Extra insurance coverage protection automotive rent is essential for any rental. It protects you from surprising harm or loss, providing a monetary security internet. Understanding the nuances of this protection is important to creating knowledgeable selections when renting a car. This information explores the varied points of extra insurance coverage, from its definition and kinds to its advantages and downsides.

Choosing the proper stage of extra insurance coverage relies on your finances and threat tolerance. Elements such because the car kind, rental length, and vacation spot can impression the price and suitability of various extra choices.

Definition and Scope of Extra Insurance coverage Protection for Automobile Rent

Embarking on a journey of exploration, whether or not close to or far, calls for a eager consciousness of potential dangers. Extra insurance coverage protection for automotive rent is an important part of this consciousness, safeguarding your monetary well-being when surprising occasions happen. This safety acts as a religious compass, guiding you in the direction of peace of thoughts throughout your travels.Extra insurance coverage protection for automotive rent is a supplementary contract that covers the monetary duty for harm to the rental automotive past the first insurance coverage.

This protection ensures that your private funds stay unburdened within the occasion of accidents or incidents. It serves as a protect, defending your monetary equilibrium throughout your travels.

Function and Perform

Extra insurance coverage protection serves a vital perform by offering a monetary security internet for the renter. It mitigates the danger of considerable out-of-pocket bills in case of injury or lack of the rental automotive. This peace of thoughts empowers you to totally immerse within the expertise of your journey, free from the nervousness of potential monetary spoil.

Typical Conditions The place Protection Applies

This protection is activated in numerous circumstances the place the first insurance coverage could not absolutely compensate the rental firm for the harm or lack of the car. This safety is most frequently wanted when the accident or incident will not be lined by the rental firm’s insurance coverage or when the harm surpasses the deductible. This assurance is a robust instrument in occasions of uncertainty.

Comparability with Different Automobile Rent Insurance coverage Varieties

Extra insurance coverage protection is distinct from complete protection. Complete protection usually addresses harm to the rental automotive from numerous incidents, together with accidents, vandalism, and pure disasters. Extra insurance coverage, nevertheless, focuses on the monetary burden of exceeding the deductible or the rental firm’s duty, and it isn’t designed to cowl all forms of damages. It’s a specialised layer of safety.

Key Variations

| Function | Extra Insurance coverage | Complete Protection |

|---|---|---|

| Protection Scope | Covers the surplus quantity payable above the deductible, often for unintended harm, vandalism, or loss. | Covers a wider vary of damages, together with accidents, vandalism, theft, and weather-related harm. |

| Monetary Duty | Protects the renter from the monetary burden of the surplus quantity. | Protects the renter and the rental firm from monetary losses. |

| Protection Quantity | Restricted to the agreed-upon extra quantity. | Normally covers the complete worth of the car or harm. |

| Protection Set off | Triggered when the harm exceeds the deductible. | Triggered by numerous incidents main to break. |

This desk highlights the important thing distinctions between extra insurance coverage and complete protection, offering a transparent understanding of their respective roles in securing your journey.

Varieties of Extra Insurance coverage Choices

Embarking on a journey of journey, whether or not for leisure or enterprise, usually includes the duty of safeguarding your belongings and commitments. Choosing the proper extra insurance coverage to your automotive rent is a vital step in making certain a easy and worry-free expertise. This choice acts as a religious compass, guiding you in the direction of monetary peace of thoughts, permitting you to deal with the current second and the journey forward.Understanding the varied extra insurance coverage choices accessible empowers you to make knowledgeable selections, aligning your decisions together with your private values and monetary circumstances.

This lets you embrace the liberty of journey with confidence and resilience.

Variations in Protection Quantities and Limits, Extra insurance coverage protection automotive rent

Totally different ranges of extra insurance coverage protection cater to various wants and budgets. These choices symbolize various levels of safety towards monetary loss. The extent of your safety is instantly associated to the extent of extra insurance coverage you choose.

Impression of Totally different Extra Ranges on the Value of Automobile Rent

The price of automotive rent is intrinsically linked to the chosen extra stage. The next stage of safety often ends in a decrease out-of-pocket expense in case of injury or accident. It is a reflection of the religious precept of preparation and prudence. By fastidiously contemplating your monetary scenario and potential dangers, you may choose an acceptable stage of protection that aligns together with your wants.

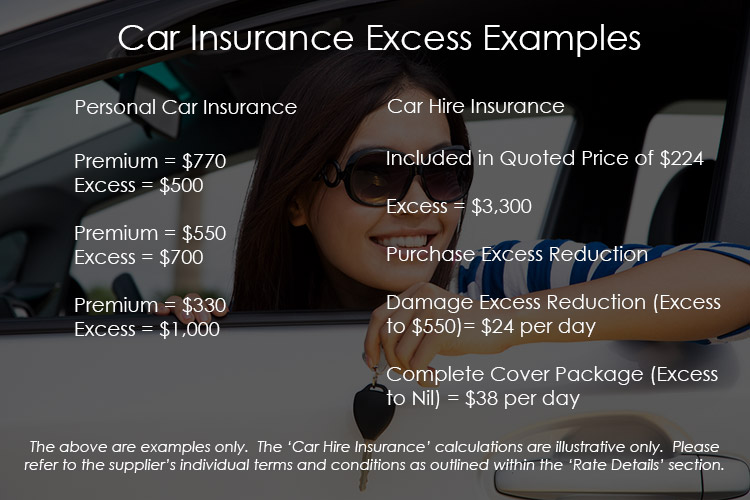

Examples of Numerous Extra Choices and Their Corresponding Costs

A complete understanding of various extra choices and their related costs empowers you to make the perfect determination. Let’s contemplate some examples:

- Primary Extra: This selection affords essentially the most primary stage of safety, usually overlaying a predetermined quantity of injury. It might be appropriate for vacationers who’re keen to bear the next threat of monetary loss in case of an incident.

- Normal Extra: This selection gives a reasonable stage of safety, overlaying a bigger quantity of injury in comparison with primary extra. It represents a balanced method to threat administration, offering an inexpensive stage of monetary safety.

- Zero Extra: This selection affords full safety, eliminating any out-of-pocket expense in case of injury or accident. That is essentially the most complete type of safety, usually mirroring a proactive method to private safety and peace of thoughts.

Desk of Extra Ranges and Related Prices

The next desk presents examples of extra ranges and related prices for various automotive rent corporations. This gives a sensible information for evaluating choices.

| Extra Degree | Value (USD) | Automobile Rent Firm |

|---|---|---|

| Primary | 100 | Firm A |

| Normal | 200 | Firm A |

| Zero | 300 | Firm A |

| Primary | 150 | Firm B |

| Normal | 250 | Firm B |

| Zero | 400 | Firm B |

Advantages and Drawbacks of Extra Insurance coverage

Embarking on a journey, whether or not bodily or metaphorical, usually includes navigating potential dangers. Understanding the potential pitfalls and rewards is essential for making knowledgeable selections. This understanding applies equally to securing automotive rent, the place the selection between extra insurance coverage and paying the surplus instantly can considerably impression your monetary well-being and peace of thoughts.Choosing the proper path requires a cautious evaluation of particular person circumstances, weighing the benefits and drawbacks of every choice.

This part delves into the intricacies of those decisions, empowering you to decide that aligns together with your particular wants and aspirations.

Benefits of Extra Insurance coverage

A main benefit of extra insurance coverage is the availability of full monetary safety. Within the occasion of an accident or harm to the employed car, the insurance coverage firm will settle the declare, releasing you from the burden of overlaying the surplus quantity. This side gives a major measure of safety, eliminating the concern and stress related to potential monetary liabilities.

Think about the peace of thoughts realizing that your monetary sources aren’t jeopardized by unexpected circumstances. This safety permits you to absolutely get pleasure from your journey with out the fixed nervousness about potential prices.

Disadvantages of Extra Insurance coverage

Whereas extra insurance coverage affords a security internet, it isn’t with out its drawbacks. One important drawback is the added price. Insurance coverage premiums for extra protection are usually increased than the quantity you’d pay instantly for the surplus. This improve in price must be thought-about as a part of the general expense of your automotive rent. Whereas the monetary safety is substantial, the elevated price can doubtlessly impression your finances, doubtlessly hindering your potential to allocate sources to different points of your journey.

Paying the Extra Instantly

Selecting to pay the surplus instantly, as a substitute of counting on insurance coverage, can current an economical different. This method saves you the extra premium for the insurance coverage, doubtlessly permitting you to allocate these funds to different points of your journey. This method fosters better monetary management. This may be significantly useful for budget-conscious vacationers who search to optimize their spending.

Evaluating Extra Insurance coverage and Paying the Extra Instantly

The choice between buying extra insurance coverage and paying the surplus instantly hinges on a cautious analysis of particular person circumstances. For these in search of most monetary safety and peace of thoughts, insurance coverage affords a sexy choice. For these prioritizing cost-effectiveness and monetary management, paying the surplus instantly could be the extra appropriate selection.

Particular person Circumstances and the Resolution

Private circumstances play a pivotal function in figuring out essentially the most appropriate method. For instance, people with a historical past of accidents or these touring in areas with increased accident charges may discover extra insurance coverage extra useful. Likewise, people who prioritize monetary flexibility and are assured of their potential to deal with unexpected bills may decide to pay the surplus instantly.

Contemplate your driving historical past, the rental location, and your total journey finances when making your determination.

Abstract Desk

| Facet | Extra Insurance coverage | Paying Extra Instantly |

|---|---|---|

| Monetary Safety | Excessive | Low |

| Value | Increased (contains premium) | Decrease (solely extra quantity) |

| Stress Degree | Decrease (no fear about extra) | Increased (potential monetary legal responsibility) |

| Flexibility | Decrease (mounted price) | Increased (management over funds) |

Elements Influencing Extra Insurance coverage Prices

Embarking on a journey of automotive rent usually includes navigating the intricacies of extra insurance coverage. Understanding the elements that affect its price is essential for making knowledgeable selections, aligning your decisions together with your religious compass of prudence and monetary consciousness. This data empowers you to navigate the world of automotive leases with confidence and peace of thoughts.Comprehending the weather that form extra insurance coverage premiums gives a framework for accountable decision-making.

By recognizing the interaction of those elements, you may navigate the complexities of automotive rent insurance coverage with a clearer understanding and a way of management.

Car Class and Premium

The kind of car rented instantly impacts the surplus insurance coverage price. Increased-value automobiles, equivalent to luxurious vehicles or sports activities vehicles, usually carry the next threat of injury or theft. This heightened threat interprets into the next premium. Premium changes mirror the inherent worth and potential vulnerability of various car lessons. Luxurious automobiles demand the next premium to mirror the potential for extra important losses.

For instance, a compact automotive incurs a decrease premium in comparison with an SUV, which in flip has a decrease premium than a high-performance sports activities automotive. This displays the inherent threat profile related to every car kind.

Rental Period and Value

The length of the rental interval performs a major function in the price of extra insurance coverage. Longer leases usually lead to the next premium. It is because the longer the car is in your possession, the better the potential publicity to break or theft. The associated fee per day usually decreases for longer leases, reflecting the decreased every day threat.

For instance, a two-week rental will seemingly price greater than a weekend rental.

Particular Elements and Their Impression

A number of elements past car class and length can have an effect on the price of extra insurance coverage. These elements embrace the particular location of the rental, the motive force’s profile (together with age and driving document), and any extra add-ons or extras. Rental places in high-crime areas or areas with increased accident charges could command increased premiums. The motive force’s profile, together with age and driving historical past, performs a major function in figuring out threat evaluation.

This ends in various premiums primarily based on driver threat. For instance, a younger driver with a restricted driving historical past may face the next premium than an skilled driver with a clear document.

Affect of Totally different Elements on Prices

| Issue | Impact on Value | Instance |

|---|---|---|

| Car Class | Increased-value automobiles have increased premiums. | A luxurious sedan could have the next premium than a compact automotive. |

| Rental Period | Longer leases often result in increased premiums. | A month-to-month rental could have the next premium than a weekend rental. |

| Driver Profile | Younger drivers with restricted expertise may face increased premiums. | A 20-year-old with a brand new license will seemingly have the next premium than a 40-year-old with a clear driving document. |

| Rental Location | Excessive-crime areas or places with increased accident charges might need increased premiums. | A rental in a significant metropolis middle will seemingly have the next premium than a rental in a rural space. |

Alternate options to Extra Insurance coverage

Embarking on a journey of automotive rent usually includes a selection: extra insurance coverage, or a path much less traveled. This exploration delves into different methods, recognizing that monetary prudence and aware decision-making are key to a satisfying expertise. Choosing the proper method aligns with private values and understanding of threat.Different methods to extra insurance coverage provide a unique perspective on managing the potential monetary burden of injury or loss throughout a rental interval.

These choices, starting from private monetary preparedness to cautious car choice, empower people to take management of their rental expertise.

Different Choices for Managing Rental Dangers

Understanding the spectrum of decisions past extra insurance coverage is essential. These alternate options usually prioritize proactive measures and self-reliance.

- Elevated Private Emergency Fund: Constructing a strong emergency fund gives a monetary security internet. This method, aligning with religious ideas of self-reliance and preparedness, reduces reliance on exterior insurance coverage and fosters private duty. The next emergency fund mitigates the danger of unexpected prices. For instance, if a car is broken throughout a visit, the non-public emergency fund permits for fast repairs or alternative while not having to depend on extra insurance coverage.

The benefit is full management and peace of thoughts. Nonetheless, sustaining a big fund can require cautious budgeting and self-discipline. This different is appropriate for people with robust monetary stability and a dedication to self-reliance.

- Complete Journey Insurance coverage: Complete journey insurance coverage can provide protection for unexpected incidents throughout a visit, together with car harm. This usually proves extra complete than solely specializing in extra insurance coverage. The benefit is broader protection, together with journey cancellations and medical bills. The drawback could be increased prices than extra insurance coverage alone. This different is appropriate for many who prioritize complete protection throughout journey and need a single coverage for numerous eventualities.

- Excessive-Deductible Automobile Insurance coverage: This selection, for people with a private automotive insurance coverage coverage, can provide safety for rental automobiles if they’re a part of a complete coverage. The benefit is decreased out-of-pocket prices in case of injury, and it aligns with private duty. The drawback is that the deductible could be substantial, and it requires an present private insurance coverage coverage.

That is appropriate for people who have already got a high-deductible automotive insurance coverage plan and need to leverage it for rental automobiles.

- Cautious Car Choice: Selecting a car with identified sturdiness and a decrease threat of injury can considerably scale back the chance of needing extra insurance coverage. This selection, aligning with mindfulness and accountable decisions, promotes a proactive method to minimizing threat. The benefit is a decrease probability of injury. The drawback is that the car won’t at all times align with the particular wants of the journey.

This different is appropriate for people who prioritize cautious planning and minimizing the potential for incidents.

- Negotiating Rental Phrases: Some rental corporations provide different choices to extra insurance coverage. Negotiating a decrease every day fee, or exploring several types of insurance coverage choices, generally is a prudent selection. The benefit is a possible discount in total price. The drawback is that this requires communication and negotiation expertise. That is appropriate for these comfy negotiating and exploring different phrases.

Value-Effectiveness Comparability

A radical comparability of the cost-effectiveness of extra insurance coverage versus different choices is important.

| Issue | Extra Insurance coverage | Different Choices |

|---|---|---|

| Value | Usually mounted, doubtlessly increased than some alternate options | Variable, doubtlessly decrease than extra insurance coverage, or comparable |

| Protection | Restricted to particular harm sorts | Broader, relying on the chosen different |

| Management | Reliance on the rental firm’s insurance coverage | Higher private management and preparedness |

The selection between extra insurance coverage and alternate options hinges on particular person threat tolerance, monetary preparedness, and journey wants. Contemplate your circumstances and select the choice that finest aligns together with your values and objectives.

Worldwide Concerns for Extra Insurance coverage

Embarking on a world journey requires cautious consideration, particularly when renting a car. Understanding the nuances of extra insurance coverage insurance policies throughout totally different nations is essential to safeguarding your monetary well-being and making certain a easy journey expertise. Worldwide automotive leases usually current distinctive challenges that necessitate a deep dive into the particular protections supplied. This understanding empowers you to make knowledgeable selections, permitting you to journey with peace of thoughts.Navigating worldwide automotive rent usually includes a labyrinth of various insurance policies and procedures.

The identical extra insurance coverage coverage you are accustomed to in your house nation won’t provide the identical stage of protection or declare course of in a international land. Due to this fact, proactive analysis and meticulous planning are important for mitigating potential monetary burdens and making certain a harmonious journey. A profound understanding of worldwide variations empowers you to embrace the journey with confidence.

Variations in Extra Insurance coverage Insurance policies Throughout International locations

Totally different nations make use of various approaches to extra insurance coverage for automotive leases. Insurance policies could fluctuate within the quantity of extra protection offered, the forms of damages lined, and the processes for submitting claims. As an illustration, some nations could provide complete safety towards all foreseeable damages, whereas others may restrict protection to particular incidents. Understanding these variations is paramount for making knowledgeable selections.

Particular Concerns for Worldwide Automobile Rent

Worldwide automotive rent calls for meticulous consideration to element. Elements such because the rental settlement’s phrases and circumstances, the native legal guidelines and rules relating to car harm, and the provision of native help providers want cautious consideration. Furthermore, the foreign money change fee performs a important function in calculating the precise price of extra insurance coverage.

Potential Points or Challenges with Extra Insurance coverage in Worldwide Leases

Potential points could come up resulting from language limitations, differing declare procedures, or unfamiliarity with native customs. For instance, a misunderstanding relating to the scope of protection may result in unexpected bills. Moreover, delays within the declare course of or a scarcity of clear communication channels may considerably impression the decision time.

Comparability of Declare Processes in Totally different International locations

The declare course of for extra insurance coverage varies considerably throughout nations. In some nations, the method could be simple and contain minimal paperwork. In others, it may very well be advanced and require in depth documentation.

Desk Evaluating Extra Insurance coverage Insurance policies in A number of International locations

| Nation | Extra Insurance coverage Coverage | Declare Course of |

|---|---|---|

| United States | Usually complete, with various ranges of protection primarily based on rental firm. Usually contains third-party legal responsibility and harm waiver. | Claims often processed by way of the rental firm; could contain offering documentation equivalent to police experiences. |

| United Kingdom | Just like US, with numerous ranges of protection. Emphasis on complete safety. | Declare course of includes contacting the rental firm and offering crucial documentation, usually together with harm assessments. |

| Germany | Complete protection is frequent. Laws guarantee honest and clear procedures. | Declare course of is usually structured, involving clear communication and documentation necessities. |

| Japan | Complete protection is extensively accessible, with emphasis on clear communication and immediate decision. | Claims are often processed by way of the rental firm, and documentation could embrace pictures and witness statements. |

Illustrative Case Research: Extra Insurance coverage Protection Automobile Rent

Embarking on a journey of journey or enterprise, we should at all times contemplate the potential for unexpected occasions. Simply as a well-built home requires a robust basis, your journey preparations want ample safety. Extra insurance coverage protection for automotive rent acts as a religious safeguard, making certain peace of thoughts amidst the inevitable uncertainties of the street.Understanding the worth of safety, each tangible and intangible, is vital to navigating the complexities of life’s experiences.

Every case research illuminates a unique aspect of this significant determination, demonstrating how prudent decisions result in optimistic outcomes. A cautious evaluation of previous experiences permits us to anticipate and put together for potential challenges.

Helpful Outcomes of Extra Insurance coverage

Selecting extra insurance coverage can deliver a way of safety and serenity, permitting you to deal with the journey reasonably than the potential for monetary pressure. In eventualities the place surprising damages happen, extra insurance coverage acts as a protect, mitigating the monetary burden.

- Situation 1: The Sudden Collision: A traveler rented a automotive for a enterprise journey. Whereas navigating a busy intersection, an unexpected collision occurred. With out extra insurance coverage, the monetary duty for the damages would have fallen totally on the traveler. With extra insurance coverage in place, the insurance coverage firm lined the repairs, making certain the journey may proceed with out interruption, preserving each time and sources.

- Situation 2: Unintended Harm: A household rented a automotive for a trip. Throughout a parking maneuver, the automotive sustained harm to its aspect mirror. The surplus insurance coverage coverage lined the price of restore, permitting the household to proceed their trip with out fear in regards to the bills.

Direct Fee of Extra

In sure cases, direct cost of the surplus may seem to be a inexpensive choice, however it’s important to weigh the long-term implications. Contemplate this as a possible religious impediment that requires cautious consideration.

- Situation 3: Minor Scratches: A enterprise skilled rented a automotive for a brief journey. Upon returning the car, minor scratches had been famous. Moderately than taking out extra insurance coverage, the skilled selected to pay the surplus instantly. This selection may appear financially enticing on this case, but when a extra important situation had been to come up, the choice may show pricey.

Causes Behind Decisions

The choice to go for extra insurance coverage or pay the surplus instantly is a private one, closely influenced by the perceived threat and the monetary consolation stage of the person.

- Situation 1 & 2: The people selected extra insurance coverage as a result of they prioritized peace of thoughts over a small potential saving. The potential for main damages or extra prices related to dealing with the restore course of themselves outweighed the price of the insurance coverage.

- Situation 3: The enterprise skilled selected to pay the surplus instantly as a result of the minor harm appeared manageable and the price of insurance coverage appeared pointless on this case. This selection demonstrates the significance of assessing the person threat related to every scenario.

Comparability of Outcomes

Evaluating the outcomes of the totally different decisions highlights the significance of proactive threat administration.

| Alternative | End result | Non secular Lesson |

|---|---|---|

| Extra Insurance coverage | Monetary safety, peace of thoughts, continued journey | Trusting in the next energy for cover. |

| Direct Fee | Probably decrease fast price, however elevated threat of unexpected monetary burden | Studying to stability practicality and prudence. |

Potential Damages and Insurance coverage Protection

Think about a state of affairs the place a rented automotive experiences a major impression throughout a collision.

- Potential Harm 1: Harm to the car’s exterior, together with dents and scratches.

- Potential Harm 2: Harm to the car’s inside, equivalent to damaged dashboard elements.

- Potential Harm 3: Harm to the car’s mechanical elements, necessitating in depth repairs.

In all these cases, extra insurance coverage would cowl the price of repairs, making certain the traveler’s monetary well-being. This protection is important for sustaining the integrity of the journey and permitting for a easy, uneventful expertise.

Remaining Wrap-Up

In conclusion, extra insurance coverage protection for automotive rent gives peace of thoughts, safeguarding you towards potential monetary liabilities. Weighing the advantages towards potential drawbacks, alongside alternate options and worldwide concerns, permits for a well-informed determination. This complete information equips you with the information to navigate the complexities of automotive rent insurance coverage and make the only option to your wants.

Solutions to Frequent Questions

What’s the distinction between extra insurance coverage and complete protection?

Extra insurance coverage covers the portion of injury exceeding your deductible, whereas complete protection gives broader safety, together with damages like vandalism or theft. Extra insurance coverage focuses on the surplus quantity, whereas complete insurance coverage goals to cowl all potential damages.

How do rental durations have an effect on extra insurance coverage prices?

Longer rental intervals usually lead to increased extra insurance coverage premiums, because the potential for harm will increase with prolonged use.

Are there any alternate options to extra insurance coverage?

Sure, different choices embrace utilizing a bank card with rental insurance coverage protection or buying journey insurance coverage that covers automotive rent.

What are some elements that affect the price of extra insurance coverage?

Elements just like the car kind, rental length, and site can considerably impression extra insurance coverage prices.