Low cost automotive insurance coverage Columbus GA beckons, a siren’s name to drivers looking for solace from the monetary storm of rising premiums. This journey unveils the hidden pathways to reasonably priced safety, revealing methods to navigate the complexities of the native market. From figuring out respected suppliers to mastering the artwork of securing decrease premiums, uncover the secrets and techniques to discovering the very best insurance coverage protection in Columbus, GA.

The automotive insurance coverage panorama in Columbus, GA, is as various as the town itself. Drivers face a mess of selections, every with its personal set of advantages and disadvantages. This information will illuminate the components influencing premiums, the important thing methods for acquiring decrease charges, and the important steps to understanding the protection choices out there.

Introduction to Low cost Automotive Insurance coverage in Columbus, GA

Within the vibrant tapestry of Columbus, Georgia, navigating the intricate world of automotive insurance coverage can really feel like a perplexing puzzle. Discovering reasonably priced protection that aligns with particular person wants requires a eager eye for element and a discerning understanding of the market forces at play. This exploration delves into the nuances of automotive insurance coverage in Columbus, highlighting the frequent hurdles and the important thing components that form premiums.The Columbus, GA, automotive insurance coverage market, like many others, presents a dynamic panorama.

Drivers face the problem of balancing cost-effectiveness with complete safety. Understanding the intricacies of protection varieties, deductibles, and coverage phrases turns into essential in securing the very best charges.

Widespread Challenges in Discovering Inexpensive Insurance coverage

Drivers in Columbus, like these throughout the nation, typically face the uphill battle of securing reasonably priced automotive insurance coverage. Competitors amongst suppliers is significant, however components past {the marketplace} affect premiums. Excessive accident charges, or a perceived increased threat of accidents in sure areas, can instantly have an effect on the price of insurance coverage.

Components Influencing Automotive Insurance coverage Premiums

Quite a few components converge to find out the worth of automotive insurance coverage in Columbus, GA. Driving historical past, car kind, and site all play a pivotal function. For instance, a driver with a clear report and a more recent, cheaper car will possible qualify for a decrease premium in comparison with somebody with a historical past of accidents or a high-performance sports activities automotive.

Insurance coverage firms typically assess the danger profile of a possible shopper based mostly on quite a lot of components.

Comparability of Automotive Insurance coverage Protection Choices

Selecting the best protection is paramount. The varied array of choices out there will be overwhelming. Understanding the implications of every protection kind permits drivers to pick out a coverage that aligns with their particular monetary state of affairs and threat tolerance.

| Protection Sort | Description | Instance |

|---|---|---|

| Legal responsibility Protection | Protects you from monetary duty in the event you trigger an accident and injure somebody or harm their property. | Covers damages to a different individual’s automotive and medical payments. |

| Collision Protection | Pays for harm to your car in an accident, no matter who’s at fault. | Covers the restore or substitute of your automotive after a collision. |

| Complete Protection | Covers harm to your car from occasions aside from collisions, resembling vandalism, theft, or weather-related incidents. | Covers harm to your automotive from hail or fireplace. |

| Uninsured/Underinsured Motorist Protection | Protects you in case you are concerned in an accident with a driver who does not have insurance coverage or has inadequate protection. | Covers your medical payments and automotive restore if the at-fault driver has insufficient insurance coverage. |

Figuring out Inexpensive Insurance coverage Suppliers in Columbus, GA

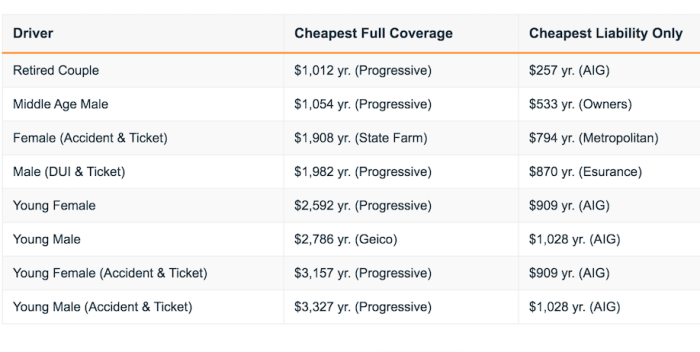

Within the tapestry of life’s requirements, securing reasonably priced automotive insurance coverage in Columbus, GA, emerges as an important thread. Navigating the intricate market calls for discerning judgment and a eager eye for worth. This exploration unveils the spectrum of respected suppliers, their aggressive charges, and the tapestry of obtainable reductions.A symphony of things influences the price of automotive insurance coverage, from the specifics of your car to your driving report.

Understanding these nuances empowers you to make knowledgeable selections, aligning your protection together with your monetary realities.

Respected Insurance coverage Corporations in Columbus, GA

Columbus, GA, boasts a constellation of insurance coverage suppliers, every vying in your patronage. 5 respected firms stand out for his or her aggressive charges and complete choices. These firms symbolize a various vary of service philosophies, making certain an acceptable match for particular person wants. State Farm, Geico, Progressive, Allstate, and Liberty Mutual are regularly acknowledged for his or her accessibility and aggressive pricing.

Reductions Out there for Automotive Insurance coverage

Reductions, typically ignored, are a treasure trove of financial savings. They symbolize a big alternative to optimize your protection with out compromising on important protections. Insurance coverage firms regularly supply reductions for secure drivers, these with accident-free information, and for many who keep a clear driving historical past. Bundling insurance coverage insurance policies (house, auto, and so on.) can regularly result in substantial financial savings.

- Protected Driver Reductions: Many firms reward drivers with clear information, acknowledging their accountable driving habits.

- Accident-Free Reductions: Insurance coverage firms typically reward people who haven’t been concerned in accidents, recognizing their proactive strategy to street security.

- Bundling Reductions: Combining a number of insurance coverage insurance policies (house, auto, and so on.) typically unlocks substantial financial savings.

- Scholar Reductions: Reductions for college kids display an organization’s dedication to younger drivers.

Buyer Service Fame

Customer support is a important issue within the insurance coverage choice course of. Constructive critiques and testimonials, coupled with a responsive strategy, converse volumes about an organization’s dedication to its shoppers. Whereas particular information varies, critiques and popularity surveys regularly determine customer support strengths and weaknesses. Assessing an organization’s dealing with of claims and its total communication technique is significant.

Comparability Desk of Insurance coverage Suppliers, Low cost automotive insurance coverage columbus ga

| Insurance coverage Firm | Options | Advantages |

|---|---|---|

| State Farm | Intensive community of brokers, big selection of protection choices, sturdy monetary stability | Acquainted model title, native presence, personalised service |

| Geico | Aggressive charges, on-line instruments, accessible claims course of | Digital-first strategy, doubtlessly decrease premiums |

| Progressive | Modern expertise, cellular apps, reductions for numerous way of life selections | Person-friendly interface, doubtlessly tailor-made protection choices |

| Allstate | Complete protection choices, a number of coverage varieties | Broad vary of safety, doubtlessly extra complete than some others |

| Liberty Mutual | Robust monetary standing, big range of protection selections | Strong popularity for customer support, typically engaging charges |

Methods for Acquiring Decrease Automotive Insurance coverage Premiums: Low cost Automotive Insurance coverage Columbus Ga

A tapestry of monetary prudence weaves itself across the pursuit of reasonably priced automotive insurance coverage in Columbus, GA. Methods for securing decrease premiums usually are not merely about saving cash; they’re about navigating the intricate dance of accountable driving and savvy insurance coverage selections. The journey to decrease premiums begins with understanding the levers of management you maintain.A eager consciousness of the components influencing your premium is essential.

Your driving report, insurance coverage bundling choices, fee selections, and even your car’s traits play vital roles. By thoughtfully contemplating these points, you’ll be able to tailor your strategy to reaching the bottom attainable premiums with out compromising security or monetary duty.

Sustaining a Good Driving File

A pristine driving report is paramount within the realm of automotive insurance coverage. Protected driving habits translate instantly into decrease premiums. Avoiding accidents and visitors violations, resembling rushing or reckless driving, considerably impacts your insurance coverage prices. Insurers view a clear driving historical past as a testomony to accountable habits, justifying decrease premiums. This proactive strategy to secure driving not solely safeguards your monetary well-being but in addition contributes to the general security of the neighborhood.

Bundling Insurance coverage Insurance policies

Bundling a number of insurance coverage insurance policies, resembling house and auto, typically yields substantial reductions. Insurers reward complete protection below a single umbrella. This technique, akin to consolidating monetary belongings, may end up in appreciable financial savings, providing a harmonious mix of cost-effectiveness and complete safety.

Impression of Fee Choices on Premium Prices

Fee choices, too, maintain the potential to affect premiums. Paying your premiums in full and on time constantly demonstrates monetary stability and reliability. This reliability, typically mirrored in decrease premiums, underscores the importance of constant and well timed funds. Moreover, exploring choices like automated funds can generally present extra financial savings, decreasing administrative hassles and making certain promptness.

Abstract of Methods and Potential Value Financial savings

| Technique | Potential Value Financial savings | Clarification |

|---|---|---|

| Sustaining a great driving report | Important financial savings | A clear driving historical past demonstrates accountable habits, which insurers reward. |

| Bundling insurance coverage insurance policies | Substantial financial savings | Combining a number of insurance policies below one umbrella can typically lead to substantial reductions. |

| Full and well timed funds | Average to vital financial savings | Constant funds display monetary stability and reliability, typically leading to decrease premiums. |

A clear driving report and well timed funds, mixed with bundling insurance policies, are sometimes essentially the most potent methods for reaching decrease premiums.

Understanding Automotive Insurance coverage Protection Choices

A tapestry of safety, automotive insurance coverage weaves a security internet round your car and its occupants. Navigating the intricate threads of protection choices can really feel daunting, however understanding every side is essential for securing a coverage that aligns together with your wants. This information empowers you to make knowledgeable selections, making certain your monetary well-being and peace of thoughts on the street.

Legal responsibility Protection Unveiled

Legal responsibility protection acts as a safeguard, defending you from monetary repercussions stemming from accidents you trigger. It covers damages incurred by others as a direct results of your actions. This basic layer of insurance coverage supplies important monetary safety within the occasion of an accident. Understanding its limitations is significant for efficient threat administration.

Collision Protection: A Fortress In opposition to Unexpected Impacts

Collision protection steps in when your car collides with one other object, be it one other car, a constructing, or a tree. This insurance coverage protects your car’s worth, no matter who was at fault. It is a essential part for sustaining your monetary stability within the occasion of an accident.

Complete Protection: A Defend In opposition to Unexpected Occasions

Complete protection presents broader safety, shielding your car from damages not stemming from collisions. This consists of incidents like vandalism, fireplace, theft, and even weather-related harm. This complete strategy to insurance coverage ensures a holistic protection in opposition to the spectrum of potential harms.

A Desk of Protection Choices

| Protection Sort | Protection Description | Typical Value (Instance) | Protection Limits (Instance) | Exclusions |

|---|---|---|---|---|

| Legal responsibility | Covers damages to others in accidents you trigger. | $50-$200 per thirty days | $100,000 per individual, $300,000 per accident | Intentional acts, race-related incidents, pre-existing circumstances |

| Collision | Covers damages to your car no matter fault. | $20-$100 per thirty days | $10,000-$25,000 | Pre-existing harm, intentional harm, put on and tear |

| Complete | Covers damages to your car from non-collision incidents. | $15-$75 per thirty days | $5,000-$10,000 | Put on and tear, pre-existing harm, intentional harm |

Significance of Coverage Particulars

Thorough examination of coverage specifics is paramount. Scrutinize protection limits, deductibles, and exclusions. An intensive understanding of those particulars is essential to keep away from unwelcome surprises. By figuring out your coverage’s specifics, you’ll be able to proactively safeguard your belongings.

Evaluating Insurance coverage Quotes from Totally different Suppliers

Unveiling the tapestry of reasonably priced automotive insurance coverage in Columbus, GA, requires a discerning eye. Like a seasoned navigator charting a course, evaluating quotes from numerous suppliers is essential for securing essentially the most advantageous coverage. Every insurer presents a singular perspective on threat evaluation, resulting in various premiums. Understanding these nuances is paramount to securing the very best protection at a value that fits your funds.Evaluating quotes is just not merely a activity; it is a strategic exploration of the insurance coverage market.

It empowers you to unearth essentially the most aggressive charges and guarantee your monetary well-being is aligned together with your driving wants. This meticulous course of, akin to a treasure hunt, unveils hidden gems of financial savings.

Strategies for Acquiring A number of Quotes

A myriad of strategies means that you can collect quotes from numerous insurance coverage suppliers. On-line comparability instruments present an environment friendly portal, streamlining the method and providing a wide selection of choices. Devoted insurance coverage brokers, with their deep understanding of the native market, can expertly information you thru the maze of selections. Immediately contacting insurers by their web sites or telephone traces is one other strategy.

Every methodology has its distinctive strengths, enabling you to tailor your quote-gathering technique.

Significance of Evaluating Quotes

Evaluating quotes from completely different suppliers is just not a mere formality; it is a important step in securing essentially the most favorable insurance coverage package deal. Insurance coverage premiums differ considerably between firms, pushed by components resembling threat evaluation methodologies, firm monetary stability, and aggressive pricing methods. This variation can translate to substantial financial savings. Failing to match quotes would possibly result in paying greater than needed for a similar protection.

Components Influencing Worth Variations

Quite a few components affect the worth of your automotive insurance coverage. Your driving report, together with any accidents or visitors violations, performs a pivotal function. The make, mannequin, and yr of your car are additionally thought-about, reflecting the potential for harm and theft. Your location in Columbus, GA, and the particular protection you choose, like complete or collision, may have an effect on your premium.

Insurance coverage firms assess threat otherwise, resulting in various pricing constructions. The quantity of legal responsibility protection and the deductibles you select are additionally key parts.

A Desk Evaluating Quotes from Totally different Suppliers

| Insurance coverage Supplier | Premium (Annual) | Protection Choices | Buyer Service Score |

|---|---|---|---|

| Firm A | $1,500 | Complete, Collision, Legal responsibility | 4.5 stars |

| Firm B | $1,250 | Complete, Collision, Legal responsibility | 4.0 stars |

| Firm C | $1,700 | Complete, Collision, Legal responsibility | 4.2 stars |

Observe: This desk is a pattern and will not mirror the present market charges. Precise premiums will differ relying on particular person circumstances.

Step-by-Step Information to Evaluating Quotes Successfully

- Outline Your Wants: Clearly Artikel the kinds of protection and the quantity of legal responsibility you want. This basis will information your search and guarantee you do not accept lower than your necessities.

- Collect Data: Analysis completely different insurance coverage suppliers in Columbus, GA, utilizing on-line instruments, brokers, or firm web sites. Gather information on out there protection choices and their related prices.

- Examine and Distinction: Fastidiously analyze the quotes from numerous suppliers. Consider not solely the premium but in addition the great protection and the customer support score. This comparative evaluation will allow you to make an knowledgeable resolution.

- Think about Your State of affairs: Account in your driving report, car particulars, and site. These components considerably impression the ultimate premium.

- Choose the Greatest Choice: Select the insurance coverage supplier providing essentially the most aggressive premium whereas sustaining the specified degree of protection. Weigh the worth of the insurance coverage package deal in opposition to the worth.

Illustrative Examples of Insurance coverage Insurance policies in Columbus, GA

A tapestry of safety, woven from threads of protection, awaits these looking for automotive insurance coverage in Columbus, GA. Navigating the myriad choices can really feel daunting, however understanding the completely different coverage varieties illuminates the trail towards essentially the most appropriate safeguard. Insurance policies, like meticulously crafted poems, supply various levels of safety and monetary solace.

Complete Automotive Insurance coverage Coverage Instance

This coverage, a complete defend, encompasses a broad spectrum of perils. It safeguards in opposition to harm from collisions, accidents, vandalism, fireplace, theft, and even weather-related incidents. Past these core parts, complete protection extends to defending the insured’s monetary well-being within the occasion of unexpected circumstances.

Key Options and Advantages:

- Collision Protection: Reimburses damages to the car ensuing from a collision, no matter fault.

- Complete Protection: Protects in opposition to numerous perils, together with hail, fireplace, vandalism, and theft.

- Uninsured/Underinsured Motorist Protection: Offers monetary safety if injured by a driver with inadequate or no insurance coverage.

- Private Harm Safety (PIP): Covers medical bills and misplaced wages for the policyholder and passengers within the occasion of an accident, no matter fault.

- Legal responsibility Protection: Protects in opposition to claims from others for accidents or damages.

Legal responsibility-Solely Automotive Insurance coverage Coverage Instance

A extra economical possibility, a liability-only coverage focuses solely on defending the policyholder’s monetary duties within the occasion of an accident. It presents minimal safety in opposition to damages to the insured car and private accidents.

Limitations:

- No Protection for Car Injury: Doesn’t reimburse the policyholder for harm to their very own car.

- Restricted Private Harm Protection: Solely covers accidents to others; no safety for the insured.

Value Breakdown

The price of automotive insurance coverage hinges on components like driving report, car kind, and site. Premium calculations think about these essential variables. Whereas a complete coverage presents broader safety, it typically comes with a better premium.

Coverage Comparability Desk

| Protection | Complete Coverage (Instance) | Legal responsibility-Solely Coverage (Instance) |

|---|---|---|

| Collision | $150 per yr | N/A |

| Complete | $100 per yr | N/A |

| Uninsured/Underinsured Motorist | $75 per yr | N/A |

| Private Harm Safety (PIP) | $125 per yr | N/A |

| Legal responsibility | $200 per yr | $100 per yr |

| Whole Premium | $650 per yr | $200 per yr |

Observe: These are illustrative examples solely and precise premiums might differ considerably based mostly on particular person circumstances.

Navigating the Claims Course of in Columbus, GA

A tapestry of occasions, generally woven with threads of mishap, calls for a transparent path for decision. Submitting a automotive insurance coverage declare in Columbus, GA, is a course of that, whereas doubtlessly fraught with paperwork and process, will be navigated with understanding and preparedness. A well-structured strategy minimizes frustration and expedites the declare’s conclusion.The journey by the claims course of is a dance of documentation, communication, and adherence to established protocols.

Understanding the particular steps, timelines, and necessities ensures a clean and environment friendly decision, in the end restoring normalcy to your life.

Steps Concerned in Submitting a Declare

A declare’s journey begins with meticulous record-keeping. Correct documentation of the incident, together with pictures and witness statements, is paramount to a swift and profitable declare. Initiating contact together with your insurance coverage supplier, sometimes through telephone or on-line portal, is the following important step. Offering detailed info relating to the accident, together with dates, occasions, places, and concerned events, is essential.

Typical Timeframe for Claims Processing

The period of claims processing in Columbus, GA, can differ. Components such because the complexity of the declare, the supply of needed documentation, and the insurance coverage firm’s inside procedures affect the timeframe. Whereas some claims could also be resolved rapidly, others might require extra time to evaluate the harm, collect proof, and confirm legal responsibility. On common, uncomplicated claims are resolved inside a couple of weeks, whereas extra complicated claims can take a number of months.

Documentation Required for a Profitable Declare

A strong documentation portfolio is important. This consists of the police report (if relevant), medical information (if accidents occurred), restore estimates, and pictures of the harm. Complete documentation supplies readability and strengthens the declare’s validity. Your insurance coverage coverage, registration, and proof of possession are additionally important components of the method. Correct and full documentation accelerates the declare decision course of.

Abstract of Claims Course of Steps

| Step | Description |

|---|---|

| 1. Assess the Injury | Completely doc the harm to your car and any accidents sustained. |

| 2. Contact Your Insurance coverage Supplier | Notify your insurance coverage firm promptly, detailing the incident and offering needed info. |

| 3. Collect Documentation | Gather all related paperwork, together with police stories, medical information, and restore estimates. |

| 4. Submit Documentation | Present the required documentation to your insurance coverage firm by the suitable channels. |

| 5. Await Evaluation | Your insurance coverage firm will assess the declare and decide the following steps. |

| 6. Declare Decision | Obtain fee or different compensation as decided by the declare’s evaluation. |

Ideas for Selecting the Proper Automotive Insurance coverage Agent

Discovering the fitting automotive insurance coverage agent in Columbus, GA, is akin to discovering a hidden gem – a accomplice who understands your wants and navigates the complexities of the insurance coverage market with finesse. This information will illuminate the qualities of a reliable agent, highlighting their essential function in securing the very best coverage tailor-made to your particular circumstances.

Figuring out Qualities of a Good Agent

A discerning automotive insurance coverage agent in Columbus, GA, possesses a mix of experience and approachability. They’re greater than only a salesperson; they’re a trusted advisor, adept at understanding your distinctive driving profile and threat components. Their data extends past coverage specifics, encompassing a complete understanding of the native insurance coverage panorama and its nuances. Moreover, a great agent actively listens to your considerations, providing clear explanations of protection choices and addressing your questions with empathy and persistence.

This relationship fosters belief and empowers you to make knowledgeable selections about your safety.

Significance of Licensed and Respected Brokers

Selecting a licensed and respected agent is paramount. A licensed agent ensures adherence to state laws, guaranteeing your coverage’s legitimacy and upholding the requirements of the insurance coverage business. A good agent, conversely, builds belief by constant professionalism and a dedication to shopper satisfaction. Their monitor report and constructive shopper testimonials present reassurance and confidence of their talents to navigate the intricacies of your protection.

This dedication to moral practices builds a robust basis for a long-term relationship.

Function of an Agent in Securing the Greatest Coverage

An insurance coverage agent acts as your middleman within the often-complex world of automotive insurance coverage. They diligently evaluate quotes from numerous suppliers, bearing in mind your particular wants and preferences. This meticulous course of helps uncover essentially the most advantageous coverage, optimizing protection whereas minimizing prices. Their familiarity with the native insurance coverage market and its distinctive dynamics permits them to determine potential financial savings and tailor protection to fulfill your particular circumstances.

This personalised strategy interprets right into a coverage that gives complete safety whereas remaining budget-friendly.

Components to Think about When Selecting an Agent

| Issue | Description |

|---|---|

| Expertise | A seasoned agent possesses a deep understanding of the insurance coverage business and native market dynamics, permitting for knowledgeable suggestions. They’ve possible seen a mess of circumstances, offering beneficial perception into numerous protection eventualities. |

| Licensing and Fame | Confirm their licensing with the state’s insurance coverage division to make sure legitimacy. Test for testimonials and critiques to gauge their popularity amongst previous shoppers. |

| Communication Fashion | A responsive agent is available to handle questions and considerations promptly. Their capacity to clarify complicated insurance policies in clear, concise language fosters understanding and confidence. |

| Customized Service | An agent who takes the time to know your particular person wants and threat profile is essential. This personalization leads to a tailor-made coverage that gives optimum safety at a aggressive value. |

| Information of Protection Choices | A complete understanding of varied protection varieties, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection, is important. This permits them to current choices that align together with your threat tolerance and funds. |

| Buyer Testimonials and Critiques | Gathering suggestions from earlier shoppers supplies beneficial insights into an agent’s professionalism, responsiveness, and talent to ship passable outcomes. |

Remaining Wrap-Up

In conclusion, securing low-cost automotive insurance coverage in Columbus, GA, is a multifaceted endeavor. Armed with data of suppliers, reductions, and methods, drivers can navigate the market with confidence. By understanding protection choices, evaluating quotes, and deciding on the fitting agent, you’ll be able to obtain the peace of thoughts that comes with satisfactory safety. This information has laid the inspiration in your journey, empowering you to make knowledgeable selections and safe essentially the most reasonably priced and complete automotive insurance coverage coverage in Columbus, GA.

Q&A

What are the frequent challenges to find reasonably priced automotive insurance coverage in Columbus, GA?

Excessive accident charges, particular demographics, and competitors amongst suppliers can all contribute to a difficult seek for reasonably priced automotive insurance coverage in Columbus, GA. Understanding these parts can help you in your search.

What reductions are generally out there for automotive insurance coverage in Columbus, GA?

Reductions for secure driving information, bundling insurance policies, and good pupil standing are sometimes out there, doubtlessly decreasing your premiums. At all times inquire about particular reductions from suppliers.

How does my driving report impression my automotive insurance coverage premiums?

A clear driving report is essential to acquiring decrease premiums. Site visitors violations and accidents can considerably improve insurance coverage prices. Sustaining a secure driving report is an funding in decrease insurance coverage prices.

What’s the typical timeframe for processing a automotive insurance coverage declare in Columbus, GA?

The timeframe for processing a automotive insurance coverage declare varies relying on the insurance coverage firm and the complexity of the declare. Contact your supplier for specifics relating to processing occasions.