The right way to know if a automotive is totaled? This is not nearly crunched metallic and insurance coverage jargon; it is about understanding your rights and making good selections after a wreck. From figuring out the extent of injury to navigating the often-confusing insurance coverage analysis course of, this information will equip you with the data to confidently decide in case your automotive is a complete loss or if repairs are possible.

We’ll discover the varied harm varieties, analyze restore prices, and delve into the insurance coverage firm’s standards for declaring a automotive totaled. We’ll additionally cowl various options, authorized issues, and essential documentation steps to make sure a clean declare course of. Let’s dive in!

Figuring out Injury Sorts

Yo, peeps! Determining if a automotive’s totaled ain’t rocket science, however figuring out the several types of harm and their severity ranges is essential. This helps you resolve if fixing it’s even value it. Let’s break it down.

Widespread Injury Sorts

Understanding the completely different sorts of injury a automotive can undergo is essential for figuring out if repairs are possible. Completely different elements of the automotive are weak to numerous sorts of injury, and a few are extra vital than others.

| Injury Kind | Description | Typical Severity Indicators |

|---|---|---|

| Body Injury | Injury to the automotive’s structural body, which is the spine of the car. That is usually essentially the most severe harm. | Bent or twisted body, seen cracks, misaligned parts. |

| Engine Injury | Issues with the engine, whether or not it is inside parts or exterior harm. | Vital oil leaks, uncommon noises, incapability to start out, damaged belts or hoses, main inside harm seen on inspection. |

| Vital Physique Injury | Injury to the outside physique panels, together with dents, scratches, and main physique panel harm. | Vital dents or holes, crushed sections, body distortion from impression, main panel harm, extreme rust or corrosion. |

| Inside Injury | Injury to the automotive’s inside, together with seats, dashboard, and electronics. | In depth harm to seats, steering wheel, dashboard, damaged or broken electronics, ripped upholstery. |

| Electrical System Injury | Injury to the automotive’s electrical parts, akin to wiring, fuses, and electronics. | Malfunctioning dashboard lights, unresponsive electronics, issue with lighting, uncommon electrical noises, malfunctioning {of electrical} equipment. |

Severity Ranges

Injury severity is a vital think about figuring out if a automotive is totaled. Minor harm can usually be repaired simply and affordably, whereas extreme harm will be prohibitively costly and even inconceivable to repair.

- Minor: This sometimes entails beauty harm like scratches or minor dents. Suppose a fender bender, or a bit ding on the bumper.

- Average: Average harm would possibly embrace extra in depth dents, a bent body, or just a few damaged inside elements. Contemplate a automotive that is been hit by a smaller object, like a motorbike.

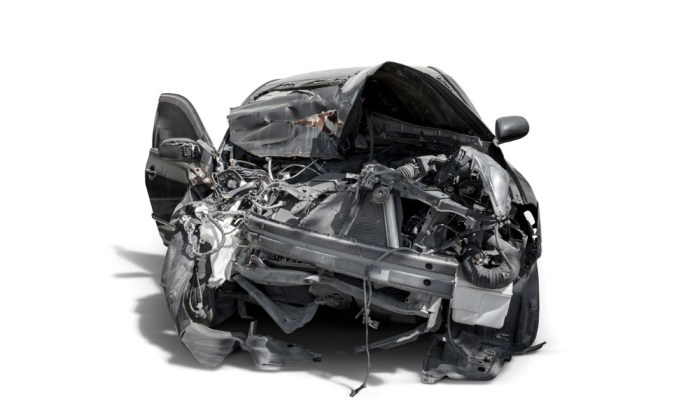

- Extreme: That is the place the harm will get actually problematic. Main physique harm, engine harm, or important body harm falls into this class. Think about a automotive that is been in a high-speed accident, or one which’s been utterly totaled by a extreme crash.

Restore Value Comparability

This desk compares the potential restore prices for various harm eventualities, which may also help you resolve if fixing it’s value it.

| Injury State of affairs | Estimated Restore Value | Is it Value-Efficient? |

|---|---|---|

| Minor physique harm (fender bender) | Rp 2,000,000 – Rp 5,000,000 | Probably sure |

| Average body harm (small accident) | Rp 5,000,000 – Rp 10,000,000 | Perhaps, will depend on the severity and elements availability |

| Extreme engine harm (complete engine alternative) | Rp 10,000,000 – Rp 20,000,000+ | Probably no |

| Whole physique harm (main accident) | Rp 20,000,000+ | Probably no |

Be aware: These are simply estimates. Precise restore prices will differ relying on the particular harm, elements availability, and mechanic’s charges.

Assessing Restore Prices

Yo, so you bought a crashed trip? Determining restore prices is essential, fam. It isn’t simply in regards to the harm; it is in regards to the $$$ concerned. Figuring out the elements that play a task in pricing can prevent from getting ripped off by some shady mechanics. Let’s dive in.

Components Influencing Restore Prices

Understanding the elements that impression restore prices is essential to getting a good value. Various things could make an enormous distinction within the ultimate invoice, from the age of your trip to the place you reside.

- Car Age: Older vehicles usually have harder-to-find elements, which drives up the worth. Plus, the know-how is likely to be outdated, that means repairs may very well be extra complicated and costly.

- Make and Mannequin: Some vehicles are simply dearer to repair than others. Particular elements is likely to be uncommon or custom-made, pushing up the restore prices.

- Components Availability: If the elements in your automotive are available, the restore is normally cheaper. But when they’re uncommon, the associated fee will improve considerably. Consider it like discovering a limited-edition sneaker; it is gonna value extra.

- Labor Charges: Mechanics’ hourly charges differ drastically relying on location and expertise. A extremely expert mechanic in an enormous metropolis will probably cost greater than a more recent one in a smaller city.

- Geographic Location: The price of labor and elements can differ drastically between states and even cities. A restore in a serious metropolitan space is commonly dearer than one in a rural space.

Estimating Restore Prices Based mostly on Injury Sorts

Estimating restore prices entails wanting on the extent of the harm. Several types of harm have completely different value tags. For instance, a fender bender will value method lower than a totaled entrance finish.

- Minor Injury: If it is only a scratch or a dent, the restore is normally easy and reasonably priced. Consider it as a small beauty repair.

- Average Injury: If elements must be changed or the body is compromised, the associated fee will increase. Count on a major restore invoice if the harm is reasonable.

- Main Injury: If the automotive’s structural integrity is severely compromised, anticipate excessive restore prices. Generally, it is cheaper to get a brand new automotive than to repair a majorly broken one.

Evaluating Restore Store Quotes

Getting quotes from completely different restore retailers is important for locating the very best deal. Do not accept the primary quote you get; store round.

- A number of Quotes: Do not restrict your self to only one or two retailers. Get quotes from a number of restore retailers to see how the pricing varies.

- Detailed Quotes: Evaluate the specifics of every quote, such because the elements listed, labor hours, and any hidden charges. Search for transparency and readability within the quotes.

Instance Restore Quotes and Interpretation

Restore quotes are paperwork that element the estimated prices for repairs. They supply a breakdown of all of the elements and labor concerned within the restore course of.

“Instance Restore Quote:

Half A

$100

Half B

$200

Labor (4 hours)

$150/hr = $600

Whole Estimate

$900″

This instance reveals the elements wanted, the labor hours, and the full value. All the time scrutinize these quotes for accuracy and readability. Do not hesitate to ask questions if something is unclear.

Insurance coverage Analysis Procedures

Yo, so that you crashed your trip and now the insurance coverage recreation is on. Determining in case your automotive’s totaled is essential, proper? It is like an entire course of, and the insurance coverage firm’s acquired their very own methods of figuring issues out. Let’s break it down.Insurance coverage corporations have a reasonably customary methodology for deciding if a automotive is a write-off.

They’re wanting on the harm, the restore prices, and the worth of the automotive to see if it is value fixing. This complete course of normally entails an expert, known as an adjuster, who involves the scene and does a correct evaluation.

Insurance coverage Adjuster’s Position

The insurance coverage adjuster is just like the detective of the harm scene. They’re those who bodily examine the automotive, assess the harm, after which suggest the subsequent steps. They collect details about the accident, the automotive’s situation, and the potential restore prices. They make a radical report that types the idea of the insurance coverage firm’s choice.

Standards for Whole Loss Willpower

Insurance coverage corporations use a number of elements to resolve if a automotive is totaled. These aren’t simply random guidelines; they’re primarily based on the cost-effectiveness of repairs.

- Extent of Injury: Main harm like body harm, important physique harm, or extreme engine harm usually results in a totaled verdict. Take into consideration dents which might be method too large, a busted body, or a totaled engine. The extra elements want changing, the extra probably it’s to be a complete loss.

- Restore Prices: The fee to repair the automotive is in comparison with the automotive’s present market worth. If the restore prices are near or exceed the automotive’s worth, it is extra prone to be declared a complete loss. For instance, think about a crash the place fixing the automotive would value greater than the automotive’s value now. That is an enormous purple flag.

- Market Worth: The present market worth of the automotive performs an enormous position. If the harm considerably reduces the automotive’s worth, it is likely to be seen as a complete loss, even when the restore prices are comparatively low. As an illustration, a classic automotive with excessive worth is likely to be totaled even with seemingly minor harm that will be simply fixable on a more recent mannequin.

- Insurance coverage Coverage Protection: Completely different insurance coverage insurance policies have completely different protection limits. Some insurance policies may need a decrease threshold for declaring a automotive totaled. This will depend on the kind of protection you might have. In case you’ve acquired a fundamental coverage, the full loss threshold is prone to be decrease than when you have complete protection.

Completely different Insurance coverage Insurance policies and Protection

Understanding the kind of insurance coverage you might have is essential. Completely different insurance policies have completely different implications for what’s lined and what’s not.

- Collision Protection: This covers harm to your automotive from a collision with one other car or object. That is usually separate from complete protection. It’s activated if you happen to trigger an accident or are concerned in a crash.

- Complete Protection: This covers harm to your automotive from varied causes, akin to hail harm, fireplace, theft, or vandalism. This protection is activated for issues aside from accidents with different automobiles or objects.

- Legal responsibility Protection: This coverage covers damages you trigger to a different particular person’s car. This isn’t about your automotive’s damages however the damages triggered to others.

- Vital Be aware: The precise standards and procedures can differ between insurance coverage corporations. All the time seek the advice of along with your insurance coverage supplier or adjuster for essentially the most up-to-date and exact data relating to your particular case. The main points could also be completely different relying in your area or the actual firm.

Understanding Whole Loss Standards

Yo, what’s up, peeps? So, you bought a wreck, and now you are tryna work out if it is a complete loss. Insurance coverage corporations ain’t enjoying video games; they gotta be certain they are not getting ripped off. This part breaks down the particular standards they use to resolve in case your trip is toast.

Insurance coverage Firm Whole Loss Standards

Insurance coverage corporations use a multi-faceted strategy to find out if a car is a complete loss. It isn’t simply in regards to the dents and dings; it is in regards to the total cost-effectiveness of restore. They contemplate a number of key elements to keep away from pointless payouts.

- Extent of Injury: This goes past superficial scratches. Main structural harm, body points, and in depth part harm all issue into the equation. Suppose bent frames, mangled bumpers, or an entire entrance finish that is been squished. Even when the automotive appears okay on the surface, main inside harm could make it a complete loss.

- Restore Prices: Insurance coverage corporations meticulously analyze the restore prices. They evaluate the estimate with the car’s present market worth. If fixing it up prices greater than the automotive is value, it is usually declared a complete loss. That is the place the idea of financial viability comes into play.

- Car’s Situation Previous to the Accident: The automotive’s pre-accident situation issues. If the automotive was already in poor form (e.g., rusted, broken, or needing a number of upkeep), the insurance coverage firm would possibly contemplate the restore prices increased, probably resulting in a complete loss choice.

- Car’s Market Worth: The insurance coverage firm appears on the market worth of the automotive mannequin. A more recent, dearer automotive mannequin is likely to be deemed a complete loss extra simply if restore prices are excessive relative to its worth.

Financial Viability

Financial viability is the cornerstone of a complete loss dedication. It is a comparability between the estimated restore prices and the car’s present market worth. If the restore prices exceed the car’s value, it is usually deemed uneconomical to restore. Consider it like this: is it value spending extra to repair the automotive than what it is really value?

“Financial viability is the precept of deciding if the price of restore outweighs the worth of the car.”

Whole Loss Examples

Listed here are some examples of automobiles that have been declared totaled, and the the explanation why:

- A 2015 Honda Civic with a smashed entrance finish and body harm. Restore prices exceeded the automotive’s market worth, making it a complete loss.

- A 2010 Toyota Camry with important flood harm and in depth inside water harm. The restore prices to switch the affected elements and the labor related to drying and repairing the automotive have been substantial, surpassing its market worth.

Comparability of Whole Loss Standards Throughout Insurance coverage Corporations

Completely different insurance coverage corporations may need barely completely different standards for figuring out a complete loss. Nonetheless, the core ideas stay the identical.

| Insurance coverage Firm | Extent of Injury Standards | Restore Value Standards | Car Worth Standards |

|---|---|---|---|

| Firm A | Structural harm, in depth physique harm | Restore prices exceeding 80% of car worth | Present market worth under 50% of authentic buy value |

| Firm B | Vital body harm, electrical system points | Restore prices exceeding 75% of car worth | Present market worth under 60% of authentic buy value |

| Firm C | Whole engine and transmission alternative | Restore prices exceeding 90% of car worth | Present market worth under 70% of authentic buy value |

Documentation and Proof

Yo, so that you wanna be certain your declare goes clean? Documentation is essential, fam. It is just like the receipts in your wrecked trip. With out correct proof, insurance coverage may not even bat an eye fixed. So, let’s get all the way down to brass tacks.

Significance of Documenting Injury

Strong documentation is essential for a profitable insurance coverage declare. It acts as concrete proof of the harm, serving to insurance coverage adjusters assess the state of affairs objectively. This prevents any potential misunderstandings or delays, guaranteeing a quicker and extra easy declare course of. Consider it as your proof in court docket, however in your automotive.

Photographing and Videographing the Injury

Capturing the harm is important. Use your cellphone, bruh. Get a number of angles, displaying all of the dents, scratches, and damaged elements. Deal with the harm clearly, not simply the final view. This fashion, the insurance coverage adjuster will get a full image of the state of affairs.

Embrace particulars just like the automotive’s VIN, the date, time, and placement of the accident (if relevant). If potential, get photographs of the encircling space, displaying the context of the harm. This will also be useful if there have been witnesses.

Examples of Documentation to Hold

Hold copies of every thing, my dude. This contains photographs, movies, police studies (if relevant), witness statements, and restore quotes. These paperwork will type the inspiration of your declare. When you have any communication with the insurance coverage firm, save these emails and textual content messages too. Having all these items available will make the entire course of method simpler.

Guidelines of Important Paperwork

- Images and movies of the harm (a number of angles, close-ups, and total view). That is the primary and most necessary piece of proof.

- Police report (if relevant). It is a essential doc detailing the accident’s specifics.

- Witness statements (if relevant). Get contact data from anybody who noticed the accident.

- Restore quotes from trusted mechanics. Get just a few quotes to point out the potential restore prices. This helps the insurance coverage adjuster perceive the restore extent.

- Copies of your insurance coverage coverage and any related paperwork.

- VIN (Car Identification Quantity) of the automotive.

- Proof of possession (automotive registration or title). That is wanted for verification.

- An in depth description of the harm. Write down every thing you bear in mind. That is particularly helpful if the harm is minor.

- A listing of any private belongings broken contained in the automotive.

- Contact data of the insurance coverage firm.

This guidelines is your information. Be sure to have all these paperwork available once you file a declare. This may prevent a ton of complications down the highway.

Alternate options to Whole Loss

Yo, peeps! So, your trip’s lookin’ a lil’ banged up, and insurance coverage is likely to be sayin’ it is a complete loss. However do not throw within the towel simply but! There are methods to struggle in your automotive, and we’re gonna break down the choices.Insurance coverage corporations usually attempt to lowball you, however you gotta stand your floor. Figuring out your rights and understanding the restore course of is essential to getting a good deal.

We’ll stroll you thru negotiating with the insurance coverage firm and getting the very best restore estimate potential.

Negotiating Restore Prices with the Insurance coverage Firm

Insurance coverage corporations have their very own formulation for figuring out restore prices. You might want to perceive these processes to successfully negotiate. Generally, they could provide a decrease restore estimate than what’s really wanted. That is the place you are available in. Researching comparable restore quotes from trusted mechanics in your space is important to counter their figures.

- Be ready to current proof. Gather all restore quotes, photographs of the harm, and any related documentation. That is essential for constructing a powerful case.

- Be assertive however well mannered. Clearly talk your issues and the the explanation why you imagine the restore value estimate is simply too low. Do not be afraid to ask questions.

- Perceive the restore course of. Insurance coverage corporations could attempt to push you right into a alternative choice. Perceive your rights, the full loss standards, and the potential prices of restore earlier than accepting a settlement.

- Get a number of quotes. Do not simply depend on the insurance coverage firm’s estimate. Search estimates from dependable restore retailers to see if the estimate is truthful. This may also help you negotiate a greater deal.

Getting a Restore Estimate for a Broken Car

Getting an correct restore estimate is paramount. A shoddy estimate can value you large time. It isn’t nearly discovering a store; it is about selecting a good one that may present a clear and trustworthy evaluation of the harm.

- Search for licensed restore retailers. Licensed retailers normally have a greater understanding of insurance coverage claims processes and are extra probably to offer correct estimates.

- Get detailed written estimates. Do not accept verbal agreements. An in depth written estimate, with photos and descriptions of the harm, is important in your information.

- Evaluate a number of estimates. Evaluating quotes from a number of respected retailers may also help you establish a good and lifelike restore value.

- Ask questions. Do not be afraid to ask questions in regards to the proposed repairs and the estimated time required to finish them. Ask in regards to the elements used and their origins. That is particularly essential for guaranteeing high quality and longevity.

Implications of Accepting or Rejecting an Insurance coverage Supply, The right way to know if a automotive is totaled

Deciding whether or not to simply accept or reject an insurance coverage provide for restore or alternative entails an important evaluation of your monetary state of affairs and the potential dangers.

- Accepting a restore provide means your car is prone to be fastened, however the associated fee is likely to be considerably lower than the car’s value.

- Rejecting a restore provide may imply it’s important to discover various choices like discovering an appropriate alternative automotive or negotiating the next restore quantity.

- Be cautious of accepting a complete loss settlement if you happen to can restore the automotive at a decrease value. It is necessary to think about all related prices, together with towing and administrative charges.

- Weigh the potential restore prices in opposition to the present market worth of your automotive to make an knowledgeable choice. A automotive is likely to be value greater than its potential restore value.

Authorized Issues

Yo, peeps, let’s discuss legislation. Navigating insurance coverage claims for a totaled trip can get difficult, particularly if issues do not go as deliberate. Figuring out your rights and the authorized course of is essential to avoiding drama and getting the very best consequence. This ain’t no recreation, so concentrate.

Authorized Rights in Car Injury Claims

Understanding your authorized rights is essential when coping with insurance coverage corporations. These rights aren’t some secret membership; they’re established to guard you. They dictate how the declare needs to be dealt with and what you are entitled to.

- You will have the appropriate to obtain a good evaluation of your car’s harm. This implies the insurance coverage firm cannot simply slap a “complete loss” label in your trip and not using a correct analysis.

- You are entitled to documentation of the harm evaluation, together with photographs and an in depth report. This paper path is your proof if issues go south. Gotta maintain these information.

- You will have the appropriate to contest the insurance coverage firm’s choice if you happen to really feel it is unfair or inaccurate. Do not be afraid to talk up if you happen to assume one thing’s off.

Position of the Legislation in Figuring out Whole Loss

The legislation is not only a spectator on this recreation. It performs a serious position in deciding if a automotive is really totaled. Insurance coverage corporations usually depend on established standards and tips. They can not simply resolve on their very own.

- Insurance coverage corporations normally have tips primarily based on trade requirements. Consider these as the foundations of the sport, set by the legislation.

- The restore prices usually get in comparison with the automotive’s present market worth. This helps them decide if fixing it’s worthwhile. If it is too costly, it is likely to be thought of totaled.

- The quantity of injury, contemplating the structural integrity, will play a component within the evaluation. A smashed body would possibly result in a complete loss verdict.

Authorized Procedures for Disputes with Insurance coverage Corporations

Disputes with insurance coverage corporations occur. It is a part of the sport. However, you’ve got acquired choices to deal with these conditions. Do not simply allow them to stroll throughout you.

- Collect all of your documentation, from receipts to photographs, and maintain it organized. This will probably be your ammo if it’s essential struggle in your rights.

- Contemplate contacting a lawyer who makes a speciality of insurance coverage claims. They’ll advise you on the very best plan of action and symbolize you in court docket if needed. This can be a good transfer.

- Insurance coverage corporations are required to offer a transparent rationalization of their choice if you happen to disagree with it. You will have the appropriate to know

-why* they assume your automotive is totaled.

Authorized Implications of Accepting or Rejecting a Settlement

Accepting or rejecting an insurance coverage settlement has authorized ramifications. Think twice earlier than making a choice. It isn’t simply in regards to the cash; it is about your rights.

- Accepting a settlement provide, even when it feels low, would possibly imply you’ll be able to’t pursue additional motion. You’ve got gotta assume twice about this.

- Rejecting a proposal may result in a proper dispute decision course of, like mediation or arbitration. This might imply extra effort and time, however it may additionally result in a greater consequence.

- Consulting a authorized skilled earlier than accepting or rejecting a settlement is very really helpful. They’ll advise you on the potential implications and information you towards the very best choice.

Closing Notes: How To Know If A Automobile Is Totaled

So, easy methods to know if a automotive is totaled? Finally, the choice rests on a cautious analysis of the harm, restore prices, and the insurance coverage firm’s evaluation. This information has offered a complete overview of the method, arming you with the data to make knowledgeable selections. Bear in mind, thorough documentation and a transparent understanding of your rights are key to a profitable declare.

In case you’re unsure about any step, search skilled recommendation. Good luck!

Fast FAQs

What if my automotive is broken however not totaled?

Even with important harm, your automotive is likely to be repairable. The bottom line is evaluating restore prices to the automotive’s present worth. If the repairs are lower than the automotive’s worth, it is value pursuing repairs.

How do I get a restore estimate?

Contact a number of respected restore retailers and request detailed quotes. Evaluate these quotes to make sure you’re getting a good value. Search for retailers with expertise in dealing with comparable kinds of harm.

What paperwork do I want for an insurance coverage declare?

Hold copies of your insurance coverage coverage, the police report (if relevant), photographs/movies of the harm, and any pre-accident inspection studies. A guidelines is obtainable on-line and will probably be offered upon request.

Can I negotiate restore prices with the insurance coverage firm?

Sure, you’ll be able to attempt to negotiate. Collect data on comparable restore prices, and current your case to the adjuster. Be ready to offer supporting documentation to again up your claims.