Low-cost automotive insurance coverage Naples Florida is an important concern for residents navigating the native market. Elements like driving habits, car sort, and even climate patterns play a major function in figuring out your premium. This information dives deep into understanding the assorted features of inexpensive automotive insurance coverage in Naples, exploring totally different suppliers, protection choices, and methods to safe the most effective deal.

Naples, Florida’s distinctive mix of way of life and driving situations influences insurance coverage prices. Understanding these components is vital to discovering the absolute best protection on the best worth.

Overview of Low-cost Automobile Insurance coverage in Naples, Florida

Naples, Florida, boasts a fascinating way of life, however this comes with a worth, together with automotive insurance coverage. Understanding the components that affect charges is essential for locating inexpensive protection. This overview explores the important thing components impacting insurance coverage prices in Naples and highlights choices for securing low-cost automotive insurance coverage.Elements influencing automotive insurance coverage charges in Naples, Florida, are various. These embrace driving file, car sort, location inside Naples, and chosen protection stage.

For instance, drivers with a clear driving file are inclined to have decrease premiums in comparison with these with accidents or site visitors violations. Equally, the kind of car, together with its make, mannequin, and yr, additionally performs a job. Increased-value automobiles typically require larger premiums as a result of elevated threat of theft or injury. The precise location inside Naples may impression charges, reflecting the world’s crime statistics and site visitors patterns.

Lastly, the chosen protection stage considerably impacts the premium, with larger protection choices commanding a better price.

Widespread Kinds of Low-cost Automobile Insurance coverage Choices

Inexpensive automotive insurance coverage choices in Naples embody varied protection varieties. Legal responsibility protection protects in opposition to claims from others should you’re at fault. Collision protection pays for damages to your car no matter fault. Complete protection covers damages attributable to perils like hail, hearth, or vandalism, even should you’re not at fault. Moreover, many suppliers supply optionally available add-ons like roadside help or uninsured/underinsured motorist safety, which may present further monetary safety.

Insurance coverage Supplier Comparability in Naples

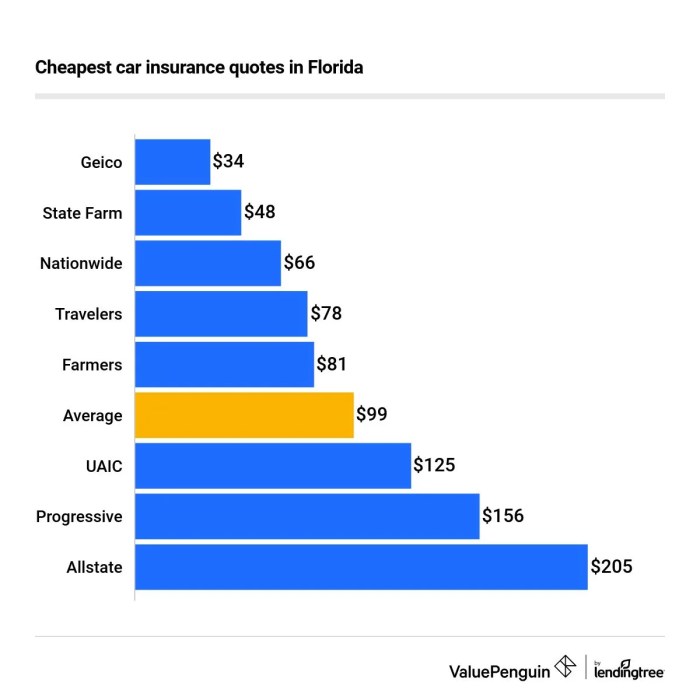

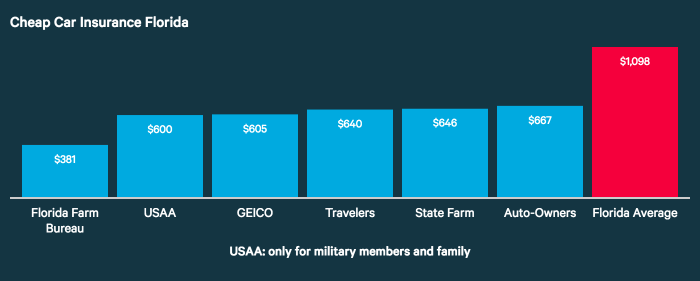

A number of insurance coverage suppliers cater to the Naples market. Key issues embrace the supplier’s fame, customer support scores, and monetary stability. For instance, some suppliers would possibly specialise in providing decrease premiums for particular driver profiles, like younger drivers or these dwelling in lower-risk areas. A comparability of various insurance coverage corporations within the Naples space can reveal various charges and coverage choices.

Elements like claims dealing with procedures and coverage flexibility must be evaluated to find out the most effective match in your wants.

Steadily Requested Questions About Inexpensive Automobile Insurance coverage

What are the commonest causes for top automotive insurance coverage premiums in Naples?Excessive premiums in Naples typically stem from components like a higher-than-average focus of high-value automobiles, the price of repairs within the space, and a comparatively excessive charge of site visitors accidents.How can I get a less expensive automotive insurance coverage quote?Evaluating quotes from a number of suppliers is crucial. On-line instruments and impartial brokers can help in acquiring varied quotes from totally different insurance coverage corporations.

Adjusting protection ranges, bundling insurance coverage insurance policies, and sustaining a protected driving file may contribute to decrease premiums.What’s one of the best ways to seek out the most effective automotive insurance coverage in Naples?The most effective strategy to discovering the most effective automotive insurance coverage includes thorough analysis, evaluating charges from varied suppliers, and evaluating the particular protection wants and monetary sources of the policyholder. This complete strategy ensures probably the most appropriate and inexpensive coverage.

Common Automobile Insurance coverage Prices in Naples, Florida

| Protection Degree | Common Price (Approximate) |

|---|---|

| Legal responsibility Solely | $800 – $1200 per yr |

| Legal responsibility + Collision | $1200 – $1800 per yr |

| Legal responsibility + Collision + Complete | $1500 – $2500 per yr |

Observe: These are approximate figures and may range relying on particular person circumstances.

Elements Affecting Automobile Insurance coverage Premiums in Naples

Securing inexpensive automotive insurance coverage in Naples, Florida, requires understanding the components influencing premiums. These components, starting from demographics to driving habits, immediately impression the price of your coverage. Navigating these variables permits you to make knowledgeable choices to probably decrease your insurance coverage bills.

Demographic Elements

Demographic traits of Naples residents, equivalent to age, gender, and marital standing, typically affect automotive insurance coverage charges. Usually, youthful drivers are inclined to have larger premiums resulting from statistically larger accident charges in comparison with older drivers. Equally, single people would possibly face larger premiums than married people in some insurance coverage fashions. It is because insurance coverage corporations use actuarial information to evaluate threat profiles.

These data-driven fashions predict potential claims based mostly on historic patterns related to particular demographics.

Driving Data and Accident Historical past

Driving data are a major determinant of automotive insurance coverage premiums in Naples. A clear driving file, devoid of accidents or site visitors violations, sometimes interprets to decrease premiums. Conversely, drivers with a historical past of accidents or transferring violations face considerably larger premiums. Insurance coverage corporations use these data to evaluate particular person threat profiles and modify premiums accordingly. For instance, a driver with a number of dashing tickets will possible pay greater than a driver with a clear file.

Automobile Sort and Mannequin

The sort and mannequin of your car additionally impression automotive insurance coverage premiums. Excessive-performance sports activities automobiles and luxurious automobiles typically include larger premiums resulting from their elevated threat of injury or theft. Conversely, older or inexpensive automobiles may need decrease premiums. Insurance coverage corporations assess the worth of the car, the chance of injury or theft, and the price of restore or alternative when figuring out premiums.

Insurance coverage Reductions, Low-cost automotive insurance coverage naples florida

A number of reductions can be found to residents of Naples, providing potential financial savings on automotive insurance coverage premiums. Reductions for protected driving data, equivalent to these provided for sustaining a clear driving historical past, are frequent. Moreover, security options in your car, equivalent to anti-theft gadgets or airbags, can typically qualify for reductions. Insurance coverage corporations acknowledge and reward drivers who prioritize security.

Desk of Reductions and Financial savings

| Low cost Sort | Description | Potential Financial savings (Instance) |

|---|---|---|

| Good Driver Low cost | For drivers with a clear driving file (no accidents or violations) | 10-20% |

| Anti-theft System Low cost | For automobiles geared up with anti-theft methods | 5-15% |

| Defensive Driving Course Low cost | For completion of a defensive driving course | 5-10% |

| A number of Automobile Low cost | For insuring a number of automobiles with the identical firm | 5-10% |

| Bundling Reductions (Residence and Auto) | For insuring each house and auto with the identical firm | 5-15% |

Observe: The potential financial savings listed are examples and will range based mostly on the person’s particular circumstances, car, and insurance coverage supplier.

Insurance coverage Suppliers and Their Insurance policies

Securing inexpensive automotive insurance coverage in Naples, Florida, includes understanding the assorted suppliers and their choices. Navigating the market requires information of the insurance policies, protection choices, and customer support reputations of various corporations. This part particulars the important thing gamers within the Naples insurance coverage scene, outlining their insurance policies and serving to you make knowledgeable choices.

Main Insurance coverage Suppliers in Naples

A number of main insurance coverage corporations function in Naples, every with a novel strategy to pricing and protection. These corporations typically cater to totally different wants and preferences, offering a variety of choices for drivers. Elements like driving historical past, car sort, and placement affect the premiums provided.

Particular Insurance policies and Protection Choices

Insurance coverage insurance policies range considerably, encompassing legal responsibility protection, complete protection, collision protection, and uninsured/underinsured motorist protection. Legal responsibility protection protects you from monetary accountability in case of accidents involving others. Complete protection protects in opposition to injury to your car from perils like vandalism or theft. Collision protection covers injury to your automotive ensuing from a collision, no matter who’s at fault. Uninsured/underinsured motorist protection safeguards you if you’re concerned in an accident with a driver who lacks enough insurance coverage.

The precise particulars of those coverages, together with deductibles and limits, must be rigorously reviewed.

Buyer Service Status

Customer support high quality varies throughout insurance coverage suppliers. Some corporations excel in immediate claims processing and responsive buyer help, whereas others may need a fame for longer declare decision occasions or less-than-stellar customer support interactions. Researching buyer critiques and testimonials is crucial to evaluate the fame of a specific supplier. This helps drivers anticipate potential challenges throughout the declare course of.

Respected Insurance coverage Brokers in Naples

Native insurance coverage brokers are invaluable sources for navigating the complexities of automotive insurance coverage. They possess in-depth information of the Naples market, permitting them to tailor insurance policies to particular wants and circumstances. A good agent may evaluate quotes from a number of suppliers, saving you effort and time. Looking for suggestions from associates, household, or native companies can present perception into dependable brokers within the Naples space.

Comparability of Insurance coverage Suppliers

| Insurance coverage Supplier | Common Premium (Estimated) | Buyer Satisfaction Ranking (Based mostly on Opinions) |

|---|---|---|

| State Farm | $1,500-$2,000 per yr | 4.2 out of 5 stars |

| Progressive | $1,200-$1,800 per yr | 4.0 out of 5 stars |

| Allstate | $1,400-$1,900 per yr | 3.8 out of 5 stars |

| Geico | $1,000-$1,500 per yr | 4.1 out of 5 stars |

| USAA | $1,200-$1,700 per yr | 4.5 out of 5 stars |

Observe: Premiums and satisfaction scores are estimated and will range based mostly on particular person components. All the time confirm with the supplier for correct quotes.

Methods for Discovering Inexpensive Automobile Insurance coverage

Securing inexpensive automotive insurance coverage in Naples, Florida, requires a proactive strategy. Understanding the assorted strategies for acquiring quotes and evaluating insurance policies is essential for minimizing premiums. This part gives sensible methods for locating the absolute best charges whereas sustaining ample protection.

Evaluating Insurance coverage Quotes from Completely different Suppliers

Acquiring quotes from a number of insurance coverage suppliers is key to discovering probably the most aggressive charges. This comparative evaluation permits for a complete analysis of various protection choices and related prices. Straight evaluating quotes from totally different corporations, reasonably than relying solely on a single supply, is crucial to make sure the absolute best worth.

Using On-line Comparability Instruments

On-line comparability instruments have revolutionized the method of discovering inexpensive automotive insurance coverage. These platforms mixture quotes from varied suppliers, simplifying the comparability course of and permitting customers to rapidly determine potential financial savings. Utilizing these instruments allows a complete overview of various insurance coverage choices, streamlining the search course of and decreasing the time spent on analysis. For instance, websites like Insurify or CompareCards present a streamlined interface for evaluating charges from a number of corporations, saving vital effort and time.

Requesting Quotes Straight from Insurance coverage Suppliers

Requesting quotes immediately from insurance coverage suppliers affords a direct channel for acquiring customized affords tailor-made to particular person wants and circumstances. This strategy permits for in-depth discussions about particular protection necessities, potential reductions, and premium buildings. It additionally permits for a customized strategy, permitting a direct negotiation of phrases and situations. By contacting suppliers immediately, people can guarantee a transparent understanding of their particular coverage choices.

Negotiating Decrease Premiums with Insurance coverage Brokers

Negotiating decrease premiums with insurance coverage brokers is usually a precious technique. Insurance coverage brokers typically have the pliability to barter premiums based mostly on components like driving file, car sort, and desired protection ranges. Constructing a rapport with the agent and brazenly discussing issues relating to premium charges can result in potential reductions. A proactive and open dialogue with the agent can typically yield higher charges.

For example, if a consumer has a clear driving file, the agent would possibly be capable of negotiate a decrease premium based mostly on the diminished threat profile.

Studying the High-quality Print of Insurance coverage Insurance policies

Rigorously reviewing the wonderful print of insurance coverage insurance policies is paramount. This thorough evaluation ensures an entire understanding of the phrases, situations, and exclusions related to the coverage. Understanding the small print of the coverage avoids surprising surprises or disputes later. This cautious examination permits policyholders to determine any hidden prices or limitations which may have an effect on their protection. Studying the wonderful print is essential for making knowledgeable choices and stopping future points.

Particular Issues for Naples Residents

Naples, Florida, affords a novel way of life, however this way of life additionally presents particular issues for automotive insurance coverage. Understanding these components can assist residents make knowledgeable choices about their protection and premiums. From the distinctive driving situations to the native climate patterns, this part delves into essential components for Naples drivers.

Driving Situations in Naples

Naples boasts scenic roadways, however these roads can current challenges for drivers. The world’s recognition attracts vacationers and residents, resulting in elevated site visitors quantity, significantly throughout peak seasons. Intersections and roadways, whereas usually well-maintained, can expertise higher-than-average congestion. This elevated site visitors density can result in extra accidents, which may impression insurance coverage charges. Moreover, the presence of pedestrians and cyclists, frequent within the space’s residential and vacationer areas, necessitates additional warning and contributes to a necessity for larger ranges of consciousness in driving practices.

Influence of Climate Patterns on Insurance coverage Charges

Naples’ local weather is a major issue for drivers. The world’s heat, sunny climate is interesting, however it will possibly additionally result in unpredictable climate occasions. Whereas hurricanes are much less frequent than in different elements of Florida, the danger nonetheless exists, impacting insurance coverage charges. Moreover, the world experiences durations of heavy rain, which may trigger flooding and make roads hazardous.

This larger threat of accidents resulting from climate situations typically leads to larger premiums for drivers within the space. Consideration should even be given to the excessive threat of sudden, extreme storms.

Significance of Understanding Native Visitors Legal guidelines and Rules

Naples has particular site visitors legal guidelines and rules that differ from different elements of Florida. It’s essential for drivers to be acquainted with these rules, which may embrace pace limits, parking restrictions, and pedestrian-cyclist security legal guidelines. Failure to adjust to these native legal guidelines can result in fines or accidents, each of which may negatively impression insurance coverage charges.

Declare Submitting Procedures within the Occasion of an Accident

Understanding the declare submitting course of is important in case of an accident. The procedures for submitting a declare range relying on the insurance coverage firm, however some common steps are constant. First, report the accident to the police. Subsequent, collect obligatory data, equivalent to witness statements, police stories, and medical data. Contact your insurance coverage firm to start the declare course of.

Thorough documentation and adherence to the corporate’s procedures are essential to make sure a clean and environment friendly declare course of. An in depth file of all steps concerned within the declare course of must be maintained. This consists of the names of people contacted, dates of contact, and particulars of any documentation offered.

Illustrative Examples of Protection Choices

Discovering the best automotive insurance coverage protection in Naples, Florida, requires understanding the assorted choices obtainable and their impression in your premiums. This part presents illustrative examples of various packages, highlighting the advantages and limitations of every. Evaluating these examples will allow you to select a coverage that meets your particular wants and finances.

Completely different Protection Bundle Examples

Understanding the assorted protection choices obtainable is essential for making an knowledgeable resolution. This part presents examples of various automotive insurance coverage packages, every with various ranges of protection and corresponding premiums.

| Protection Bundle | Legal responsibility Protection | Collision Protection | Complete Protection | Uninsured/Underinsured Motorist Protection | Premium (Estimated) | Description |

|---|---|---|---|---|---|---|

| Fundamental Safety | Minimal Necessities | No | No | No | $800-$1200 yearly | This package deal gives the minimal legal responsibility protection required by regulation. It affords no safety for injury to your car or for accidents sustained in an accident involving an uninsured driver. |

| Reasonable Safety | Above Minimal Necessities | Sure (Decrease Deductible) | No | Sure | $1200-$1800 yearly | This package deal gives larger legal responsibility protection than the minimal necessities. It consists of collision protection with a decrease deductible, and uninsured/underinsured motorist protection. |

| Complete Safety | Above Minimal Necessities | Sure (Decrease Deductible) | Sure | Sure (Increased Limits) | $1800-$2500 yearly | This package deal gives the very best stage of protection, together with legal responsibility protection exceeding minimal necessities, collision protection with a decrease deductible, complete protection (defending your car from injury not associated to collisions), and excessive limits for uninsured/underinsured motorist protection. |

Navigating Coverage Sorts

Insurance coverage insurance policies could be advanced. This part particulars the process for understanding and navigating totally different coverage varieties. Understanding the particular language of your coverage is important to figuring out what’s and is not lined. Seek the advice of with an insurance coverage agent or use on-line sources to make clear any uncertainties. Totally evaluation the coverage paperwork earlier than signing.

Influence of Protection Choices on Premiums

The selection of protection choices immediately influences the premium quantity. A better stage of protection sometimes leads to a better premium. For instance, including collision and complete protection will considerably improve your premium in comparison with a coverage with solely legal responsibility protection. This can be a direct correlation: larger protection, larger premiums. The associated fee distinction between the essential safety and complete safety packages illustrates this precept.

It is vital to rigorously weigh the potential prices in opposition to the advantages of every protection stage.

Final Phrase

In conclusion, securing low-cost automotive insurance coverage in Naples, Florida includes cautious consideration of particular person circumstances, comparability purchasing, and understanding the native market dynamics. By following the methods Artikeld on this information, you possibly can navigate the method confidently and procure probably the most appropriate insurance coverage plan in your wants. Keep in mind, probably the most inexpensive choice is not all the time the most effective; rigorously consider the protection and coverage particulars.

Important FAQs: Low-cost Automobile Insurance coverage Naples Florida

What are the everyday reductions obtainable for automotive insurance coverage in Naples?

Reductions range by supplier however typically embrace protected driver applications, anti-theft gadgets, and good pupil applications. It is worthwhile to inquire about particular reductions with totally different insurance coverage corporations.

How do I evaluate insurance coverage quotes on-line?

Quite a few on-line comparability instruments let you enter your car data and driving historical past to obtain quotes from varied suppliers. This helps you rapidly assess totally different choices.

What are some frequent causes for top automotive insurance coverage charges in Naples?

Increased charges can stem from components like a better focus of luxurious automobiles, particular climate situations, and presumably a higher-than-average accident charge. Investigating these components with insurance coverage suppliers can make clear the pricing.

What paperwork do I have to get a automotive insurance coverage quote in Naples?

Usually, you may want your driver’s license, car data (yr, make, mannequin), and any related particulars about reductions or claims historical past. Seek the advice of the insurance coverage supplier’s particular necessities.