Are you able to cancel a automobile insurance coverage declare? Navigating the world of insurance coverage claims can really feel like navigating a maze, however understanding the foundations could make the journey smoother. This complete information explores the complexities of canceling a automobile insurance coverage declare, analyzing insurance policies, causes, procedures, and potential penalties. We’ll unravel the intricacies of cancellation, guaranteeing you will have the information to make knowledgeable selections.

From frequent causes for cancellation to the steps concerned and the influence on future premiums, this information empowers you with the important info to know your choices. Whether or not you are dealing with unexpected circumstances or just need to rethink a declare, this useful resource gives the insights you want.

Understanding Declare Cancellation Insurance policies

Yo, peeps! Cancelling a automobile insurance coverage declare ain’t at all times a bit of cake. It is a complete course of, and figuring out the foundations is essential to avoiding drama later. Understanding the insurance policies is essential to be sure to’re doing issues proper.Declare cancellation insurance policies fluctuate wildly relying in your particular insurance coverage supplier and coverage sort. It is like looking for your favourite pair of denims in a large retailer – you gotta dig round to search out the proper match.

Completely different insurance policies have completely different guidelines for canceling claims, so it is vital to examine the advantageous print of your coverage.

Widespread Causes for Declare Cancellation

Insurance coverage corporations enable declare cancellations for varied causes. Generally, you may must cancel a declare in case you resolve to deal with the damages your self, or in case you uncover that the injury was not as extreme as initially reported. Different occasions, the explanation might be that you’ve got settled the matter exterior of insurance coverage, like in case you attain an settlement with the opposite celebration concerned.

Understanding these causes helps you establish if cancellation is a viable choice.

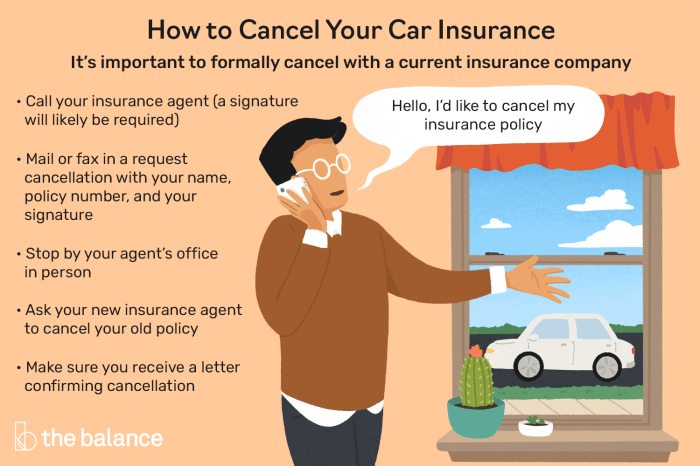

Steps to Provoke a Declare Cancellation Request

Cancelling a declare often includes a proper course of. You gotta contact your insurance coverage supplier on to provoke the cancellation request. They will in all probability want particular particulars just like the declare quantity, the explanation for cancellation, and any supporting documentation. Observe the steps Artikeld in your coverage doc to keep away from any delays. Principally, the extra organized you might be, the smoother the cancellation course of will go.

Examples of Permissible and Impermissible Declare Cancellations

Generally, canceling a declare is completely cool, like in case you repair a minor scratch your self and resolve towards submitting a declare. Nonetheless, in case you’ve already filed a declare and obtained fee, canceling it is perhaps a troublesome promote. It is completely different if the insurance coverage firm already permitted the declare. At all times double-check your coverage’s advantageous print to keep away from any surprises.

For instance, in case you resolve to restore the injury your self after submitting a declare, however earlier than receiving any fee, you doubtless can cancel the declare.

Varieties of Automobile Insurance coverage Insurance policies and Their Impression

Completely different automobile insurance coverage insurance policies have various declare cancellation guidelines. Collision protection insurance policies, as an illustration, may need stricter guidelines than complete insurance policies. Collision protection offers with injury from accidents, whereas complete covers different injury, like vandalism. In the event you’re unsure what sort of coverage you will have, examine your coverage paperwork or name your insurer.

Cancelling a Declare Primarily based on Coverage Provisions

Each coverage has particular provisions for canceling claims. These provisions often Artikel the timeframe inside which you’ll cancel a declare, the required documentation, and the results of canceling a declare that has already been partially or totally processed. It is like a set of directions; it’s important to comply with them exactly to keep away from any points. Verify your coverage paperwork to know these provisions totally.

These clauses element how one can cancel a declare, what documentation is required, and potential penalties of canceling a declare that has already been partially or totally processed.

Causes for Declare Cancellation

Yo, so that you suppose you are all set along with your insurance coverage declare? Suppose once more, fam. Insurance coverage corporations ain’t simply gonna hand over the dough. They gotta be sure that every thing’s legit, or they’re gonna cancel your declare. It is all about ensuring the entire thing provides up, you recognize?Insurance coverage corporations have a bunch of causes for canceling a declare, and it isn’t at all times about you doing one thing flawed.

Generally, it is only a misunderstanding or a easy mistake. Understanding the foundations of the sport is essential to avoiding any complications down the street.

Inaccurate Data Offered

Giving the flawed information in your declare can completely mess issues up. Possibly you unintentionally typed within the flawed date or gave a barely off description of the injury. These little errors can result in a declare cancellation. The insurance coverage firm wants correct particulars to course of the declare pretty and to make sure the declare aligns with their coverage.

Offering false or deceptive info, even when unintentional, will be grounds for cancellation. Consider it like submitting a faux receipt; it isn’t gonna fly.

Declare Fraud

If the insurance coverage firm suspects your declare is a rip-off, they will completely cancel it. This might occur in the event that they discover inconsistencies in your story or proof suggesting you faked the injury. They will examine to see in case you’re attempting to drag a quick one. They use varied strategies, from checking witness statements to reviewing photographs and movies of the incident.

They will additionally examine your driving report and insurance coverage historical past for any purple flags. They’re on the lookout for patterns or something that does not fairly match.

Underestimated Injury

Possibly you thought the injury to your journey was a small fender bender, however the insurance coverage firm sees in any other case. In the event that they discover the injury is definitely extra in depth than you initially estimated, they may cancel your declare and open a brand new one with the next payout quantity. This often occurs when there are hidden damages or additional injury that wasn’t initially obvious.

Consider it like discovering a hidden crack within the wall; it is necessary to let the consultants consider the extent of the injury.

Widespread Causes for Declare Cancellation

| Cause | Coverage Clause | Process |

|---|---|---|

| Inaccurate Data | Part 3.2 | Present revised particulars |

| Declare Fraud | Part 5.1 | Submit proof of fraud |

| Underestimated Injury | Part 2.4 | Re-evaluate injury |

Strategy of Declare Cancellation

Yo, so that you’re tryna cancel a automobile insurance coverage declare? Completely comprehensible, life occurs, proper? This breakdown will stroll you thru the steps, so you may get this entire factor sorted ASAP.Cancelling a declare ain’t rocket science, however figuring out the ropes is essential to avoiding any drama. This information lays out the standard course of, and a few useful tricks to be sure to’re heading in the right direction.

Typical Declare Cancellation Steps

Cancelling a declare often includes a number of key steps. First, you gotta resolve in case you actually need to cancel it. Are you 100% positive? If that’s the case, it’s essential to attain out to your insurance coverage firm. They will in all probability need some information from you to verify the declare cancellation.

- Contact your insurance coverage supplier. You’ll be able to often do that on-line, over the telephone, or through mail. Choose the strategy that works finest for you. In the event you’re logging on, you may must log into your account.

- Present the mandatory documentation. Your insurance coverage firm may want proof of the declare cancellation request. This might embrace the declare quantity, particulars about why you are canceling, and any supporting paperwork associated to the declare.

- The insurance coverage firm will overview your request. They will verify that the declare has been canceled and provide the ultimate affirmation.

Declare Cancellation Flowchart

(It is a placeholder for a flowchart picture. A flowchart would visually signify the steps described above, displaying the completely different choices and potential outcomes, like the choice factors of whether or not to cancel or not, the required documentation, and the ultimate affirmation from the insurance coverage firm.)

Comparability of Cancellation Processes by Insurance coverage Firm

This desk exhibits how completely different corporations deal with declare cancellations. Notice that timeframes can fluctuate relying on the particular scenario.

| Insurance coverage Firm | Cancellation Process | Timeframe |

|---|---|---|

| Firm A | On-line portal, telephone name, or mail | 7-10 enterprise days |

| Firm B | On-line portal, telephone name, or mail | 5-7 enterprise days |

Required Documentation for Cancellation

You will doubtless want to offer some paperwork to provoke the cancellation course of. This often consists of the declare quantity, the explanation for cancellation, and any supporting proof. In case your declare was associated to an accident, you may want police stories or medical data. It is a good suggestion to maintain copies of all of the paperwork you submit.

- Declare quantity

- Cause for cancellation

- Supporting paperwork (e.g., police stories, medical data)

Monitoring Declare Cancellation Standing

Keep watch over the standing of your declare cancellation request. Most insurance coverage corporations supply methods to trace the progress of your request on-line or through telephone. You too can ask your agent for updates. In the event you do not hear again inside an inexpensive timeframe, it is at all times a good suggestion to comply with up with the corporate.

Penalties of Declare Cancellation

Yo, so that you’re fascinated with ditching that automobile insurance coverage declare? Effectively, it isn’t so simple as simply saying “nah,” fam. There’s a complete lotta potential downsides you gotta take into account. Consider it like canceling a VIP live performance ticket—you may get your a refund, however you additionally may miss out on some severe advantages.Cancelling a declare can have a severe influence in your insurance coverage scenario.

It is not simply concerning the speedy price; it may have an effect on your future charges and even your capacity to file claims sooner or later. It is like messing with the system, and the system would not at all times forgive you.

Potential Implications of Declare Cancellation

Cancelling a declare can result in a wide range of repercussions. You may lose out on the protection you have been anticipating, and it may have a adverse influence in your credit score rating, making it tougher to get loans or different monetary merchandise. It is a threat it’s essential to weigh fastidiously, like selecting between a killer new pair of footwear or saving up for an even bigger buy.

Penalties of a Denied Cancellation Request

In case your request to cancel the declare is denied, the insurance coverage firm will doubtless comply with by means of with the unique declare course of. This might imply you are caught with the preliminary settlement, they usually may even pursue additional motion to get well any bills or damages associated to the declare. It is like being locked right into a deal you did not need.

Impression on Future Insurance coverage Premiums

Submitting a declare, even in case you cancel it later, can typically enhance your future insurance coverage premiums. Insurance coverage corporations usually issue within the frequency of claims when setting charges. So, in case you cancel a declare, however have a historical past of claims, your premiums may keep increased than anticipated. It is like having a foul status with the insurance coverage sport.

Declare Cancellation Attraction Course of

In the event you disagree with the insurance coverage firm’s determination to disclaim your declare cancellation request, you will have the proper to attraction. The method sometimes includes offering supporting documentation and clearly explaining why you consider the cancellation needs to be permitted. It is like a proper argument to show your level.

Circumstances for Reopening a Canceled Declare

Hardly ever, a canceled declare is perhaps reopened below sure circumstances. For instance, if new proof emerges that considerably alters the unique declare, or if there was a mistake within the preliminary declare course of, the insurance coverage firm may enable it. That is like getting a second likelihood at one thing you thought was over. It is not frequent, however it’s attainable.

Declare Cancellation Insurance policies and Rules

Yo, so that you’re tryna cancel a declare? Understanding the foundations is essential, fam. Completely different states have completely different guidelines for canceling automobile insurance coverage claims, and understanding these insurance policies is essential to keep away from any drama. It is like navigating a maze, however as an alternative of a maze, it is a bunch of sophisticated laws.

Related Rules Regarding Declare Cancellation

Insurance coverage corporations aren’t simply gonna allow you to cancel a declare on a whim. There are particular laws in place to guard each the policyholder and the insurance coverage firm. These laws fluctuate by state, however they often revolve round issues just like the timeframe for canceling a declare, the explanations allowed for cancellation, and the method concerned. These laws are designed to verify every thing is truthful for everybody concerned.

State Rules in Declare Cancellation Procedures

Every state has its personal algorithm for canceling automobile insurance coverage claims. These laws dictate the procedures for canceling claims, the grounds for cancellation, and the required paperwork. For instance, some states may require a particular type to be stuffed out, whereas others may need completely different deadlines for canceling a declare. This implies you gotta know the particular legal guidelines in your state.

Policyholder Rights Relating to Declare Cancellation

Policyholders have sure rights in relation to canceling claims. They often have the proper to know the explanations for potential cancellation, the method for interesting a cancellation determination, and the proper to hunt authorized counsel in the event that they really feel their rights have been violated. Principally, you are not only a pawn on this sport; you will have some say.

Comparability of Declare Cancellation Insurance policies Throughout States

Declare cancellation insurance policies differ considerably throughout states. Some states may enable cancellation for minor discrepancies or for conditions the place the policyholder not wants the declare. Different states may need stricter pointers and require extra substantial causes for cancellation. It is like evaluating apples and oranges, every state has its personal distinctive algorithm.

Authority of Insurance coverage Regulators in Dealing with Declare Cancellation Disputes

Insurance coverage regulators play a significant function in resolving disputes relating to declare cancellations. They examine complaints, mediate disagreements between policyholders and insurers, and implement laws to make sure truthful practices. Principally, they’re the referees ensuring everybody performs by the foundations. You probably have an issue with a declare cancellation, they’re those you may attain out to for assist.

Different Dispute Decision: Can You Cancel A Automobile Insurance coverage Declare

Yo, so that you’re completely not stoked about your declare getting canceled? No worries, fam. There are methods to combat again and get issues sorted out with out going to courtroom. These different strategies are chill and sometimes quicker than conventional lawsuits.This part breaks down the way to navigate the dispute decision course of for declare cancellation points, providing some severe choices for getting your insurance coverage scenario on monitor.

Different Strategies for Resolving Declare Cancellation Points, Are you able to cancel a automobile insurance coverage declare

These strategies are often cheaper and faster than a full-blown authorized battle. They’re completely a greater approach to deal with issues than simply giving up.

- Mediation: Mediation is sort of a chill hangout with a impartial third celebration, known as a mediator. They assist each you and the insurance coverage firm hash out an answer you each can agree on. It is like a peace treaty, however as an alternative of swords, you utilize phrases. That is usually an excellent efficient approach to resolve points with out going to courtroom.

- Arbitration: Arbitration is a bit more formal. An arbitrator, like a decide, listens to each side of the story and comes to a decision. This determination is often binding, which means you gotta comply with it. Consider it as a personal mini-trial the place you do not have to fret a couple of decide or jury.

Mediation: Settling Disputes Amicably

Mediation is tremendous chill. It is like a pleasant chat the place each side work collectively to discover a resolution. A impartial third celebration (the mediator) helps information the dialogue, ensuring everybody feels heard and revered. Consider it as a collaborative problem-solving session. The aim is to succeed in a mutually agreeable settlement with out going to courtroom.

The mediator would not resolve the result; they simply facilitate the dialogue.

Arbitration Procedures for Declare Cancellation Disputes

Arbitration is a little more structured. It is like a mini-trial, however as an alternative of a decide and jury, you will have a impartial arbitrator. The arbitrator listens to each side of the argument, evaluations proof, after which comes to a decision. This determination is commonly binding, which means each events should abide by it. It is quicker than a conventional lawsuit, and the method is often cheaper.

There’s often a algorithm that govern the arbitration course of, and you need to familiarize your self with them.

Submitting Complaints with Insurance coverage Regulatory Our bodies

In the event you’re completely pissed off with the entire declare cancellation course of, you may file a grievance with the state insurance coverage regulatory physique. That is like your final resort, however it’s necessary to know your rights. These businesses examine complaints and might take motion in the event that they discover the insurance coverage firm has tousled. Search for your state’s insurance coverage division on-line or contact them immediately.

The grievance course of varies by state, so it is tremendous necessary to know your state’s guidelines.

Interesting a Declare Cancellation Choice

In the event you disagree with the declare cancellation determination, you may completely attraction it. Often, the attraction course of includes submitting a written request explaining why you consider the unique determination was flawed. Be ready to current supporting documentation to again up your claims. Insurance coverage corporations often have particular pointers about the way to attraction a call. Verify with the insurance coverage firm or your state’s insurance coverage division to search out out the precise course of.

Conclusive Ideas

In conclusion, canceling a automobile insurance coverage declare is a nuanced course of that requires cautious consideration. Understanding the insurance policies, procedures, and potential penalties empowers you to make knowledgeable selections. This information has supplied a complete overview, however keep in mind to at all times seek the advice of along with your insurance coverage supplier for particular particulars relating to your coverage. By understanding your rights and tasks, you may navigate the declare cancellation course of with confidence.

Key Questions Answered

Can I cancel a declare if I alter my thoughts?

Typically, canceling a declare merely since you change your thoughts is not attainable. There have to be a legitimate cause Artikeld in your coverage, reminiscent of a major discount in injury or inaccuracies within the preliminary declare.

How lengthy does it take to cancel a declare?

The timeframe for canceling a declare varies by insurance coverage firm and the specifics of the case. Some corporations supply faster processing by means of on-line portals, whereas others might take longer. Verify your coverage for estimated timelines.

What occurs if my declare cancellation request is denied?

In case your request is denied, your declare might proceed as initially filed. The denial letter ought to Artikel the explanations for the rejection, permitting you to doubtlessly attraction or perceive the subsequent steps.

Will canceling a declare have an effect on my future insurance coverage premiums?

This depends upon the explanation for cancellation. In some instances, canceling a declare may need no influence. Nonetheless, if the cancellation is because of fraud or inaccurate info, it may doubtlessly have an effect on your future premiums. Evaluate your coverage fastidiously.