Low-cost automobile insurance coverage Fort Lauderdale FL is a severe sport, and this information’s gonna break it down. We’ll cowl all the pieces from the native market to savvy methods to slash your premiums. Fort Lauderdale’s acquired some distinctive elements affecting charges, so let’s get into it.

From evaluating quotes to understanding protection varieties, this information supplies a complete overview of securing inexpensive automobile insurance coverage in Fort Lauderdale, Florida. Navigating the insurance coverage maze might be tough, however we have got you coated with skilled recommendation and actionable ideas.

Introduction to Reasonably priced Automobile Insurance coverage in Fort Lauderdale, FL

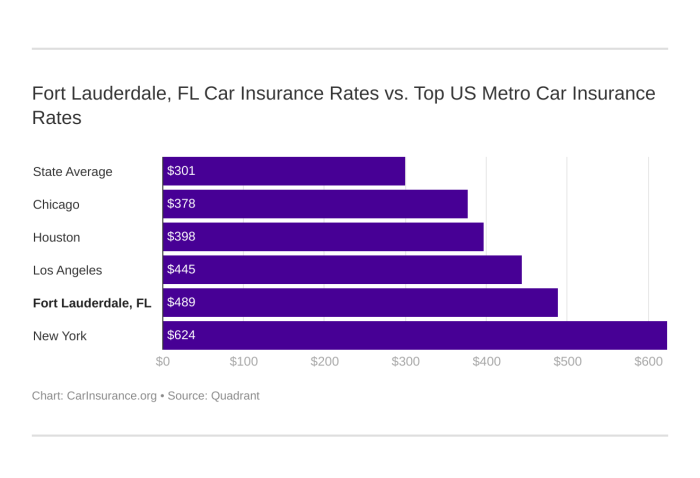

The Fort Lauderdale, FL, automobile insurance coverage market presents a posh panorama, influenced by elements like excessive inhabitants density, particular climate patterns, and a mixture of demographics. Discovering inexpensive protection whereas sustaining ample safety might be difficult for drivers on this space. Understanding the nuances of the market and the variables affecting charges is essential for securing aggressive insurance coverage premiums.Aggressive pricing is a key side of navigating the automobile insurance coverage market in Fort Lauderdale.

That is pushed by the provision of a number of insurers vying for purchasers, but additionally by the necessity to consider elements like threat profiles, car varieties, and driver historical past to find out acceptable premiums. Understanding these influencing elements is important to acquiring an acceptable insurance coverage coverage.

Widespread Components Influencing Automobile Insurance coverage Charges

Quite a few elements contribute to the price of automobile insurance coverage in Fort Lauderdale, and these are sometimes intertwined. Demographic elements, reminiscent of age and driving historical past, considerably impression charges. Youthful drivers typically face greater premiums as a consequence of their perceived greater threat profile, whereas older drivers with a confirmed historical past of secure driving may see decrease charges. Equally, a driver’s location inside Fort Lauderdale can affect premiums as a consequence of variations in visitors density and accident charges.

Automobile sort and worth additionally play a crucial position; higher-value automobiles typically require greater insurance coverage protection, which interprets to greater premiums. Moreover, claims historical past, each private and within the insured’s instant household, will have an effect on premiums. These elements are thought of when insurers assess threat and decide acceptable charges.

Comparability of Insurance coverage Quotes

Evaluating quotes from numerous insurance coverage suppliers is important for acquiring probably the most aggressive charges. Completely different insurers use completely different methodologies for calculating premiums, and the resultant charges can differ considerably. An intensive comparability throughout a number of suppliers, together with native and nationwide corporations, can result in substantial financial savings. By understanding the protection choices provided by completely different suppliers, drivers can choose insurance policies that greatest meet their particular wants and price range.

Dependable Insurance coverage Corporations in Fort Lauderdale, FL

A wide range of insurance coverage corporations function within the Fort Lauderdale space, providing a spread of services and products. Selecting a good firm is essential to making sure dependable protection and repair. Some well-established and respected insurance coverage suppliers within the area embrace State Farm, Allstate, Geico, Progressive, and Liberty Mutual. It is very important analysis the monetary stability and customer support scores of every firm earlier than making a call.

- State Farm: Recognized for its intensive community and complete protection choices.

- Allstate: Affords a variety of insurance policies, together with each conventional and customised choices.

- Geico: A well-liked nationwide firm with aggressive charges and accessible on-line providers.

- Progressive: Typically praised for its user-friendly on-line platform and aggressive pricing methods.

- Liberty Mutual: Acknowledged for its customer support and concentrate on offering complete insurance coverage options.

Historic Developments in Fort Lauderdale Automobile Insurance coverage

The automobile insurance coverage market in Fort Lauderdale, like elsewhere, has seen vital evolution. Initially, charges have been typically based mostly on a mixture of things like car worth and driver age, with little emphasis on particular person driving data. Over time, insurers started incorporating extra refined threat evaluation methodologies, together with driving habits and claims historical past, resulting in a extra individualized strategy to pricing.

This pattern in direction of personalised pricing continues right now, with insurers utilizing superior applied sciences to additional refine their threat evaluation methods.

Figuring out Components Affecting Insurance coverage Premiums: Low-cost Automobile Insurance coverage Fort Lauderdale Fl

Insurance coverage premiums in Fort Lauderdale, FL, are influenced by a wide range of elements past easy demographics. Understanding these elements is essential for securing probably the most inexpensive protection whereas sustaining ample safety. An intensive evaluation of those components empowers people to make knowledgeable selections relating to their insurance coverage selections.A large number of variables, starting from driving conduct to car traits, contribute to the ultimate premium quantity.

Every issue performs a particular position in calculating the chance profile related to a specific policyholder. The evaluation of those dangers by insurance coverage corporations instantly impacts the price of premiums.

Influence of Driving Data on Insurance coverage Prices

Driving data are a main determinant in establishing insurance coverage premiums. Accidents and violations, each transferring and non-moving, considerably enhance insurance coverage prices. A historical past of accidents, notably these involving extreme accidents or property harm, considerably elevates the chance profile, resulting in greater premiums. Equally, repeated visitors violations, reminiscent of dashing tickets or reckless driving convictions, point out the next probability of future incidents, thus justifying a premium enhance.

Insurance coverage corporations use refined algorithms to investigate driving data and assess the chance related to every policyholder.

Influence of Automobile Sort and Mannequin on Premiums

The sort and mannequin of a car play a considerable position in figuring out insurance coverage premiums. Sure car varieties, notably these identified for greater accident charges or extra pricey repairs, command greater premiums. Luxurious automobiles, sports activities vehicles, and high-performance fashions typically fall into this class because of the elevated potential for harm and restore prices. The car’s make and mannequin additionally issue into the calculation, as sure manufacturers and fashions might have the next charge of theft or accidents, resulting in an elevated premium.

Insurance coverage corporations meticulously analyze information on car accidents, thefts, and restore prices to regulate premiums accordingly.

Position of Location inside Fort Lauderdale, FL, on Insurance coverage Charges

Geographic location inside Fort Lauderdale, FL, can affect insurance coverage charges. Areas with greater crime charges, notably these vulnerable to accidents as a consequence of heavy visitors or poor highway situations, are likely to have greater premiums. Particular neighborhoods or streets identified for greater incident charges of theft or vandalism might mirror within the premiums. Insurance coverage corporations conduct thorough analyses of native crime statistics, accident experiences, and visitors patterns to evaluate the chance degree related to every location.

Comparability of Age and Gender on Automobile Insurance coverage Prices

Age and gender are vital elements influencing automobile insurance coverage premiums in Fort Lauderdale, FL. Youthful drivers, notably these of their teenagers and early twenties, typically face greater premiums as a consequence of their statistically greater accident charges. That is largely attributed to a mixture of inexperience, greater risk-taking behaviors, and fewer driving expertise. Equally, gender may play a minor position, although the impact is usually much less vital than age.

Insurance coverage corporations depend on intensive information units to ascertain age-related and gender-related threat profiles and modify premiums accordingly.

Reductions Out there to Policyholders in Fort Lauderdale, FL

A number of reductions can be found to policyholders in Fort Lauderdale, FL, to probably cut back premiums. These reductions might be categorized into differing types. Examples embrace secure driver reductions for accident-free data, multi-vehicle reductions for a number of automobiles insured underneath the identical coverage, and anti-theft system reductions for automobiles geared up with safety methods. Insurance coverage corporations usually supply reductions for numerous elements, reminiscent of anti-theft units, accident-free driving data, or good pupil standing.

An entire listing of obtainable reductions must be reviewed with the insurance coverage supplier.

Exploring Completely different Insurance coverage Suppliers

Deciding on the proper automobile insurance coverage supplier in Fort Lauderdale, FL, is essential for securing monetary safety and aggressive pricing. Understanding the strengths and weaknesses of varied corporations, together with their claims dealing with procedures and customer support, is paramount to creating an knowledgeable resolution. This part delves into outstanding insurance coverage suppliers, analyzing their protection choices, premiums, and buyer critiques to help customers to find one of the best match for his or her wants.

Distinguished Insurance coverage Corporations in Fort Lauderdale

A number of insurance coverage corporations supply aggressive charges and complete protection in Fort Lauderdale. Key gamers embrace Geico, State Farm, Progressive, Allstate, and Liberty Mutual.

Evaluation of Insurance coverage Supplier Strengths and Weaknesses

Every insurance coverage supplier possesses distinctive strengths and weaknesses in customer support, claims dealing with, and coverage options. Components like firm status, buyer suggestions, and particular coverage choices contribute to the general evaluation.

- Geico: Typically cited for aggressive pricing, Geico might generally face challenges in claims dealing with, as reported by some clients. Their coverage choices are usually commonplace, however reductions and particular applications can assist decrease premiums.

- State Farm: Recognized for its intensive community of brokers and an extended historical past within the trade, State Farm typically supplies personalised service. Nevertheless, some clients report probably greater premiums in comparison with different suppliers. Their protection is complete and contains numerous add-on choices.

- Progressive: Progressive excels in utilizing expertise to streamline the claims course of and supply handy on-line instruments. Whereas this improves effectivity, some clients have reported difficulties in sure claims conditions. Their insurance policies usually embrace commonplace protection packages.

- Allstate: Allstate supplies a broad vary of protection choices, together with tailor-made options for particular wants. Buyer critiques point out combined experiences, with some highlighting glorious service whereas others report challenges in claims dealing with. Their pricing varies relying on the coverage and driver profile.

- Liberty Mutual: Liberty Mutual is understood for its sturdy monetary stability and infrequently gives aggressive premiums. Customer support critiques are usually constructive, however claims dealing with procedures might differ based mostly on the person case. They ceaselessly supply reductions and bundles.

Protection Choices and Coverage Options

Insurance coverage suppliers supply numerous protection choices, starting from primary legal responsibility protection to complete and collision protection. Understanding the several types of protection is important to choosing probably the most appropriate coverage on your wants.

Comparative Evaluation of Coverage Choices

| Insurance coverage Firm | Common Premium (Estimated) | Protection Particulars (Instance) | Buyer Opinions (Abstract) |

|---|---|---|---|

| Geico | $950 | Legal responsibility, complete, collision, uninsured/underinsured motorist | Typically constructive for pricing, combined on claims dealing with. |

| State Farm | $1100 | Legal responsibility, complete, collision, uninsured/underinsured motorist, roadside help | Optimistic for agent community, probably greater premiums. |

| Progressive | $1025 | Legal responsibility, complete, collision, accident forgiveness | Optimistic for on-line instruments, combined for claims dealing with in some instances. |

| Allstate | $1075 | Legal responsibility, complete, collision, private damage safety | Combined, relying on particular agent and declare state of affairs. |

| Liberty Mutual | $1000 | Legal responsibility, complete, collision, rental automobile protection | Optimistic for monetary stability, combined on declare decision. |

Out there Reductions

Insurance coverage corporations typically supply reductions to incentivize clients. These reductions can differ considerably and rely on elements like driver historical past, car sort, and utilization.

| Insurance coverage Firm | Instance Reductions |

|---|---|

| Geico | Good pupil low cost, multi-policy low cost, anti-theft system low cost |

| State Farm | Good pupil low cost, multi-policy low cost, defensive driving course low cost |

| Progressive | Multi-policy low cost, accident forgiveness low cost, good pupil low cost |

| Allstate | Good pupil low cost, multi-policy low cost, anti-theft system low cost |

| Liberty Mutual | Multi-policy low cost, good pupil low cost, anti-theft system low cost |

Methods for Securing Low-cost Automobile Insurance coverage

Securing inexpensive automobile insurance coverage in Fort Lauderdale, FL, includes a multifaceted strategy that goes past merely selecting the bottom premium. A complete understanding of varied elements influencing charges and proactive methods are essential for reaching cost-effective protection. This part Artikels key methods to acquire probably the most aggressive automobile insurance coverage charges.Evaluating quotes from a number of suppliers is a crucial step in securing inexpensive automobile insurance coverage.

This course of permits for an in depth evaluation of protection choices and pricing constructions, enabling knowledgeable selections. The supply of on-line assets considerably facilitates this comparability course of.

Evaluating Insurance coverage Quotes

A complete strategy to evaluating quotes includes systematically gathering info from numerous suppliers. This meticulous course of ensures a good evaluation of the accessible choices. Immediately contacting insurance coverage corporations and using on-line comparability instruments are efficient strategies for acquiring a number of quotes.

- Direct Contacting Insurance coverage Corporations: This technique includes contacting insurance coverage corporations instantly, requesting quotes, and punctiliously evaluating the provided protection and pricing. Whereas probably time-consuming, it could actually yield personalised quotes tailor-made to particular wants.

- Using On-line Comparability Instruments: On-line comparability instruments supply a streamlined and environment friendly technique for acquiring quotes from a number of suppliers concurrently. Customers enter their car info, driving historical past, and desired protection, and the instrument aggregates quotes from numerous corporations. This technique saves appreciable effort and time, permitting a speedy comparability of varied pricing constructions.

Acquiring On-line Quotes Successfully

Acquiring on-line quotes effectively includes a methodical strategy, guaranteeing correct and full info is offered. A well-structured course of minimizes errors and maximizes the accuracy of the generated quotes.

- Correct Automobile Data: Present exact particulars concerning the car, together with make, mannequin, 12 months, and VIN (Automobile Identification Quantity). Inaccuracies on this information can result in inaccurate or deceptive quotes.

- Exact Driving Historical past: Precisely report your driving historical past, together with any accidents, violations, or claims. Transparency on this space is essential for receiving correct quotes.

- Complete Protection Choice: Fastidiously evaluate and choose the suitable protection choices, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Selecting the best degree of protection balances safety and cost-effectiveness.

- Evaluate and Comparability: Totally evaluate the quotes from completely different suppliers, taking note of particulars reminiscent of protection limits, deductibles, and premiums. Evaluating the varied choices facilitates an knowledgeable resolution.

Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, reminiscent of residence and auto insurance coverage, can considerably cut back premiums. Insurance coverage suppliers typically supply discounted charges for purchasers who mix a number of insurance policies underneath one umbrella.

This technique is usually a financially engaging possibility for customers who want to consolidate their insurance coverage wants.

Utilizing Comparability Web sites

Using devoted comparability web sites is an environment friendly technique for analyzing and evaluating insurance coverage charges. These web sites mixture information from a number of suppliers, enabling a complete comparability. This instrument permits for fast and efficient analysis of the accessible choices.

Sustaining a Good Driving Document

Sustaining a clear driving report is important for securing favorable insurance coverage charges. A constant historical past of secure driving practices displays positively on insurance coverage premiums.

- Avoiding Accidents and Violations: Prioritizing secure driving practices and adhering to visitors legal guidelines minimizes the chance of accidents and violations. This instantly impacts the insurance coverage premiums charged by suppliers.

- Reporting Accidents Promptly: Within the unlucky occasion of an accident, reporting it promptly to the authorities and insurance coverage firm is crucial. Following this process maintains a transparent report of the incident and avoids potential problems.

Understanding Insurance coverage Protection Choices

Selecting the suitable automobile insurance coverage protection is essential for shielding your monetary well-being and guaranteeing ample safety within the occasion of an accident or harm to your car. Understanding the several types of protection accessible, their phrases, situations, and limitations, is important for making knowledgeable selections and securing probably the most appropriate coverage on your wants and price range.

Kinds of Protection

Numerous protection choices can be found to safeguard your car and private pursuits. Understanding these choices is significant for choosing the proper coverage. Legal responsibility protection, as an illustration, protects you towards monetary duty for damages to others. Collision protection protects your car towards harm from a collision with one other car or object, whereas complete protection addresses harm from perils past collisions, reminiscent of theft, vandalism, or pure disasters.

Legal responsibility Protection

Legal responsibility protection, a elementary element of most insurance policies, protects policyholders from monetary duty arising from damages triggered to different events. This protection usually contains bodily damage legal responsibility and property harm legal responsibility. Bodily damage legal responsibility covers medical bills and misplaced wages for injured events in accidents involving your car. Property harm legal responsibility compensates for harm to the property of others ensuing from an accident you’re liable for.

Coverage limits outline the utmost quantity the insurance coverage firm pays for claims underneath this protection.

Collision Protection

Collision protection pays for damages to your car if it is concerned in a collision, no matter fault. This protection typically contains deductibles, that are the quantities you’re liable for paying out of pocket earlier than the insurance coverage firm steps in. The next deductible can lead to decrease premiums, nevertheless it additionally means a larger monetary burden in case you file a declare.

The choice to buy collision protection must be made based mostly on elements like your car’s worth, your price range, and your driving habits.

Complete Protection

Complete protection addresses damages to your car from occasions past collisions. These occasions can embrace theft, vandalism, fireplace, hail, and climate occasions. It protects your funding towards unexpected circumstances that would considerably cut back the worth of your car. Complete protection might be an essential consideration for automobiles parked in high-risk areas or these with distinctive vulnerabilities.

Coverage Phrases and Situations

Fastidiously reviewing the coverage’s phrases and situations is paramount. These paperwork Artikel the specifics of your protection, together with exclusions, limitations, and obligations. Understanding these clauses is crucial to avoiding misunderstandings and disputes within the occasion of a declare.

Exclusions and Limitations

Insurance coverage insurance policies typically comprise exclusions and limitations that specify conditions the place protection might not apply. For instance, some insurance policies might exclude protection for pre-existing harm or harm attributable to intentional acts. Understanding these limitations is important to keep away from surprises when making a declare. Reviewing the particular language of your coverage is essential for guaranteeing you may have the suitable protection.

Deductibles and Premiums

Deductibles play an important position in figuring out insurance coverage premiums. Increased deductibles usually result in decrease premiums, whereas decrease deductibles lead to greater premiums. The deductible quantity represents the monetary duty you bear earlier than the insurance coverage firm pays a declare. The selection of deductible is a trade-off between value and monetary safety.

Evaluating Protection Choices Throughout Suppliers

Evaluating protection choices throughout completely different insurance coverage suppliers is beneficial. Suppliers might supply various ranges of protection and premiums. Take into account elements like coverage limits, deductibles, and protection varieties when evaluating insurance policies from numerous corporations. Analyzing completely different insurance policies can assist you discover one of the best stability between value and safety. Comparative analyses of protection packages throughout completely different suppliers can assist customers make knowledgeable selections.

Navigating the Claims Course of

The claims course of, a crucial side of automobile insurance coverage, Artikels the procedures for dealing with accidents, damages, or different coated incidents. Understanding these procedures is important for policyholders in Fort Lauderdale, FL, to make sure a clean and environment friendly decision. A well-defined claims course of minimizes potential disputes and ensures that policyholders obtain the compensation they’re entitled to.Submitting a declare, whether or not for minor fender benders or main collisions, is a structured course of.

Every insurance coverage firm has its personal particular protocol, however usually, these protocols purpose for a standardized and truthful evaluation of damages and compensation.

Claims Course of Overview

The claims course of includes a number of key steps, which may differ based mostly on the particular insurance coverage supplier and the character of the declare. A typical course of begins with reporting the incident and gathering vital info.

Reporting the Incident

Instantly reporting the incident to the insurance coverage firm is essential. This usually includes contacting the insurer by way of cellphone, on-line portal, or mail. Documentation of the incident, together with time, location, and witnesses, is significant. Pictures of the harm and any accidents are additionally important. Correct and full reporting is important for a good and well timed declare decision.

Gathering Proof

Gathering supporting proof is an integral a part of the claims course of. This will likely embrace police experiences, witness statements, restore estimates, medical data, and different pertinent paperwork. The insurer might request particular info or paperwork. Gathering and offering this proof promptly can expedite the claims course of.

Insurance coverage Firm Claims Procedures, Low-cost automobile insurance coverage fort lauderdale fl

Completely different insurance coverage corporations make use of various declare procedures. Some corporations supply on-line declare portals, enabling policyholders to file and observe claims digitally. Others might require a extra conventional technique of submitting a declare. Figuring out the particular procedures of the insurer is useful in navigating the claims course of.

Examples of Conditions Requiring Claims

Numerous conditions necessitate submitting a declare with an insurance coverage firm. These embrace accidents involving different automobiles, harm to the insured car, theft, and harm from climate occasions. Within the occasion of an accident involving one other celebration, the insured car, or the insured particular person, submitting a declare ensures the suitable compensation is obtained.

Widespread Points and Resolutions

A number of points can come up throughout the claims course of. These embrace disagreements on the extent of harm, disputes over legal responsibility, delays in processing claims, and communication breakdowns. Insurance coverage adjusters play a key position in resolving these points.

Position of Insurance coverage Adjusters

Insurance coverage adjusters are essential in dealing with claims. They examine the incident, assess the damages, and negotiate settlements. Adjusters work to assemble proof, consider the declare, and decide the suitable compensation. Additionally they attempt to resolve disputes pretty and effectively.

Steps Concerned in Submitting a Declare with Completely different Corporations

| Insurance coverage Firm | Typical Declare Submitting Steps |

|---|---|

| Firm A | Report incident, present documentation, full on-line type, present further supporting paperwork. |

| Firm B | Contact claims division, present particulars, submit images and police report, comply with up on standing. |

| Firm C | Report on-line or by cellphone, present all required paperwork, take part in adjuster investigations, comply with up on correspondence. |

Ideas for Sustaining a Good Driving Document

Sustaining a clear driving report is essential for securing inexpensive automobile insurance coverage in Fort Lauderdale, FL. A constructive driving historical past demonstrates accountable conduct on the highway, resulting in decrease insurance coverage premiums. This part Artikels methods for secure driving practices, the significance of avoiding visitors violations, and the implications of accumulating violations and accidents on insurance coverage prices.A powerful driving report instantly correlates with decrease insurance coverage charges.

Insurers assess threat based mostly on elements reminiscent of accident historical past, visitors violations, and driving habits. By adhering to secure driving practices and avoiding infractions, drivers can considerably enhance their probabilities of securing aggressive insurance coverage premiums.

Secure Driving Practices in Fort Lauderdale

Secure driving practices are paramount for sustaining a constructive driving report and decreasing the chance of accidents. Adhering to hurry limits, avoiding distractions, and sustaining a secure following distance are elementary parts of secure driving. Fort Lauderdale’s numerous highway situations, together with excessive visitors density and diversified climate patterns, necessitate even larger warning.

- Adhering to Velocity Limits: Exceeding velocity limits will increase the chance of accidents, particularly in densely populated areas like Fort Lauderdale. Strict adherence to posted velocity limits is an important aspect in minimizing accident threat.

- Avoiding Distractions: Distracted driving, together with utilizing cell telephones, consuming, or adjusting the radio, considerably will increase the chance of accidents. Sustaining concentrate on the highway is important for secure driving in Fort Lauderdale.

- Sustaining a Secure Following Distance: Sustaining a enough following distance permits drivers to react to surprising conditions and keep away from rear-end collisions, a typical reason for accidents in Fort Lauderdale.

- Defensive Driving: Defensive driving includes anticipating potential hazards and reacting proactively to keep away from accidents. Drivers ought to pay attention to their environment, anticipate potential dangers, and be ready to react to surprising conditions. That is notably essential in Fort Lauderdale’s advanced visitors surroundings.

Significance of Avoiding Site visitors Violations

Site visitors violations, reminiscent of dashing, operating pink lights, and reckless driving, instantly impression insurance coverage premiums. Every violation will increase the chance profile assigned to the driving force, resulting in greater insurance coverage charges. The buildup of violations can considerably enhance insurance coverage prices.

- Dashing Violations: Dashing is a typical visitors violation that considerably will increase insurance coverage premiums. It’s essential to stick to posted velocity limits to keep away from such violations.

- Operating Purple Lights: Operating pink lights is a extremely dangerous violation that dramatically will increase the probability of collisions. Following visitors alerts is essential for avoiding such violations and sustaining a secure driving report.

- Reckless Driving: Reckless driving behaviors, together with aggressive lane modifications and weaving by visitors, enhance accident threat and lead to substantial insurance coverage premium will increase.

Driver Training and Enchancment Applications

Driver schooling and enchancment applications supply worthwhile assets for enhancing driving expertise and bettering highway security. These applications present strategies for safer driving practices, together with defensive driving methods. Taking part in these applications can result in a discount in insurance coverage premiums.

- Driver Enchancment Programs: Driver enchancment programs typically concentrate on defensive driving strategies, accident avoidance, and secure driving habits. Completion of such programs might lead to lowered insurance coverage premiums, notably for drivers with a historical past of violations.

- Defensive Driving Programs: Defensive driving programs present methods for anticipating potential hazards and reacting proactively to keep up secure driving habits. These programs are sometimes sponsored by insurance coverage corporations or native driving faculties.

Penalties of Accumulating Site visitors Violations and Accidents

Accumulating visitors violations and accidents considerably will increase insurance coverage premiums. Insurance coverage corporations assess drivers’ threat profiles based mostly on their driving historical past, and a poor report instantly interprets to greater premiums. Constant secure driving habits are important for sustaining a aggressive insurance coverage charge.

Insurance coverage corporations use a driver’s driving historical past to evaluate their threat profile. A poor driving report considerably will increase insurance coverage prices.

- Elevated Premiums: Every visitors violation and accident provides to a driver’s threat profile, leading to greater insurance coverage premiums.

- Insurance coverage Denials: Repeated violations and accidents can result in insurance coverage corporations denying protection altogether, making it troublesome to acquire insurance coverage at any worth.

Examples of Secure Driving Habits and Behaviors

Examples of secure driving habits embrace sustaining a secure following distance, utilizing flip alerts, and avoiding distractions whereas driving. These behaviors reveal a dedication to highway security and contribute to a decrease threat profile.

- Predictive Driving: Predictive driving includes anticipating potential hazards and reacting proactively to keep away from collisions. This contains anticipating the actions of different drivers and adjusting driving conduct accordingly.

- Accountable Driving Practices: Accountable driving practices contain a dedication to secure driving habits, together with adhering to hurry limits, avoiding distractions, and sustaining a secure following distance.

Conclusive Ideas

So, securing low cost automobile insurance coverage in Fort Lauderdale is not rocket science. By understanding the native market, evaluating quotes, and understanding protection, you could find a coverage that matches your price range. This information has given you the instruments to take management of your insurance coverage wants, making the method simpler to deal with. Keep in mind to check and think about all of your choices earlier than committing.

Standard Questions

What are the commonest reductions accessible for automobile insurance coverage in Fort Lauderdale?

Reductions differ by supplier however typically embrace secure driving, multi-policy, and pupil reductions. Test with particular person corporations for particulars.

How does my driving report have an effect on my insurance coverage premiums?

Accidents and violations considerably impression premiums. A clear report is essential to decrease charges.

Are there any particular corporations that constantly supply decrease charges in Fort Lauderdale?

A number of corporations are aggressive in Fort Lauderdale, however analysis is essential. Evaluating quotes from a number of suppliers is significant.

How typically ought to I evaluate my automobile insurance coverage coverage?

Reviewing your coverage a minimum of every year, or each time there are main life modifications, can assist make sure you’re getting the very best deal.