Low-cost automotive insurance coverage Modesto CA is a vital consideration for drivers within the space. Navigating the varied insurance coverage market will be daunting, however understanding the elements affecting premiums and accessible reductions may help you discover one of the best coverage. This complete information explores the panorama of reasonably priced automotive insurance coverage in Modesto, offering insights into protection choices, supplier comparisons, and methods for securing financial savings.

Discovering reasonably priced automotive insurance coverage in Modesto entails extra than simply evaluating costs. Elements like your driving document, automobile kind, and placement all play a job. This information delves into the specifics, providing actionable ideas and sources to empower you in your seek for the best coverage.

Overview of Low-cost Automotive Insurance coverage in Modesto, CA

The Modesto, CA, automotive insurance coverage market is aggressive, providing a spread of choices for drivers in search of reasonably priced protection. Nevertheless, navigating the assorted insurance policies and understanding the elements impacting premiums is essential for securing one of the best deal. This overview will make clear the market dynamics and assist shoppers make knowledgeable selections.The price of automotive insurance coverage in Modesto, CA, is influenced by a posh interaction of things.

These elements, mentioned intimately under, are essential for understanding tips on how to safe reasonably priced protection.

Elements Influencing Automotive Insurance coverage Premiums

A number of elements considerably have an effect on automotive insurance coverage premiums in Modesto, CA. These elements fluctuate significantly and should be thought of when evaluating numerous insurance coverage choices. Age, driving document, and automobile kind all play a important position in premium calculation.

- Driving Historical past: A clear driving document is a significant factor in acquiring reasonably priced insurance coverage. Accidents, site visitors violations, and at-fault incidents considerably enhance premiums. For instance, a driver with a historical past of rushing tickets will probably pay greater than a driver with no violations. Equally, a driver with a historical past of accidents could have increased premiums.

- Demographics: Demographics similar to age, gender, and placement additionally affect insurance coverage prices. Youthful drivers typically pay increased premiums resulting from statistically increased accident charges. Location-specific elements similar to high-crime areas or accident-prone roadways also can have an effect on insurance coverage charges.

- Car Sort: The kind of automobile a driver owns impacts insurance coverage prices. Excessive-performance automobiles or these with the next theft threat usually have increased premiums. That is true as a result of the upper value of restore or substitute elements usually results in increased premiums. As an example, a sports activities automotive is prone to have increased premiums than a normal sedan.

- Protection Choices: The extent of protection chosen instantly impacts the premium. Complete protection (for injury not attributable to accidents) and collision protection (for injury attributable to accidents) are examples of protection choices that may affect the ultimate premium. Drivers should rigorously consider their wants and funds to find out the suitable stage of protection.

Typical Protection Choices for Inexpensive Automotive Insurance coverage

Inexpensive automotive insurance coverage in Modesto, CA, usually consists of the important coverages required by regulation. Drivers should be aware of the extent of protection wanted to guard themselves and their belongings. Nevertheless, there are alternatives to cut back prices whereas sustaining important safety.

- Legal responsibility Protection: That is the minimal protection required by regulation and protects you in case you are at fault in an accident. It covers damages to the opposite celebration’s automobile and accidents to them.

- Collision Protection: This protection pays for damages to your automobile no matter who’s at fault. This could be a essential a part of a complete insurance coverage coverage and could also be essential relying on monetary elements and legal responsibility.

- Complete Protection: This covers injury to your automobile from non-collision incidents, similar to vandalism, theft, or weather-related occasions. Whereas not at all times essential, complete protection provides extra monetary safety.

Comparability of Low-cost Automotive Insurance coverage Sorts

A comparability desk highlights the important thing variations between numerous insurance coverage varieties. Selecting the best kind of insurance coverage is dependent upon particular person wants and threat tolerance.

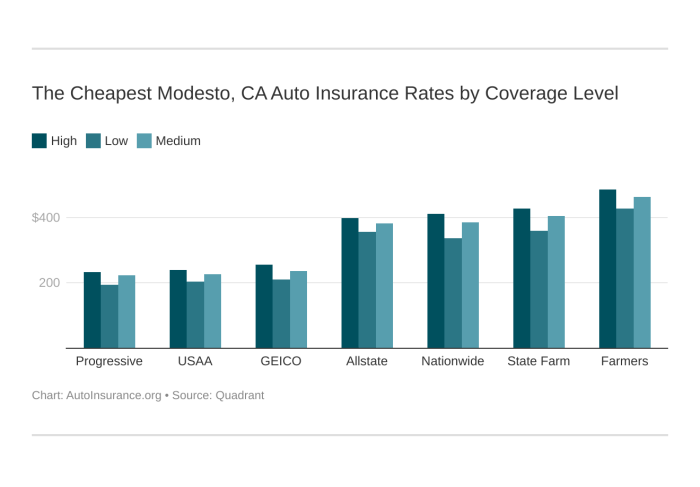

Evaluating Insurance coverage Suppliers in Modesto, CA

Selecting the best automotive insurance coverage supplier in Modesto, CA is essential for monetary safety and peace of thoughts. Understanding the assorted choices and their strengths and weaknesses empowers you to make an knowledgeable determination. A radical comparability of key suppliers is crucial to establish one of the best match to your particular wants and funds.Navigating the insurance coverage market can really feel overwhelming, with quite a few corporations vying for your corporation.

This part will delve right into a comparability of high suppliers in Modesto, highlighting their protection packages, pricing buildings, and customer support reputations. This in-depth evaluation will enable you to make an knowledgeable determination.

High Insurance coverage Suppliers in Modesto, CA

A number of insurance coverage suppliers function in Modesto, providing various ranges of service and pricing. Figuring out the highest contenders out there is essential for a radical comparability. Key gamers usually embrace nationwide corporations, regional giants, and native companies, every with its personal strategy to pricing and customer support. Primarily based on market share, repute, and availability within the space, among the most distinguished suppliers are prone to be State Farm, Geico, and Progressive.

Protection Packages and Pricing Buildings

Insurance coverage suppliers in Modesto supply a spread of protection packages. Understanding these packages is important for choosing the best safety. A complete comparability of those packages requires analyzing legal responsibility protection, collision protection, complete protection, and probably extra protection choices similar to uninsured/underinsured motorist protection. Value comparisons ought to account for deductibles, coverage limits, and any reductions that may be accessible.

Policyholders also needs to think about the particular wants of their automobile and driving historical past when assessing completely different protection packages.

Buyer Service Status

Customer support performs a important position within the insurance coverage shopping for expertise. A supplier’s repute for responsiveness, effectivity, and dealing with claims successfully can considerably affect your alternative. Critiques, rankings, and testimonials from earlier prospects supply useful insights right into a supplier’s customer support capabilities. Constructive suggestions usually factors to clean declare processes, immediate communication, and a dedication to resolving buyer points.

Comparability Desk

| Supplier | Strengths | Weaknesses | Buyer Service |

|---|---|---|---|

| State Farm | Sturdy model repute, intensive community, big selection of protection choices, usually aggressive pricing. | Potential for forms in declare processes, generally perceived as much less aware of buyer wants than smaller suppliers. | Usually thought of dependable, with a well-established presence. Nevertheless, buyer critiques counsel room for enchancment in rapid response time. |

| Geico | Recognized for aggressive pricing, user-friendly on-line platform, usually good for younger drivers or these with good driving data. | Might supply much less complete protection packages in comparison with some rivals, generally perceived as missing customized service. | Customer support rankings fluctuate; some report constructive experiences with on-line platforms, whereas others categorical frustration with cellphone interactions. |

| Progressive | Aggressive pricing, progressive on-line instruments, and sometimes provides good reductions, particularly for protected drivers. | Restricted native presence in comparison with some rivals, probably much less customized service. | Usually rated positively for on-line buyer assist and effectivity in claims processing, however some prospects have reported challenges with cellphone help. |

| (Non-obligatory: Add a fourth/fifth supplier based mostly on native market knowledge) |

Reductions and Financial savings Methods for Low-cost Automotive Insurance coverage

Securing reasonably priced automotive insurance coverage in Modesto, CA requires a proactive strategy, and strategically leveraging accessible reductions is essential. Understanding the assorted low cost alternatives and implementing efficient financial savings methods can considerably cut back your insurance coverage premiums. This part particulars accessible reductions, strategies to safe them, and examples related to Modesto drivers.Maximizing reductions is a confirmed technique for acquiring decrease automotive insurance coverage premiums.

Cautious consideration of your driving historical past, automobile traits, and way of life selections can unlock important financial savings. By understanding the nuances of every low cost, Modesto drivers could make knowledgeable selections to reduce their insurance coverage prices.

Reductions Accessible for Modesto Drivers

Quite a few reductions can be found to Modesto drivers, usually based mostly on elements similar to driving document, automobile options, and way of life selections. Understanding these reductions is vital to acquiring the absolute best charges.

- Secure Driving Historical past: Insurance coverage corporations steadily supply reductions to drivers with a clear driving document, demonstrating accountable conduct on the street. This features a lack of accidents and site visitors violations. For instance, a driver with no accidents or violations for 5 years would possibly qualify for a 15% low cost.

- Defensive Driving Programs: Finishing defensive driving programs can show a dedication to protected driving practices, usually leading to discounted premiums. These programs equip drivers with methods to keep away from accidents and preserve protected driving habits.

- Car Options: Insurance coverage corporations usually present reductions for automobiles with security options like anti-theft gadgets, airbags, and superior braking programs. A automobile geared up with a number of security options would possibly qualify for a mixed low cost, probably decreasing premiums by 10% or extra.

- Bundling Insurance coverage Insurance policies: Bundling a number of insurance coverage insurance policies, similar to residence and auto insurance coverage, with the identical supplier, can usually yield a mixed low cost. This technique is helpful for Modesto residents who maintain numerous insurance coverage insurance policies. Combining auto and householders insurance coverage with the identical supplier would possibly end in a 5-10% discount.

- Good Scholar Standing: Insurers steadily supply reductions to college students enrolled in a highschool or faculty. This displays the decrease threat profile of younger drivers actively engaged in tutorial pursuits.

Strategies to Safe Reductions and Financial savings

Proactively in search of and claiming accessible reductions is essential for minimizing automotive insurance coverage premiums. Insurers supply numerous reductions, and drivers must be diligent in figuring out and making use of for them.

- Assessment Insurance coverage Insurance policies Recurrently: Recurrently reviewing your insurance coverage coverage is crucial to establish any potential reductions you may be eligible for. Insurance coverage suppliers steadily replace their reductions, and drivers ought to verify for any modifications or newly added choices.

- Examine Insurance coverage Quotes: Evaluating quotes from a number of insurance coverage suppliers is crucial for acquiring the absolute best charges. Completely different suppliers supply numerous reductions, and evaluating quotes permits drivers to establish and leverage these reductions.

- Keep a Clear Driving File: A spotless driving document is a key think about acquiring decrease insurance coverage premiums. Keep away from accidents and site visitors violations to keep up eligibility for safe-driving reductions.

- Set up Security Options: Think about putting in security options in your automobile to probably qualify for reductions. This demonstrates a proactive strategy to security and should end in decrease premiums.

Insurance coverage Reductions Primarily based on Driver Profile and Car Options

Driver profiles and automobile traits usually affect insurance coverage reductions. These elements contribute to the general threat evaluation by insurance coverage suppliers.

- Age and Expertise: Youthful drivers typically have increased premiums resulting from their increased threat profile. As drivers achieve expertise and show accountable conduct, premiums usually lower.

- Marital Standing: Married drivers usually obtain reductions, reflecting a decrease threat profile in comparison with single drivers. That is usually attributed to shared obligations and a extra secure way of life.

- Car Security Scores: Autos with increased security rankings usually qualify for reductions, reflecting the decreased threat related to safer automobiles. Vehicles with superior security options are prone to have decrease premiums.

Evaluating and Contrasting Low cost Alternatives

Evaluating and contrasting low cost alternatives permits drivers to make knowledgeable selections relating to their insurance coverage insurance policies. Drivers ought to rigorously analyze the phrases and circumstances of every low cost to find out which of them are most useful.

| Low cost Class | Description | Instance |

|---|---|---|

| Secure Driving Historical past | Reductions based mostly on accident-free driving data. | 5-15% low cost for drivers with no accidents or violations for a sure interval. |

| Defensive Driving Programs | Reductions for finishing defensive driving programs. | 5-10% low cost for efficiently finishing a defensive driving course. |

| Car Options | Reductions for automobiles with superior security options. | 3-7% low cost for automobiles geared up with anti-theft programs, airbags, and superior braking programs. |

| Bundling Insurance coverage Insurance policies | Reductions for bundling a number of insurance coverage insurance policies. | 5-10% low cost for bundling auto and residential insurance coverage insurance policies. |

| Good Scholar Standing | Reductions for college kids actively pursuing schooling. | 2-5% low cost for college kids enrolled in highschool or faculty. |

Elements Affecting Automotive Insurance coverage Prices in Modesto: Low-cost Automotive Insurance coverage Modesto Ca

Automotive insurance coverage premiums in Modesto, CA, are influenced by a posh interaction of things, and understanding these elements is essential for securing reasonably priced protection. Town’s particular traits, together with site visitors patterns and demographics, contribute to the general threat evaluation that insurers use to find out charges. This evaluation instantly impacts the price of your coverage.Insurers meticulously analyze numerous knowledge factors to ascertain charges, making knowledgeable selections about pricing.

This data-driven strategy goals to stability affordability with threat administration, a course of important to sustaining a secure insurance coverage market.

Visitors Accidents and Insurance coverage Premiums

Visitors accidents considerably influence automotive insurance coverage charges in Modesto. A better frequency of accidents in a selected space results in elevated premiums for all drivers in that space. It’s because insurers should account for the elevated threat of claims. Accidents, whether or not minor or main, contribute to the next general declare value for the insurance coverage firm, which is mirrored within the charges.Modesto, like different city areas, experiences fluctuations in accident charges.

Information from the California Division of Motor Autos (DMV) exhibits a correlation between accident frequency and insurance coverage premiums. As an example, areas with increased charges of rear-end collisions would possibly see premiums enhance for all drivers. This displays the upper likelihood of claims arising from that particular kind of accident. Equally, a rise in accidents involving particular kinds of automobiles (e.g., older mannequin vehicles) might additionally result in increased charges for these automobile varieties.

Car Sort and Options Affecting Insurance coverage Prices

The kind and options of a automobile play a pivotal position in figuring out insurance coverage prices. It’s because sure automobiles are inherently dearer to restore or change than others. Luxurious automobiles, for instance, steadily contain increased restore prices resulting from their superior elements and specialised elements. This interprets to increased premiums for house owners of such automobiles.Moreover, automobiles with superior security options, like airbags and anti-lock brakes, typically end in decrease premiums.

This displays the decreased threat of accidents and accidents related to these options. Insurers use knowledge evaluation to find out how numerous automobile varieties and options influence declare frequencies and severity.

Driver Age and Expertise and Insurance coverage Prices

Driver age and expertise are important elements in figuring out automotive insurance coverage premiums. Youthful drivers, usually, are assigned increased premiums resulting from their perceived increased accident threat in comparison with older, extra skilled drivers. This increased threat is commonly attributed to inexperience, which can result in extra frequent accidents.Equally, drivers with a historical past of site visitors violations, similar to rushing tickets or DUI convictions, face increased premiums.

These violations show a sample of dangerous driving conduct, which raises the insurer’s evaluation of threat. Insurers make the most of knowledge to establish tendencies and patterns in accident charges and declare histories for various age teams and driver expertise ranges.

Stream Chart: Accidents’ Impact on Insurance coverage Premiums

(A visible flowchart, although not a picture, would present the next chain of results: Elevated accident frequency in an space -> Larger declare prices for insurers -> Elevated threat evaluation -> Larger premiums for all drivers within the space.)

(A visible flowchart, although not a picture, would present the next chain of results: Elevated accident frequency in an space -> Larger declare prices for insurers -> Elevated threat evaluation -> Larger premiums for all drivers within the space.)

Assets and Instruments for Discovering Low-cost Automotive Insurance coverage

Securing reasonably priced automotive insurance coverage in Modesto, CA, requires strategic use of available sources. Comparability instruments present a strong benefit, permitting drivers to swiftly analyze numerous insurance policies and establish probably the most cost-effective choices. A proactive strategy, coupled with cautious analysis, is vital to attaining optimum financial savings.

On-line Comparability Instruments

On-line comparability instruments are indispensable for locating aggressive automotive insurance coverage quotes. These platforms mixture knowledge from a number of insurance coverage suppliers, enabling a complete overview of obtainable insurance policies. This streamlined strategy saves important effort and time in comparison with manually contacting every supplier. Crucially, these instruments empower drivers to match options and costs, facilitating knowledgeable selections.

Advantages and Limitations of Comparability Instruments

Using comparability instruments yields quite a few benefits. They furnish a broad spectrum of quotes, enabling drivers to establish potential financial savings. The instruments are sometimes user-friendly, permitting for simple navigation and coverage choice. Nevertheless, limitations exist. The introduced quotes may not embody all accessible reductions or particular provides.

Drivers should stay vigilant, cross-referencing quotes and contacting insurers instantly to make sure they are not lacking out on probably higher offers. In essence, comparability instruments present a place to begin however do not assure the last word very best worth.

Efficient Use of Comparability Instruments

To leverage comparability instruments successfully, drivers ought to present correct details about their automobile, driving historical past, and protection wants. This meticulous strategy ensures exact quote technology. Fastidiously scrutinize the small print of every quote, paying explicit consideration to protection limits, deductibles, and related charges. Do not hesitate to contact insurers instantly for clarification on particular elements of the coverage. By using a methodical strategy, drivers can obtain a extremely aggressive insurance coverage fee.

Navigating the Modesto Automotive Insurance coverage Market

The Modesto automotive insurance coverage market, like others, presents nuances. Drivers ought to concentrate on native elements that may affect premiums, similar to site visitors patterns or accident charges. Familiarizing themselves with these elements permits for a extra knowledgeable evaluation of potential coverage prices. Moreover, sustaining a constructive driving document, avoiding site visitors violations, and demonstrating accountable driving habits can considerably influence insurance coverage premiums.

Staying knowledgeable and actively taking part within the course of is crucial to securing probably the most favorable insurance coverage charges.

Comparability of On-line Automotive Insurance coverage Comparability Instruments, Low-cost automotive insurance coverage modesto ca

| Device | Options | Professionals | Cons |

|---|---|---|---|

| Insurify | In depth community of insurers, user-friendly interface, customized suggestions. | Wide selection of quotes, simple comparability, probably identifies hidden reductions. | Might not at all times supply absolutely the lowest worth, some options require a subscription. |

| Policygenius | Complete protection choices, simple quote course of, devoted buyer assist. | In-depth coverage explanations, help with numerous protection wants, available assist. | Restricted collection of insurers in comparison with some rivals, will not be very best for very particular wants. |

| Insure.com | Offers a number of insurer quotes, highlights financial savings alternatives, permits for fast coverage comparability. | Simple-to-understand comparability charts, handy options, potential for important financial savings. | Accuracy of displayed knowledge would possibly fluctuate barely, will not be your best option for complicated coverage necessities. |

Suggestions for Selecting the Proper Automotive Insurance coverage Coverage

Selecting the best automotive insurance coverage coverage is essential for shielding your monetary well-being and guaranteeing peace of thoughts. A poorly chosen coverage can go away you susceptible to important monetary burdens within the occasion of an accident or different lined incident. Understanding the nuances of various insurance policies and thoroughly contemplating your particular wants is paramount.Choosing a automotive insurance coverage coverage that adequately addresses your dangers and funds requires cautious consideration.

This entails evaluating your driving historical past, automobile kind, and placement, and evaluating numerous insurance coverage suppliers’ choices. A radical understanding of protection choices and exclusions is crucial to keep away from surprising gaps in safety.

Elements to Think about When Choosing a Coverage

Cautious analysis of assorted elements is important for choosing the best automotive insurance coverage coverage. These elements embrace your driving document, the worth of your automobile, and the particular protection you require. Understanding your private wants and preferences at the side of accessible choices will result in probably the most appropriate coverage.

- Driving File: A clear driving document usually ends in decrease premiums. Accidents or site visitors violations considerably enhance insurance coverage prices. Historic knowledge in your driving habits will have an effect on your insurance coverage fee.

- Car Sort and Worth: Luxurious automobiles or high-performance vehicles usually command increased insurance coverage premiums resulting from their increased restore prices. Equally, the worth of your automobile impacts the quantity of protection you would possibly want.

- Protection Wants: Think about the extent of protection you want based mostly in your monetary scenario and the potential dangers related along with your way of life and driving habits. Complete protection, collision protection, and legal responsibility protection all contribute to the general value.

- Deductibles: A better deductible usually results in decrease premiums. Nevertheless, be ready to pay a bigger quantity out-of-pocket within the occasion of a declare. Understanding the trade-off between premiums and potential out-of-pocket prices is crucial.

- Location: Areas with increased charges of accidents or site visitors incidents usually have increased insurance coverage premiums. Your location performs a big position in figuring out your insurance coverage charges.

Significance of Studying Coverage Paperwork Fastidiously

Thorough evaluate of coverage paperwork is crucial for avoiding future disputes and guaranteeing you perceive the phrases and circumstances. A cursory look can result in surprising prices or protection gaps.

- Understanding Coverage Language: Coverage paperwork usually use complicated authorized terminology. Taking the time to grasp the language is essential to keep away from misinterpretations. Search clarification if essential.

- Reviewing Protection Limits: Confirm that the protection limits align along with your wants and monetary scenario. Be sure you have enough protection to guard your self within the occasion of a big loss.

- Figuring out Exclusions: Fastidiously evaluate the coverage exclusions to grasp what occasions or conditions aren’t lined. This helps you anticipate potential gaps in protection.

Understanding and Evaluating Protection Choices

Evaluating completely different protection choices is important for making an knowledgeable determination. This course of requires a scientific strategy to judge numerous coverage options and their implications.

- Legal responsibility Protection: This covers damages you trigger to others in an accident. Understanding the completely different legal responsibility limits is essential.

- Collision Protection: This covers damages to your automobile no matter who’s at fault.

- Complete Protection: This covers damages to your automobile attributable to occasions aside from collisions, similar to theft, vandalism, or climate occasions.

Understanding Coverage Exclusions

Understanding coverage exclusions is essential to keep away from surprising gaps in protection. These clauses Artikel the particular conditions or circumstances not lined by the coverage.

- Pre-existing Situations: Some insurance policies might exclude protection for pre-existing circumstances. A radical understanding of those exclusions is essential.

- Particular Actions: Sure actions, like racing or taking part in high-risk sports activities, may be excluded from protection.

- Car Use: Particular makes use of of the automobile, like utilizing it for industrial functions, may not be lined. This can be a essential space to grasp.

Guidelines for Reviewing Automotive Insurance coverage Insurance policies

A guidelines for reviewing automotive insurance coverage insurance policies may help streamline the method and guarantee complete analysis.

- Protection Limits: Assessment the protection quantities for legal responsibility, collision, and complete.

- Deductibles: Examine deductible quantities throughout completely different insurance policies.

- Exclusions: Fastidiously evaluate the listing of exclusions to establish potential gaps in protection.

- Coverage Interval: Confirm the coverage length and renewal dates.

- Coverage Prices: Examine the general value of various insurance policies.

End result Abstract

In conclusion, securing low-cost automotive insurance coverage in Modesto requires a proactive strategy. By understanding the important thing elements influencing prices, evaluating suppliers, and exploring accessible reductions, you will discover a coverage that meets your wants with out breaking the financial institution. This information offers a place to begin, and using on-line sources and in search of skilled recommendation can additional refine your seek for probably the most appropriate automotive insurance coverage in Modesto, CA.

Questions and Solutions

What’s the common value of automotive insurance coverage in Modesto, CA?

Common prices fluctuate considerably relying on elements like driving document, automobile kind, and protection selections. Contacting native insurance coverage brokers or utilizing on-line comparability instruments is advisable to get a customized estimate.

What reductions are usually accessible for Modesto drivers?

Reductions usually embrace these for protected driving, a number of automobiles, good scholar standing, and sure automobile options. Particular particulars are depending on the insurer.

How does my driving document have an effect on my automotive insurance coverage premium in Modesto?

A clear driving document normally results in decrease premiums. Accidents or violations can considerably enhance your charges. Constant protected driving practices are essential.

Can I discover automotive insurance coverage comparability instruments on-line for Modesto?

Sure, a number of web sites supply instruments to match quotes from numerous insurers in Modesto. Use these instruments to get a number of quotes and establish potential financial savings.