Lack of use protection automobile insurance coverage supplies monetary help when your car is unusable because of injury or accident. This vital part of your coverage typically covers bills like rental automobiles, misplaced wages, and different related prices, guaranteeing a easy transition when your car is out of fee. Understanding the nuances of this protection is important for navigating unexpected circumstances, guaranteeing monetary safety and minimizing disruptions.

The interaction of assorted components, from the kind of injury to the specifics of your coverage, determines the extent of your protection. Understanding these intricacies permits for knowledgeable selections and proactive planning, mitigating potential monetary burdens.

This information delves into the intricacies of lack of use protection, exploring its varied sides, from its definition and kinds to say procedures and exclusions. By analyzing the interaction between protection choices, exclusions, and the declare course of, you acquire a deeper understanding of how this protection capabilities throughout the broader context of automobile insurance coverage.

Defining Lack of Use Protection: Loss Of Use Protection Automobile Insurance coverage

Lack of use protection in automobile insurance coverage is sort of a security web, offering monetary help when your automobile is out of fee because of an accident or coated occasion. It is a essential part of complete insurance coverage, serving to you navigate the sudden prices whereas your car is being repaired or changed. Think about a sudden breakdown, stopping you from commuting to work.

This protection will help you cowl the prices of different transportation, holding your life on observe.This protection helps you handle bills whereas your car is out of motion. It is designed to ease the monetary burden of being unable to make use of your automobile, providing varied advantages tailor-made to your particular wants. Several types of lack of use protection present various levels of monetary help.

Lack of Use Protection Sorts

Lack of use protection typically consists of a number of choices to assist with transportation bills throughout a coated incident. These choices cater to completely different wants and circumstances.

- Rental Reimbursement: The sort of protection compensates for the price of renting a brief car whereas your automobile is being repaired. This may be extraordinarily useful for sustaining your every day routine, whether or not for work, errands, or private commitments. It is a direct and tangible advantage of lack of use protection. This profit will help ease the monetary pressure related to changing your transportation wants.

- Different Choices: Moreover rental reimbursement, some insurance policies may embody protection for extra bills like non permanent transportation prices, equivalent to utilizing a ride-sharing service or a public transport system. This may very well be particularly priceless if it’s important to transport items or individuals. This may present further help, making the scenario extra manageable in the course of the restore or alternative interval.

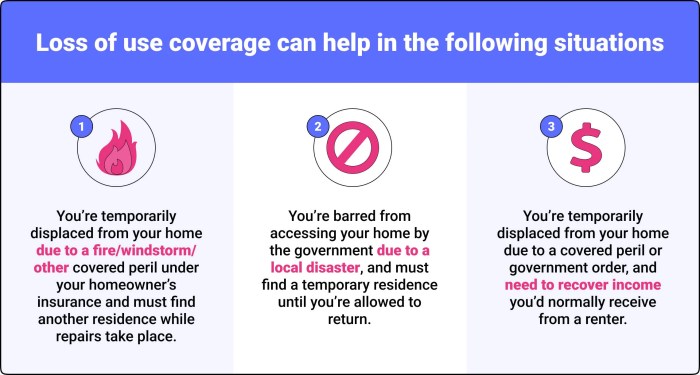

Circumstances for Lack of Use Protection

Lack of use protection usually applies when your automobile is deemed unusable because of a coated occasion. These occasions are sometimes accidents, however also can embody issues like vandalism and even pure disasters. For instance, in case your automobile is broken past restore in a fireplace, lack of use protection would doubtless apply. It’s at all times finest to test your coverage particulars for particular exclusions and limitations.

Comparability of Lack of Use Protection Choices

| Protection Kind | Description | Advantages | Limitations |

|---|---|---|---|

| Rental Reimbursement | Covers the price of renting a substitute car whereas your automobile is being repaired or changed. | Gives a handy and dependable various transportation in the course of the restore interval. | Might have every day or weekly limits on rental reimbursement quantities. Insurance policies may specify the kinds of automobiles that qualify for reimbursement. |

| Different | Covers further transportation bills like ride-sharing or public transport. | Presents flexibility in selecting transportation choices, particularly if a rental is unavailable or unsuitable. | The reimbursement quantity is usually primarily based on the precise bills incurred, however insurance policies might set limits on whole reimbursement. The precise technique of reimbursement may range. |

Protection Exclusions and Limitations

Lack of use protection, whereas a useful perk, ain’t a magic bullet. It is received some limitations, similar to every part else on this world. Understanding these exclusions and limitations is essential to creating certain you are not caught off guard when a mishap strikes. Like a wise palemban service provider, it is advisable to know the deal earlier than you signal the contract!

Widespread Exclusions

Lack of use protection typically comes with an inventory of exclusions. These are conditions the place the protection will not kick in, so it is important to know what they’re. It is like figuring out the “no-go” zones in your insurance coverage coverage.

- Pre-existing injury: In case your automobile already had a pre-existing concern that is now making it unusable, the lack of use protection may not cowl it. Think about you had a leaky radiator for some time and it lastly precipitated your automobile to interrupt down. The protection may not cowl the time you could not use the automobile if it was a pre-existing downside.

- Harm attributable to your actions: If the injury to your automobile is a results of your individual negligence or recklessness, lack of use protection may not apply. Like for those who parked your automobile in a flood zone and it received flooded, the insurance coverage firm may not cowl the time you could not use it.

- Harm attributable to battle or terrorism: Protection normally excludes occasions like battle or terrorism. It is a fairly frequent exclusion in most insurance coverage insurance policies, because the dangers are large and unpredictable.

- Harm attributable to put on and tear: Common put on and tear in your automobile, like regular use and growing old, is not usually coated by lack of use protection. Consider it like regular automobile upkeep, like altering your oil.

- Harm attributable to neglect or lack of upkeep: In case your automobile is not maintained correctly and that results in injury, lack of use protection most likely will not cowl the time you may’t use it.

Limitations in Particular Eventualities

The period of time lack of use protection applies can range relying on the circumstances. It isn’t at all times a straight-forward “this many days” kind of deal.

- Restore time: The protection typically solely applies for the time it takes to restore your automobile, not for any additional time you may want to rearrange transportation. It is like in case your automobile wants a brand new engine, the protection may solely pay for the time it takes to put in the brand new engine, not the additional time it is advisable to discover various transportation.

- Different transportation: You probably have different transportation choices (like a spare automobile or public transport), the period of time coated for lack of use could be lowered. It is because you may have a technique to get round whereas your automobile is being fastened.

- Whole loss: In case your automobile is deemed a complete loss, the lack of use protection may solely cowl a particular interval, or it may not cowl it in any respect. It is because the insurance coverage firm is actually changing the automobile, and the worth of utilizing the outdated one is not as excessive as if it is simply being repaired.

Conditions The place Protection May Not Apply

There are conditions the place lack of use protection merely will not cowl your bills.

- Delays in restore: If there are sudden delays in getting your automobile repaired, the lack of use protection may not prolong past a sure interval. This may very well be because of components shortages or unexpected problems in the course of the restore course of.

- Unexpected circumstances: In case you expertise points that weren’t anticipated (like a significant climate occasion that impacts the restore course of), the protection may not apply to the additional time it takes to get your automobile again on the highway. It is because the insurance coverage firm is not liable for points past their management.

Abstract Desk

| Exclusion Class | Instance | Rationalization |

|---|---|---|

| Pre-existing Harm | Leaking radiator inflicting breakdown | Harm current earlier than the coated occasion. |

| Negligence | Parking in a flood zone | Harm attributable to your actions. |

| Acts of Warfare/Terrorism | Harm throughout a battle | Protection normally excludes these occasions. |

| Put on and Tear | Regular automobile deterioration | Common use and growing old aren’t coated. |

| Lack of Upkeep | Ignoring mandatory upkeep | Harm attributable to neglecting automobile care. |

Declare Course of and Procedures

Submitting a lack of use declare is usually a bit like navigating a Palembang river, typically winding and typically easy. However don’t be concerned, we’ll information you thru the method step-by-step, making it as easy as a conventional Palembang boat trip. Understanding the declare course of ensures a hassle-free expertise and a swift decision.This part particulars the method of submitting a lack of use declare, from the preliminary steps to the anticipated timeframe.

We’ll Artikel the required documentation and make clear the timeline, guaranteeing a clear and environment friendly declare decision. This may make the entire course of much less daunting and extra comprehensible.

Declare Submitting Steps

The declare course of is structured in a method that is simple to comply with. Every step is designed to streamline the method and guarantee a well timed decision. We have laid out the steps for readability.

- Report the Loss: Instantly report the incident to your insurance coverage supplier. That is essential for initiating the declare course of. Contact the insurance coverage firm utilizing the quantity in your coverage doc or the designated channels. A well timed report ensures a easy course of. For instance, in case your automobile is broken in a site visitors accident, report it instantly to your insurer.

- Collect Required Paperwork: That is like assembling the elements for a scrumptious Palembang dish. The mandatory paperwork makes the declare course of run easily. You will want your coverage particulars, proof of possession, and an in depth report of the incident. If there are witnesses, their statements are useful too.

- Submit the Declare Type: Fill out the lack of use declare kind precisely and utterly. This manner is your official request to the insurance coverage firm. Make sure you present all of the required particulars to keep away from any delays in processing.

- Present Supporting Paperwork: Connect any supporting paperwork, equivalent to police experiences, restore estimates, or medical payments if relevant. These paperwork help your declare and supply a transparent image of the scenario.

- Await Analysis: The insurance coverage firm will consider your declare primarily based on the supplied data and paperwork. This analysis course of can take time. Be affected person and comply with up together with your insurer if mandatory. Like a patiently crafted Palembang batik, the analysis course of takes time to finish.

- Settlement: As soon as the declare is permitted, the insurance coverage firm will prepare the settlement. This might contain offering compensation for lack of use, or arranging non permanent transportation. The settlement quantity will depend upon the main points of your declare.

Documentation Required

To expedite the declare course of, guarantee you may have the required paperwork available. The next paperwork are essential for a lack of use declare:

- Coverage Particulars: Your insurance coverage coverage doc, together with coverage quantity, protection particulars, and call data.

- Proof of Possession: Car registration, possession certificates, or some other related doc proving your possession of the car.

- Incident Report: An in depth report of the incident, together with date, time, location, and outline of the occasion. This may embody a police report if one was filed.

- Restore Estimates: If relevant, restore estimates for the broken car, or a letter from the mechanic describing the injury. This helps in assessing the full restore price and the lack of use.

- Medical Payments (if relevant): In instances the place the accident includes accidents, medical payments are important to help the declare.

Timeline for Processing

The timeline for processing a lack of use declare can range relying on a number of components. These components embody the complexity of the declare, the provision of supporting paperwork, and the insurer’s inside procedures.

| Step | Description | Required Paperwork | Timeline |

|---|---|---|---|

| Report the Loss | Preliminary contact with the insurance coverage firm | Coverage particulars | Inside 24 hours |

| Declare Submission | Submission of the declare kind and supporting paperwork | Declare kind, supporting paperwork | Inside 5 enterprise days |

| Analysis | Assessment and evaluation of the declare by the insurer | All supporting paperwork | 7-14 enterprise days |

| Settlement | Settlement of the declare | Authorised declare paperwork | 7-21 enterprise days |

Evaluating with Different Coverages

Hai, kawan-kawan! Kita mau bahas lebih dalam nih, tentang perbandingan antara asuransi kehilangan penggunaan (lack of use) dengan jenis asuransi mobil lainnya, seperti complete dan collision. Penting banget nih buat kita semua, supaya kita paham mana yang paling cocok buat mobil kesayangan kita.Understanding the nuances of various automobile insurance coverage coverages is essential for making knowledgeable selections. Figuring out which protection most accurately fits your wants helps you keep away from monetary burdens and preserve peace of thoughts.

Lack of Use Protection In comparison with Complete

Lack of use protection and complete protection tackle completely different points of automobile possession. Complete protection, then again, primarily focuses on damages attributable to perils like storms, vandalism, or accidents involving animals. Lack of use protection, in distinction, steps in when your car is broken and unavailable to be used, whatever the trigger.

- Lack of use protection kicks in when your automobile is broken and unusable, no matter who precipitated the injury. This may very well be because of a complete declare occasion, or a myriad of different conditions.

- Complete protection, then again, immediately addresses the restore or alternative of the broken car. It is like a direct repair for the injury.

Lack of Use Protection In comparison with Collision

Collision protection and lack of use protection are each triggered by accidents, however they’ve distinct roles. Collision protection primarily offers with the bodily injury attributable to a collision, whereas lack of use protection addresses the consequential monetary losses from not with the ability to use your car.

- Collision protection particularly focuses on the repairs or alternative prices in case your car is broken in a collision, regardless of whose fault it’s.

- Lack of use protection, nonetheless, steps in to compensate for the monetary hardship you face because of not accessing your automobile. This might embody issues like transportation prices or misplaced wages.

Comparative Desk

| Protection Kind | Key Options | Benefits | Disadvantages |

|---|---|---|---|

| Lack of Use | Covers misplaced revenue, transportation bills, and different prices when your automobile is unusable because of injury. | Gives monetary safety throughout a interval of car unavailability. Very helpful for those who rely in your automobile for work or different important actions. | Would not immediately cowl the price of repairs or alternative. It is a supplementary protection. |

| Complete | Covers damages from varied perils, equivalent to climate occasions, vandalism, or accidents with animals. | Gives broad safety in opposition to sudden damages. | Would not cowl the prices related to the time your car is unusable. |

| Collision | Covers damages ensuing from collisions with different automobiles or objects. | Gives safety for damages from accidents. | Would not cowl the prices related to the time your car is unusable. |

Illustrative Eventualities

Lack of use protection, a significant a part of your automobile insurance coverage, steps in when your car is unavailable to be used because of unexpected circumstances. Understanding these eventualities will aid you recognize the peace of thoughts this protection provides. Think about with the ability to proceed your every day life with out the monetary pressure of a automobile mishap, because of the help of your coverage!Lack of use protection kicks in when your car is out of fee because of occasions like accidents, theft, or injury requiring restore.

It helps compensate for the bills you incur whereas your automobile is unusable. Understanding the way it works in several conditions will present priceless insights into the advantages and limitations of this protection.

Car Totaled in an Accident

Lack of use protection is especially helpful when your car is deemed a complete loss in an accident. This implies the restore price exceeds the car’s worth, making repairs impractical.

-

Your automobile is totally totaled in a fender bender. It’s essential to get round, and the restore prices are astronomical. Lack of use protection will aid you cowl the price of various transportation, like taxis or ride-sharing companies, whereas your car is being changed. This protection also can aid you cowl the price of any mandatory bills.

The precise quantity of compensation will rely in your coverage phrases and the bills incurred.

- The insurance coverage firm deems the car past restore after a major accident. This protection helps you cowl the price of a rental automobile, public transport, or ride-sharing companies whereas the insurance coverage firm processes the declare and arranges for a brand new car. The potential prices embody rental charges, gasoline bills, and potential inconvenience.

- The accident includes substantial injury. In case your automobile is totaled, your lack of use protection will give you a financial compensation to cowl the non permanent inconvenience attributable to the shortcoming to make use of your automobile. The profit lies in avoiding the disruption in your every day life whereas the declare is being processed and a brand new car is being acquired.

Theft of Your Car

Even when your automobile is stolen, lack of use protection is there that will help you. This protection will help you with the monetary implications whereas your car is recovered or changed.

- Your automobile is stolen, leaving you stranded. Lack of use protection will present compensation for various transportation bills, together with ride-sharing companies, taxis, or public transportation. This protection will aid you preserve your every day routine whereas ready for the authorities to recuperate your automobile or the insurance coverage firm to settle the declare.

- Your automobile is stolen and broken. The protection supplies help with non permanent transportation prices whereas the police examine and your car is recovered or repaired. It may possibly additionally assist with any further prices related to the theft, equivalent to non permanent lodging or different bills.

- The car is stolen and unrecoverable. Lack of use protection will help you with the non permanent transportation prices whilst you receive a brand new car or till the police discover the stolen car. This protection will help you in sustaining your every day life and routine.

Car Harm Requiring Prolonged Restore

Generally, a automobile accident or incident necessitates in depth repairs.

- Your automobile wants in depth repairs. Lack of use protection will assist cowl the price of non permanent transportation whereas your car is within the store. This will help you keep away from monetary burdens and guarantee you may proceed your every day routines.

- The automobile is broken past restore, or a brand new half is unavailable. Lack of use protection supplies non permanent transportation options whereas the car is below restore. The potential prices embody transportation bills and different incidental prices.

- The repairs take longer than anticipated. Lack of use protection can cowl non permanent transportation bills in the course of the prolonged restore interval. This protection can forestall monetary hardship throughout a prolonged restore course of.

Significance of Understanding Phrases and Circumstances

Understanding the precise phrases and circumstances of your lack of use protection is essential.

Assessment your coverage fastidiously to know the protection limits, exclusions, and procedures. This may aid you make knowledgeable selections and make sure you get essentially the most out of your protection.

Shopper Recommendation and Suggestions

Hai semuanya! Selecting the best automobile insurance coverage lack of use protection is usually a bit tough, however don’t be concerned, we’re right here that will help you navigate the method with ease, like a seasoned Palembang driver! Understanding your choices and figuring out your rights is essential to getting the absolute best safety.This part will present sensible recommendation, guaranteeing you are well-equipped to make knowledgeable selections about lack of use protection and navigate claims processes like a professional.

Selecting the Proper Lack of Use Protection

Choosing the proper lack of use protection is essential for shielding your monetary well-being in case of an accident. Take into account the worth of your automobile, the extent of the repairs, and your potential revenue loss in the course of the restore interval. A complete protection can present a security web in case your automobile is unusable for an prolonged interval because of an accident or different coated occasion.

Do not simply seize the most affordable possibility; consider the protection limits to make sure it aligns together with your wants and expectations.

Studying Your Coverage Paperwork Fastidiously

Completely reviewing your coverage paperwork is important to understanding your rights and tasks. Pay shut consideration to the specifics of lack of use protection, together with the circumstances below which it applies, the utmost payout quantity, and any exclusions. Understanding these particulars will forestall any disagreeable surprises throughout a declare course of. Search for readability and specifics, not simply broad statements.

Ask questions if one thing is not clear.

Negotiating with Insurance coverage Corporations Throughout a Declare

When submitting a declare, a well mannered and assertive method can considerably enhance your probabilities of a beneficial consequence. Clearly and concisely current your case, documenting all related data, equivalent to restore estimates and revenue loss. Be ready to supply supporting proof. In case you really feel the insurance coverage firm is not being truthful, search skilled steerage. Bear in mind, you may have rights, and it is important to guard them.

Be skilled and chronic, but in addition affected person and understanding.

In search of Authorized Recommendation, Lack of use protection automobile insurance coverage

There are cases the place looking for authorized counsel is beneficial. In case you encounter important obstacles in the course of the declare course of, or for those who really feel the insurance coverage firm is not fulfilling their contractual obligations, looking for authorized recommendation may be useful. For instance, if the insurance coverage firm delays or denies your declare with out legitimate justification, consulting a authorized skilled is a great step.

Do not hesitate to hunt assist when mandatory. Your rights are necessary, and authorized illustration can defend them.

Illustrative Examples of Conditions Requiring Authorized Recommendation

Listed below are some examples the place looking for authorized recommendation is smart:

- The insurance coverage firm denies your declare with out a clear rationalization or justification, resulting in important monetary hardship.

- The insurance coverage firm provides a settlement quantity that falls considerably brief of the particular damages incurred, together with the lack of use.

- The insurance coverage firm refuses to compensate for misplaced revenue in the course of the interval of automobile restore, regardless of the protection explicitly together with such losses.

- The insurance coverage firm misrepresents or ignores related coverage clauses or provisions associated to your lack of use declare.

Finish of Dialogue

In conclusion, lack of use protection automobile insurance coverage is an important part of any complete car insurance coverage coverage. Understanding the scope of this protection, its potential advantages, and the accompanying limitations empowers you to make knowledgeable selections about your insurance coverage wants. Thorough analysis and cautious consideration of your particular circumstances are key to maximizing the safety this protection provides.

Bear in mind, every coverage is exclusive, and consulting your insurance coverage supplier is essential for personalised steerage.

Questions Usually Requested

What are frequent exclusions for lack of use protection?

Widespread exclusions typically embody pre-existing circumstances, intentional injury, or use of the car for unlawful actions. Coverage specifics range, so at all times seek the advice of your coverage paperwork for full particulars.

How lengthy does the declare course of usually take?

Declare processing timelines depend upon the insurance coverage firm and the complexity of the declare. Usually, it might probably vary from just a few weeks to a number of months. Elements just like the completeness of documentation and the necessity for value determinations can affect the timeframe.

What paperwork are wanted for a lack of use declare?

Important paperwork normally embody police experiences (if relevant), restore estimates, and proof of rental automobile bills. Particular necessities range by insurance coverage firm; check with your coverage for exact particulars.

How does lack of use protection examine to complete protection?

Lack of use protection addresses the monetary affect of a car being unusable, whereas complete protection usually pays for injury to your car, no matter fault. Lack of use is an ancillary profit that enhances complete protection. They perform independently, with lack of use overlaying consequential prices associated to the car’s unavailability and complete protection addressing the bodily injury to the car itself.