm, and perceived utilization. Sports activities automobiles, for instance, are continuously related to greater speeds and doubtlessly extra reckless driving. SUVs, whereas typically perceived as protected, might be costlier to restore if broken.

Sedans, with their comparatively decrease worth and restore prices, are likely to have decrease premiums.

Location

Geographic location performs a crucial position in automotive insurance coverage premiums in Pittsburgh. Areas with greater charges of accidents, theft, or vandalism typically see greater premiums. It’s because the insurance coverage firm assesses the danger related to the realm. For instance, areas identified for high-speed driving or frequent accidents could have greater premiums in comparison with areas with decrease incident charges.

Inside Pittsburgh, particular neighborhoods or boroughs could have various charges on account of native circumstances.

Driver Age

Driver age is a major determinant of insurance coverage premiums. Youthful drivers are sometimes assigned greater premiums than older drivers. It’s because youthful drivers are statistically extra vulnerable to accidents than older drivers. The elevated accident danger interprets to a better perceived danger for the insurance coverage firm. For instance, a 16-year-old driver will probably have a a lot greater premium than a 35-year-old driver.

Expertise and maturity play a key position within the notion of danger by insurance coverage firms.

Desk: Impression of Age and Driving Historical past on Insurance coverage Premiums

| Driver Age | Driving Historical past (Clear/Accidents) | Estimated Premium Impression |

|---|---|---|

| 16-25 | Clear | Larger than common |

| 16-25 | Accidents/Violations | Considerably greater |

| 26-35 | Clear | Common |

| 26-35 | Accidents/Violations | Larger than common |

| 36+ | Clear | Decrease than common |

| 36+ | Accidents/Violations | Average to greater than common |

High Automobile Insurance coverage Corporations in Pittsburgh

Navigating the automotive insurance coverage panorama in Pittsburgh can really feel overwhelming. Understanding the strengths and weaknesses of various suppliers is essential for securing the very best protection at a aggressive value. This part delves into the highest insurance coverage firms working within the space, analyzing their reputations, providers, and buyer experiences.The supply of numerous insurance coverage choices in Pittsburgh is a testomony to town’s thriving market.

Evaluating numerous suppliers’ strengths and weaknesses permits customers to make knowledgeable selections that align with their particular person wants and monetary circumstances. Understanding buyer evaluations and business rankings offers invaluable insights for choosing essentially the most appropriate coverage.

High Automobile Insurance coverage Suppliers in Pittsburgh

Quite a few firms supply automotive insurance coverage in Pittsburgh, however some constantly rank greater primarily based on buyer satisfaction and monetary stability. This part highlights key suppliers, analyzing their reputations and providers.

- State Farm: A well-established nationwide model, State Farm boasts a large community of brokers throughout Pittsburgh. Their in depth protection choices typically embody customized service and aggressive pricing. Nonetheless, some prospects report longer wait occasions for claims processing, particularly throughout peak seasons. State Farm’s robust popularity for customer support, mixed with its in depth protection choices, typically makes it a preferred alternative.

- Progressive: Progressive, identified for its online-focused strategy, gives aggressive charges, notably for drivers with good security data. The corporate typically employs revolutionary applied sciences to streamline claims and coverage administration, making it user-friendly. Nonetheless, buyer evaluations recommend that customer support interactions can generally be impersonal. Progressive typically excels in effectivity, notably for on-line interactions.

- Geico: Geico is one other well-liked nationwide insurer that has a powerful presence in Pittsburgh. The corporate continuously advertises engaging reductions, corresponding to these for protected driving or multi-policy holders. Nonetheless, customer support interactions could generally really feel impersonal or much less responsive than some opponents. Geico’s give attention to reductions and affordability typically appeals to budget-conscious customers.

- Allstate: Allstate gives complete protection choices with a community of brokers throughout Pittsburgh. Their providers typically embody help with numerous claims, however evaluations point out potential delays in claims decision for some prospects. Allstate typically gives numerous protection choices that may be tailor-made to particular person wants.

- Liberty Mutual: Liberty Mutual is one other notable supplier with a presence in Pittsburgh. They’re acknowledged for his or her customer support and declare dealing with effectivity. Nonetheless, some prospects report difficulties in accessing particular coverage info or help throughout particular declare processes. Liberty Mutual’s popularity typically highlights the significance of readability and accessibility inside their service.

Buyer Service and Claims Dealing with

Customer support experiences differ considerably amongst these firms. Elements like declare dealing with effectivity, responsiveness of brokers, and accessibility of coverage info affect total satisfaction. Some insurers excel in proactive communication, whereas others prioritize claims decision effectivity.

| Insurance coverage Supplier | Buyer Evaluate Abstract (Based mostly on Verified Sources) | Trade Rating (Based mostly on Latest Experiences) |

|---|---|---|

| State Farm | Typically optimistic, however some report gradual claims processing | Excessive |

| Progressive | Typically praised for on-line effectivity, however some discover customer support impersonal | Medium-Excessive |

| Geico | Aggressive pricing, however some studies of impersonal customer support | Medium |

| Allstate | Complete protection, however potential delays in declare decision | Medium-Excessive |

| Liberty Mutual | Good customer support and effectivity, however potential points with accessing info | Excessive |

Suggestions for Discovering the Finest Automobile Insurance coverage in Pittsburgh

Securing essentially the most advantageous automotive insurance coverage in Pittsburgh entails a strategic strategy. Understanding the elements influencing charges and using efficient comparability strategies are essential for minimizing premiums whereas sustaining ample protection. This complete information offers actionable steps that can assist you discover one of the best automotive insurance coverage match to your wants and funds.Discovering the perfect automotive insurance coverage coverage requires a proactive and knowledgeable strategy.

It isn’t nearly evaluating costs; it is about evaluating protection, understanding reductions, and leveraging obtainable assets. By following the following tips, you may navigate the Pittsburgh automotive insurance coverage market with confidence and discover essentially the most appropriate coverage to your state of affairs.

Efficient Quote Comparability Methods

Evaluating insurance coverage quotes successfully is paramount to securing the very best charges. An intensive comparability course of entails gathering quotes from a number of suppliers, making certain correct information enter, and understanding the nuances of various insurance policies. This enables for a well-informed determination that balances price and protection.

- Collect Quotes from A number of Suppliers: Do not restrict your search to only one or two firms. Search quotes from a various vary of insurers, together with well-known nationwide suppliers and native firms. This ensures a broad vary of choices and permits for a extra complete comparability. For instance, examine quotes from Geico, Progressive, State Farm, and native insurers in Pittsburgh.

- Enter Correct Data: Be certain that the knowledge you present for every quote request is correct and full. Minor inaccuracies can considerably influence the quoted premiums. Double-check particulars corresponding to your driving historical past, car info, and private particulars to keep away from errors. Be meticulous to forestall inaccurate calculations.

- Perceive Coverage Particulars: Rigorously evaluation every coverage’s particulars earlier than making a call. Take note of protection limits, deductibles, and exclusions. Evaluating totally different coverage phrases, situations, and limitations will enable you establish one of the best match to your particular wants.

Leveraging On-line Comparability Instruments

On-line comparability instruments present a handy and environment friendly solution to examine automotive insurance coverage quotes. These instruments combination information from a number of insurers, streamlining the method and permitting you to see an summary of obtainable choices rapidly. These instruments present a simplified course of to match insurance coverage choices.

- Make the most of On-line Comparability Web sites: Quite a few web sites focus on evaluating automotive insurance coverage quotes. These platforms typically present user-friendly interfaces, enabling you to enter your info and obtain prompt quotes from a number of suppliers. Use these instruments to quickly collect quotes and examine costs.

- Evaluate Options and Protection: Whereas evaluating quotes, do not simply give attention to the worth. Consider the options and protection supplied by every insurer. Perceive how deductibles and protection limits have an effect on your total price and safety.

Contemplating Out there Reductions

Reductions can considerably scale back your automotive insurance coverage premiums. These reductions typically mirror particular demographics, driving behaviors, or monetary tasks. Making the most of obtainable reductions can prevent cash and make insurance coverage extra reasonably priced.

- Protected Driving Reductions: Insurers continuously supply reductions for protected drivers. If in case you have a clear driving file, contemplate inquiring about protected driving reductions. driving file demonstrates accountable conduct and may translate to decrease premiums.

- Good Credit score Reductions: Good credit score scores are sometimes linked to decrease insurance coverage premiums. Sustaining a great credit score historical past could end in a reduction out of your insurance coverage supplier. A robust monetary standing typically leads to higher insurance coverage charges.

- Multi-Coverage Reductions: Bundling your insurance coverage insurance policies (e.g., automotive, residence, renters) with one supplier can result in a multi-policy low cost. Talk about this selection along with your present suppliers to see if it is a viable method to save cash.

- Different Reductions: Different reductions could embody anti-theft gadgets, defensive driving programs, or particular car options. Examine these choices along with your insurance coverage supplier to find out in the event you qualify for a reduction.

Using On-line Assets for Quote Comparisons

On-line assets, corresponding to insurer web sites and comparability platforms, present handy entry to insurance coverage quotes. These assets can streamline the comparability course of and make discovering one of the best deal simpler.

- Examine Insurer Web sites Instantly: Visiting the web sites of particular person insurers lets you collect quotes immediately. Use their on-line instruments or contact their customer support representatives to request quotes. Many insurers supply their very own quote calculators for ease of use.

- Evaluate Comparability Web sites: Comparability web sites combination quotes from numerous insurers, making it easier to match totally different suppliers. Use these instruments to slender down your decisions and make an knowledgeable determination.

Protection Choices and Concerns

Selecting the best automotive insurance coverage protection is essential for safeguarding your self and your property in Pittsburgh. Past the essential legal responsibility protection, numerous non-obligatory add-ons can considerably improve your safety. Understanding these choices and their worth is crucial to creating knowledgeable selections.

Non-compulsory Coverages in Pittsburgh

Pittsburgh’s numerous driving situations and potential dangers necessitate cautious consideration of non-obligatory coverages. These coverages can typically be the distinction between a manageable monetary state of affairs and a major monetary burden in case of an accident or different unexpected circumstances.

Roadside Help

Roadside help is a invaluable addition to any automotive insurance coverage coverage. It offers essential assist in sudden conditions, corresponding to a flat tire, lifeless battery, or automotive lockout. This service gives a substantial peace of thoughts, particularly throughout inclement climate widespread in Pittsburgh. The comfort of speedy help can save vital time and stress. Examples embody jump-starts, tire adjustments, and locksmith providers.

Uninsured/Underinsured Motorist Safety

Uninsured/underinsured motorist safety is crucial protection in Pittsburgh. This safety steps in if one other driver concerned in an accident is uninsured or has inadequate protection to compensate to your damages. This protection is especially very important in a metropolis the place accidents can happen, and drivers is perhaps uninsured or underinsured. For instance, a driver inflicting an accident may not have ample insurance coverage to cowl your accidents or car harm.

This protection mitigates the monetary danger in such eventualities.

Collision Protection

Collision protection is vital for safeguarding your car. This protection pays for damages to your car whether it is concerned in an accident, no matter who’s at fault. In Pittsburgh, the place the climate may cause accidents and the driving situations might be difficult, this protection gives vital safety towards monetary losses on account of harm to your car.

Contemplate the price of repairs or replacements, which might be substantial.

Complete Protection

Complete protection protects your car towards damages aside from collision, corresponding to vandalism, theft, or harm from climate occasions. In Pittsburgh, with its diversified climate patterns, this protection is important to handle potential harm. As an example, hailstorms or extreme climate occasions may cause in depth harm, and complete protection will compensate you for the restore or alternative.

Abstract of Non-compulsory Coverages

| Protection | Advantages | Essential Conditions |

|---|---|---|

| Roadside Help | Offers help with flat tires, soar begins, and lockouts. | Surprising mechanical points, inclement climate, or lockouts. |

| Uninsured/Underinsured Motorist Safety | Covers damages if one other driver is uninsured or underinsured. | Accidents involving uninsured or underinsured drivers. |

| Collision Protection | Pays for damages to your car in an accident, no matter fault. | Accidents, no matter who’s at fault. |

| Complete Protection | Covers harm from theft, vandalism, or climate occasions. | Vandalism, theft, hail harm, or flood harm. |

Understanding Coverage Phrases and Situations

Navigating the complexities of automotive insurance coverage insurance policies can really feel daunting. Nonetheless, an intensive understanding of coverage phrases and situations is essential for Pittsburgh drivers. This data empowers you to make knowledgeable selections, keep away from surprises, and make sure you’re adequately protected. Figuring out your rights and tasks underneath your coverage is paramount.

Significance of Understanding Coverage Phrases

Understanding your automotive insurance coverage coverage phrases and situations is important for a easy expertise in Pittsburgh. It protects you from unexpected monetary burdens and ensures you are conscious of your protection limitations. A complete understanding helps you keep away from expensive errors and ensures you obtain the protection you anticipate when making a declare.

Figuring out Essential Clauses

A number of clauses inside your coverage are notably vital. Essential clauses typically relate to legal responsibility, deductibles, and exclusions. Figuring out these clauses prevents misunderstandings and helps you anticipate potential prices.

Legal responsibility Protection

Legal responsibility protection protects you in the event you’re at fault in an accident. Understanding the coverage’s limits and what it covers for bodily harm and property harm is crucial. The particular wording and limitations of your legal responsibility protection are key elements in your safety. Instance: A coverage with a $100,000 restrict for bodily harm legal responsibility implies that in the event you’re discovered chargeable for accidents inflicting greater than $100,000 in medical bills for others, you might be chargeable for the distinction.

Deductibles

Deductibles symbolize the quantity you will pay out-of-pocket earlier than your insurance coverage firm steps in. Understanding your deductible quantity is crucial, because it immediately impacts your out-of-pocket prices. Larger deductibles typically result in decrease premiums. Instance: A $1,000 deductible means you will pay the primary $1,000 of a coated declare, whereas the insurance coverage firm covers the remaining.

Exclusions

Exclusions specify conditions or occasions not coated by your coverage. Figuring out these exclusions is essential to keep away from surprises. Insurance policies continuously exclude protection for sure varieties of automobiles, particular driving conditions, or pre-existing situations. Instance: In case your coverage excludes protection for accidents involving uninsured drivers, you will want extra protection to guard your self if concerned in an accident with a driver missing insurance coverage.

Widespread Coverage Phrases and Explanations

| Coverage Time period | Rationalization |

|---|---|

| Legal responsibility Protection | Protects you in the event you’re at fault in an accident, protecting damages to others. |

| Collision Protection | Covers harm to your car in an accident, no matter who’s at fault. |

| Complete Protection | Covers harm to your car from occasions aside from accidents, corresponding to vandalism or theft. |

| Deductible | The quantity you pay out-of-pocket earlier than your insurance coverage firm covers a declare. |

| Coverage Limits | Most quantity your insurance coverage firm can pay for a declare. |

| Exclusions | Conditions or occasions not coated by your coverage. |

Evaluating Quotes and Making a Determination: Finest Automobile Insurance coverage In Pittsburgh

Securing one of the best automotive insurance coverage in Pittsburgh entails extra than simply the bottom value. A complete strategy considers numerous elements past the premium, making certain you are not simply saving cash, but in addition deciding on a supplier that aligns along with your wants and values. Cautious comparability and analysis are essential steps on this course of.Evaluating quotes from totally different insurance coverage suppliers is an important step in direction of discovering essentially the most appropriate protection.

This entails meticulously reviewing the phrases and situations, protection particulars, and related prices. A scientific strategy lets you establish the strengths and weaknesses of every quote, resulting in a well-informed determination.

Steps in Evaluating Quotes

Cautious comparability of quotes requires a methodical strategy. Begin by amassing quotes from a number of insurers. This course of typically entails finishing on-line kinds or contacting insurance coverage brokers immediately. Do not hesitate to request clarifications on any unclear points of the quotes. Detailed understanding of every quote’s options and conditions is important.

- Collect quotes from no less than three totally different insurance coverage suppliers. This broadens your choices and permits for a comparative evaluation.

- Evaluate the coverage particulars for every quote, making certain all points of protection are clearly understood.

- Completely look at the particular phrases and situations to establish any potential hidden prices or limitations.

- Evaluate the full price of premiums, deductibles, and different related bills.

Elements to Contemplate Past Value

Value is not the only real determinant of a great automotive insurance coverage coverage. Elements like customer support, popularity, and monetary stability play a major position within the total expertise. An organization with a confirmed observe file and a powerful monetary standing can supply extra dependable protection in the long term. A responsive and useful customer support staff can ease your thoughts throughout claims processing.

- Buyer Service: Contemplate the responsiveness and helpfulness of the insurance coverage supplier’s customer support representatives. Constructive buyer evaluations and testimonials can point out an organization dedicated to glorious service.

- Status: Analysis the corporate’s popularity for dealing with claims pretty and effectively. Search for respected sources corresponding to client studies or business rankings.

- Monetary Stability: Assess the monetary energy of the insurance coverage firm. Corporations with a powerful monetary ranking are much less prone to face points fulfilling their obligations within the occasion of a declare.

Weighing the Execs and Cons of Every Quote

A crucial step within the comparability course of is meticulously weighing the benefits and downsides of every quote. This entails analyzing the main points of every coverage and figuring out the way it aligns along with your particular person wants. Figuring out strengths and weaknesses helps you make an knowledgeable determination.

- Establish the important thing options and advantages supplied by every coverage.

- Evaluate the price of premiums and deductibles, contemplating potential financial savings.

- Analyze the protection choices and assess the extent of safety supplied.

- Contemplate the popularity and monetary stability of the insurance coverage supplier.

Structured Quote Comparability Desk

A structured desk facilitates a transparent comparability of quotes. It lets you arrange the important thing options and consider every quote objectively.

| Insurance coverage Supplier | Premium | Deductible | Protection Choices | Buyer Service Score | Monetary Energy Score | General Evaluation |

|---|---|---|---|---|---|---|

| Firm A | $1,200 | $500 | Complete, Collision, Legal responsibility | 4.5/5 | AA | Robust Worth |

| Firm B | $1,500 | $1,000 | Complete, Collision, Legal responsibility, Uninsured Motorist | 4.0/5 | A+ | Good Protection |

| Firm C | $1,000 | $250 | Complete, Collision, Legal responsibility | 3.5/5 | A | Wonderful Worth |

Illustrative Case Research of Pittsburgh Automobile Insurance coverage

Discovering one of the best automotive insurance coverage in Pittsburgh entails extra than simply evaluating costs. Actual-life experiences and strategic approaches typically play an important position in securing essentially the most appropriate protection. Understanding these case research can present invaluable insights for navigating the insurance coverage panorama.Efficient automotive insurance coverage choice requires a considerate strategy, going past merely the most cost effective possibility. Analyzing private wants, understanding numerous protection choices, and strategically leveraging obtainable assets are key to attaining optimum outcomes.

Case Research 1: The Price range-Aware Scholar

This case research highlights a younger grownup, Sarah, who wanted reasonably priced automotive insurance coverage in Pittsburgh whereas attending school. She understood the significance of protection however was constrained by a restricted funds.Sarah’s technique concerned evaluating totally different firms and evaluating quotes. She actively sought reductions, corresponding to these for good pupil drivers and protected driving habits. She additionally researched totally different protection ranges, choosing legal responsibility protection as her major focus, understanding her potential monetary publicity.

Her analysis additionally targeted on understanding the implications of varied deductibles and their influence on her total premium.

Case Research 2: The Skilled Driver Searching for Complete Protection

This case research examines a long-time Pittsburgh driver, Mark, who prioritized complete protection and sought to reduce his insurance coverage prices.Mark’s technique was a multifaceted one. He leveraged his years of protected driving expertise by actively in search of reductions for accident-free driving data. He investigated numerous insurance coverage suppliers to establish these providing complete packages with aggressive charges. Understanding the monetary implications of upper deductibles and the protection supplied by every firm was crucial to his determination.

He finally opted for a better deductible and one of the best protection that aligned along with his wants.

Case Research 3: The New Driver Navigating Insurance coverage Choices

This case research particulars the expertise of Emily, a latest Pittsburgh resident who obtained a driver’s license.Emily’s technique targeted on in search of steerage from educated insurance coverage brokers and using on-line assets. She understood that new drivers typically face greater premiums. She actively sought recommendation on the required protection and reductions obtainable for brand new drivers. She in contrast numerous coverage phrases, specializing in legal responsibility protection, collision protection, and the price implications of every.

Case Research Instance: The Financial savings of Sarah

Sarah, a school pupil, initially confronted a premium of $1,800 yearly. By way of cautious analysis and the utilization of pupil reductions, she efficiently lowered her premium to $1,500. This represents a major saving of $300 yearly. This case research demonstrates the potential for substantial financial savings by strategic analysis and the utilization of obtainable reductions.

Final Phrase

Navigating the world of automotive insurance coverage in Pittsburgh can really feel overwhelming, however this information has supplied a transparent roadmap. By understanding the nuances of the market, the elements affecting your charges, and the choices obtainable, you are empowered to safe one of the best automotive insurance coverage in Pittsburgh. Bear in mind to completely examine quotes, weigh the professionals and cons of every supplier, and prioritize your particular wants.

With cautious consideration and a well-informed strategy, you may confidently discover the optimum protection to guard your funding and guarantee a worry-free driving expertise within the Metal Metropolis.

Incessantly Requested Questions

What reductions can be found for automotive insurance coverage in Pittsburgh?

Reductions differ by insurer however can embody safe-driving incentives, multi-policy reductions, and good pupil/good driver applications. It is price checking with particular person firms for particular gives.

How do I select the appropriate protection stage for my wants?

Contemplate your car’s worth, your driving habits, and your monetary state of affairs. Legal responsibility protection is a authorized minimal, however greater protection ranges supply better safety towards accidents and damages.

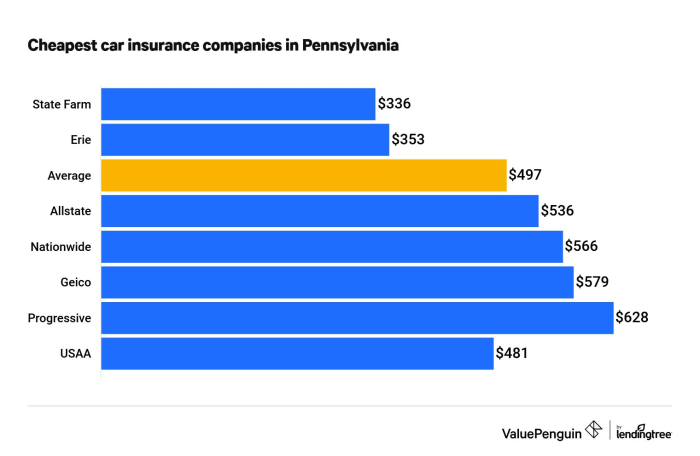

What’s the common price of automotive insurance coverage in Pittsburgh?

Common prices fluctuate primarily based on numerous elements, together with car sort, driver profile, and chosen protection choices. It is best to get customized quotes for an correct estimate.

Can I get automotive insurance coverage if I’ve a DUI or accident on my file?

Sure, however premiums will probably be greater. Some firms could supply specialised applications for drivers with a historical past of accidents or violations.