Automobile insurance coverage dealer San Diego is your key to navigating the complicated world of auto insurance coverage in San Diego. Discovering the proper coverage, with one of the best protection and charges, can really feel overwhelming. However with a educated dealer, you may get the proper safety and get monetary savings. We’ll discover how brokers may also help you discover the right match, making certain you are lined and guarded.

San Diego’s numerous driving surroundings and ranging car sorts imply that one-size-fits-all insurance coverage options hardly ever work. An excellent dealer understands these nuances and might tailor a coverage to your particular wants. From legal responsibility to collision, complete protection, and extra, we’ll talk about the totally different coverage choices out there.

Introduction to Automobile Insurance coverage Brokers in San Diego

Navigating the complexities of automobile insurance coverage in San Diego can really feel overwhelming. The market provides a mess of choices, from conventional suppliers to progressive digital platforms. Understanding the position of a dealer, the forms of insurance policies out there, and the significance of selecting a good one can empower you to make knowledgeable selections and safe one of the best protection.The San Diego automobile insurance coverage market is a dynamic panorama, influenced by components comparable to the town’s numerous demographics, its reputation as a vacationer vacation spot, and the distinctive wants of its residents.

This necessitates a complete method to insurance coverage, encompassing varied protection choices to fulfill particular person necessities.

Automobile Insurance coverage Brokers in San Diego

Brokers act as intermediaries, connecting policyholders with insurers. They leverage their experience to determine probably the most appropriate insurance coverage choices primarily based on particular wants, driving down premiums and optimizing protection. This experience proves invaluable in a market as complicated as San Diego’s, the place components like site visitors density, car sorts, and driving habits can all affect premiums.

Frequent Varieties of Automobile Insurance coverage Insurance policies, Automobile insurance coverage dealer san diego

A variety of automobile insurance coverage insurance policies cater to totally different wants. Complete insurance policies supply safety towards varied incidents, together with collisions, vandalism, and theft, whereas legal responsibility protection is important for safeguarding towards monetary duty in accidents. Collision protection is activated when your car is concerned in an accident, no matter fault. Uninsured/Underinsured Motorist protection protects you from drivers with out sufficient insurance coverage.

Moreover, some insurance policies could supply roadside help, rental automobile reimbursement, or different supplementary advantages.

Significance of Discovering a Respected Dealer

Selecting a good dealer in San Diego is essential for making certain you obtain correct info and tailor-made recommendation. A reliable dealer will completely assess your wants, discover a number of choices from varied insurers, and current you with clear and concise suggestions. This meticulous course of, mixed with the dealer’s in-depth data of the native market, can considerably affect the general value and effectiveness of your insurance coverage protection.

It is vital to contemplate the dealer’s expertise, licensing, and consumer critiques to make a well-informed determination.

Comparability of Insurance coverage Suppliers in San Diego

The desk under offers a comparative overview of some insurance coverage suppliers working in San Diego, highlighting protection and premium variations. This knowledge is for illustrative functions solely and ought to be seen as a place to begin for additional analysis and session with a certified dealer. Precise protection and premiums could range primarily based on particular person circumstances.

| Supplier | Protection A (e.g., Legal responsibility) | Protection B (e.g., Collision) | Protection C (e.g., Complete) | Premium (Instance, $ per yr) |

|---|---|---|---|---|

| Instance Supplier 1 | Glorious | Good | Common | $1,800 |

| Instance Supplier 2 | Very Good | Glorious | Good | $1,650 |

Advantages of Utilizing a Dealer

Navigating the San Diego automobile insurance coverage market can really feel like a maze. With numerous choices and complicated jargon, discovering the right coverage will be overwhelming. A devoted automobile insurance coverage dealer acts as your information, streamlining the method and making certain you get the very best protection on the best worth.Brokers possess a deep understanding of the native market and the varied insurance coverage suppliers, enabling them to effectively evaluate insurance policies and determine the optimum match on your wants.

They’re your advocate, working tirelessly to safe probably the most favorable phrases on your automobile insurance coverage.

Discovering the Greatest Offers

Brokers excel at figuring out hidden reductions and particular provides typically ignored by people. They’ve established relationships with insurers, granting them entry to unique offers and promotions not publicly marketed. This specialised data interprets into potential financial savings for you. For instance, a dealer would possibly uncover a bundled low cost for owners and automobile insurance coverage, or a pupil low cost that you just would not have identified about.

This proactive method considerably enhances your probabilities of securing a decrease premium.

Evaluating Insurance policies

Insurance coverage insurance policies range considerably of their phrases and situations. A dealer acts as a comparability professional, meticulously evaluating totally different insurance policies primarily based in your particular necessities. They take into account components like protection limits, deductibles, and add-ons like roadside help or rental automobile protection. This detailed evaluation ensures you are not simply getting the most cost effective choice but in addition probably the most complete protection tailor-made to your wants.

For example, a dealer would possibly evaluate a coverage with increased legal responsibility limits and decrease collision protection to 1 with decrease legal responsibility however extra complete protection for particular add-ons.

Potential Price Financial savings

The advantages of utilizing a dealer prolong to important value financial savings. By figuring out hidden reductions and successfully evaluating insurance policies, brokers can probably decrease your automobile insurance coverage premiums by a substantial margin. That is particularly useful in a aggressive market like San Diego. A dealer would possibly discover a coverage with a 15% low cost for accident-free driving mixed with a particular introductory supply, resulting in a considerable discount in your annual premiums.

Abstract of Dealer Benefits

| Profit | Description |

|---|---|

| Decrease Premiums | Brokers leverage their experience and relationships to safe aggressive premiums, probably saving you important quantities in your annual automobile insurance coverage. |

| Complete Protection | Brokers completely analyze varied insurance policies, making certain you choose a complete protection plan that meets your particular wants and threat profile, avoiding gaps in safety. |

| Knowledgeable Recommendation | Brokers present beneficial insights and steering, serving to you perceive complicated insurance coverage phrases and situations. They clarify totally different coverages and enable you select the most suitable choice. |

| Sooner Declare Processing | Brokers typically have established relationships with insurance coverage suppliers, probably expediting the declare course of. They act as your advocate, making certain your declare is processed effectively and promptly. |

Components Affecting Automobile Insurance coverage Premiums in San Diego

Navigating the automobile insurance coverage panorama in San Diego, like another bustling metropolis, requires understanding the important thing variables that form your premium prices. Understanding these components empowers you to make knowledgeable selections, probably saving you cash and making certain you are adequately protected.Figuring out the components that affect your automobile insurance coverage premiums lets you make good selections about protection and probably get monetary savings.

This consciousness can result in a extra financially sound method to automobile insurance coverage.

Driving Document

Your driving historical past is a big think about figuring out your automobile insurance coverage premiums. A clear driving file, free from accidents and site visitors violations, usually ends in decrease premiums. Conversely, a historical past of accidents or violations can result in substantial will increase in your premium. It is because insurers assess threat primarily based on previous habits, and a historical past of irresponsible driving alerts a better likelihood of future claims.

Insurers analyze the frequency and severity of incidents in your driving file to evaluate your threat profile.

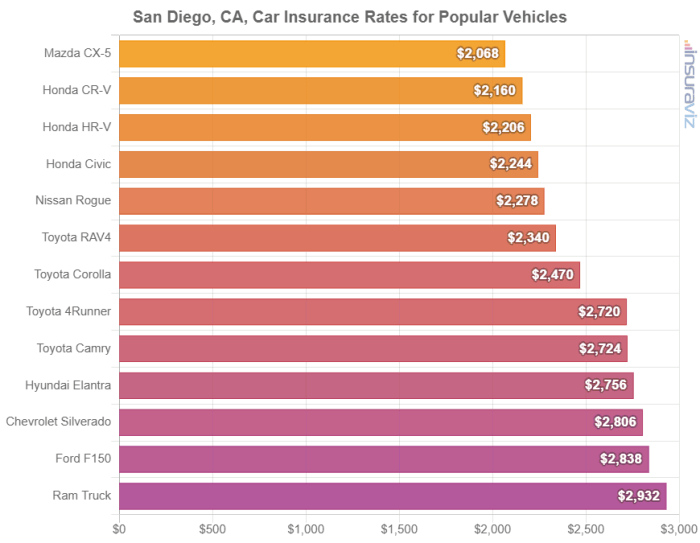

Automobile Kind

The kind of car you drive performs a vital position in your automobile insurance coverage premium. Sports activities automobiles, luxurious automobiles, and high-performance automobiles typically have increased premiums in comparison with extra customary fashions. This is because of components like potential for increased restore prices, theft charges, and perceived threat related to sure car sorts. For example, a sports activities automobile, with its increased restore prices and potential for injury, carries a larger threat for insurers, resulting in a better premium.

Location

Your location in San Diego can considerably affect your automobile insurance coverage premium. Areas with increased crime charges, increased accident charges, or extra site visitors congestion are inclined to have increased premiums. It is a direct reflection of the elevated threat related to these areas. For instance, areas susceptible to accidents because of climate situations or street infrastructure may have increased premiums.

Age and Gender

Age and gender are additionally thought-about when calculating automobile insurance coverage premiums. Youthful drivers, typically with much less expertise, are sometimes assigned increased premiums. Equally, whereas there is not a common pattern, some research present that, on common, male drivers could have barely increased premiums than feminine drivers. This displays the statistically noticed threat profiles for various demographics. Nonetheless, it’s essential to do not forget that particular person driving habits are a much more important issue than gender or age.

Automobile Protection Choices

Completely different protection choices out there on your car can affect your premiums. Greater protection ranges, comparable to complete protection and collision protection, typically include increased premiums. It is because insurers account for the larger potential value related to these complete coverages. A comparability of protection choices lets you tailor your protection to your wants and finances.

It is vital to seek out the proper steadiness between complete protection and cost-effectiveness.

Components Influencing Premiums

| Issue | Description | Affect on Premium |

|---|---|---|

| Driving Document | Quantity and severity of accidents and violations | Greater violations/accidents = increased premiums |

| Automobile Kind | Efficiency, make, mannequin, and worth of the car | Excessive-performance/luxurious automobiles = increased premiums |

| Location | Crime fee, accident fee, and site visitors congestion within the space | Excessive-risk areas = increased premiums |

| Age and Gender | Driver’s age and gender | Youthful drivers/males could have barely increased premiums |

| Protection Choices | Complete, collision, legal responsibility | Greater protection = increased premiums |

Discovering Respected Brokers in San Diego

Navigating the automobile insurance coverage panorama in San Diego can really feel like a maze. With so many brokers vying for your online business, how do you make sure you’re partnering with somebody reliable and able to securing the very best charges? Selecting a good dealer is essential for getting the proper protection on the proper worth. It is a good transfer, one that may prevent each cash and complications.Discovering the proper dealer is not nearly worth; it is about peace of thoughts.

A dependable dealer acts as your advocate, serving to you perceive complicated insurance policies and negotiating favorable phrases. They’re your accomplice within the course of, making certain you are totally protected and assured in your insurance coverage selections.

Licensing and Status Checks

Verifying a dealer’s licensing and status is paramount. A good dealer will readily present documentation of their insurance coverage license, demonstrating their authorization to promote insurance policies in San Diego. It is a essential first step in constructing belief and making certain you are working with a professional entity. Checking their status via on-line critiques and business directories is equally vital.

These assets can supply beneficial insights into the dealer’s previous efficiency and consumer satisfaction.

Assets for Verifying Dealer Credentials

A number of assets can help in verifying a dealer’s credentials. The California Division of Insurance coverage web site is a beneficial device for confirming a dealer’s license standing. This official authorities useful resource offers entry to a database of licensed insurance coverage brokers and brokers, permitting for fast verification of credentials. Business-specific evaluation platforms and directories additionally present beneficial perception. These platforms typically characteristic scores, testimonials, and suggestions from previous purchasers.

Significance of Studying Critiques and Testimonials

Shopper critiques and testimonials supply a wealth of firsthand info. Studying these accounts lets you gauge a dealer’s responsiveness, communication abilities, and total consumer service. Actual-life tales can present essential insights into the dealer’s dealing with of claims, coverage changes, and the general buyer expertise. Unfavorable critiques, whereas probably alarming, can spotlight areas for enchancment.

Evaluating Dealer Scores and Certifications

A desk evaluating totally different brokers and their scores, certifications, and critiques is introduced under. This desk offers a complete overview of assorted brokers within the San Diego space. It will possibly enable you make an knowledgeable determination by evaluating key metrics. Contemplate the components Artikeld earlier when evaluating the desk’s info.

| Dealer | Score | Certification | Critiques |

|---|---|---|---|

| Instance Dealer 1 | 4.5 stars | Licensed Insurance coverage Skilled (CIP) | Constructive critiques highlighting fast responses and useful recommendation. |

| Instance Dealer 2 | 4.2 stars | Affiliate of the Insurance coverage Institute (AII) | Blended critiques, some purchasers reward responsiveness whereas others point out gradual declare processing. |

| Instance Dealer 3 | 4.8 stars | Chartered Property Casualty Underwriter (CPCU) | Excessive reward for thorough coverage explanations and aggressive pricing. |

Selecting the Proper Automobile Insurance coverage Coverage

Navigating the world of automobile insurance coverage can really feel like deciphering a cryptic code. However understanding your choices empowers you to make good monetary selections. The proper coverage protects you and your car, offering peace of thoughts in at the moment’s dynamic driving panorama. Selecting properly includes a cautious examination of various coverages and their implications.Choosing the proper automobile insurance coverage coverage is essential for safeguarding your monetary well-being and peace of thoughts.

It is not nearly numbers; it is about understanding the nuances of protection and making knowledgeable selections. Understanding the varied forms of protection, their significance, and potential exclusions empowers you to pick a coverage that most accurately fits your wants and finances. In the end, this lets you drive with confidence and resilience.

Completely different Varieties of Automobile Insurance coverage Protection

A complete automobile insurance coverage coverage sometimes consists of varied protection choices, every enjoying a significant position in defending your pursuits. Understanding these choices is paramount to creating an knowledgeable determination.

- Legal responsibility Protection: This protection protects you should you trigger an accident that ends in damage or property injury to a different social gathering. It is typically required by legislation, making certain you possibly can meet monetary obligations within the occasion of an accident the place you might be at fault.

- Collision Protection: This protection pays for injury to your car if it is concerned in an accident, no matter who’s at fault. That is essential for changing or repairing your car, making certain you are financially ready for such occasions.

- Complete Protection: This protection goes past accidents, paying for injury to your car attributable to occasions like theft, vandalism, hearth, hail, or pure disasters. It acts as a security web towards unexpected circumstances that may considerably affect your car’s situation.

Significance of Legal responsibility, Collision, and Complete Protection

These three coverages are elementary to a strong automobile insurance coverage coverage. Understanding their respective roles is significant for making a sound determination.

- Legal responsibility Protection: Supplies monetary safety should you trigger injury or damage to others. It safeguards your belongings from substantial monetary repercussions. For instance, should you’re concerned in an accident and trigger important injury to a different driver’s automobile, legal responsibility protection helps cowl these prices, stopping you from being personally liable.

- Collision Protection: Protects your car’s monetary worth no matter fault. In case your automobile is broken in an accident, collision protection helps cowl the restore or alternative prices. Think about a situation the place you are concerned in a minor fender bender; collision protection steps in to deal with the restore with out requiring you to pay out-of-pocket.

- Complete Protection: Presents safety towards a wider vary of occasions past accidents. It addresses injury from theft, vandalism, hearth, or weather-related occasions. A sudden hail storm inflicting important injury to your automobile is an instance the place complete protection comes into play.

Understanding Coverage Exclusions

Fastidiously reviewing coverage exclusions is important. Understanding what is not lined in your coverage is essential to keep away from surprises or gaps in safety.

- Coverage exclusions are outlined clauses that restrict protection. They specify occasions or circumstances that aren’t included within the insurance coverage coverage’s safety. It’s important to fastidiously evaluation the fantastic print of your coverage to keep away from any surprises or gaps in protection.

Evaluating Completely different Protection Ranges

Completely different protection ranges supply various levels of safety. Understanding the implications of every stage is important for choosing the proper coverage on your wants and finances. This determination requires a cautious analysis of your monetary scenario and the potential dangers you face on the street.

| Protection Kind | Description | Significance |

|---|---|---|

| Legal responsibility | Protects towards injury or damage to others. | Required in most states; protects your private belongings. |

| Collision | Covers injury to your car in an accident, no matter fault. | Important for repairing or changing your car if broken in an accident. |

| Complete | Covers injury to your car from occasions aside from accidents (e.g., theft, vandalism, hearth). | Supplies safety towards varied unexpected occasions that may injury your car. |

Claims Course of with a San Diego Dealer

Navigating the complexities of a automobile accident declare will be irritating. A talented San Diego automobile insurance coverage dealer acts as your advocate, streamlining the method and making certain your finest pursuits are protected. This contemporary method prioritizes effectivity and peace of thoughts throughout a difficult time.Understanding the claims course of empowers you to make knowledgeable selections. Figuring out the steps concerned and the position your dealer performs is essential in making certain a easy and optimistic consequence.

Steps in Submitting a Declare

Figuring out the steps concerned in submitting a declare with a San Diego automobile insurance coverage dealer helps you anticipate and put together for every section. Following a transparent course of ensures you are not overlooking essential documentation or steps.

- Report Accident: Instantly following an accident, report it to the authorities, and procure a police report if one is obtainable. This doc is significant for the claims course of and helps set up the circumstances of the accident.

- Contact Dealer: Attain out to your dealer as quickly as potential. Your dealer will information you thru the following steps and assist collect the required info for the declare.

- Collect Documentation: This step includes accumulating all related paperwork, together with your insurance coverage coverage, police report (if out there), medical payments, restore estimates, and witness statements. A complete assortment of proof is important for a profitable declare.

- Negotiate Settlement: Your dealer will negotiate with the at-fault social gathering’s insurance coverage firm to achieve a good settlement. This will contain back-and-forth communication and probably mediation. This stage requires endurance and clear communication.

Frequent Claims

Understanding frequent claims helps anticipate potential situations and the way a dealer can help.

- Property Injury: This includes injury to your car, requiring restore or alternative. Examples embody dents, scratches, or extra important structural injury. A dealer helps get hold of truthful estimates for repairs.

- Bodily Harm: This covers medical bills, misplaced wages, and ache and struggling associated to accidents sustained in an accident. Your dealer will coordinate with medical suppliers and insurance coverage adjusters.

- Uninsured/Underinsured Motorist Protection: If the at-fault driver lacks sufficient insurance coverage or is uninsured, this protection helps defend you. A dealer will deal with the claims course of in these situations.

Dealer’s Function in Facilitating the Declare Course of

A dealer’s position is essential in streamlining the declare course of and making certain a optimistic consequence.

- Advocacy: Your dealer acts as your advocate, representing your pursuits all through the claims course of. They may guarantee your rights are protected.

- Coordination: Brokers coordinate with all events concerned, together with insurance coverage corporations, medical suppliers, and restore retailers. This coordination minimizes delays and potential misunderstandings.

- Negotiation: Skilled brokers are expert negotiators, striving to acquire a good settlement on your losses. This typically includes in depth communication with insurance coverage adjusters.

Claims Course of Abstract

This desk Artikels the important steps concerned in a automobile insurance coverage declare when working with a dealer.

| Step | Description |

|---|---|

| Report Accident | Instantly report the accident to the authorities and procure a police report if out there. |

| Contact Dealer | Attain out to your dealer as quickly as potential for steering. |

| Collect Documentation | Accumulate all related paperwork, together with insurance coverage insurance policies, medical payments, and restore estimates. |

| Negotiate Settlement | Your dealer negotiates with the at-fault social gathering’s insurance coverage firm to achieve a good settlement. |

Evaluating Automobile Insurance coverage Quotes

Navigating the world of automobile insurance coverage can really feel like a maze, however evaluating quotes is your compass. Understanding how totally different suppliers worth their insurance policies is essential for securing one of the best deal. Good shoppers take management by actively in search of and evaluating quotes to seek out probably the most appropriate coverage for his or her wants.

Methods for Acquiring A number of Quotes

Getting a number of quotes is essential to unlocking one of the best automobile insurance coverage charges. It is a easy course of that yields important rewards. A proactive method ensures you are not locked into an unnecessarily costly coverage.

- Make the most of On-line Comparability Instruments: Quite a few web sites devoted to automobile insurance coverage comparability act as highly effective instruments. These platforms combination quotes from varied insurers, permitting you to check coverages and premiums in a single location.

- Attain Out to A number of Brokers: Contacting a number of insurance coverage brokers in San Diego is a beneficial method. Brokers act as intermediaries, offering you with quotes from varied corporations.

- Verify with Your Present Supplier: Even should you’re glad together with your present insurance coverage, periodically requesting a quote out of your present supplier may also help you keep conscious of potential financial savings. It is a proactive measure to keep up affordability.

Significance of Evaluating Coverages and Premiums

Evaluating each protection and premium is important. Concentrate on the small print, not simply the bottom quantity. A seemingly cheap coverage would possibly lack important protections. A complete comparability identifies the proper steadiness between value and protection.

- Protection Adequacy: Make sure the coverage covers your wants adequately. Consider legal responsibility limits, complete and collision protection, and take into account add-ons like uninsured/underinsured motorist safety.

- Premium Evaluation: Scrutinize the premium quantities. Whereas a decrease premium is fascinating, prioritize protection over the bottom potential value. Contemplate the long-term implications of inadequate protection.

Assets for On-line Automobile Insurance coverage Quotes

The digital age offers ample assets for acquiring automobile insurance coverage quotes. Leveraging these instruments empowers you to make knowledgeable selections.

- Devoted Comparability Web sites: Many web sites concentrate on aggregating automobile insurance coverage quotes from varied suppliers. These web sites typically present a user-friendly interface for evaluating quotes.

- Insurance coverage Dealer Web sites: Brokers typically have their very own web sites the place you possibly can request quotes. Utilizing these platforms may also help slender your search.

Evaluating Automobile Insurance coverage Quotes – A Pattern Desk

| Supply | Premium | Protection |

|---|---|---|

| Dealer A | $1,500 | Legal responsibility: $300,000; Collision: $100,000; Complete: $50,000; Uninsured/Underinsured: $25,000 |

| Dealer B | $1,750 | Legal responsibility: $500,000; Collision: $150,000; Complete: $75,000; Uninsured/Underinsured: $50,000 |

Word: Premiums and coverages are examples and should range primarily based on particular person circumstances. At all times confirm the small print with the insurance coverage supplier.

Ending Remarks

In conclusion, selecting a good automobile insurance coverage dealer in San Diego is a brilliant transfer. They may also help you evaluate quotes, perceive totally different coverages, and finally, prevent cash. This complete information has offered insights into the method, serving to you make knowledgeable selections. Keep in mind to analysis and evaluate brokers to seek out one of the best match on your wants.

Let’s guarantee you’ve gotten the proper safety on your car and peace of thoughts on the street.

Knowledgeable Solutions: Automobile Insurance coverage Dealer San Diego

What are the everyday prices of automobile insurance coverage in San Diego?

Automobile insurance coverage premiums in San Diego range primarily based on a number of components, together with your driving file, car kind, location, and protection choices. It is best to get customized quotes from a number of brokers to get a clearer image.

How lengthy does it normally take to get a automobile insurance coverage quote from a dealer?

A good dealer can present a quote inside a couple of days, typically even sooner. The velocity relies on the dealer’s effectivity and the knowledge you present.

What forms of automobiles have increased insurance coverage premiums in San Diego?

Excessive-performance sports activities automobiles and luxurious automobiles typically include increased insurance coverage premiums than customary fashions. The worth and potential threat components play a task.