Low cost automotive insurance coverage Columbus GA is a vital matter for each driver within the area. Navigating the intricate panorama of insurance coverage choices can really feel daunting, however this information illuminates the trail to reasonably priced and complete protection. Understanding the elements influencing premiums, evaluating suppliers, and strategizing for the very best offers are essential parts of this journey.

From analyzing driving information and car sorts to exploring reductions and bundling choices, this complete information empowers you to make knowledgeable selections. Columbus GA’s distinctive insurance coverage market is explored, offering insights into tailor-made options to your particular wants.

Introduction to Low cost Automotive Insurance coverage in Columbus, GA

The automotive insurance coverage market in Columbus, Georgia, like many different areas, is characterised by a various vary of suppliers and ranging charges. Understanding the elements influencing these charges is essential for securing reasonably priced protection. This evaluation examines the important thing parts of the Columbus market, highlighting the significance of comparability buying and the various kinds of insurance coverage obtainable.Navigating the complexities of automotive insurance coverage could be daunting.

Nevertheless, by understanding the frequent elements impacting premiums and the obtainable protection choices, shoppers could make knowledgeable selections to safe cost-effective safety. This method emphasizes proactive analysis and comparability buying to make sure optimum worth for the insurance coverage bought.

Components Influencing Automotive Insurance coverage Premiums in Columbus, GA

A number of elements contribute to the price of automotive insurance coverage in Columbus, GA. These elements are sometimes intertwined, and their mixed impact can considerably influence the ultimate premium.

- Driving Report: A clear driving report, free from accidents and site visitors violations, is a key think about acquiring decrease premiums. Constant protected driving habits immediately translate to a decrease threat profile for insurers, leading to decreased premiums. Conversely, a historical past of accidents or violations will usually result in greater premiums.

- Automobile Kind and Worth: The sort and worth of the car are additionally essential issues. Greater-value automobiles, or these with options that appeal to theft or vandalism, sometimes have greater premiums. It’s because the potential loss or harm related to these automobiles is bigger.

- Location and Demographics: Geographic location inside Columbus, GA, can affect insurance coverage charges. Areas with greater charges of accidents or crime typically see premiums adjusted accordingly. Moreover, elements just like the age and intercourse of the driving force, in addition to any private traits, may affect premiums.

- Protection Choices: The particular protection chosen immediately impacts premiums. Greater ranges of protection, together with complete and collision, typically include elevated premiums. Selecting the suitable steadiness between protection and value is essential.

Varieties of Automotive Insurance coverage Out there

Understanding the various kinds of automotive insurance coverage obtainable is vital for choosing the precise protection. Every kind gives a definite stage of safety.

- Legal responsibility Insurance coverage: That is essentially the most fundamental type of automotive insurance coverage, masking damages to others in case you are at fault in an accident. It’s sometimes required by legislation in most states.

- Complete Insurance coverage: This kind of protection protects your car from damages not attributable to collisions, equivalent to vandalism, fireplace, hail, or theft. It typically comes with further premiums, however gives essential safety for surprising occasions.

- Collision Insurance coverage: This protection pays for damages to your car whether it is concerned in an accident, no matter who’s at fault. This kind of insurance coverage is especially helpful to forestall monetary burden from accidents.

- Uninsured/Underinsured Motorist Protection: This protection protects you and your car if concerned in an accident with a driver who lacks or has inadequate insurance coverage. It acts as a security internet in opposition to vital monetary losses.

Discovering Reasonably priced Automotive Insurance coverage Choices

The method of discovering reasonably priced automotive insurance coverage choices includes a proactive and systematic method.

- Comparability Purchasing: Evaluating quotes from a number of insurance coverage suppliers is crucial. On-line comparability instruments and direct contact with insurance coverage firms are helpful strategies for acquiring varied quotes.

- Reviewing Protection Wants: Understanding your particular wants and threat profile is essential. Evaluating your driving habits, car, and placement is essential to find out the suitable protection and to keep away from pointless premiums.

- Bundling Insurance policies: Bundling your automotive insurance coverage with different insurance policies, equivalent to residence or renters insurance coverage, can generally supply reductions. These reductions generally is a vital think about decreasing premiums.

- Sustaining a Good Driving Report: Sustaining a clear driving report, free from accidents and site visitors violations, is a key technique for securing decrease premiums.

Components Affecting Automotive Insurance coverage Prices in Columbus, GA: Low cost Automotive Insurance coverage Columbus Ga

Auto insurance coverage premiums in Columbus, GA, like elsewhere, are influenced by a posh interaction of things. Understanding these elements is essential for shoppers in search of cost-effective protection. These elements are usually not static; they’ll change over time as a consequence of market situations, native traits, and regulatory shifts.The price of automotive insurance coverage is just not arbitrary; it’s a calculated threat evaluation.

Insurers use statistical knowledge to foretell the chance of claims and potential losses related to particular drivers, automobiles, and areas. Components like driving habits, car traits, and geographical location all contribute to this evaluation.

Driving Information

Driving information are a major determinant of automotive insurance coverage premiums. A historical past of accidents, site visitors violations, and claims considerably impacts charges. Accidents, significantly these involving critical accidents or fatalities, elevate premiums significantly. Insurance coverage firms use this knowledge to evaluate threat, reflecting the fee related to potential future claims. Insurance coverage firms use statistical evaluation to correlate driving information with the chance of future claims.

For instance, a driver with a historical past of dashing tickets or reckless driving might face considerably greater premiums in comparison with a driver with a clear report. A DUI conviction, particularly, will end in a considerable and long-lasting improve in insurance coverage prices.

Automobile Kind and Mannequin

The sort and mannequin of a car play a vital function in figuring out insurance coverage premiums. Sure automobiles are statistically extra susceptible to accidents or have greater restore prices. Sports activities vehicles, as an example, are sometimes related to greater premiums as a consequence of their potential for greater accident severity and restore prices. Equally, luxurious automobiles might have greater premiums due to the potential for greater restore prices.

Insurance coverage firms assess the price of restore, alternative components, and potential legal responsibility in case of an accident. Conversely, automobiles with security options, like superior airbags or anti-lock brakes, might qualify for reductions.

Location inside Columbus, GA

Location inside Columbus, GA, also can have an effect on automotive insurance coverage charges. Areas with greater crime charges, accident frequencies, or explicit site visitors patterns might have greater premiums. Insurers might modify charges based mostly on native demographics, site visitors quantity, or accident patterns. Excessive-accident areas typically have greater insurance coverage premiums, as this means a better potential for claims. This issue displays the geographic distribution of threat throughout the metropolis.

Out there Reductions

A number of reductions can be found to drivers in Columbus, GA, who display protected driving practices or meet sure standards. Secure drivers, typically recognized by their accident-free information or participation in defensive driving programs, are eligible for reductions. Likewise, college students with good educational information might qualify for decreased premiums. These reductions incentivize protected driving habits and accountable habits. The supply of reductions varies relying on the insurance coverage supplier.

Insurance coverage firms use reductions to reward protected driving habits and encourage accountable insurance coverage practices.

Value Implications of Varied Components

| Issue | Description | Value Influence | Instance |

|---|---|---|---|

| Driving Report | Quantity and severity of previous accidents | Greater premiums for accidents; substantial will increase for critical violations like DUI | At-fault accident leading to property harm |

| Automobile Kind | Kind of automotive (sports activities automotive, SUV, and so on.) | Greater premiums for higher-risk automobiles, decrease premiums for automobiles with superior security options | Excessive-performance sports activities automotive |

| Location | Particular space inside Columbus, GA | Doubtlessly greater premiums in high-accident areas | Excessive-traffic intersections within the metropolis |

| Reductions | Secure driving, good scholar standing, and so on. | Lowered premiums for protected driving habits and good educational efficiency | Participation in a defensive driving course |

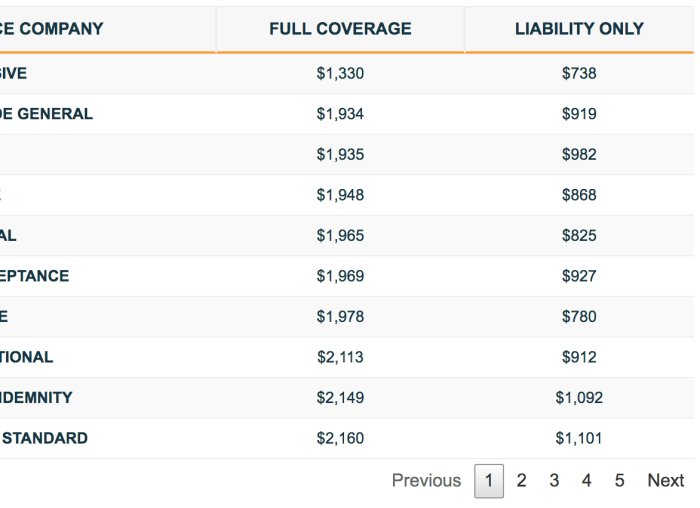

Comparability of Insurance coverage Suppliers in Columbus, GA

Navigating the panorama of automotive insurance coverage suppliers could be difficult, significantly in a aggressive market like Columbus, GA. Understanding the strengths and weaknesses of various firms is essential for securing essentially the most appropriate protection at a aggressive worth. This evaluation will present a comparative overview of main insurers within the area, highlighting key coverage options and related prices.A radical comparability of insurance coverage suppliers is crucial for shoppers in search of optimum protection.

Completely different insurers make use of varied underwriting methods and claim-handling procedures, leading to various coverage prices and buyer experiences. This comparative evaluation goals to offer insights into the nuances of every supplier, enabling knowledgeable decision-making.

Main Insurance coverage Firms in Columbus, GA

A number of main insurance coverage firms function in Columbus, GA, providing varied automotive insurance coverage packages. This part Artikels among the most outstanding suppliers within the space.

- State Farm: A well-established nationwide model, State Farm boasts a big community of brokers all through Columbus. Their widespread presence typically interprets to available assist and declare processing.

- Geico: Geico, identified for its aggressive advertising and marketing campaigns, regularly affords aggressive charges, significantly for youthful drivers or these with a demonstrably protected driving report.

- Progressive: Progressive, one other nationwide participant, is acknowledged for its digital-first method to customer support. Their on-line platforms and cellular apps typically streamline the claims course of.

- Allstate: A significant nationwide insurer, Allstate maintains a considerable presence in Columbus. They typically supply a variety of insurance policies catering to numerous wants, together with particular reductions for bundled companies.

- USAA: Whereas primarily targeted on navy members and their households, USAA’s insurance policies are regularly acknowledged for his or her aggressive pricing construction for eligible clients.

Evaluating Insurance coverage Packages

Evaluating completely different insurance coverage packages requires a scientific method. This includes evaluating coverage options, protection limits, and related premiums.

- Protection Limits: Assess the legal responsibility limits, collision protection, and complete protection supplied by every coverage. A complete coverage sometimes gives a broader vary of safety, encompassing harm attributable to occasions past the driving force’s management.

- Deductibles: Deductibles symbolize the quantity the policyholder should pay out-of-pocket earlier than the insurance coverage firm covers any bills. Decrease deductibles sometimes end in greater premiums.

- Reductions: Varied reductions can be found from completely different insurers. Examples embody reductions for protected driving information, anti-theft gadgets, or bundled companies like residence insurance coverage. It is very important inquire in regards to the particular reductions supplied by every firm and decide if they’re relevant to the policyholder’s state of affairs.

Comparative Evaluation of Coverage Options and Prices

The next desk gives an estimated comparability of coverage options and prices for the most important insurance coverage suppliers in Columbus, GA. Notice that these figures are estimates and precise prices might fluctuate based mostly on particular person circumstances.

| Insurance coverage Supplier | Options | Value (estimated) | Buyer Critiques |

|---|---|---|---|

| State Farm | In depth community, a number of reductions, good customer support | $1,500 – $2,000 yearly | Usually constructive, with some studies of gradual declare processing |

| Geico | Aggressive charges, user-friendly on-line platform, number of reductions | $1,200 – $1,800 yearly | Constructive opinions relating to on-line companies and aggressive charges |

| Progressive | Digital platform, environment friendly claims course of, numerous low cost choices | $1,300 – $1,900 yearly | Usually constructive, with some complaints about customer support accessibility |

| Allstate | Big selection of insurance policies, bundled companies, robust native presence | $1,400 – $2,100 yearly | Blended opinions, with some constructive suggestions on bundled companies however others highlighting difficulties in declare dealing with |

| USAA | Aggressive pricing for eligible members, devoted customer support | $1,000 – $1,500 yearly | Usually extremely constructive for eligible members, however restricted availability for non-members |

Methods for Acquiring Low cost Automotive Insurance coverage in Columbus, GA

Securing reasonably priced automotive insurance coverage in Columbus, GA, requires a proactive method past merely evaluating suppliers. Understanding the elements influencing premiums and using strategic strategies can considerably cut back prices. This includes cautious consideration of reductions, coverage particulars, and efficient comparability methods.Efficient methods for acquiring reasonably priced automotive insurance coverage contain a multifaceted method, encompassing reductions, bundling, comparability strategies, and meticulous overview of coverage specifics.

A complete understanding of those parts empowers shoppers to barter essentially the most favorable insurance coverage phrases, finally minimizing their monetary burden.

Figuring out and Maximizing Reductions, Low cost automotive insurance coverage columbus ga

Reductions symbolize a major alternative to decrease insurance coverage premiums. A proactive method to figuring out and leveraging these reductions can lead to substantial financial savings. Insurers typically supply reductions for varied elements, together with protected driving information, anti-theft gadgets, and sure driver profiles.

- Secure Driving Information: Sustaining a clear driving report, free from accidents or site visitors violations, is essential for acquiring favorable charges. Insurance coverage firms typically reward drivers with constantly accountable driving habits with decreased premiums.

- Defensive Driving Programs: Completion of defensive driving programs can display a dedication to protected driving practices and might result in reductions on insurance coverage premiums.

- Anti-theft Gadgets: Set up of anti-theft gadgets, equivalent to alarms or monitoring methods, can sign a dedication to car safety and sometimes qualifies for reductions from insurance coverage suppliers.

- A number of Coverage Bundling: Bundling automotive insurance coverage with different insurance coverage merchandise, equivalent to owners or renters insurance coverage, can typically result in a reduced general premium.

- Good Pupil Reductions: If a policyholder is a scholar, some suppliers might supply a reduction on automotive insurance coverage, particularly if they’ve educational report.

- Driver Schooling Programs: Participation in driver schooling programs throughout childhood can generally qualify for a reduction on automotive insurance coverage.

Evaluating Quotes from A number of Suppliers

Evaluating quotes from a number of insurance coverage suppliers is crucial for securing essentially the most aggressive charges. A complete comparability permits shoppers to determine essentially the most advantageous coverage choices.

- On-line Comparability Instruments: Leveraging on-line comparability instruments gives a streamlined method to gathering quotes from varied insurers. These instruments accumulate knowledge from completely different suppliers and current them in a user-friendly format.

- Direct Contact with Suppliers: Immediately contacting insurers by way of cellphone or on-line portals can present customized quotes and permit for in-depth dialogue of particular wants.

- Reviewing Coverage Paperwork: Scrutinizing the main points of every coverage is vital. This contains understanding protection limits, deductibles, and any exclusions.

- In search of Suggestions: In search of suggestions from trusted people or professionals can supply insights into respected insurance coverage suppliers and doubtlessly uncover favorable charges.

Understanding Coverage Particulars and Protection

Understanding the specifics of an insurance coverage coverage is vital for acquiring the very best protection on the best worth. A radical understanding of the coverage’s provisions and limitations is paramount for making knowledgeable selections.

- Protection Limits: Understanding the boundaries of protection for legal responsibility, collision, and complete is essential. Adjusting these limits can influence premium prices.

- Deductibles: Reviewing and understanding the deductibles for varied forms of protection is crucial. Greater deductibles can lead to decrease premiums.

- Exclusions: Realizing the precise exclusions inside a coverage is essential to keep away from surprises within the occasion of a declare.

Step-by-Step Information to Acquiring Quotes

A structured method to acquiring quotes from a number of suppliers streamlines the method.

- Collect Data: Compile all crucial details about the car, driver, and desired protection.

- Make the most of Comparability Instruments: Use on-line comparability instruments to acquire quotes from a number of suppliers.

- Contact Insurers Immediately: Request quotes immediately from suppliers you have an interest in.

- Overview Coverage Paperwork: Rigorously overview the main points of every coverage, together with protection limits, deductibles, and exclusions.

- Evaluate Quotes: Evaluate the quotes from completely different suppliers, contemplating all facets of the coverage.

- Choose the Greatest Coverage: Select the coverage that finest meets your wants and finances.

Understanding Automotive Insurance coverage Insurance policies in Columbus, GA

Comprehending automotive insurance coverage insurance policies is essential for accountable car possession in Columbus, GA. A radical understanding empowers people to make knowledgeable selections about protection, making certain sufficient safety and avoiding monetary pitfalls. This part particulars the assorted forms of protection, related phrases, and the significance of cautious coverage overview.Correct evaluation of threat and wishes is paramount when choosing automotive insurance coverage.

Policyholders should consider their driving habits, car kind, and monetary state of affairs to find out the suitable stage of protection.

Varieties of Automotive Insurance coverage Protection

Various kinds of protection tackle various dangers related to car possession. Understanding these distinctions is crucial for choosing the proper coverage. Complete protection, for instance, protects in opposition to incidents not coated by legal responsibility insurance coverage, equivalent to vandalism or climate harm.

- Legal responsibility Protection: This basic protection protects in opposition to claims arising from harm to a different individual’s car or harm to a different individual attributable to the policyholder. It sometimes contains bodily harm legal responsibility and property harm legal responsibility, with various limits based mostly on coverage choice. For instance, a coverage with $100,000 in bodily harm legal responsibility protects these injured in an accident as much as that quantity.

- Collision Protection: This protection compensates for harm to the policyholder’s car no matter who’s at fault in an accident. It typically comes with a deductible, which the policyholder should pay earlier than the insurer reimburses the remaining prices.

- Complete Protection: This protection safeguards the policyholder’s car in opposition to non-collision occasions, together with vandalism, theft, fireplace, hail, or climate harm. It is essential for shielding the car’s worth within the occasion of such incidents.

- Uninsured/Underinsured Motorist Protection: This protection is crucial to guard the policyholder if concerned in an accident with a driver missing sufficient insurance coverage. It helps cowl medical bills and car restore prices when the at-fault driver has inadequate or no insurance coverage.

Phrases and Situations of Insurance policies

Insurance policies comprise particular phrases and situations that govern protection. Understanding these provisions is significant for avoiding disputes and making certain readability.

- Deductibles: Deductibles are the quantities policyholders should pay out-of-pocket earlier than insurance coverage protection kicks in. Decrease deductibles usually end in greater premiums.

- Coverage Limits: Coverage limits specify the utmost quantity the insurer pays for a selected declare. These limits are essential to know the monetary safety afforded by the coverage.

- Exclusions: Insurance policies typically exclude sure forms of incidents or damages from protection. Familiarizing oneself with these exclusions is essential to keep away from misunderstandings.

Significance of Coverage Paperwork

Thorough overview of coverage paperwork is crucial for making certain readability and avoiding potential points. Policyholders ought to search clarification on any clauses or phrases they don’t perceive.

“Make sure to fastidiously learn each element of your coverage to make sure that it meets your wants.”

Examples of Protection Ranges and Implications

Completely different protection ranges supply various levels of safety. As an example, a coverage with greater legal responsibility limits gives better monetary safety in case of serious damages or accidents.

| Protection Degree | Description | Implications |

|---|---|---|

| Primary Legal responsibility | Covers harm to different events’ property and accidents to others. | Restricted safety for policyholder’s car and private harm. |

| Full Protection | Contains legal responsibility, collision, and complete protection. | Offers broader safety in opposition to varied dangers. |

Suggestions for Selecting the Proper Automotive Insurance coverage Coverage in Columbus, GA

Deciding on the suitable automotive insurance coverage coverage in Columbus, GA, is essential for monetary safety and peace of thoughts. A well-chosen coverage balances protection wants with affordability, making certain complete safety in opposition to potential dangers. Understanding the important thing standards and issues empowers people to make knowledgeable selections that align with their particular circumstances.Thorough analysis of assorted elements, from protection ranges to coverage limits, permits drivers to pick a coverage that meets their wants and finances.

This includes a cautious evaluation of potential dangers and desired ranges of safety, finally resulting in an acceptable coverage that provides steadiness between price and complete protection.

Standards for Deciding on a Automotive Insurance coverage Coverage

Evaluating potential insurance coverage insurance policies requires cautious consideration of particular standards. Components equivalent to driving report, car kind, and geographical location considerably influence premium prices. A clear driving report typically ends in decrease premiums, whereas newer, higher-value automobiles sometimes require greater protection limits. Location-specific knowledge, like accident charges and theft statistics, additionally play a task in figuring out premiums.

Complete analysis of those elements gives a basis for making knowledgeable selections about insurance coverage protection.

Significance of Enough Protection

Insurance coverage protection should adequately tackle particular person wants and circumstances. Complete protection, together with legal responsibility, collision, and complete, protects in opposition to varied dangers. A radical evaluation of potential dangers, together with the worth of the car, private legal responsibility publicity, and potential medical bills, helps decide acceptable protection ranges. For instance, people with high-value automobiles or vital private belongings might require greater legal responsibility limits.

Enough protection gives a monetary security internet in opposition to surprising occasions.

Methods for Acquiring Greatest Worth

Acquiring one of the best worth from a automotive insurance coverage coverage includes exploring varied methods. Comparability buying amongst a number of suppliers is crucial to seek out aggressive charges. Reductions, equivalent to these for protected driving information or a number of automobiles, can considerably cut back premiums. Bundling insurance coverage merchandise, like residence and auto insurance coverage, might result in potential reductions. Understanding and leveraging obtainable reductions maximizes cost-effectiveness.

Coverage Limits and Deductibles

Coverage limits and deductibles are vital issues. Coverage limits outline the utmost quantity the insurance coverage firm pays for a coated loss. Deductibles are the quantities policyholders should pay out-of-pocket earlier than insurance coverage protection kicks in. Selecting acceptable limits and deductibles includes balancing monetary duty with potential dangers. Decrease deductibles normally correlate with greater premiums, whereas greater deductibles imply decrease premiums.

A radical understanding of those parts is essential for knowledgeable decision-making.

Inquiries to Ask Earlier than Committing

A pre-commitment overview ought to contain asking particular inquiries to insurance coverage suppliers. Understanding the main points of protection, together with particular exclusions and limitations, is significant. Clarifying the claims course of, coverage changes, and the provision of further protection choices are important. Questions in regards to the particular phrases and situations, equivalent to fee strategies, renewal processes, and dispute decision procedures, are essential.

Thorough investigation into the specifics of the insurance coverage coverage earlier than finalizing the dedication ensures a complete understanding.

Conclusion

In conclusion, securing low-cost automotive insurance coverage in Columbus GA requires a strategic method. By evaluating quotes, understanding coverage particulars, and recognizing the elements influencing premiums, you’ll be able to navigate the method with confidence. This information affords sensible steps and insightful comparisons to empower you to decide on one of the best protection to your state of affairs. Finally, your selection hinges in your cautious consideration of particular person wants and circumstances, making certain you safe the very best deal.

FAQ Information

What are the most typical reductions obtainable for automotive insurance coverage in Columbus, GA?

Reductions typically embody these for protected drivers, good college students, and people who bundle insurance coverage insurance policies. Examine with particular person suppliers for particular particulars and eligibility.

How can I evaluate insurance coverage quotes successfully?

Use on-line comparability instruments, contact a number of suppliers immediately, and evaluate coverage options and prices to make knowledgeable selections.

What are the standard prices for various kinds of protection (e.g., legal responsibility, collision)?

Prices fluctuate enormously based mostly on elements like your driving report and car kind. It is advisable to acquire quotes from varied suppliers to get a transparent image of worth ranges.

How can I decrease my insurance coverage premiums in Columbus, GA?

Methods embody sustaining a clear driving report, putting in security options in your car, and exploring reductions obtainable from insurance coverage suppliers.