Citi Double Money Card rental automobile insurance coverage presents a novel alternative to mix rewards incomes with important journey safety. This complete information explores the potential financial savings and advantages of utilizing the Citi Double Money Card for rental automobile insurance coverage, outlining varied situations and evaluating it to various choices.

Understanding the rewards construction of the Citi Double Money Card is essential for maximizing its worth. This consists of the potential for incomes rewards on on a regular basis transactions, and particularly on rental automobile insurance coverage funds, with detailed examples and comparisons to different rewards playing cards.

Understanding the Citi Double Money Card

Proper, so the Citi Double Money Card’s a fairly standard selection, particularly for college kids and grads. It is all about these cashback rewards, and it is bought a fairly simple system. Mainly, it is designed to make on a regular basis spending extra rewarding.

Advantages of the Citi Double Money Card

The Citi Double Money Card presents a easy but efficient rewards system. The core profit is the constant 2% cashback on all purchases. It is a big draw for anybody seeking to maximize their spending returns, whether or not it is filling up on the petrol station or grabbing lunch on the canteen. It is a dependable method to get some further money again with out an excessive amount of fuss.

Rewards Construction and Incomes Potential

The Double Money Card’s rewards construction is crystal clear. You earn 2% cashback on each buy, each on purchases made in credit score and debit. This interprets into a big return in your spending, particularly should you’re an everyday spender. Take into consideration shopping for books, stationary, and even simply each day groceries; the rewards add up shortly. A scholar who spends £500 a month on important objects may see a pleasant chunk of money again.

Examples of On a regular basis Transactions

Let’s break down some on a regular basis situations the place this card shines. Fueling up your automobile? 2% cashback. Shopping for groceries? 2% cashback.

Paying on your uni lodging? 2% cashback. Mainly, each transaction earns you a return. Even smaller purchases add up over time. This makes it a wonderful selection for college kids who’re all the time on the go and want to trace their bills.

Comparability with Different Rewards Playing cards

In comparison with different cashback playing cards, the Double Money Card stands out for its simplicity. No difficult tiers or classes. It is a simple 2% throughout the board, which makes it simple to calculate your returns. Another playing cards would possibly provide increased rewards in particular classes, however the Double Money Card’s constant return is enticing for its simplicity and predictability.

This predictability is particularly necessary for college kids, who typically have restricted budgets and want a transparent image of their returns.

Reward Classes and Charges

| Reward Class | Charge |

|---|---|

| All Purchases | 2% Cashback |

The desk clearly reveals that there are not any separate reward classes, the cashback fee is mounted at 2% for all transactions. This makes the cardboard extraordinarily user-friendly. It is a easy, dependable method to construct up cashback rewards without having to trace varied classes.

Rental Automotive Insurance coverage Choices

Proper, so you have bought your Citi Double Money Card sorted, now let’s speak about rental automobile insurance coverage. It’s kind of of a minefield, mate, however figuring out the choices is essential to avoiding a hefty invoice if one thing goes pear-shaped. We’ll cowl the completely different insurance policies, how they stack up, and while you

actually* want further cowl.

Rental automobile insurance coverage is a vital side of any journey involving a employed car. Understanding the assorted choices accessible is crucial for guaranteeing monetary safety in case of unexpected occasions. Totally different suppliers provide various ranges of protection, and it is vital to scrutinize the phrases and situations to keep away from disagreeable surprises.

Rental Automotive Insurance coverage Suppliers

Rental firms, insurance coverage corporations, and even your bank card typically provide add-on insurance coverage. Understanding the completely different suppliers and their insurance policies is essential to creating an knowledgeable choice. Evaluating insurance policies side-by-side is necessary, trying on the specifics of every, reasonably than counting on broad statements.

Comparability of Insurance coverage Protection

Totally different insurance coverage insurance policies provide various ranges of safety. Some deal with complete harm, others on legal responsibility, whereas some present a mix of each. Key elements to contemplate embody protection for accidents, vandalism, theft, and even pure disasters. The extent of safety differs considerably between suppliers, and studying the nice print is essential.

Phrases and Circumstances of Rental Automotive Insurance coverage

The nice print is your good friend right here, of us. Each coverage has phrases and situations that Artikel the specifics of protection, exclusions, and limitations. Examine for extra charges, deductibles, and geographical limitations. You do not need to be caught with an enormous invoice if one thing goes flawed. Crucially, perceive the ‘exclusions’ – what is not coated.

Conditions Requiring Extra Insurance coverage

There are particular circumstances the place supplemental rental automobile insurance coverage is not only advisable, however important. Should you’re planning on venturing off-road, or should you’re driving in an space with a better threat of accidents, think about an improve. Equally, should you’re planning to make use of the rental automobile for an extended interval, or for actions that might result in vital harm, think about enhanced insurance coverage.

The hot button is to evaluate the potential dangers of your journey.

Execs and Cons of Rental Automotive Insurance coverage Packages

| Insurance coverage Bundle | Execs | Cons |

|---|---|---|

| Fundamental Protection | Usually cheaper. | Restricted safety, typically with excessive deductibles. |

| Complete Protection | Protects in opposition to a variety of damages (together with vandalism and theft). | Sometimes costlier. |

| Legal responsibility-Solely Protection | Covers harm to different autos or folks in an accident. | Does not cowl harm to your rental automobile. |

| Insurance coverage from Credit score Card | Usually bundled, doubtlessly cheaper than different choices. | Could have particular limitations and exclusions. |

This desk provides a common overview. At all times examine the particular phrases and situations of every package deal supplied by the rental firm and your bank card to verify it aligns along with your wants.

Combining Card and Rental Automotive Insurance coverage

Proper, so you have bought your Citi Double Money Card, and also you’re seeking to snag some wheels for a highway journey, proper? Combining the cardboard with rental automobile insurance coverage is usually a whole game-changer, doubtlessly saving you some severe dosh and incomes you rewards. Let’s delve into the nitty-gritty.Utilizing your Citi Double Money Card for rental automobile insurance coverage funds is usually a savvy transfer, particularly if the rental firm enables you to pay utilizing the cardboard.

This technique, if all goes nicely, can hyperlink your insurance coverage and card rewards applications, doubtlessly unlocking some severe perks. Bear in mind, it is all about discovering the most effective offers and maximizing these candy, candy rewards.

Benefits of Utilizing the Card for Rental Automotive Insurance coverage Funds

Utilizing the Citi Double Money Card for rental automobile insurance coverage funds is usually a sensible play. It typically lets you earn rewards factors or cashback, doubtlessly decreasing the general price of your rental. Plus, it simplifies issues, making the entire course of extra environment friendly. The hot button is to concentrate on the particular phrases and situations of each your card and the rental firm.

Advantages of Utilizing the Card for Reserving and Paying for Rental Vehicles

Using your Citi Double Money Card for reserving and paying for rental automobiles presents a number of benefits. First, you possibly can typically earn rewards factors or cashback in your bookings and funds. It is a essential side, particularly should you’re a frequent renter. Secondly, utilizing the cardboard for rental automobile bookings can provide a simple fee methodology, streamlining the complete course of.

Lastly, many rental firms provide reductions or particular offers to cardholders. Do not miss out on these potential financial savings.

Significance of Checking Rental Automotive Insurance coverage Phrases and Circumstances

Completely reviewing the rental automobile insurance coverage phrases and situations is essential. Be sure that the insurance coverage supplied by the rental firm is ample on your wants and that the Citi Double Money Card can be utilized to pay for it. Failing to take action may result in surprising prices or missed alternatives to leverage your card’s rewards program. Be a meticulous scholar of the nice print!

Incomes Rewards on Rental Automotive Insurance coverage, Citi double money card rental automobile insurance coverage

Whereas it won’t be simple, there’s an opportunity to earn rewards on rental automobile insurance coverage when utilizing your Citi Double Money Card. This hinges on the specifics of each the rental settlement and the rewards program related to the cardboard. It is all about discovering offers and maximizing rewards.

Value Financial savings and Reward Potential Desk

| Situation | Rental Value (Excluding Insurance coverage) | Insurance coverage Value with Card | Insurance coverage Value with out Card | Reward Potential |

|---|---|---|---|---|

| Situation 1: Excessive-value card, low-cost insurance coverage | £100 | £20 | £25 | £2 Cashback |

| Situation 2: Common-value card, moderate-cost insurance coverage | £150 | £30 | £35 | £3 Cashback |

| Situation 3: Low-value card, high-cost insurance coverage | £200 | £40 | £50 | £4 Cashback |

Be aware: These are hypothetical situations and reward potential might differ primarily based on particular person circumstances and particular card presents.

Potential Financial savings and Rewards

Proper, so that you’re after the juicy bits – the potential financial savings and rewards you possibly can snag with this Citi Double Money Card and rental automobile insurance coverage combo. Mainly, we’re taking a look at how a lot you possibly can pocket and how you can maximise these candy rewards.This part dives into the nitty-gritty of calculating your rewards, exhibiting how a lot you may doubtlessly save, and providing you with methods for getting essentially the most out of the deal.

It is all about sensible spending and making your pennies work tougher for you.

Reward Calculation on Rental Automotive Insurance coverage

That is the place the rubber meets the highway. The rewards are instantly tied to the quantity you spend on rental automobile insurance coverage. For each pound you spend, you earn a sure share. So, should you shell out £100 on your insurance coverage, you will get again a certain quantity.

Reward calculation: Reward factors = (Insurance coverage price) x (Reward share)

For instance, if the reward share is 2%, and also you spend £100, your reward is £2.

Potential Financial savings Examples

Let us take a look at some sensible situations. Think about you are planning a weekend getaway. A typical rental automobile insurance coverage coverage may cost £50. Utilizing the Citi Double Money Card, you may doubtlessly earn £1 or £2 again. That is a small win, however provides up over time.One other instance: An extended journey would possibly imply £150 in insurance coverage.

Utilizing the Citi Double Money Card, you may doubtlessly earn £3 or £4 again, which is a considerable quantity.

Methods to Maximize Rewards

Maximising rewards is not rocket science. Just a few key methods can actually ramp up your earnings. Firstly, concentrate on the completely different insurance coverage choices. Totally different suppliers have completely different pricing fashions, so procuring round may be worthwhile. Secondly, make sure you’re utilizing the cardboard for all eligible purchases, together with your rental automobile insurance coverage.

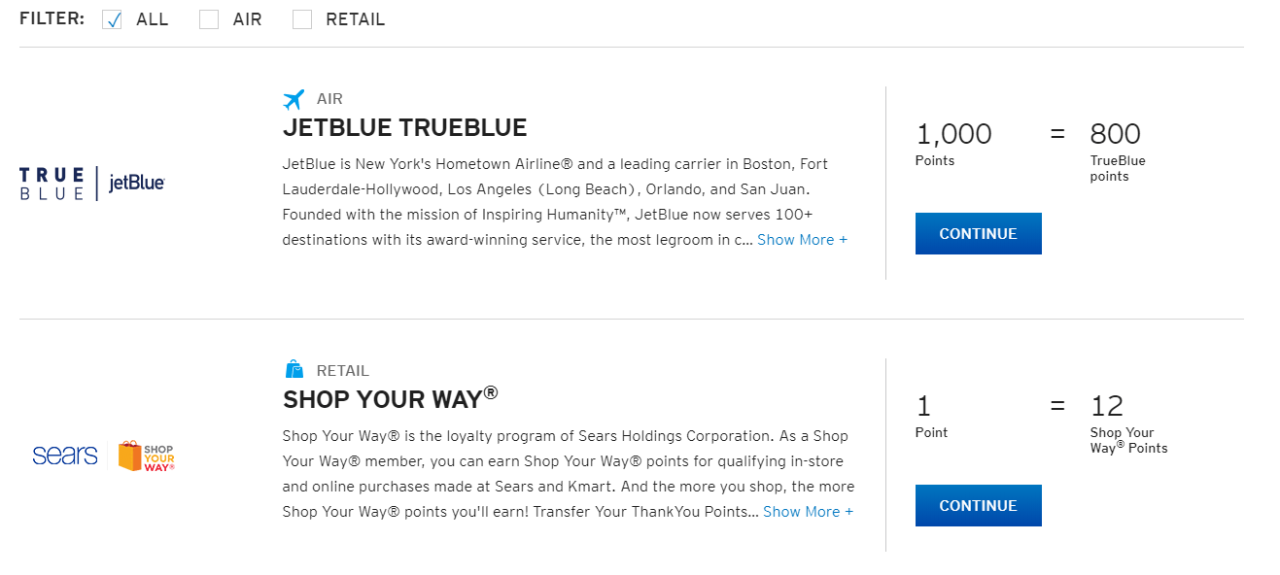

Redeeming Rewards

Redeeming rewards is normally fairly simple. Your rewards factors are normally convertible to reward playing cards, journey vouchers, and even money again. Examine the Citi Double Money Card phrases and situations for particular redemption choices.

Reward Eventualities Desk

| Situation | Insurance coverage Value (£) | Reward Proportion (%) | Reward Factors (£) |

|---|---|---|---|

| Brief Journey | 50 | 2 | 1 |

| Medium Journey | 100 | 2 | 2 |

| Lengthy Journey | 150 | 2 | 3 |

| Luxurious Automotive Rental | 200 | 2 | 4 |

This desk illustrates potential rewards throughout varied journey situations, demonstrating how utilizing the Citi Double Money Card for rental automobile insurance coverage may also help you earn rewards. Keep in mind that reward percentages might differ primarily based on the particular deal and the circumstances.

Particular Use Instances and Issues

Proper, so you have bought the Double Money Card, rental automobile insurance coverage sorted, now let’s delve into when this combo won’t be the best choice. Typically, the plain is not all the time the most effective, you recognize? We’ll cowl potential pitfalls and how you can examine apples and oranges – or on this case, rental insurance coverage choices.This part unpacks conditions the place utilizing the Citi Double Money Card for rental insurance coverage won’t be essentially the most bang on your buck.

We’ll additionally take a look at potential drawbacks and how you can choose the proper match on your wants. Plus, we’ll present you some alternative routes to get coated, after which we’ll examine the prices and perks of various choices in a useful desk.

Eventualities The place Double Money Card Insurance coverage May Not Be Superb

Utilizing the Citi Double Money Card for rental automobile insurance coverage won’t be the most effective transfer in case your rental is already coated by one other supply. For instance, in case your present journey insurance coverage or an organization coverage already consists of complete protection, you won’t want the cardboard’s add-on. Additionally, if the rental firm presents its personal insurance coverage plan at a aggressive value, that is perhaps a more cost effective selection.

Potential Drawbacks of Utilizing the Card

One potential disadvantage is that the cardboard’s rental insurance coverage won’t all the time provide the identical degree of protection as different choices. It may even have increased extra quantities or exclusions, and doubtlessly, much less complete protection. It is price noting that the phrases and situations of the rental firm’s insurance coverage may present extra complete safety. This implies it could possibly be costlier than the cardboard’s insurance coverage in some conditions.

Evaluating Totally different Rental Insurance coverage Choices

To find out the best choice, it’s good to examine apples to apples. This implies trying on the protection ranges, extra quantities, exclusions, and premiums for various choices. Do not simply deal with the headline value; dive into the small print. Contemplate elements just like the rental length, car kind, and your private threat tolerance. Additionally, take into consideration what your present insurance coverage protection already offers.

Various Strategies for Securing Rental Automotive Insurance coverage

Rental firms typically provide their very own insurance coverage choices, which is usually a strong various. Some journey insurance coverage packages additionally embody rental automobile protection. Should you’re travelling with buddies, you may doubtlessly break up the prices of a mixed coverage, or every of you may get coated below a private coverage.

Value and Profit Comparability Desk

| Insurance coverage Possibility | Protection Stage | Extra Quantity | Premium | Extra Advantages |

|---|---|---|---|---|

| Citi Double Money Card | [Insert Coverage Detail] | [Insert Excess Detail] | [Insert Premium Detail] | [Insert Benefits Detail] |

| Rental Firm Insurance coverage | [Insert Coverage Detail] | [Insert Excess Detail] | [Insert Premium Detail] | [Insert Benefits Detail] |

| Journey Insurance coverage | [Insert Coverage Detail] | [Insert Excess Detail] | [Insert Premium Detail] | [Insert Benefits Detail] |

| Private Insurance coverage (if relevant) | [Insert Coverage Detail] | [Insert Excess Detail] | [Insert Premium Detail] | [Insert Benefits Detail] |

Be aware: Premiums and protection ranges differ primarily based on the particular rental, coverage, and different elements. At all times evaluation the nice print.

Illustrative Eventualities and Comparisons

Proper, so we’re breaking down when utilizing the Citi Double Money for rental automobile insurance coverage is a complete game-changer, and when different choices are the higher transfer. We’ll additionally crunch the numbers on the price of every strategy, so you may make a completely knowledgeable choice.This part dives into real-world examples to point out how the Citi Double Money Card’s rental automobile insurance coverage is usually a sensible play.

We’ll additionally take a look at conditions the place different choices is perhaps extra savvy, and the important thing elements to weigh up earlier than you decide to anybody plan.

Excessive-Profit Situation: The Finances-Acutely aware Globetrotter

Utilizing the Citi Double Money Card for rental automobile insurance coverage is a very shrewd transfer for college kids or price range travellers on prolonged journeys. The potential reward factors or cashback from the double-cashback construction can offset the price of insurance coverage, successfully decreasing the general expense. Consider it as getting a bit further on your buck.

Various Choices: The Pre-Booked Professional

For individuals who have pre-booked leases and already bought insurance coverage from their journey company or bank card (non-Citi Double Money) it is perhaps a waste of time to go for the card-based insurance coverage. In these circumstances, utilizing the present insurance coverage will probably be cheaper than the card-based choice. Additionally, think about that the cardboard’s insurance coverage may need restrictions or limitations.

Resolution-Making Components: The Value-Profit Evaluation

A number of elements affect the most effective insurance coverage selection. Firstly, think about the full rental price, the insurance coverage premiums, and any further charges or exclusions. Secondly, examine the insurance coverage protection supplied by completely different choices, and lastly, think about the rewards and cashback you may earn from the Citi Double Money Card. It is a balancing act.

Value Comparability: A Quantity-Crunching Method

Let us take a look at just a few examples to see how the Citi Double Money Card stacks up in opposition to different choices. Assume a rental automobile prices £500 for every week, with insurance coverage costing £50. If the cardboard presents a 2% cashback on all purchases, the cashback on the insurance coverage could be £1.

Insurance coverage Decisions and Prices: A Desk

| Insurance coverage Possibility | Value | Rewards/Advantages | Suitability |

|---|---|---|---|

| Citi Double Money Card Insurance coverage | £50 (or much less relying on card’s options) | 2% cashback on insurance coverage, potential reward factors | Superb for many who use the cardboard for all or most of their rental bills, and who ceaselessly lease automobiles |

| Journey Company Insurance coverage | £40 | Possible a part of a package deal deal, doubtlessly bundled with different providers. | Good if you have already got a package deal cope with the journey company |

| Credit score Card Insurance coverage (Non-Citi Double Money) | £45 | Probably included along with your bank card. | Good in case your bank card already presents rental automobile insurance coverage |

| Rental Firm Insurance coverage | £60 | Costliest choice, however might present extra complete protection | Appropriate should you require essentially the most intensive protection and have no need for cashback or reward factors |

The most suitable choice relies on your particular person circumstances and preferences. Fastidiously weigh the fee, protection, and rewards earlier than making a choice.

Data for a Detailed Comparability Desk

Proper, so we’d like a correct comparability desk to assist peeps resolve on the most effective rental automobile insurance coverage choice. This ain’t simply concerning the Citi Double Money Card, it is about all the alternatives on the market. We have to lay all of it out so college students can simply see the professionals and cons of every.This desk would be the final cheat sheet, breaking down the important thing elements to assist college students make the neatest transfer.

We’re speaking protection limits, deductibles, charges, and, crucially, how the Citi Double Money Card stacks up in opposition to different choices. It is all about readability and ease of understanding, so we will keep away from any confusion.

Knowledge Factors for the Comparability Desk

This desk must be jam-packed with the important particulars. Consider it as a complete breakdown of every insurance coverage choice. We’ll be utilizing an ordinary format, so everybody can get the gist of it.

- Protection Limits: Most quantity the insurance coverage pays out in case of an accident or harm. That is essential for figuring out the extent of safety. For instance, a coverage with a better protection restrict provides you extra monetary safety within the occasion of main harm or harm.

- Deductibles: The quantity the renter is liable for paying out-of-pocket earlier than insurance coverage kicks in. A decrease deductible means much less upfront price, however increased premiums is perhaps the value you pay. For instance, a decrease deductible may imply a less expensive premium, but when an accident happens, you will must pay a better quantity out-of-pocket.

- Charges: Any further fees related to the insurance coverage coverage. This might embody extra fees for particular harm sorts, or charges for protection upgrades. For instance, if you wish to add further protection for particular damages, like fireplace or theft, you may need to pay further charges. You additionally want to contemplate whether or not the cardboard’s insurance coverage is bundled or if there are further prices.

- Rental Automotive Insurance coverage Choices: Checklist all of the potential choices accessible (e.g., the Citi Double Money Card insurance coverage, a third-party insurance coverage, the rental firm’s insurance coverage). That is the essential a part of the comparability. We have to clearly establish which insurance coverage choice is being in contrast.

- Premiums/Prices: The entire price of every insurance coverage choice, together with any potential reductions. We should be clear about the price of every choice. For instance, some insurance policies would possibly provide reductions when you’ve got driving report.

- Exclusions/Limitations: Any conditions the place the insurance coverage will not cowl damages or losses. That is necessary to know to keep away from disagreeable surprises later. For instance, sure pre-existing situations or accidents is probably not coated.

Desk Construction for Complete Comparability

The desk must be specified by a transparent and easy-to-understand format, making it simple to match varied choices at a look. A well-structured desk is essential to understanding the variations between insurance coverage insurance policies.

| Function | Citi Double Money Card Rental Insurance coverage | Rental Firm Insurance coverage | Third-Occasion Insurance coverage |

|---|---|---|---|

| Protection Restrict (e.g., £10,000) | [Insert amount] | [Insert amount] | [Insert amount] |

| Deductible (e.g., £500) | [Insert amount] | [Insert amount] | [Insert amount] |

| Charges (e.g., administration charge) | [Insert amount/description] | [Insert amount/description] | [Insert amount/description] |

| Premiums/Prices | [Insert cost] | [Insert cost] | [Insert cost] |

| Exclusions/Limitations | [List exclusions] | [List exclusions] | [List exclusions] |

| Extra Advantages (e.g., roadside help) | [List benefits] | [List benefits] | [List benefits] |

Final Conclusion: Citi Double Money Card Rental Automotive Insurance coverage

In conclusion, the Citi Double Money Card presents a compelling choice for rental automobile insurance coverage, providing potential financial savings and rewards via strategic planning. Nevertheless, cautious consideration of particular person wants and circumstances is crucial to find out the optimum strategy for maximizing the advantages of this distinctive mixture. This information serves as a useful resource that can assist you weigh the choices and make an knowledgeable choice.

Frequent Queries

Can I take advantage of the Citi Double Money Card for every type of rental automobile insurance coverage?

The Citi Double Money Card can be utilized for rental automobile insurance coverage protection supplied by varied suppliers, but it surely’s important to examine the particular phrases and situations of the rental settlement and the cardboard’s phrases to verify compatibility.

What are the standard limitations or exclusions of the rental automobile insurance coverage supplied by the cardboard?

Particular limitations and exclusions differ primarily based on the cardboard’s phrases and situations, and the insurance coverage supplier. Assessment the nice print rigorously earlier than making a choice.

How do I redeem rewards earned from utilizing the Citi Double Money Card for rental automobile insurance coverage?

Rewards earned via the Citi Double Money Card for rental automobile insurance coverage are sometimes redeemed in line with the cardboard’s phrases and situations. Examine your card’s rewards program for particulars.

Are there any potential drawbacks to utilizing the Citi Double Money Card for rental automobile insurance coverage?

Whereas the Citi Double Money Card can provide rewards, it could not all the time be essentially the most cost-effective choice in comparison with different standalone rental insurance coverage insurance policies, and cautious comparability is crucial.