Can you place legal responsibility insurance coverage on a financed automotive? Understanding the connection between automotive financing and insurance coverage is essential. Totally different mortgage varieties, the position of the lienholder, and the steps within the financing course of all play a big half in figuring out your insurance coverage wants. This information explores the authorized necessities, coverage varieties, and penalties of insufficient insurance coverage, providing a complete overview of methods to navigate this important facet of automotive possession.

Navigating the complexities of automotive insurance coverage when financing a automobile could be daunting. This text demystifies the method, outlining the authorized obligations, totally different protection choices, and the way your lender components into the equation. It additionally examines different insurance coverage options and the significance of clear communication between you and your lender concerning insurance coverage adjustments. By the top, you may have a clearer understanding of methods to safe the suitable protection to your financed automotive.

Legal responsibility Insurance coverage Necessities

Having enough legal responsibility insurance coverage is a important facet of auto possession, particularly when a automotive is financed. Lenders require this safety to safeguard their funding and make sure the borrower’s potential to fulfill monetary obligations. This part delves into the authorized mandates surrounding legal responsibility insurance coverage for financed automobiles and its implications.

Authorized Necessities, Can you place legal responsibility insurance coverage on a financed automotive

Jurisdictions worldwide have legal guidelines mandating legal responsibility insurance coverage for automobiles. These laws fluctuate, however the frequent thread is defending the rights of these injured or whose property is broken by a automobile’s operation. Failure to keep up enough protection can result in important monetary and authorized penalties. The particular necessities typically embody the kinds of protection, minimal limits, and procedures for acquiring proof of insurance coverage.

Minimal Protection Limits

Lenders typically set minimal legal responsibility protection limits, which should be met for the mortgage approval course of to proceed. These necessities shield the lender from potential monetary losses within the occasion of an accident. These minimal limits usually are not set arbitrarily however are based mostly on the standard prices related to accidents and property injury in accidents. For instance, a lender would possibly require a minimal bodily harm legal responsibility protection of $100,000 per individual and $300,000 per accident, in addition to a minimal property injury legal responsibility protection of $25,000.

This ensures that the monetary burden of a serious accident is mitigated.

Implications of Inadequate Protection

Inadequate legal responsibility insurance coverage can have extreme penalties. With out enough protection, the policyholder might face private monetary smash attributable to a court-ordered settlement or judgment exceeding the coverage limits. Moreover, the shortcoming to fulfill the lender’s required protection limits might result in mortgage default and repossession of the automobile. This underscores the significance of guaranteeing ample protection to guard each the policyholder and the lender.

Conditions Requiring Legal responsibility Insurance coverage

Legal responsibility insurance coverage performs an important position in numerous accident situations. A collision leading to accidents to a different driver, passengers, or pedestrians might set off a big declare, far exceeding the policyholder’s private sources. Equally, injury to a different individual’s property, similar to their automobile or house, necessitates legal responsibility protection to settle the declare. Moreover, incidents the place the policyholder is discovered at fault for an accident are one other essential occasion the place legal responsibility insurance coverage is crucial to cowl the damages.

Legal responsibility Insurance coverage Protection Choices and Prices

| Protection | Description | Value Instance |

|---|---|---|

| Bodily Damage Legal responsibility | Covers medical bills, misplaced wages, and ache and struggling for these injured in an accident the place the policyholder is at fault. It sometimes entails protection limits per individual and per accident. | $100,000 per individual/$300,000 per accident – $50-$200 per yr (varies extensively by location, automobile kind, and driver historical past). |

| Property Harm Legal responsibility | Covers injury to a different individual’s property (e.g., automobiles, buildings) attributable to the policyholder’s actions. It sometimes has a particular restrict for the entire damages. | $25,000 – $50-$150 per yr (varies extensively by location, automobile kind, and driver historical past). |

Word: Value examples are approximate and will differ considerably based mostly on components similar to driving document, automobile kind, location, and protection limits. Seek the advice of with an insurance coverage supplier for customized quotes.

Insurance coverage Insurance policies and Automobile Financing: Can You Put Legal responsibility Insurance coverage On A Financed Automobile

Securing insurance coverage for a financed automobile is an important step within the car-buying course of. It protects each the client and the lender, guaranteeing monetary safety in case of injury or theft. Understanding the several types of insurance coverage and the way they work together with financing is significant for making knowledgeable selections.

Insurance coverage Insurance policies Related to Financed Vehicles

Totally different insurance coverage insurance policies cater to numerous dangers related to automotive possession. For a financed automobile, a mix of insurance policies is commonly required to fulfill the lender’s stipulations and shield the client’s funding. Complete and collision protection are significantly necessary.

- Complete protection protects the automobile from injury attributable to occasions past a collision, similar to climate occasions, vandalism, or theft. That is important because it covers losses not lined by collision insurance coverage, safeguarding the automobile’s worth in unexpected circumstances.

- Collision protection pays for injury to the automobile ensuing from a collision, no matter who’s at fault. This can be a important element, because it safeguards the automobile’s restore prices in case of accidents. This ensures the automobile could be repaired or changed within the occasion of an accident, fulfilling the financing settlement’s phrases.

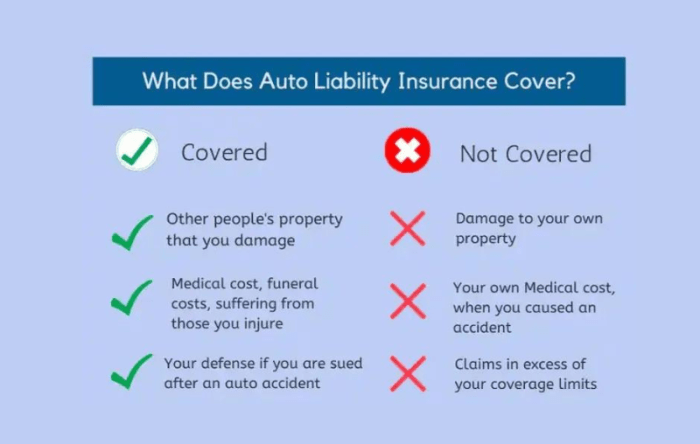

- Legal responsibility insurance coverage, whereas required in most jurisdictions, covers injury or accidents brought on to others in an accident. It is a legally mandated protection, offering safety in opposition to third-party claims. It would not cowl the automobile itself, although.

Influence of Add-on Coverages on Premiums

Add-on coverages, like roadside help or rental automotive reimbursement, can considerably affect the general insurance coverage premium. These add-on coverages provide extra advantages, typically at an additional value. The price of these add-ons varies considerably relying on the particular protection and the supplier.

- Roadside help gives help in case of breakdowns, flat tires, or different mechanical points. This service could be priceless in guaranteeing the automobile is promptly addressed.

- Rental automotive reimbursement covers the price of a rental automobile whereas the insured automotive is being repaired. That is useful when the insured automobile is broken and unavailable to be used.

Insurance coverage Premium Calculation and Components

Insurance coverage premiums are calculated utilizing a fancy system that considers a number of components. This system is designed to mirror the chance related to insuring a selected automobile and driver. Understanding these components will help in mitigating prices.

- Driving document: A clear driving document with no main infractions signifies decrease threat, resulting in decrease premiums. Conversely, drivers with frequent accidents or violations will seemingly pay greater premiums.

- Automobile kind: The worth, age, and make/mannequin of the automobile play a big position. Excessive-value, newer automobiles sometimes have greater premiums in comparison with older, inexpensive fashions.

- Location: Insurance coverage premiums fluctuate geographically attributable to components like accident charges and theft incidents. Areas with greater crime charges for automotive theft or accidents are inclined to have greater premiums.

- Utilization: The frequency and objective of auto use additionally affect premiums. Industrial use or intensive use of the automobile can lead to greater premiums.

Lender’s Position in Insurance coverage Approval

The lender performs an important position in approving or rejecting insurance coverage insurance policies for a financed automotive. Lenders will assessment the coverage to make sure it meets their minimal necessities and protects their funding. This verification course of is important for upholding the financing settlement’s phrases.

- Lenders typically require a minimal stage of protection, sometimes together with legal responsibility, complete, and collision protection.

- The lender opinions the coverage’s particulars to make sure it adequately protects their monetary curiosity within the automobile.

Flowchart of Acquiring Insurance coverage for a Financed Automobile

The method of acquiring insurance coverage for a financed automobile typically follows a structured process. This flowchart illustrates the standard steps concerned within the course of.

(A visible flowchart can be introduced right here, illustrating the steps:

1. Software for insurance coverage,

2. Coverage approval/rejection by insurance coverage supplier,

3. Coverage affirmation and issuance by supplier,

4. Coverage presentation to the lender,

5.

Lender approval,

6. Issuance of insurance coverage certificates,

7. Registration/updates for insurance coverage data)

Penalties of Inadequate Insurance coverage

Failing to keep up enough insurance coverage on a financed automobile can have critical repercussions, impacting each your monetary well-being and your authorized standing. Understanding these penalties is essential for accountable automotive possession.Inadequate insurance coverage protection on a financed automobile can result in important monetary and authorized points. That is significantly necessary to know because the lender holds a lien on the automobile, and their pursuits are additionally jeopardized by insufficient insurance coverage.

Authorized Penalties for Insufficient Protection

Lenders typically require particular insurance coverage protection to guard their pursuits. Failure to keep up this protection can lead to violations of the mortgage settlement, resulting in potential authorized motion. This could embody defaulting on the mortgage, repossession of the automobile, and the lender pursuing authorized motion to recuperate any losses they incur.

Monetary Penalties for Insufficient Protection

Past the authorized implications, inadequate insurance coverage can create substantial monetary burdens. If you happen to’re concerned in an accident, and your protection is inadequate, it’s possible you’ll be held chargeable for the total quantity of damages exceeding your coverage limits. This might result in a big monetary burden, exceeding the worth of the automobile itself. Think about the potential for uninsured/underinsured motorist claims to be wanted.

For instance, if a negligent driver causes an accident and you’re unable to completely recuperate damages from their insurance coverage, your private property is perhaps in danger.

Examples of Vital Monetary Loss

Think about a situation the place you’re concerned in a collision with a negligent driver. In case your protection is inadequate, you is perhaps responsible for damages past your coverage limits, doubtlessly dealing with important monetary hardship. For example, if a minor accident leads to a big restore invoice, you may be chargeable for the whole value in case your insurance coverage protection falls quick.

One other instance might contain a serious accident the place medical bills for concerned events, together with property injury, exceed the boundaries of your insurance coverage coverage.

Potential Prices Related to Inadequate Insurance coverage

| Protection Stage | Potential Prices |

|---|---|

| Low Protection | Vital restore prices exceeding coverage limits, potential for authorized motion from the lender and/or the opposite occasion concerned within the accident, private legal responsibility for damages exceeding coverage limits, and a diminished potential to pursue compensation for accidents. |

| No Protection | Full duty for all damages in an accident, together with property injury, medical bills, and potential authorized charges. Repossession of the automobile by the lender is a possible consequence, together with extreme monetary penalties. |

Insurance coverage and Mortgage Paperwork

Sustaining enough automobile insurance coverage is essential when financing a automotive. Lenders use insurance coverage as a type of safety in opposition to potential monetary losses if the automobile is broken or stolen. This ensures they’re lined in case the borrower defaults on the mortgage. The particular phrases and circumstances concerning insurance coverage are Artikeld inside the mortgage settlement.Mortgage paperwork typically comprise detailed clauses concerning insurance coverage, guaranteeing the lender’s curiosity is protected all through the mortgage time period.

These clauses specify the required insurance coverage protection, minimal protection quantities, and the method for notifying the lender of any adjustments to the coverage.

Insurance coverage Coverage Reflection in Mortgage Paperwork

The mortgage settlement will explicitly state the lender’s necessities for automobile insurance coverage. This consists of the kind of insurance coverage (e.g., complete, collision, legal responsibility), the minimal protection quantity, and the deductible. The lender’s curiosity is immediately tied to the borrower’s potential to keep up ample insurance coverage.

Clauses and Provisions Associated to Insurance coverage in Financing Agreements

Mortgage agreements sometimes embody clauses outlining the duty of the borrower to keep up insurance coverage. These clauses specify the minimal protection necessities and the significance of notifying the lender of any adjustments to the coverage. Failure to adjust to these provisions might result in penalties and even mortgage default. The lender must know the insurance coverage standing to evaluate the chance related to the mortgage.

Technique of Notifying the Lender About Insurance coverage Adjustments

Lenders typically require debtors to inform them of any adjustments to their automobile insurance coverage inside a particular timeframe, often a couple of days to some weeks. This enables the lender to stay knowledgeable concerning the present insurance coverage protection. This timeframe is often clearly acknowledged within the mortgage settlement. Failing to inform the lender inside the specified interval might lead to a breach of contract.

Pattern Clause Associated to Insurance coverage Necessities in a Mortgage Settlement

“The borrower agrees to keep up legal responsibility insurance coverage with a minimal protection quantity of $100,000 on the financed automobile. The borrower should notify the lender of any adjustments to the insurance coverage coverage inside 10 days of the change.”

Alternate options to Conventional Legal responsibility Insurance coverage

Past the elemental requirement of legal responsibility insurance coverage for a financed automobile, supplementary protection choices can improve safety and tackle potential monetary dangers. These options, similar to hole insurance coverage and umbrella insurance policies, present extra safeguards past the essential legal responsibility protection. Understanding their advantages, drawbacks, and prices can empower knowledgeable decision-making when financing a automotive.

Hole Insurance coverage

Hole insurance coverage is an important consideration when financing a automobile. It protects the distinction between the automobile’s precise money worth (ACV) and the excellent mortgage stability within the occasion of a complete loss or theft. That is significantly necessary when the automobile’s worth depreciates considerably, doubtlessly exceeding the mortgage quantity. With out hole insurance coverage, the lender could pursue the borrower for the remaining mortgage stability.

Advantages of hole insurance coverage embody the next:

- Protects the borrower from the distinction between the automobile’s worth and the mortgage quantity if totaled or stolen.

- Reduces monetary duty in a loss scenario.

- Ensures the borrower is not personally responsible for the mortgage stability if the automobile’s worth is lower than the mortgage quantity.

Drawbacks of hole insurance coverage are restricted:

- The price of hole insurance coverage can fluctuate considerably relying on the automobile’s make, mannequin, and situation.

- Hole insurance coverage premiums are sometimes included as a financing choice.

Umbrella Coverage

An umbrella coverage acts as a secondary layer of safety, augmenting current insurance coverage protection. It gives extra legal responsibility protection, doubtlessly extending to private legal responsibility past the automobile. This protection is effective for unexpected circumstances or conditions the place legal responsibility surpasses the boundaries of a typical coverage.

Advantages of an umbrella coverage embody:

- Supplies an extra layer of safety past typical legal responsibility insurance coverage.

- Provides broader safety for incidents involving private harm or property injury.

- Extends protection for actions exterior the scope of a automobile, similar to accidents or lawsuits.

Drawbacks of an umbrella coverage are:

- An umbrella coverage will not be obligatory and is perhaps dearer than different kinds of insurance coverage.

- Coverage limits and protection fluctuate considerably, impacting the extent of safety.

Comparability of Various Insurance coverage Choices

| Various | Description | Value Instance |

|---|---|---|

| Hole Insurance coverage | Covers the distinction between the automobile’s worth and the mortgage quantity in a complete loss or theft situation. | $50-$150 per yr (varies considerably). |

| Umbrella Coverage | Supplies extra legal responsibility protection past typical insurance coverage limits. | $100-$500+ per yr (varies vastly based mostly on protection). |

Final Recap

In conclusion, guaranteeing enough legal responsibility insurance coverage on a financed automotive is a important duty. Your lender performs a significant position in these preparations, typically requiring particular protection ranges. Understanding the implications of inadequate insurance coverage, and the varied coverage choices obtainable, is vital to avoiding potential monetary and authorized points. This complete information gives a roadmap for navigating the intricacies of insurance coverage for financed automobiles, empowering you to make knowledgeable selections.

FAQ Insights

Can I take advantage of a bank card to pay for automotive insurance coverage?

Sure, you should utilize a bank card to pay for automotive insurance coverage. Most insurance coverage corporations settle for bank card funds. Nevertheless, phrases and circumstances could apply, and it is best to verify the fee methodology with the insurance coverage supplier.

What are the results of not having sufficient insurance coverage for a financed automotive?

Penalties of inadequate insurance coverage on a financed automobile can embody the lender taking motion, similar to repossessing the automotive, and doubtlessly authorized penalties for not assembly the minimal protection necessities.

How do I notify my lender of an insurance coverage coverage change?

The particular course of for notifying your lender about insurance coverage adjustments is Artikeld in your mortgage settlement. Typically, it’s essential to present written discover inside a specified timeframe.

What’s the distinction between complete and collision insurance coverage?

Complete insurance coverage covers injury from occasions not involving a collision, similar to vandalism or climate injury. Collision insurance coverage covers injury to your automobile attributable to a collision with one other automobile or object.