Low-cost South Dakota automobile insurance coverage is a high precedence for a lot of drivers. Navigating the complexities of insurance coverage charges, protection choices, and reductions can really feel overwhelming. This information breaks down the important thing components influencing prices and offers sensible methods for locating inexpensive protection in South Dakota. We’ll cowl every little thing from understanding your state’s minimal necessities to uncovering hidden reductions and evaluating suppliers.

From understanding the several types of insurance coverage out there, to evaluating numerous suppliers, and exploring methods to decrease your premiums, this complete information empowers you to make knowledgeable choices about your South Dakota automobile insurance coverage.

Introduction to South Dakota Automobile Insurance coverage

Yo, peeps! South Dakota automobile insurance coverage ain’t rocket science, however it’s vital to know the principles. This rundown will break down the fundamentals, from what components jack up your charges to the several types of protection and the authorized stuff you gotta know. Get able to be a professional at automobile insurance coverage within the Mount Rushmore state!South Dakota’s automobile insurance coverage scene is fairly normal, however there are some particular issues to remember.

Your driving file, the kind of automobile you drive, and even the place you reside can all have an effect on how a lot you pay. Plus, the state has sure necessities for protection, so it is essential to grasp what’s wanted to be legit on the street.

Components Influencing Automobile Insurance coverage Charges

Understanding what components influence your automobile insurance coverage premiums is essential. Components like your driving historical past (tickets, accidents, claims) immediately affect your charge. A clear slate normally means decrease premiums. Your car’s sort and worth additionally play a task. A sporty, high-performance automobile will seemingly have a better charge than a primary sedan.

Location issues too. Areas with greater charges of accidents or theft are likely to have dearer premiums. Lastly, your age and gender may influence your charges, however that is much less widespread than different components.

Forms of Automobile Insurance coverage Protection

South Dakota provides a variety of protection choices, like legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Legal responsibility insurance coverage protects you if you happen to’re at fault in an accident and trigger injury to another person’s car or harm. Collision protection pays for damages to your automobile if it is concerned in a crash, no matter who’s at fault. Complete protection covers injury to your car from issues like vandalism, fireplace, or theft.

Uninsured/underinsured motorist protection is important if somebody with out insurance coverage wrecks you.

Authorized Necessities for Automobile Insurance coverage

South Dakota, like most states, has necessary minimal insurance coverage necessities. You possibly can’t simply cruise round with out the best protection. Failure to fulfill these necessities can lead to fines and penalties. Ensure you’re compliant with the legislation to keep away from bother with the authorities.

Minimal Required Protection Ranges

| Automobile Sort | Minimal Bodily Harm Legal responsibility | Minimal Property Injury Legal responsibility |

|---|---|---|

| Passenger Automobile | $25,000 per individual, $50,000 per accident | $25,000 |

| Bike | $25,000 per individual, $50,000 per accident | $25,000 |

| Industrial Automobile | Necessities range based mostly on car use and kind; seek the advice of with an insurance coverage skilled for particular tips. | Necessities range based mostly on car use and kind; seek the advice of with an insurance coverage skilled for particular tips. |

Completely different car sorts might need totally different minimal necessities for legal responsibility protection. This desk offers a basic thought of the minimal protection wanted for passenger autos and bikes. For industrial autos, necessities could be extra advanced, so it is best to seek the advice of with an insurance coverage skilled. At all times test with the South Dakota Division of Insurance coverage for probably the most up-to-date data.

Understanding Low-cost Automobile Insurance coverage Choices

Yo, so that you tryna snag some low-cost automobile insurance coverage in South Dakota? It’s very doable, fam. This ain’t rocket science, however figuring out the ropes can prevent a ton of dough. We’ll break down find out how to get the perfect offers, from reductions to comparability instruments.Discovering inexpensive automobile insurance coverage in South Dakota is all about technique. It isn’t nearly choosing the primary firm you see; there are methods to get main financial savings.

Various factors like your driving file, automobile sort, and even the place you reside can influence your premiums. Let’s dive into the small print to get you that candy, candy low cost.

Strategies for Acquiring Low-cost Automobile Insurance coverage

Discovering low-cost insurance coverage ain’t nearly luck. There are confirmed methods that work like magic. Understanding these strategies may help you land the very best deal.

- Store Round: Do not accept the primary quote you get. Evaluating charges from a number of suppliers is essential. Consider it like looking for the perfect deal on sneakers – you gotta test all of the shops before you purchase.

- Bundle Your Insurance policies: If you have already got different insurance coverage like owners or renters, bundle them collectively. Many firms provide reductions for bundling. It is like getting a combo meal at a restaurant – extra bang on your buck.

- Pay Yearly: Paying your premiums yearly as an alternative of month-to-month typically nets a reduction. It is like getting a bulk low cost on the grocery retailer.

- Enhance Your Driving Report: A clear driving file is essential. Avoiding accidents and site visitors violations can considerably decrease your premiums. Consider it like credit score rating – it opens doorways.

- Think about a Secure Driver Program: Some firms provide reductions for taking part in protected driving applications. These applications typically train you protected driving strategies. It is like taking a course to grow to be a greater driver.

Reductions and Incentives

Insurers typically provide reductions based mostly on particular standards. Understanding these may help you save large.

- Good Scholar Reductions: For those who’re a pupil, some insurers provide reductions. This can be a win-win – you get decrease charges, they usually get a loyal buyer.

- Multi-Automobile Reductions: If in case you have a number of vehicles insured with the identical firm, you would possibly get a reduction. This is sort of a household deal at a theme park – everybody saves.

- Defensive Driving Programs: Finishing defensive driving programs can typically earn you reductions. It is like getting a certification for a greater driving file.

- Anti-theft Units: Putting in anti-theft gadgets in your automobile can decrease your premiums. It is a sensible method to defend your funding and get monetary savings.

- Security Options: Automobiles with superior security options like airbags and anti-lock brakes can typically get you a reduction. It is like getting a guaranty on your automobile.

Insurance coverage Supplier Comparability

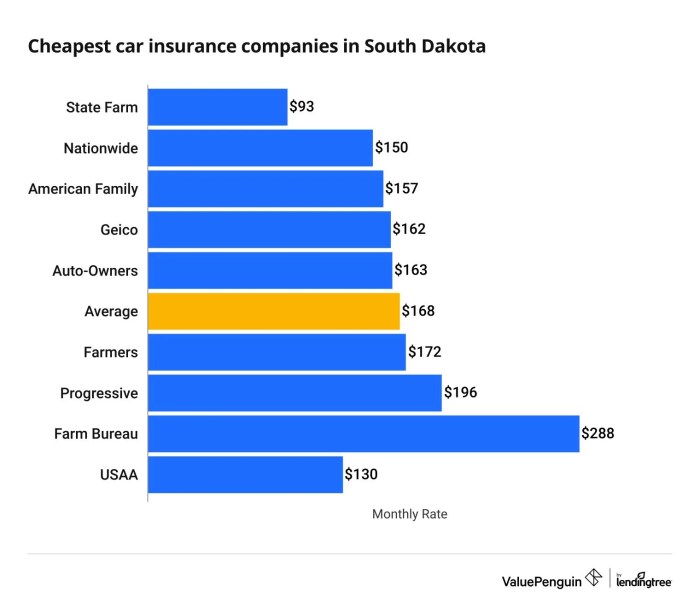

Completely different insurers have totally different pricing fashions. Evaluating suppliers is essential to seek out the perfect match.

- State Farm: Identified for its wide selection of services and products. Typically thought of a strong choice for complete protection.

- Geico: Typically thought of one of many extra inexpensive choices, identified for his or her aggressive pricing.

- Progressive: Identified for his or her on-line instruments and easy-to-use platforms.

- Allstate: A well known supplier with in depth protection choices. In addition they provide a variety of reductions.

- Nationwide: Identified for his or her versatile insurance coverage choices, together with choices for particular wants.

Insurance coverage Comparability Instruments

Utilizing comparability instruments may help you discover the perfect charges. These websites let you examine totally different insurance coverage quotes shortly and simply.

- Insurify: A comparability software that may assist you to get quotes from numerous suppliers.

- Policygenius: A platform with complete data on numerous insurance policies.

- QuoteWizard: Offers easy-to-understand comparisons and choices for various insurance policies.

- NerdWallet: A good monetary web site that additionally offers automobile insurance coverage comparability instruments.

- Insure.com: A preferred web site for evaluating quotes from numerous insurers.

Professionals and Cons of On-line Comparability Instruments

On-line comparability instruments could make discovering low-cost automobile insurance coverage a breeze. Understanding the professionals and cons is crucial.

| Function | Professionals | Cons |

|---|---|---|

| Ease of Use | Rapidly examine a number of quotes. | Could not present detailed data on particular insurance policies. |

| Time Saving | Save time by evaluating quotes in a single place. | Could not provide personalised service. |

| Price Comparability | Simply examine costs from numerous suppliers. | Could not be capable to discover probably the most tailor-made insurance policies. |

| Entry to Data | Present entry to data on totally different insurance policies. | Won’t be up to date repeatedly or present the newest charges. |

| Transparency | Typically clear about charges and hidden prices. | Could not all the time be fully correct with supplier quotes. |

Components Affecting Automobile Insurance coverage Prices

Yo, peeps! Automobile insurance coverage ain’t free, fam. It is all in regards to the dangers you tackle the street, and the costs replicate that. Understanding these components is essential to scoring a candy deal. So, let’s dive into the nitty-gritty.Insurance coverage firms gotta work out how dangerous you’re behind the wheel, and that impacts your premium. Consider it like this: an organization that insures a bunch of reckless drivers has to pay out extra in claims.

So, to cowl these payouts, the premiums for everybody go up. Various factors weigh in closely in your insurance coverage charge, out of your driving file to your journey itself.

Driving Historical past Impression on Premiums

Your driving file is a large deal. Accidents, rushing tickets, and even shifting violations all add as much as a better threat profile. Firms use this information to find out how seemingly you’re to trigger a declare. A clear file means decrease premiums, whereas a checkered previous means greater charges. That is like getting a foul grade on a report card – it’s a must to work more durable to get higher.

For instance, a teen with a couple of minor site visitors violations will seemingly pay greater than a teen with an ideal driving file.

Automobile Sort and Age Affect on Prices

The kind of automobile you drive issues too. Excessive-performance vehicles, sports activities vehicles, or luxurious autos are sometimes dearer to insure than primary sedans. It is because they’re extra prone to be concerned in accidents that trigger greater payouts. Additionally, the older the car, the extra seemingly it’s to have greater restore prices. Think about a traditional automobile; components are more durable to seek out and substitute, which provides to the chance.

That is like shopping for a elaborate cellphone; you are extra prone to get it broken or stolen.

Location and Demographics Impact on Pricing

The place you reside and your demographics play a component too. Sure areas are statistically extra susceptible to accidents than others, so premiums are greater in these areas. For instance, a metropolis with a excessive inhabitants density or a number of intersections might need greater insurance coverage charges than a quiet, rural space. Demographics additionally have an effect on pricing, with sure age teams or genders going through totally different charges.

It is like renting an house; the placement and neighborhood decide the worth.

Credit score Historical past Function in Automobile Insurance coverage Premiums

Your credit score rating, surprisingly, can influence your automobile insurance coverage charges. Insurance coverage firms use credit score scores to gauge your monetary accountability. A decrease credit score rating might imply greater premiums, as it’d point out a better threat of not paying your insurance coverage invoice or different money owed. Consider it like a financial institution mortgage; a poor credit score rating means you are a better threat.

The next credit score rating reveals you are accountable and reliable, which interprets to a decrease premium.

South Dakota Automobile Insurance coverage Charge Impression Components

| Issue | Impression on Charges | Instance |

|---|---|---|

| Driving Report | Glorious file = decrease charges; Accidents/Violations = greater charges | A teen with no accidents pays lower than a teen with one accident. |

| Automobile Sort | Luxurious/Excessive-Efficiency = greater charges; Primary Sedans = decrease charges | A sports activities automobile will price extra to insure than a compact automobile. |

| Automobile Age | Older autos = greater charges; Newer autos = decrease charges | A ten-year-old automobile will price extra to insure than a 2-year-old automobile. |

| Location | Excessive-accident areas = greater charges; Low-accident areas = decrease charges | Insurance coverage in a metropolis identified for site visitors will likely be dearer than in a rural space. |

| Credit score Historical past | Good credit score = decrease charges; Poor credit score = greater charges | Somebody with credit score rating will get a decrease premium than somebody with a low credit rating. |

Methods for Discovering Inexpensive Protection

Yo, tryna avoid wasting moolah on automobile insurance coverage? It’s very doable, fam. We’re breaking down the strikes to snag the most affordable charges with out sacrificing protection. It is all about sensible decisions and somewhat hustle.Discovering inexpensive automobile insurance coverage ain’t rocket science, however it takes somewhat know-how. There are tons of how to chop prices with out compromising on safety.

Let’s dive into some critical methods.

Bundling Insurance coverage Merchandise

Combining your automobile insurance coverage with different insurance policies, like house or renters insurance coverage, typically unlocks candy reductions. Insurance coverage firms find it irresistible while you bundle, ‘trigger it means much less work for them and more cash in your pocket. Consider it like a combo meal deal – you get extra on your buck. This can be a main method to decrease premiums.

Secure Driving Practices

That is an important factor, yo. Driving safely is the important thing to getting decrease premiums. The less accidents and claims you could have, the much less your insurance coverage firm has to pay out. Assume defensive driving – being conscious of your environment, not rushing, and avoiding dangerous maneuvers. It is about being a accountable driver.

A good way to decrease your charges.

Defensive Driving Programs

Taking a defensive driving course may help you grow to be a greater, safer driver. These programs train you find out how to keep away from accidents and react safely to harmful conditions. Firms typically provide reductions for finishing these programs, which may prevent a critical chunk of change in your insurance coverage premiums. This can be a win-win – you get higher at driving and get monetary savings.

Reductions for Secure Drivers in South Dakota

| Low cost Sort | Description |

|---|---|

| Good Scholar Low cost | College students with tutorial file typically get reductions. |

| Accident-Free Driving Low cost | Years of accident-free driving historical past can result in substantial financial savings. |

| Secure Driver Coaching Course Low cost | Completion of a defensive driving course can lead to a reduction. |

| Multi-Coverage Low cost | Bundling automobile insurance coverage with different insurance coverage merchandise like owners or renters insurance coverage typically provides reductions. |

| Low Mileage Low cost | For those who drive much less, it’s possible you’ll qualify for a decrease premium. |

These reductions aren’t universally out there. The supply of particular reductions will range relying on the insurance coverage firm and your particular state of affairs. At all times test along with your insurance coverage supplier for particulars.

Evaluating Insurance coverage Suppliers: Low-cost South Dakota Automobile Insurance coverage

Yo, peeps! Determining low-cost automobile insurance coverage in South Dakota generally is a complete grind. However do not sweat it! Understanding how totally different insurance coverage firms stack up is essential to getting the perfect deal. We’re breaking down find out how to examine suppliers, from protection to customer support to monetary stability. That is your final information to scoring the bottom charges doable.Evaluating insurance coverage suppliers is not nearly value; it is about getting the best protection on your journey and peace of thoughts.

You gotta have a look at the superb print, see what sort of perks every firm provides, and ensure they are a strong participant within the recreation. This fashion, you keep away from getting ripped off.

Protection Choices

Completely different insurance coverage firms provide numerous protection choices. Some might need additional perks like roadside help or rental automobile protection. Others would possibly deal with the necessities. Understanding these variations is essential to discovering a coverage that matches your wants and price range. Principally, you’ll want to select the extent of protection that fits your state of affairs.

Take into consideration what you need to defend in case of an accident or different points.

Buyer Service Rankings

Customer support is a significant factor. An organization with nice opinions and a status for serving to clients is price contemplating. Search for firms which have a strong on-line presence and good suggestions from earlier clients. Unhealthy customer support generally is a actual headache if you’ll want to file a declare or have a query. Learn how the corporate responds to buyer inquiries and complaints, and if they’ve a number of methods to achieve out to them.

Monetary Stability

An organization’s monetary stability is vital. You need to ensure they will pay out claims if one thing goes down. Search for firms with a robust historical past and status within the trade. That is like checking if an organization has a strong monitor file of fulfilling its obligations, guaranteeing you will not be left excessive and dry if you’ll want to file a declare.

An organization’s monetary energy could be mirrored of their scores by impartial organizations or their monitor file of paying claims.

Claims Course of

The claims course of is one other key space to think about. Have a look at how straightforward it’s to file a declare, how lengthy the method normally takes, and the way responsive the corporate is to your wants. Some firms are tremendous environment friendly, whereas others generally is a actual ache to take care of. That is vital as a result of a easy claims course of could make an enormous distinction if you’ll want to file a declare.

Understanding the corporate’s course of for dealing with claims can prevent a number of time and problem.

Comparability Desk

| Insurance coverage Supplier | Protection Choices | Pricing | Buyer Service Score (out of 5) | Claims Course of Score (out of 5) |

|---|---|---|---|---|

| InsCo 1 | Complete, collision, legal responsibility, uninsured/underinsured, roadside help | $1200/12 months | 4.5 | 4.2 |

| InsCo 2 | Complete, collision, legal responsibility, uninsured/underinsured, rental automobile | $1500/12 months | 4.0 | 4.8 |

| InsCo 3 | Complete, collision, legal responsibility, uninsured/underinsured | $1000/12 months | 3.8 | 3.5 |

This desk provides a primary comparability of three main insurance coverage firms in South Dakota. Bear in mind, costs and scores can change, so all the time do your analysis. Do not simply accept the primary one you see! Examine the small print to seek out the perfect deal for you.

Analyzing Particular Reductions

Yo, future drivers, tryna avoid wasting critical money on insurance coverage? Understanding the precise reductions out there can critically assist you to out. Completely different reductions are supplied based mostly on numerous components, like your age, driving file, and even the kind of automobile you drive. So, let’s dive into the deets!

Reductions for Younger Drivers

Younger drivers typically face greater insurance coverage premiums as a result of they’re statistically extra prone to get into accidents. However there are reductions on the market particularly for you! Insurance coverage firms acknowledge that many younger drivers are accountable and able to avoiding accidents. Reductions is perhaps supplied for issues like good grades, driving programs, or taking part in protected driving applications. This will considerably cut back your premium.

For instance, a youngster who maintains a excessive GPA would possibly qualify for a pupil low cost, which in flip reduces their automobile insurance coverage prices.

Reductions for College students and Seniors

Proof of being a pupil or senior can unlock reductions. College students typically have decrease insurance coverage premiums than non-students, as a result of insurance coverage firms acknowledge the decrease threat profile. Equally, seniors typically qualify for reductions as effectively. These reductions could be fairly candy, probably saving you chunk of change in your month-to-month invoice.

Reductions for Secure Driving and Accident-Free Information

Sustaining a clear driving file is essential for getting the perfect automobile insurance coverage charges. Insurance coverage firms reward protected drivers with reductions. The extra accident-free years you could have below your belt, the decrease your premium is prone to be. This can be a large motivator for accountable driving habits! It is a win-win state of affairs, as you get monetary savings and keep accident-free.

Reductions for Particular Automobile Sorts

Insurance coverage premiums are affected by the kind of car you drive. For those who drive a fuel-efficient automobile, you may typically qualify for a reduction, and you may additionally get a reduction for a low-theft-risk automobile. For instance, a hybrid automobile would possibly qualify for a fuel-efficiency low cost, making insurance coverage cheaper. Likewise, newer, well-maintained autos with superior security options might qualify for a reduction.

Desk of Obtainable Reductions

| Low cost Sort | Eligibility Standards |

|---|---|

| Scholar Low cost | Proof of enrollment in a highschool or school |

| Senior Low cost | Proof of age (normally 55+ or 65+) |

| Secure Driving Low cost | Accident-free driving file for a specified interval (e.g., 3 years) |

| Good Scholar Low cost | Sustaining a sure GPA or tutorial achievement |

| Defensive Driving Course Low cost | Completion of a defensive driving course |

| Automobile Security Function Low cost | Automobile outfitted with superior security options (airbags, anti-theft techniques, and so forth.) |

| Gas Effectivity Low cost | Driving a fuel-efficient car (e.g., hybrid or electrical automobile) |

Navigating the Insurance coverage Software Course of

Getting low-cost automobile insurance coverage in South Dakota is completely doable, however you gotta know the ropes. The applying course of ain’t rocket science, however understanding the steps and paperwork wanted can prevent main complications. Understanding what to anticipate will make the entire thing approach smoother.The applying course of for automobile insurance coverage includes a number of key steps, from gathering required paperwork to really submitting the appliance.

Understanding the method ensures a easy expertise and helps you keep away from widespread pitfalls that may delay and even block your utility. This part breaks down the appliance course of, equipping you with the information to get the very best deal.

Steps Concerned in Acquiring a South Dakota Automobile Insurance coverage Quote

Getting a quote is step one. This includes offering details about your car, driving historical past, and private particulars to insurance coverage suppliers. Insurance coverage firms use this information to evaluate your threat profile and decide an appropriate premium. Completely different suppliers use totally different strategies for quoting. Some use on-line instruments, whereas others require a cellphone name or in-person assembly.

Store round to seek out the perfect deal.

Required Paperwork for Making use of for Automobile Insurance coverage

The paperwork wanted range barely relying on the insurance coverage supplier, however usually, you may want:

- Proof of Id: A legitimate driver’s license and state-issued ID are normally required. Be sure these are present and legitimate. Expired or incorrect paperwork will trigger issues.

- Proof of Automobile Possession: This would possibly embody the car title or a registration doc, relying on the state’s necessities. Guarantee the small print on the doc match your car.

- Driving Historical past Report: Insurance coverage suppliers want your driving historical past to evaluate your threat. Verify with the supplier to see what format they like.

- Proof of Residence: Your present handle is required to substantiate your location and to find out if you happen to stay in a high-risk space. Your utility invoice or a current lease settlement will suffice.

- Fee Data: The insurer wants a way for processing funds. Offering your banking data will guarantee easy processing.

Typical Underwriting Course of, Low-cost south dakota automobile insurance coverage

Underwriting is the method the place insurance coverage firms consider your threat and decide your premium. It includes reviewing the paperwork you submitted and checking your driving historical past. Insurance coverage firms use advanced algorithms to evaluate your threat, taking into consideration components like your age, driving file, car sort, and placement. Every firm’s underwriting course of is exclusive, so analysis the corporate’s particular standards.

Widespread Pitfalls and The way to Keep away from Them

- Inaccurate Data: Guarantee all the knowledge you present is correct and up-to-date. Inaccuracies can delay or reject your utility.

- Lacking Paperwork: Ensure you collect all of the required paperwork earlier than beginning the appliance course of. Verify the insurer’s particular necessities to keep away from delays.

- Not Evaluating Quotes: Do not accept the primary quote you get. Examine quotes from a number of insurers to seek out the perfect deal. It is essential to grasp the protection and pricing.

- Not Understanding the Protection: Learn the superb print and be sure you perceive the protection supplied within the coverage. Ask questions if something is unclear.

Step-by-Step Information for Finishing an On-line Insurance coverage Software

- Select Your Insurance coverage Supplier: Choose the insurance coverage supplier that most closely fits your wants and price range. Analysis their protection and status.

- Collect Required Paperwork: Accumulate all the mandatory paperwork, guaranteeing they’re correct and up-to-date. This can prevent a number of time.

- Entry the On-line Software: Go to the insurer’s web site and find the web utility type.

- Fill Out the Software: Fastidiously full all of the required fields with correct data. Double-check for errors.

- Add Paperwork: Add the required paperwork as instructed by the insurer. Guarantee they’re within the right format.

- Evaluate and Submit: Evaluate all the knowledge you’ve got entered earlier than submitting the appliance. Guarantee every little thing is correct.

- Affirmation: You will obtain a affirmation electronic mail or message as soon as the appliance is processed. Preserve monitor of your utility quantity.

Illustrating South Dakota Insurance coverage Prices

Yo, peep this, automobile insurance coverage in South Dakota ain’t no joke. It is all in regards to the location, protection stage, and even your age. Understanding the costs is essential to saving some critical dough.Insurance coverage charges in South Dakota range extensively, relying on the place you reside. Some areas are dearer than others, and that immediately impacts your premium. Completely different protection ranges additionally influence the fee—extra complete protection normally means a better price ticket.

Understanding these components is essential to getting the perfect deal.

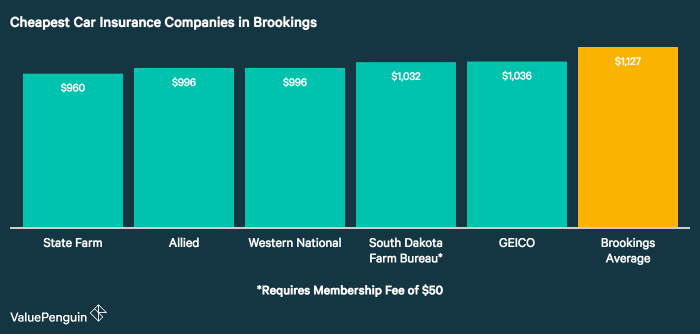

Common Prices Throughout South Dakota Areas

Completely different components of the state see totally different charges. For instance, the Black Hills area tends to have greater premiums than the japanese a part of the state. City areas usually have greater prices in comparison with rural areas. That is due to components like site visitors density, theft charges, and the quantity of harm that happens in numerous areas.

| Area | Estimated Common Premium (USD) |

|---|---|

| Black Hills | $1,500 – $2,000 |

| Japanese South Dakota | $1,200 – $1,500 |

| City Areas (e.g., Sioux Falls) | $1,400 – $1,800 |

| Rural Areas | $1,000 – $1,200 |

Typical Prices for Completely different Protection Ranges

The quantity of protection you select immediately impacts the worth you pay. Primary legal responsibility protection is the most affordable, however it provides the least safety. Increased ranges of protection, like complete and collision, are dearer however present better safety towards damages.

- Legal responsibility Protection: Probably the most primary protection, defending you from the prices of harming one other individual or their property in an accident. It is the most affordable choice however provides restricted safety.

- Collision Protection: This pays for damages to your car no matter who brought about the accident. It is a dearer choice, however it’s vital if you wish to repair your automobile after an accident.

- Complete Protection: This protects your car from issues past collisions, like climate injury, vandalism, theft, or fireplace. It is a higher-priced choice, however offers extra peace of thoughts.

Impression of Reductions on Premiums

Reductions can considerably cut back your insurance coverage prices. These reductions can embody good pupil reductions, reductions for protected driving data, and even reductions for bundling your insurance coverage with different companies.

- Secure Driving Report: A clear driving file demonstrates accountable driving habits, resulting in decrease insurance coverage charges.

- Bundling Insurance coverage: Bundling your automobile insurance coverage with different companies like house insurance coverage or life insurance coverage can typically get you a reduction.

- Good Scholar Reductions: Insurers typically provide reductions for college kids who’re enrolled in class.

Common Automobile Insurance coverage Prices by Age

Insurance coverage charges range by age group. Youthful drivers usually pay extra as a result of a better threat of accidents. Older drivers typically get decrease charges, displaying their decreased accident threat.

(Instance visible: A bar graph displaying how automobile insurance coverage prices rise sharply for teenagers and younger adults, then regularly lower as drivers age.)

Conclusion

In conclusion, discovering low-cost South Dakota automobile insurance coverage includes understanding the components that have an effect on your charges, evaluating suppliers, and using out there reductions. This information offers a roadmap to discovering probably the most inexpensive and appropriate protection on your wants. By making use of the methods mentioned, you possibly can confidently navigate the insurance coverage panorama and safe the very best deal.

Detailed FAQs

What are the minimal automobile insurance coverage necessities in South Dakota?

South Dakota’s minimal necessities range relying on the kind of car. A desk detailing these specifics is included within the full information.

How does my driving file have an effect on my insurance coverage premiums?

A historical past of accidents or violations can considerably enhance your premiums. Secure driving practices and sustaining a clear file are essential for decrease charges.

What reductions can be found for younger drivers in South Dakota?

A number of reductions can be found for younger drivers, typically associated to particular insurance coverage suppliers and driving historical past. Particulars on particular applications are within the information.

What are some widespread pitfalls to keep away from when making use of for automobile insurance coverage?

Fastidiously evaluate the appliance course of and required paperwork. Widespread errors embody inaccurate data or failing to reveal related particulars. A step-by-step information to keep away from these points is obtainable within the information.