How do I do know if my automobile has hole insurance coverage? This vital query usually arises when dealing with surprising car harm. Understanding hole insurance coverage is essential for car homeowners, because it acts as a security web, filling the monetary hole between the precise money worth of a car and the excellent mortgage quantity. This complete information dives into the intricacies of hole insurance coverage, explaining its function, protection particulars, and the best way to confirm its presence inside your present automobile insurance coverage coverage.

Hole insurance coverage, a specialised type of auto protection, protects you in opposition to monetary losses when a totaled car’s worth falls wanting the mortgage stability. It is a essential side of complete car possession, significantly for these with excellent auto loans. This information will present a transparent and concise rationalization of the best way to confirm in case your coverage consists of hole insurance coverage protection, permitting you to be well-prepared for any unlucky occasion.

Understanding Hole Insurance coverage

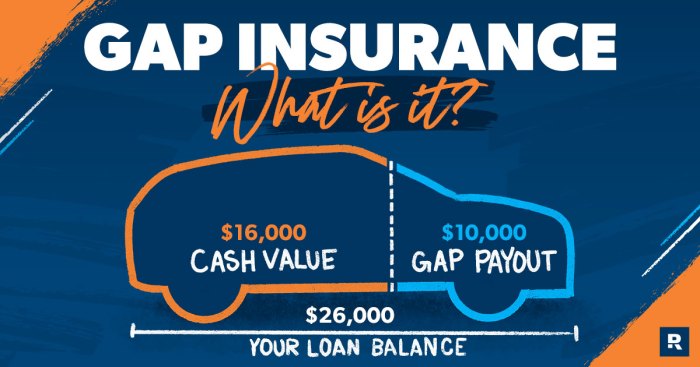

Navigating the complexities of automobile insurance coverage will be daunting, particularly when unfamiliar phrases like “hole insurance coverage” floor. This significant protection protects you from monetary loss when your car’s worth depreciates under the quantity owed on the mortgage or lease. Understanding its nuances is vital to making sure you are adequately ready for unexpected circumstances.Hole insurance coverage, in essence, bridges the hole between the remaining mortgage or lease stability and the car’s diminished worth following an accident or whole loss.

This implies in case your automobile is totaled, and its worth is lower than what you continue to owe, hole insurance coverage kicks in to cowl the distinction. This safeguard protects you from having to pay the excellent mortgage quantity even when the automobile’s salvage worth is inadequate.

Hole Insurance coverage Defined

Hole insurance coverage is a supplementary protection that protects in opposition to monetary duty for the distinction between the excellent mortgage quantity and the car’s precise worth after an accident or whole loss. It primarily compensates for the depreciation of the car that sometimes happens over time. This safety is especially invaluable for brand spanking new or costly autos, because the hole between the car’s worth and the mortgage quantity tends to be important in the course of the early years of possession.

Circumstances Requiring Hole Insurance coverage

Hole insurance coverage is incessantly mandatory when a car’s worth drops considerably under the excellent mortgage quantity, usually because of depreciation, accidents, or different unexpected circumstances. That is significantly true for brand spanking new autos, which depreciate quickly of their first few years. In case your car is totaled in an accident and the payout from insurance coverage is lower than the quantity you owe on the mortgage, hole insurance coverage will be important in avoiding private monetary burdens.

Hole Insurance coverage vs. Complete/Collision Protection

Hole insurance coverage operates independently of complete or collision protection. Complete protection protects in opposition to harm attributable to perils like hail, hearth, theft, or vandalism, whereas collision protection safeguards in opposition to harm ensuing from an accident. Hole insurance coverage, however, focuses solely on the monetary distinction between the car’s worth and the excellent mortgage or lease stability. It steps in when the car’s worth drops under the excellent mortgage, no matter the reason for the loss.

Comparability Desk: Hole Insurance coverage vs. Different Automotive Insurance coverage Sorts

| Characteristic | Hole Insurance coverage | Complete/Collision |

|---|---|---|

| Protection | Covers the distinction between the car’s worth and the excellent mortgage/lease stability if the car is totaled or considerably broken. | Covers damages to the car because of varied occasions (complete) or accidents (collision). |

| Goal | Protects the borrower from having to pay the excellent mortgage/lease stability if the car’s worth is lower than the mortgage quantity. | Protects the car from monetary loss because of harm or accidents. |

| Triggering Occasion | Complete loss or important harm leading to a price under the excellent mortgage/lease quantity. | Injury attributable to coated perils or accidents. |

| Relationship to Mortgage/Lease | Straight associated to the excellent mortgage or lease stability. | Indirectly associated to the mortgage or lease. |

Figuring out Protection Standing

Figuring out in case your automobile has hole insurance coverage is essential for understanding your monetary safety in case of a complete loss. This readability empowers you to make knowledgeable selections about your car’s worth and potential protection. Correctly figuring out your hole insurance coverage protection ensures you are ready for unexpected circumstances and perceive your monetary tasks.Verifying hole insurance coverage protection includes a number of key steps.

These steps assist make sure you’re totally conscious of the protection you may have, avoiding any surprises or gaps in your safety. A proactive method to verifying protection is significant in managing your car’s monetary threat.

Figuring out Strategies for Checking Protection, How do i do know if my automobile has hole insurance coverage

A number of avenues exist to substantiate your hole insurance coverage standing. These strategies present clear and direct methods to grasp your protection.

- Reviewing coverage paperwork is an easy technique to substantiate hole insurance coverage protection. Coverage paperwork usually explicitly state the sorts of protection included. This doc is often obtainable on-line or by way of your insurance coverage supplier.

- Accessing the insurance coverage supplier’s web site permits you to seek for protection data. Many insurance coverage suppliers have devoted sections on their web sites to element protection particulars and supply coverage summaries.

- Contacting your insurance coverage supplier immediately permits you to make clear any questions on your coverage. A direct dialog with an agent can affirm protection specifics and make clear any ambiguities.

Accessing Coverage Paperwork to Verify Hole Insurance coverage

Coverage paperwork function definitive proof of protection. They include the specifics of your settlement with the insurance coverage firm. These paperwork are important in understanding your safety and making certain that you just’re adequately coated.Reviewing coverage paperwork completely can determine particulars about your hole insurance coverage protection. Finding the related sections is essential for verifying protection and avoiding any misinterpretations.

Contacting the Insurance coverage Supplier to Confirm Hole Protection

Direct communication together with your insurance coverage supplier is a dependable strategy to confirm your hole insurance coverage protection. This method ensures readability and accuracy about your coverage. Direct contact ensures a whole understanding of your protection.Contacting your insurance coverage supplier will be achieved through telephone, electronic mail, or in particular person. Choose the tactic that most closely fits your wants and preferences. Observe up with a affirmation to make sure that your question has been acquired and processed.

Frequent Locations to Search for Hole Insurance coverage Info

The next desk Artikels frequent areas for locating hole insurance coverage data. Understanding these areas may also help you shortly find the small print you want.

| Location | Particulars |

|---|---|

| Coverage Paperwork | Coverage paperwork, usually obtainable on-line or out of your insurance coverage supplier, often include a selected part detailing hole insurance coverage protection, together with the phrases, circumstances, and extent of the protection. That is the first supply of data. |

| Insurance coverage Web site | Many insurance coverage suppliers keep a devoted part on their web site, offering entry to coverage summaries, protection particulars, and FAQs. This usually consists of details about hole insurance coverage. |

| Insurance coverage Agent | Your insurance coverage agent can present a transparent rationalization of your coverage, reply your questions on hole insurance coverage, and ensure your protection particulars. |

Situations and Examples

Navigating the complexities of automobile possession will be tough, particularly when contemplating monetary safety. Understanding when hole insurance coverage is a invaluable software, and when it isn’t, is essential for making knowledgeable selections. This part explores varied situations, highlighting conditions the place hole insurance coverage proves useful and people the place it may be pointless.Hole insurance coverage acts as a security web, bridging the distinction between the precise money worth of your car and what you continue to owe in your mortgage.

This safety is especially essential in situations of great loss or harm, stopping monetary hardship.

Examples of Helpful Conditions

Hole insurance coverage turns into particularly pertinent when the car’s worth considerably depreciates earlier than it is totaled or considerably broken. A standard instance includes a brand new car that quickly loses worth in comparison with its authentic value. If the car is totaled or severely broken in an accident, the insurance coverage settlement might not cowl the excellent mortgage quantity. Hole insurance coverage would then step in, making certain the mortgage is repaid.

One other state of affairs is when a used automobile is concerned in an accident that leads to a complete loss. If the automobile’s worth on the time of the accident is decrease than the excellent mortgage quantity, hole insurance coverage will cowl the distinction.

Examples of Conditions The place Hole Insurance coverage May Not Be Needed

In some instances, the car’s worth may not depreciate as considerably, or the insurance coverage settlement would possibly cowl the complete mortgage stability. If you buy a car with a low excellent mortgage stability, and the car’s worth continues to be above the mortgage quantity even after depreciation, hole insurance coverage may not be important. That is additionally true in instances of minor harm the place the restore prices are decrease than the distinction between the car’s worth and the mortgage quantity.

A State of affairs The place Hole Insurance coverage Pays Out

Think about Sarah bought a brand new SUV for $50,000 with a $45,000 mortgage. After a 12 months, the SUV was concerned in a collision, leading to a complete loss. The insurance coverage settlement, based mostly on the present market worth, was $35,000. Because the settlement was lower than the excellent mortgage stability of $45,000, hole insurance coverage would pay the distinction of $10,000, making certain Sarah’s mortgage is totally repaid.

Automobile Sorts and Hole Insurance coverage Want

| Automobile Kind | Hole Insurance coverage Want |

|---|---|

| New Automobile | Excessive. New autos depreciate quickly, rising the probability that the insurance coverage settlement will likely be decrease than the mortgage quantity. |

| Used Automobile | Doubtlessly Excessive, however depends upon the car’s age and situation. Older or high-mileage used autos might depreciate shortly, making hole insurance coverage worthwhile. |

Frequent Points and Options

Navigating the complexities of hole insurance coverage can generally result in misunderstandings and frustrations. This part addresses frequent pitfalls and affords sensible options to make sure a clean claims course of. Figuring out the potential challenges forward can empower you to make knowledgeable selections and resolve any points effectively.Hole insurance coverage, whereas designed to guard you from monetary losses, will be misinterpreted. Frequent misconceptions usually come up from the intricate nature of the protection, resulting in confusion about its applicability and the claims course of.

Understanding these frequent points is essential to successfully using the advantages of hole insurance coverage.

Frequent Misconceptions about Hole Insurance coverage

Many imagine hole insurance coverage covers all losses, whatever the circumstances. That is inaccurate. Hole insurance coverage solely compensates for the distinction between the precise money worth of a car and the excellent mortgage stability. Different components, such because the situation of the car, might also affect the declare. Moreover, the protection is often contingent on the precise phrases Artikeld within the coverage.

Potential Issues in Hole Insurance coverage Claims

A big concern in hole insurance coverage claims includes the evaluation of the car’s situation. The willpower of whole loss will be subjective and generally disputed, resulting in delays or denial of claims. Discrepancies within the appraisal of the car’s worth in comparison with the agreed-upon quantity within the insurance coverage coverage also can trigger issues. Correct documentation and communication all through the declare course of are important to avoiding these pitfalls.

Resolving Points with Hole Insurance coverage Suppliers

Efficient communication and documentation are key to resolving any points arising from hole insurance coverage claims. When a dispute arises, promptly contact the insurance coverage supplier. Present all mandatory documentation, together with the coverage particulars, appraisal reviews, and any supporting proof. Have interaction in open dialogue with the supplier to grasp their perspective and work in the direction of a mutually agreeable decision. Sustaining a transparent and detailed file of all communications is crucial for a smoother decision.

If a passable decision is not reached by way of direct communication, exploring mediation or arbitration choices could also be mandatory.

Desk of Frequent Causes for Hole Insurance coverage Claims

| Cause | Clarification |

|---|---|

| Complete Loss | The car is deemed a complete loss by the insurance coverage firm, which means its restore price exceeds its market worth or the fee to restore exceeds the car’s worth. |

| Partial Loss | The car is broken past a sure threshold, requiring important repairs. The price of repairs might exceed the car’s depreciated worth, doubtlessly triggering a spot declare. |

| Theft | If the car is stolen, the insurance coverage firm might cowl the distinction between the precise money worth and the mortgage stability. |

| Injury from an Accident | Accidents can result in important harm that exceeds the car’s worth. This example can necessitate a spot insurance coverage declare if the price of restore is past the car’s present worth. |

| Hail Injury | Intensive hail harm could make the price of repairs considerably larger than the car’s worth. This will result in a complete loss state of affairs and subsequent hole insurance coverage declare. |

Coverage Info and Particulars

Navigating your auto insurance coverage coverage to seek out hole insurance coverage specifics can really feel like trying to find a needle in a haystack. Understanding the coverage language is essential for precisely figuring out your protection and avoiding surprises. Figuring out your rights and tasks concerning hole protection empowers you to make knowledgeable selections.Coverage language, usually dense and technical, defines the scope of your hole insurance coverage.

This part clarifies the best way to decipher these phrases and find vital data resembling deductibles and premiums, finally enabling you to make well-informed selections about your protection.

Coverage Language Examples

Coverage wording concerning hole insurance coverage varies considerably relying on the insurer. Nonetheless, frequent themes emerge. For example, a coverage would possibly state: “Hole insurance coverage covers the distinction between the precise money worth (ACV) of the car and the excellent mortgage stability within the occasion of a complete loss.” Or, it might specify: “Hole insurance coverage just isn’t relevant if the car is stolen.” It is vital to completely look at the coverage wording to grasp the precise circumstances underneath which the protection applies.

Decoding Coverage Phrases

Rigorously scrutinize the coverage wording to know the exact phrases. Search for phrases like “precise money worth,” “whole loss,” and “excellent mortgage stability.” These phrases immediately affect your protection. For instance, “whole loss” could also be outlined as a state of affairs the place the car’s restore prices exceed a sure proportion of its worth, or the place it’s deemed irreparable.

Understanding these nuances prevents misinterpretations and clarifies the precise circumstances by which your hole protection prompts.

Finding Deductibles and Premiums

Hole insurance coverage deductibles and premiums aren’t all the time prominently displayed. Usually, they’re nestled inside the broader insurance coverage coverage particulars. You may sometimes discover them in a piece devoted to protection specifics, or presumably in a separate addendum or rider. Contact your insurer immediately if the data is unclear, as the precise placement might differ relying on the corporate.

Reviewing the complete coverage, together with any endorsements or riders, will enable you to find the related data. For example, you would possibly discover a separate schedule itemizing premium quantities for various hole insurance coverage choices.

Key Phrases and Definitions

This desk supplies a concise overview of important phrases associated to hole insurance coverage.

| Time period | Definition |

|---|---|

| Deductible | The quantity you pay out-of-pocket earlier than your insurance coverage protection kicks in. This could possibly be a hard and fast greenback quantity or a proportion of the loss. |

| Premium | The periodic cost (month-to-month, quarterly, or yearly) you make to keep up your hole insurance coverage protection. This cost relies on varied components, such because the car’s worth, the mortgage stability, and the chosen protection degree. |

| Precise Money Worth (ACV) | The estimated value of a car based mostly on its situation, age, and market worth. |

| Complete Loss | A state of affairs the place the price of repairs exceeds a selected threshold or when the car is deemed irreparable. |

| Excellent Mortgage Stability | The remaining quantity owed on the car mortgage. |

Sources and Additional Studying

Navigating the world of hole insurance coverage will be simplified by leveraging available assets. Understanding the nuances of protection, coverage specifics, and potential points requires entry to dependable data. This part supplies invaluable pathways to deepen your data.

Dependable Sources for Studying About Hole Insurance coverage

Quite a few respected sources provide complete data on hole insurance coverage. These assets will be categorized by their nature, starting from authorities businesses to industry-specific organizations. Leveraging these assets permits for a well-rounded understanding of the subject.

- Governmental Companies: Governmental businesses, such because the Shopper Monetary Safety Bureau (CFPB) and state insurance coverage departments, usually publish client guides and FAQs associated to insurance coverage insurance policies, together with hole insurance coverage. These assets are incessantly up to date and supply a impartial perspective, making them dependable beginning factors.

- Insurance coverage Business Organizations: Organizations just like the Insurance coverage Info Institute (III) and the American Insurance coverage Affiliation (AIA) provide detailed explanations of assorted insurance coverage varieties, together with hole insurance coverage. These organizations are immediately concerned within the insurance coverage {industry} and are thus educated about {industry} greatest practices.

- Shopper Advocacy Teams: Shopper advocacy teams, devoted to defending customers’ rights, can present insights into frequent client complaints and considerations concerning hole insurance coverage. This helps determine potential pitfalls and potential avenues for resolving points.

Finding Further Info from Shopper Organizations

Shopper organizations play an important function in offering unbiased details about insurance coverage merchandise. Their function is to assist customers navigate complicated monetary merchandise, together with hole insurance coverage.

- Shopper Stories: Shopper Stories is a well known client advocacy group. They usually publish articles and reviews evaluating varied insurance coverage merchandise, together with hole insurance coverage, based mostly on client suggestions and {industry} evaluation. Their method is often consumer-centric, which supplies invaluable perception.

- State Insurance coverage Departments: State insurance coverage departments are liable for regulating insurance coverage firms inside their jurisdiction. These departments provide assets and knowledge tailor-made to the precise laws and practices of their state. They’re a dependable supply for coverage particulars.

Discovering Credible Web sites Associated to Hole Insurance coverage

Dependable web sites provide an enormous repository of data on hole insurance coverage. Selecting reliable sources is paramount to creating knowledgeable selections.

- Insurance coverage Firm Web sites: Insurance coverage firms themselves usually present details about hole insurance coverage on their web sites. These assets can Artikel their particular insurance policies and protection particulars. Rigorously overview the wonderful print, and all the time take into account that this data is introduced in a means that’s favorable to the corporate.

- Unbiased Monetary Advisor Web sites: Unbiased monetary advisors who focus on insurance coverage can provide insights and views on hole insurance coverage, usually offering comparisons between completely different protection choices and illustrating the potential advantages and disadvantages.

Desk of Hyperlinks to Useful Web sites and Organizations

The next desk supplies hyperlinks to some respected web sites and organizations providing data on hole insurance coverage.

| Web site/Group | Hyperlink |

|---|---|

| Insurance coverage Info Institute (III) | [Insert III Link Here] |

| Shopper Monetary Safety Bureau (CFPB) | [Insert CFPB Link Here] |

| Nationwide Affiliation of Insurance coverage Commissioners (NAIC) | [Insert NAIC Link Here] |

| Shopper Stories | [Insert Consumer Reports Link Here] |

Abstract

In conclusion, verifying hole insurance coverage protection includes reviewing coverage paperwork, contacting your insurer, and understanding the nuances of your particular coverage. By proactively checking for hole insurance coverage, you may keep away from potential monetary pitfalls and guarantee you’re adequately protected within the occasion of a car whole loss. The examples and assets offered will equip you with the data essential to confidently navigate the complexities of hole insurance coverage.

FAQ Abstract: How Do I Know If My Automotive Has Hole Insurance coverage

Does hole insurance coverage cowl harm from vandalism?

Hole insurance coverage sometimes covers the distinction between the car’s precise money worth and the excellent mortgage stability solely in instances of whole loss. Vandalism-related harm may be coated by complete insurance coverage, however not essentially by hole insurance coverage.

How lengthy does it take to obtain a spot insurance coverage payout?

The timeframe for a spot insurance coverage payout can differ relying on the insurance coverage supplier and the complexity of the declare. Elements like declare investigation and administrative procedures might affect the length. It is advisable to contact your insurance coverage supplier immediately for particular declare timelines.

What occurs if my car is stolen?

Hole insurance coverage sometimes covers the mortgage shortfall provided that the car is totaled. If the car is recovered, the insurance coverage protection might differ relying on the precise coverage phrases. It’s important to overview your coverage’s particulars concerning theft situations.

Can I add hole insurance coverage to an present coverage?

Including hole insurance coverage to an present coverage depends upon your insurer’s insurance policies and the car’s present standing. Contact your insurance coverage supplier to find out the feasibility of including hole protection to your present coverage.