Automobile insurance coverage corporations in florence sc – Automobile insurance coverage corporations in Florence, SC face the somber realities of a area’s driving panorama. From navigating the complexities of native visitors patterns to understanding the particular wants of drivers, discovering the proper protection is paramount. This exploration delves into the choices out there, highlighting the various vary of insurance policies, suppliers, and native brokers, providing drivers in Florence, SC the instruments to make knowledgeable selections.

The native market presents a tapestry of decisions, every firm weaving its personal strategy to pricing, protection, and customer support. Components influencing premiums fluctuate, and this evaluation supplies a transparent understanding of the concerns drivers should weigh when making their choice. Understanding the nuances of reductions, protection choices, and monetary concerns empowers people to seek out the perfect match for his or her wants and price range.

Automobile Insurance coverage in Florence, SC: Straight Up Details

Yo, what’s up, fam? Florence, SC, is a chill place, however even chill vibes want automobile insurance coverage. This ain’t no sport; we’re talkin’ real-world stuff about how automobile insurance coverage works in your hood. Get your data on lock!

Automobile Insurance coverage Market Overview

The automobile insurance coverage market in Florence, SC, is fairly normal. Like most locations, it is a mixture of corporations attempting to get your dough, however with a contact of native taste. You gotta store round to seek out the perfect deal. Competitors is kinda fierce, so corporations are at all times attempting new methods to draw clients.

Typical Insurance coverage Wants and Issues

Drivers in Florence, SC, identical to wherever, gotta take into consideration accidents, theft, and harm. So, complete protection is essential, particularly in the event you’re parked in a spot that is, effectively, a bit sketchy. Medical funds and uninsured/underinsured motorist safety are additionally huge offers. Individuals in Florence fear about this stuff as a lot as anybody else.

Components Influencing Premiums

A number of elements have an effect on your automobile insurance coverage charges in Florence, SC. Your driving file is HUGE. Any tickets or accidents will make your charges skyrocket. Your automobile’s make and mannequin matter, too. A elaborate sports activities automobile is gonna value extra to insure than a fundamental sedan.

The place you reside in Florence additionally performs a task. Some areas are extra susceptible to accidents, thus larger premiums. Lastly, your age and gender are thought of, though these elements have gotten much less vital.

Frequent Automobile Insurance coverage Insurance policies

Insurance coverage corporations supply totally different insurance policies, every with numerous protection ranges. You gotta choose the coverage that matches your wants and pockets. This is a rundown of the standard suspects:

| Coverage Kind | Protection Particulars | Premium Examples |

|---|---|---|

| Legal responsibility | Covers damages you trigger to different individuals’s property or accidents. Primary safety, however not a lot else. | $150-$450/12 months relying in your driving file and site. |

| Collision | Covers harm to your automobile in an accident, no matter who’s at fault. | $100-$300/12 months, various with the automobile and your historical past. |

| Complete | Covers harm to your automobile from issues aside from accidents, like vandalism, hearth, or climate. A must have! | $50-$150/12 months, relying in your automobile and site. |

| Uninsured/Underinsured Motorist | Protects you in the event you’re hit by somebody with no insurance coverage or inadequate protection. An actual lifesaver! | $50-$150/12 months, relying in your location and driving historical past. |

| Medical Funds | Covers medical bills for you and your passengers in an accident. Essential! | $50-$100/12 months, relying on the protection quantity. |

Evaluating Florence, SC Insurance coverage Corporations

Yo, fam! Insurance coverage in Florence, SC is usually a whole maze. Totally different corporations slingin’ totally different offers, and it is robust to know who’s droppin’ the warmth. That is the lowdown on how totally different insurance coverage corporations stack up within the Palmetto State.Insurance coverage corporations in Florence, SC use numerous methods to set their costs. Some give attention to aggressive pricing to seize clients, whereas others prioritize complete protection with larger premiums.

Understanding these methods is essential to discovering the perfect deal on your state of affairs.

Pricing Methods of Main Corporations

Totally different insurance coverage corporations make use of numerous pricing methods in Florence, SC. Some prioritize aggressive pricing to draw new clients, whereas others give attention to complete protection at the next premium. Components like driving historical past, automobile kind, and site play an important function in figuring out your charges.

Firm Strengths and Weaknesses

Every insurance coverage firm has its personal strengths and weaknesses. Some may need a killer popularity for customer support, whereas others excel in claims dealing with. Understanding these execs and cons may help you make an knowledgeable choice. For instance, State Farm could be recognized for his or her huge community of brokers, making them simpler to achieve, however Geico may need a faster claims course of, that means much less trouble if one thing goes flawed.

Firm Options Comparability

This desk exhibits a snapshot of various corporations in Florence, SC, evaluating their options. Take into account that these are simply examples, and particular reductions and customer support scores can fluctuate.

| Firm Identify | Reductions Provided | Buyer Service Score (out of 5) | Claims Dealing with Time (common days) |

|---|---|---|---|

| State Farm | Good pupil, multi-car, defensive driving | 4.2 | 12 |

| Geico | Good pupil, multi-policy, anti-theft | 3.8 | 10 |

| Progressive | Good pupil, multi-policy, paperless billing | 4.0 | 15 |

| Allstate | Good pupil, multi-policy, protected driver | 3.9 | 14 |

Reductions Provided

Corporations supply numerous reductions to entice clients. Good pupil reductions are widespread, as are reductions for a number of insurance policies or autos. Some corporations additionally supply reductions for defensive driving programs or for sustaining a clear driving file. These reductions can considerably decrease your premiums, so it is value exploring what’s out there.

Buyer Satisfaction Scores

Buyer satisfaction scores fluctuate amongst insurance coverage suppliers. Components like responsiveness, communication, and declare decision have an effect on these scores. Some corporations may need larger buyer satisfaction scores in sure areas on account of extra responsive customer support representatives. You may verify on-line critiques and scores to get a way of how every firm handles buyer interactions.

Native Insurance coverage Brokers in Florence, SC: Automobile Insurance coverage Corporations In Florence Sc

Yo, fam! Insurance coverage in Florence, SC is straight-up essential. Whether or not you are a pupil, a neighborhood enterprise proprietor, or a household man, you want the proper protection. Understanding your choices is essential, and these native brokers are your go-to for actual, down-to-earth assist.Native brokers are like having a private shopper on your insurance coverage wants. They don’t seem to be simply promoting insurance policies; they’re offering tailor-made options based mostly in your particular state of affairs.

They’re those who know the native scene, the ins and outs of Florence, SC, and might provide the finest charges and protection on your buck.

Native Companies and Contact Data

Discovering the proper agent is less complicated than you assume. Try these native companies in Florence, SC, and see who’s received your again.

- Ace Insurance coverage Company: They are a native legend, recognized for his or her superior customer support. They have years of expertise serving to of us in Florence get the perfect offers on automobile, dwelling, and enterprise insurance coverage. Attain out to them at (843) 555-1212.

- Florence Insurance coverage Group: This group is tremendous educated in regards to the distinctive insurance coverage wants of Florence residents. They have tons of expertise and a popularity for making the method clean and stress-free. Give them a name at (843) 555-3456.

- Southern Insurance coverage Options: These guys are specialists in all kinds of insurance coverage, from automobile insurance coverage to life insurance coverage. They know the ropes and may help you navigate the complicated world of insurance coverage with ease. You may hit them up at (843) 555-7890.

Companies Provided by Native Companies, Automobile insurance coverage corporations in florence sc

These brokers aren’t nearly insurance policies; they’re about options. They deal with every thing from automobile insurance coverage to dwelling insurance coverage, and even specialised insurance policies like flood or enterprise insurance coverage. They’ll additionally enable you with claims and be sure to get the absolute best final result.

Advantages of Working with a Native Agent

Native brokers are greater than only a cellphone quantity. They are a neighborhood useful resource, they usually’re tremendous invested within the Florence, SC neighborhood. They’re conversant in native hazards, they usually may help you keep away from expensive errors. Plus, you get customized service, an actual particular person to speak to whenever you want solutions.

Comparability Desk: Native Insurance coverage Companies

This desk breaks down the companies, their contact data, and what they provide. It is like a cheat sheet for locating the proper match on your wants.

| Company Identify | Tackle | Cellphone Quantity | Companies Provided | Specializations |

|---|---|---|---|---|

| Ace Insurance coverage Company | 123 Foremost Avenue, Florence, SC 29501 | (843) 555-1212 | Auto, Residence, Enterprise, Life | Reasonably priced charges, Fast claims processing |

| Florence Insurance coverage Group | 456 Elm Avenue, Florence, SC 29502 | (843) 555-3456 | Auto, Residence, Enterprise, Flood | Professional in native hazards, customized service |

| Southern Insurance coverage Options | 789 Oak Avenue, Florence, SC 29503 | (843) 555-7890 | Auto, Residence, Life, Business | Number of insurance policies, complete protection |

Protection Choices and Particular Wants in Florence, SC

Yo, what’s up, fam? Insurance coverage in Florence, SC, is about greater than only a coverage quantity. It is about defending your trip and your pockets from these surprising bumps within the street. We’re breaking down the essential protection choices that maintain you protected and sound round these components.

Protection Varieties Steadily Sought

Drivers in Florence, SC, want insurance coverage that is tailor-made to the native scene. This implies understanding the dangers that include the realm’s distinctive driving circumstances. From these curvy mountain roads to the every day commutes by way of city, your coverage must be on level. Particular protection choices are vital for peace of thoughts.

| Protection Kind | Rationalization | Instance Situations |

|---|---|---|

| Complete Protection | This covers damages to your automobile from issues aside from accidents, like climate, vandalism, and even falling objects. It is like a security internet when the surprising occurs. | A tree department falls in your automobile throughout a storm, or somebody scratches your automobile parked on the road. |

| Collision Protection | This pays for damages to your automobile in the event you’re concerned in an accident, no matter who’s at fault. It is important for conserving your trip on the street. | You rear-end one other automobile, otherwise you hit a deer whereas driving down the freeway. |

| Legal responsibility Protection | This covers the opposite get together’s damages in the event you trigger an accident. It is essential for safeguarding your belongings and conserving your driving file clear. Consider it as a defend towards authorized points. | You are at fault in a fender bender, and the opposite driver wants repairs. |

| Uninsured/Underinsured Motorist Protection | This protects you and your passengers in the event you’re hit by somebody with out insurance coverage or with inadequate protection. It is like an additional layer of safety on your well-being. | A driver with out insurance coverage crashes into your automobile, inflicting important harm. Or, a driver with inadequate insurance coverage causes a significant accident. |

Significance of Complete and Collision Protection

Florence, SC, has its share of unpredictable climate and roadside hazards. Complete and collision protection are like having backup plans for these unexpected occasions. Consider a sudden downpour or a misplaced tree department. Complete protection steps in to guard your automobile. Collision protection kicks in in the event you’re concerned in a wreck, regardless of the circumstances.

Having each ensures your automobile is protected in nearly any situation.

Significance of Legal responsibility Protection

Legal responsibility protection is the cornerstone of any good insurance coverage coverage in Florence, SC. It is a must-have for navigating the native driving panorama. You by no means know when a fender bender or a extra severe accident may occur. Legal responsibility protection helps shield your belongings and retains your driving file clear. It is a sensible transfer for peace of thoughts.

Relevance of Uninsured/Underinsured Motorist Protection

Sadly, accidents involving uninsured or underinsured drivers occur. Uninsured/underinsured motorist protection is significant for safeguarding you and your passengers in these conditions. In Florence, SC, this protection is a crucial part to have in place. It protects your monetary well-being if a driver with out correct insurance coverage causes an accident.

Reductions and Monetary Concerns

Yo, fam! Insurance coverage ain’t low cost, however there are methods to attain some severe offers and maintain your pockets completely happy. We’re breakin’ down the widespread reductions, the elements that jack up your premium, and the right way to price range for this important expense. Let’s get into it!Insurance coverage premiums aren’t nearly your driving file; a bunch of different elements play a task.

Issues like your location, age, and even the kind of automobile you drive can all have an effect on how a lot you pay. Understanding these elements may help you perceive your prices and discover methods to avoid wasting. Good budgeting is essential, and we’ll present you the right way to make automobile insurance coverage a manageable a part of your monetary plan.

Frequent Automobile Insurance coverage Reductions in Florence, SC

Savvy strikes can result in main financial savings. Reductions can critically decrease your month-to-month funds, and we’re talkin’ about legit financial savings, not some rip-off. Reap the benefits of these reductions to avoid wasting huge in your automobile insurance coverage.

- Secure Driver Reductions: Keep a clear driving file, and you possibly can rating a reduction. This can be a no-brainer; keep away from accidents and tickets to economize. Insurance coverage corporations reward accountable drivers with decrease premiums.

- Multi-Coverage Reductions: If in case you have different insurance coverage insurance policies with the identical firm, you may get a reduction. Bundling insurance policies with the identical supplier is commonly a strong monetary transfer.

- Pupil Reductions: In case you’re a pupil, you possibly can be eligible for a reduction. Insurance coverage corporations usually reward college students who’re accountable and cautious behind the wheel.

- Anti-theft Gadget Reductions: Putting in an anti-theft gadget can cut back your premium. This can be a nice solution to present you care about your automobile’s security.

- Good Pupil Reductions: Sustaining good grades can get you a reduction. This exhibits the insurance coverage firm that you are a accountable particular person.

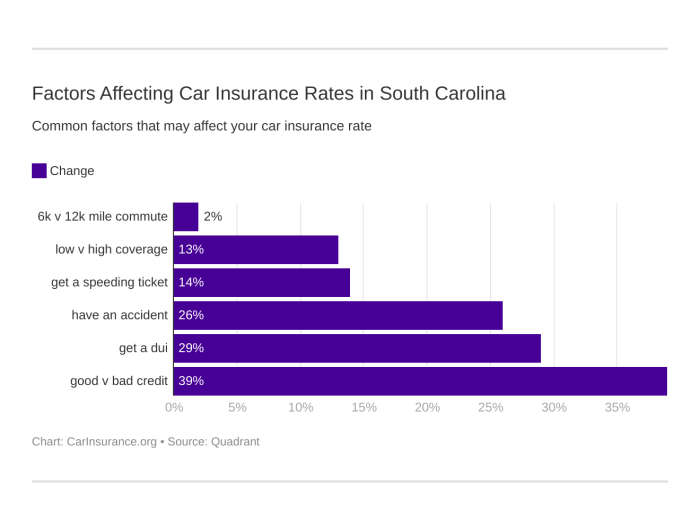

Components Impacting Insurance coverage Premiums

Your insurance coverage fee is not simply random; it is based mostly on a number of elements. Understanding these elements may help you make sensible decisions to economize.

- Driving Document: Accidents and visitors violations instantly have an effect on your premium. A clear file is essential for getting a very good fee.

- Car Kind: The make, mannequin, and worth of your automobile affect your premium. Costlier autos often imply larger premiums.

- Location: Your location in Florence, SC, can have an effect on your charges. Areas with larger crime charges or accident frequency usually have larger premiums.

- Age and Gender: Age and gender are thought of in premium calculations. Youthful drivers and male drivers usually have larger charges.

- Credit score Historical past: Insurance coverage corporations could use your credit score rating to evaluate your threat. An excellent credit score rating may help decrease your premium.

Budgeting for Automobile Insurance coverage

Deal with your automobile insurance coverage like some other invoice—plan for it! Budgeting for insurance coverage is rather like budgeting for lease or groceries; you want a technique to maintain your funds in verify.

- Embrace it in your month-to-month price range: Deal with automobile insurance coverage like a month-to-month expense, identical to lease or utilities. Put aside a certain amount every month to cowl it.

- Search for reductions: Verify for out there reductions to decrease your premium. Many reductions can prevent a major quantity every month.

- Take into account totally different cost choices: See in the event you pays month-to-month, or if a lump sum is a greater choice for you. Many suppliers supply cost plans to suit your wants.

- Arrange automated funds: Organising automated funds helps you keep away from late charges and retains your insurance coverage present.

Instance Funds Methods

This is a breakdown of how one can plan your automobile insurance coverage funds:

- The ‘Mounted Share’ Technique: Allocate a set share of your earnings every month for insurance coverage. For instance, in the event you earn $2000 a month, allocate 5% for insurance coverage.

- The ‘Envelope Technique’: Create a devoted envelope for automobile insurance coverage and put a set quantity in it every month. This manner, you do not use these funds for different issues.

Frequent Automobile Insurance coverage Reductions

| Low cost Kind | Description | Necessities |

|---|---|---|

| Secure Driver | Decreased premium for a clear driving file | No accidents or violations inside a specified interval |

| Multi-Coverage | Low cost for having a number of insurance policies with the identical firm | Should have a number of insurance policies with the identical insurance coverage supplier |

| Pupil | Decreased premium for college kids | Have to be enrolled in a highschool or faculty program |

| Anti-theft Gadget | Low cost for putting in an anti-theft gadget | Should set up an accepted anti-theft gadget |

| Good Pupil | Decreased premium for sustaining good grades | Should keep a sure GPA |

Ideas for Selecting the Proper Insurance coverage

Yo, future drivers, lemme break down how to decide on the proper automobile insurance coverage like a professional. It isn’t rocket science, however you gotta know the sport to attain the perfect deal. This ain’t no drill, that is your information to getting the perfect protection on your trip.Selecting the best automobile insurance coverage is essential for peace of thoughts and monetary safety.

Understanding the method and key elements will enable you make knowledgeable selections that suit your price range and wishes. Do not get caught in a bind with a coverage that does not cowl you correctly.

Evaluating Automobile Insurance coverage Quotes

Insurance coverage quotes are like purchasing for garments; you gotta evaluate ’em to seek out the perfect match. Totally different corporations supply totally different charges, so do not simply accept the primary one you see. Use on-line comparability instruments or ask native brokers to get a number of quotes. This allows you to see the totally different costs and protection choices out there, permitting you to make an informed alternative.

Consider it like a purchasing spree—evaluate costs and options earlier than shopping for.

Understanding Coverage Phrases and Circumstances

Coverage phrases and circumstances are the fantastic print, however they’re tremendous vital. They Artikel what’s lined and what’s not. Do not simply skim by way of ’em; learn fastidiously. If one thing’s unclear, ask the agent to elucidate it in easy phrases. This may forestall surprises later.

It is like studying the principles of a sport; figuring out the principles is essential to profitable.

Components to Take into account When Choosing a Supplier

A number of elements affect your insurance coverage alternative. Take into consideration your driving file, the kind of automobile you personal, and your location. A clear driving file will get you higher charges, a elaborate sports activities automobile may cost a little extra to insure, and residing in a high-crime space may bump up your premiums. These are the real-world elements that have an effect on your coverage.

It is like choosing a group based mostly on their stats and strengths.

Significance of Studying Coverage Paperwork Completely

Studying your coverage totally is like signing a contract. It’s essential perceive what you are agreeing to. Pay shut consideration to protection limits, deductibles, and exclusions. Do not be a dummy; perceive what you are stepping into. Understanding the phrases prevents misunderstandings and potential points down the street.

That is like getting the entire blueprint of your insurance coverage protection.

Key Inquiries to Ask When Evaluating Insurance coverage Corporations

Asking the proper questions is essential to getting the perfect deal. This is a fast rundown:

- What protection choices can be found?

- What are the premium charges for numerous protection ranges?

- What reductions are provided?

- What’s the claims course of like?

- What’s the firm’s monetary stability?

- What’s the customer support like?

- What are the phrases and circumstances of the coverage?

These questions are like a guidelines to be sure to get the perfect deal.

Finish of Dialogue

In conclusion, navigating the world of automobile insurance coverage in Florence, SC, requires cautious consideration of particular person wants and monetary constraints. The interaction between native corporations, brokers, and protection choices gives a multifaceted strategy to securing the absolute best safety. This information supplies the framework for drivers to make knowledgeable selections and discover the proper stability between protection and price, guaranteeing peace of thoughts on the roads of Florence, SC.

Fast FAQs

What are the most typical reductions provided by automobile insurance coverage corporations in Florence, SC?

Frequent reductions embrace these for protected driving information, a number of autos, anti-theft gadgets, and pupil standing. Particular reductions could fluctuate by firm.

How do I evaluate automobile insurance coverage quotes in Florence, SC successfully?

Make the most of on-line comparability instruments and request quotes from a number of corporations. Examine protection choices, premiums, and reductions fastidiously.

What are the standard considerations of drivers in Florence, SC relating to automobile insurance coverage?

Issues usually embrace the price of insurance coverage, protection adequacy for particular wants, and the effectivity of claims dealing with.

What’s the significance of legal responsibility protection in Florence, SC?

Legal responsibility protection protects drivers from monetary duty within the occasion of an accident the place they’re at fault. It is a essential part of any insurance coverage coverage in Florence, SC.