Low-income automotive insurance coverage Texas presents distinctive challenges for a lot of Texans. Excessive premiums typically make it tough for these with restricted incomes to afford mandatory protection. This information explores the complexities of discovering inexpensive choices, examines accessible authorities help, and highlights methods to navigate the market efficiently.

This complete useful resource will delve into the precise obstacles confronted by low-income drivers in Texas, together with the elements that contribute to excessive premiums, frequent misconceptions about insurance coverage, and the totally different types of monetary assist accessible. We can even discover insurance coverage corporations tailoring their choices to this demographic, authorities help packages, and efficient methods for locating inexpensive choices.

Overview of Low-Revenue Automobile Insurance coverage in Texas

Securing inexpensive automotive insurance coverage is a major hurdle for a lot of low-income Texans. The price of protection typically presents a considerable monetary pressure, impacting their capability to fulfill different important wants. This overview examines the challenges, contributing elements, and accessible help packages to navigate this significant facet of monetary stability.Excessive insurance coverage premiums for low-income Texans stem from a confluence of things.

These embrace the next danger of accidents as a result of elements like automobile upkeep and driving habits. Furthermore, a historical past of accidents or violations can result in increased premiums. Moreover, insurers typically base premiums on elements like location, automobile kind, and driving historical past.

Challenges Confronted by Low-Revenue Texans

Low-income Texans ceaselessly face challenges in accessing inexpensive automotive insurance coverage. Restricted monetary sources typically make it tough to afford even probably the most primary protection, impacting their capability to take care of transportation for work, faculty, and different important actions. This could result in a cycle of poverty, as employment alternatives could also be restricted with out dependable transportation. This lack of entry to insurance coverage additionally will increase the chance of monetary hardship within the occasion of an accident.

Elements Contributing to Excessive Premiums

A number of elements contribute to the elevated price of automotive insurance coverage for low-income Texans. One essential issue is the upper fee of accidents reported in areas with restricted entry to preventative upkeep and automobile repairs. Drivers in these conditions could also be extra prone to drive older, much less dependable automobiles, rising the chance of mechanical failures and accidents. Moreover, insurance coverage corporations could alter premiums primarily based on perceived danger particularly geographic areas.

Statistical information typically displays increased accident charges in these areas, resulting in increased premiums.

Widespread Misconceptions

A typical false impression is that low-income people have restricted or no choices for inexpensive automotive insurance coverage. Truly, a number of monetary help packages and reductions can be found. One other false impression is that insurance coverage protection is just too costly for low-income people. This typically overlooks the supply of inexpensive choices like liability-only insurance policies and the potential for reductions.

Monetary Help Applications

Quite a few monetary help packages exist to help low-income Texans in acquiring inexpensive automotive insurance coverage. These packages typically present subsidies or reductions on premiums. For instance, the Texas Division of Insurance coverage could provide particular packages tailor-made to low-income people. Moreover, some non-profit organizations present grants or monetary assist to assist offset the price of automotive insurance coverage. These packages goal to make sure that Texans have entry to mandatory protection, no matter their revenue stage.

Significance of Inexpensive Automobile Insurance coverage

Inexpensive automotive insurance coverage is essential for the financial well-being of Texans. Dependable transportation is significant for accessing employment, healthcare, and academic alternatives. The shortcoming to acquire insurance coverage can restrict employment choices and hinder upward mobility. This, in flip, can have a cascading impact on the financial stability of people and households. Insurance coverage supplies monetary safety within the occasion of accidents, stopping additional monetary hardship and guaranteeing a security web for people and households.

Insurance coverage Firms Concentrating on Low-Revenue Texans

Many insurance coverage corporations acknowledge the distinctive wants of low-income Texans and are actively working to supply inexpensive and accessible protection choices. This typically includes modern methods and tailor-made merchandise designed to deal with particular monetary constraints confronted by this demographic. Understanding these approaches is essential for low-income people searching for the very best safety for his or her automobiles.

Insurance coverage Firms Actively Concentrating on Low-Revenue Texans

A number of insurance coverage corporations have demonstrated a dedication to offering inexpensive auto insurance coverage to low-income Texans. These corporations typically make use of varied methods to succeed in and successfully serve this market phase.

Methods to Entice Low-Revenue Texans

Firms make the most of a multifaceted method to draw this demographic. These methods could embrace simplified coverage constructions, decrease upfront premiums, versatile cost choices, and streamlined utility processes. Moreover, some corporations associate with group organizations or provide reductions for these assembly particular standards, similar to taking part in driver security packages.

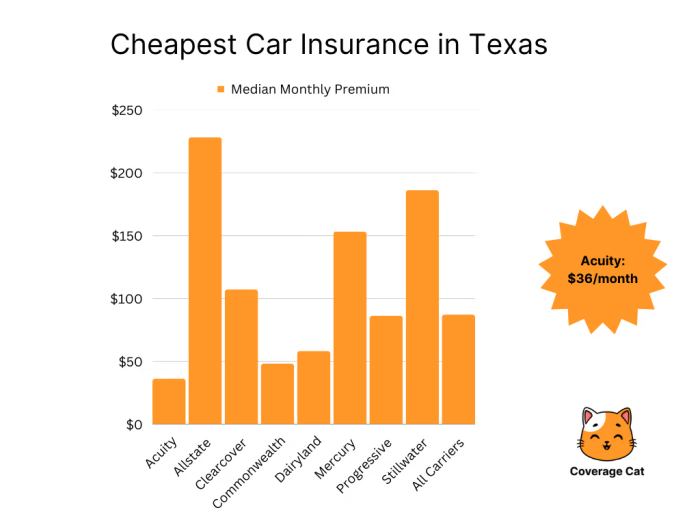

Comparability of Providers and Protection Choices

Whereas the specifics differ, insurance coverage corporations concentrating on low-income Texans usually provide a variety of protection choices. Some may deal with offering legal responsibility protection, whereas others could provide complete packages. The hot button is discovering a coverage that gives enough safety with out breaking the financial institution.

Desk Contrasting Insurance coverage Suppliers, Insurance policies, and Prices

| Insurance coverage Supplier | Coverage Sort | Protection Particulars | Estimated Value |

|---|---|---|---|

| State Farm (Low-Revenue Program) | Fundamental Legal responsibility | Covers damages to others in an accident. Might embrace restricted collision and complete protection relying on particular necessities of this system. | $300 – $600 per 12 months (estimates primarily based on common low-income Texan driver profile) |

| Farmers Insurance coverage (Finances-Pleasant Plans) | Restricted Complete | Covers damages to the insured automobile along with legal responsibility protection. Protection limits could also be decrease in comparison with customary insurance policies. | $400 – $800 per 12 months (estimates primarily based on common low-income Texan driver profile) |

| Mercury Insurance coverage (Inexpensive Auto Choices) | Fundamental Legal responsibility & Collision | Gives legal responsibility protection and a primary stage of collision protection. Deductibles could also be increased than different choices. | $500 – $900 per 12 months (estimates primarily based on common low-income Texan driver profile) |

| AAA Texas Auto Insurance coverage | Worth-Primarily based Legal responsibility | Focuses on offering inexpensive legal responsibility protection with an emphasis on simplified insurance policies and clear pricing. Further protection choices can be found at increased premiums. | $450 – $750 per 12 months (estimates primarily based on common low-income Texan driver profile) |

Notice: Estimated prices are approximations and may differ considerably primarily based on particular person driving data, automobile sorts, and particular coverage decisions. It’s essential to assessment the main points of every coverage to make sure it meets particular person wants.

Authorities Help Applications for Automobile Insurance coverage

Texas, like many states, acknowledges the monetary pressure that automotive insurance coverage can place on low-income residents. Consequently, varied authorities packages are designed to supply help and cut back the burden of insurance coverage premiums. These packages goal to make sure that entry to automotive insurance coverage will not be restricted by monetary limitations, thereby selling highway security and monetary stability for people.These government-backed packages provide essential help, making automotive insurance coverage extra inexpensive for qualifying Texans.

Understanding the eligibility necessities and utility processes is important for navigating these sources and benefiting from the help they provide. This part particulars the accessible packages, their necessities, and the advantages they supply.

State Applications

Texas presents a number of state-sponsored packages to help low-income people in acquiring inexpensive automotive insurance coverage. These initiatives typically work along with non-public insurance coverage corporations to supply backed premiums or monetary help. The eligibility standards for these packages differ, sometimes contemplating elements like family revenue, asset limits, and particular wants.

Federal Assist Applications

Federal authorities packages also can play a job in offering automotive insurance coverage help. These packages are sometimes administered by the state however align with federal tips. Their availability could rely on particular monetary conditions and eligibility requirements. These packages can present useful supplementary assist along with state-level help.

Eligibility Standards and Software Course of

Eligibility standards for these packages differ, typically together with documentation of revenue, property, and household dimension. The applying course of sometimes includes gathering mandatory paperwork, finishing functions, and present process verification processes. Contacting the related company or group immediately is essential for detailed info on the precise necessities and procedures.

Forms of Assist Supplied

Authorities packages present varied types of help, together with premium help, subsidies, or monetary incentives. Premium help could immediately cut back the month-to-month price of automotive insurance coverage, whereas subsidies can offset parts of the whole premium. Monetary incentives could also be supplied as grants or vouchers that can be utilized in direction of insurance coverage premiums.

Desk of Key Options of Authorities Applications

| Program Identify | Eligibility Standards | Advantages | Contact Data |

|---|---|---|---|

| Texas Inexpensive Insurance coverage Program (Instance) | Family revenue beneath a sure threshold, proof of residency in Texas, and assembly particular standards. | Backed premiums for qualifying low-income people. Potential reductions for particular insurance coverage corporations and merchandise. | Texas Division of Insurance coverage, particular contact info (this is able to get replaced with precise particulars). |

| Nationwide Flood Insurance coverage Program (Instance) | Householders positioned in flood-prone areas, meet specified revenue standards, and could also be a part of a federally supported program | Monetary help for flood-related insurance coverage. | Federal Emergency Administration Company (FEMA), particular contact info (this is able to get replaced with precise particulars). |

Methods for Discovering Inexpensive Automobile Insurance coverage

Securing inexpensive automotive insurance coverage is essential for low-income Texans, enabling them to take care of transportation and meet day by day wants. This part particulars efficient methods to navigate the usually complicated panorama of automotive insurance coverage choices and safe probably the most appropriate protection at an affordable price.Discovering the precise automotive insurance coverage plan requires a proactive and knowledgeable method. Understanding the accessible choices, evaluating quotes, and maximizing reductions are key components in attaining cost-effective protection.

This information supplies a structured method to assist low-income Texans obtain these targets.

Ideas for Discovering Inexpensive Automobile Insurance coverage

A number of methods can considerably cut back automotive insurance coverage premiums for low-income Texans. The following tips deal with proactive steps to manage prices and optimize protection.

- Evaluate Quotes from A number of Suppliers: Acquiring quotes from varied insurance coverage corporations is important. Variations in charges and protection choices exist, so evaluating a number of presents is essential to figuring out probably the most cost-effective plan. A scientific method to comparability can considerably affect the ultimate price.

- Store Round Often: Insurance coverage charges can fluctuate, and market situations affect pricing. Often reviewing quotes ensures you are receiving probably the most aggressive fee accessible. This observe will help lower your expenses over time, notably in intervals of market modifications or fee changes.

- Perceive Your Wants and Protection: Defining your particular wants and desired protection is essential. Extreme protection may improve prices unnecessarily. Understanding your automobile’s worth and private circumstances is essential to ascertain acceptable protection. Consider the dangers related together with your automobile and driving habits to find out the mandatory protection limits.

- Take into account Reductions: Many insurance coverage corporations provide reductions for varied elements, similar to protected driving, anti-theft units, and good pupil standing. Investigating and leveraging accessible reductions can considerably cut back your insurance coverage premium.

Evaluating Insurance coverage Quotes

A scientific method to evaluating quotes is significant for locating probably the most appropriate and inexpensive plan. Following a structured course of ensures you do not miss key elements influencing pricing.

- Collect Data: Accumulate particulars about your automobile, driving historical past, and any reductions chances are you’ll qualify for. Correct information varieties the muse for correct quotes.

- Use On-line Comparability Instruments: On-line instruments can considerably streamline the quote comparability course of. These instruments combination quotes from varied insurance coverage corporations, enabling a direct comparability of various plans.

- Evaluate Coverage Particulars: Fastidiously assessment the coverage particulars, together with protection limits, exclusions, and deductibles. Perceive the specifics of every coverage to make sure it aligns together with your wants and danger tolerance.

- Contact Insurance coverage Brokers: Insurance coverage brokers can present customized steerage and help in understanding coverage phrases and situations. They will help make clear coverage language and establish acceptable protection to your particular wants.

Utilizing On-line Comparability Instruments Successfully

On-line comparability instruments are useful sources for locating inexpensive automotive insurance coverage. Leveraging these instruments successfully can considerably streamline the method.

- Select Respected Comparability Websites: Choose platforms with a robust popularity and a confirmed observe report for accuracy and transparency. This ensures you are receiving dependable and verifiable information.

- Enter Correct Data: Offering correct and full info is vital for producing correct quotes. Errors can result in inaccurate outcomes.

- Evaluate A number of Insurance policies: Evaluate totally different insurance policies side-by-side to simply establish variations in protection and pricing. This comparative evaluation is significant for making knowledgeable selections.

- Learn Evaluations and Testimonials: Reviewing buyer suggestions on the comparability websites can present useful insights into the corporate’s service and responsiveness.

Sustaining a Good Driving File

A clear driving report immediately impacts automotive insurance coverage premiums. A historical past of protected driving habits results in decrease premiums. This facet considerably influences the price of automotive insurance coverage.

Sustaining a very good driving report is significant for attaining decrease premiums. Keep away from site visitors violations and preserve a constant report of protected driving habits. A constructive driving report immediately impacts the price of insurance coverage, and it’s a vital facet of accountable driving.

Reductions for Low-Revenue Drivers, Low-income automotive insurance coverage texas

Numerous reductions can considerably cut back insurance coverage prices for low-income drivers. Understanding these reductions can save substantial quantities.

Insurance coverage corporations typically provide reductions for varied elements. These can embrace reductions for protected driving, anti-theft units, and good pupil standing. Figuring out and leveraging these reductions can immediately translate to decrease insurance coverage premiums. It is essential to pay attention to the precise reductions accessible to search out probably the most cost-effective answer.

Insurance coverage Choices Past Conventional Firms

Past conventional insurance coverage suppliers, a number of various choices can present inexpensive automotive insurance coverage for low-income Texans. These choices typically leverage group partnerships and non-profit initiatives to bridge the hole in entry to protection. Recognizing the distinctive challenges confronted by this demographic, modern packages have emerged to supply extra tailor-made and accessible options.

Different Insurance coverage Suppliers

Numerous community-based packages and non-profit initiatives provide automotive insurance coverage options for low-income Texans. These packages ceaselessly leverage partnerships with native organizations and authorities businesses to supply help and subsidies. They typically prioritize affordability and accessibility over maximizing revenue. Their construction permits for tailor-made approaches to fulfill the precise wants of their goal inhabitants.

Examples of Profitable Initiatives in Texas

A number of profitable initiatives exist in Texas demonstrating the effectiveness of community-based insurance coverage packages. For instance, the “Texas Auto Insurance coverage Help Program” collaborates with native charities to supply monetary assist and sources for insurance coverage premiums. One other instance is the “Inexpensive Insurance coverage Consortium of Texas,” a non-profit group that gives discounted charges and academic sources to assist low-income people navigate the insurance coverage course of.

Finding Different Choices

Finding these various insurance coverage choices typically requires proactive analysis and exploration. Contacting local people facilities, non-profit organizations, and authorities businesses is a useful first step. On-line searches for “inexpensive automotive insurance coverage packages” or “low-income automotive insurance coverage help” also can yield related outcomes. Using social media teams or boards centered on monetary help or group sources could present entry to packages or people with information of particular initiatives.

Key Options of Different Insurance coverage Choices

| Insurance coverage Supplier Sort | Protection Particulars | Goal Demographic | Contact Data |

|---|---|---|---|

| Texas Auto Insurance coverage Help Program | Gives monetary help for insurance coverage premiums, probably together with reductions or subsidies. Might require eligibility verification. | Low-income Texans dealing with monetary hardship in acquiring automotive insurance coverage. | Contact this system immediately by its web site or native associate organizations. |

| Inexpensive Insurance coverage Consortium of Texas | Gives discounted charges and academic supplies on insurance coverage insurance policies. Might embrace help with claims processing. | Low-income people searching for inexpensive and accessible automotive insurance coverage. | Contact the group immediately by its web site or discover native contacts by their web site. |

| Native Neighborhood Facilities/Non-profits | Might provide referrals to insurance coverage packages or monetary help to cowl premiums. Help could differ primarily based on the precise group. | Low-income Texans and people dealing with monetary difficulties. | Contact local people facilities or non-profit organizations immediately. |

Illustrative Case Research: Low-income Automobile Insurance coverage Texas

Low-income Texans face distinctive challenges in securing inexpensive automotive insurance coverage. These case research spotlight how varied packages and choices can mitigate these challenges and enhance entry to important protection. These examples display the constructive impression of those sources on the lives of people in the neighborhood.Understanding the precise wants and conditions of low-income Texans is essential to creating efficient options.

These case research provide a glimpse into the realities confronted by many and showcase how tailor-made help can result in constructive outcomes.

Case Examine 1: Maria Hernandez

Maria Hernandez, a single mom working two part-time jobs in Houston, struggled to afford automotive insurance coverage. Her present automobile was important for transporting her kids to highschool and work. By the Texas Division of Insurance coverage’s low-income help program, she was in a position to safe a considerably diminished fee on her coverage. This allowed her to focus her restricted sources on different requirements for her household.

Case Examine 2: David Rodriguez

David Rodriguez, a latest immigrant in San Antonio, confronted a language barrier and lack of familiarity with the native insurance coverage market. He wanted dependable automotive insurance coverage to make sure protected transportation to his job as a supply driver. A neighborhood non-profit group supplied steerage and translated paperwork, serving to him navigate the applying course of for presidency help packages. This resulted in a considerable lower in his month-to-month insurance coverage premiums.

Case Examine 3: Aisha Khan

Aisha Khan, a pupil in Austin, had lately acquired her driver’s license. Discovering inexpensive automotive insurance coverage was a major hurdle. She was capable of finding an insurance coverage firm particularly concentrating on younger drivers with inexpensive charges and tailor-made protection choices, because of on-line analysis and suggestions from her school’s monetary assist workplace. This allowed her to take care of her driving privileges and commute to varsity with out vital monetary pressure.

Case Examine 4: Profitable Functions for Help

A number of elements contribute to profitable functions for presidency help packages. Candidates who clearly articulate their monetary limitations and display the need of automotive insurance coverage for important transportation usually tend to be authorised. Thorough documentation, together with pay stubs, proof of residency, and automobile registration, strengthens the applying. Proactive engagement with this system directors all through the method can also be helpful.

An important part is the understanding that these packages are designed to assist low-income Texans, and people shouldn’t hesitate to hunt help in the event that they meet the eligibility necessities.

Examples of Profitable Functions

- Full and correct documentation of revenue and bills.

- Clear rationalization of the necessity for automotive insurance coverage for transportation to employment or academic establishments.

- Immediate follow-up with insurance coverage suppliers and help program directors.

- Understanding the precise necessities and eligibility standards for every program.

These illustrative examples spotlight the constructive outcomes of assorted insurance coverage choices and authorities help packages accessible to low-income Texans. By actively searching for out these sources, people can safe inexpensive automotive insurance coverage and preserve their mobility.

Client Rights and Protections

Low-income Texans, like all shoppers, are entitled to sure rights and protections when buying automotive insurance coverage. These rights guarantee truthful therapy and recourse in the event that they expertise unfair practices. Understanding these rights is essential for navigating the insurance coverage market successfully and guaranteeing they don’t seem to be taken benefit of.Texas regulation supplies a framework of shopper protections designed to safeguard drivers from predatory or misleading practices.

These protections goal to stage the enjoying discipline, stopping exploitation of susceptible populations and selling equitable entry to inexpensive insurance coverage. Information of those rights empowers low-income Texans to hunt redress when mandatory.

Client Rights Concerning Automobile Insurance coverage in Texas

Texas regulation Artikels a number of shopper rights associated to automotive insurance coverage. These rights cowl facets of the insurance coverage utility course of, coverage phrases, and claims dealing with. This framework goals to supply truthful therapy for all drivers, no matter revenue.

- Truthful Software Practices: Insurance coverage corporations are legally obligated to deal with all candidates pretty and with out discrimination. This consists of not denying protection primarily based on elements like revenue, race, or gender, however quite on legit danger assessments. Firms should adhere to clear, clear, and constant utility procedures.

- Coverage Transparency: Insurance coverage insurance policies have to be clear, simply comprehensible, and freed from deceptive or misleading language. Texas regulation mandates that insurance policies clearly Artikel protection particulars, premiums, and claims procedures, guaranteeing shoppers absolutely comprehend their obligations and rights.

- Truthful Claims Dealing with: Insurance coverage corporations should deal with claims promptly and pretty. They’re required to research claims diligently, and talk with policyholders all through the method. Policyholders are entitled to obtain immediate, clear, and sincere responses to their inquiries relating to their declare standing.

Recourse for Unfair Remedy

If a low-income Texan believes they’ve been handled unfairly by an insurance coverage supplier, a number of avenues of recourse can be found. These choices vary from casual complaints to formal authorized motion.

- State Insurance coverage Division Complaints: The Texas Division of Insurance coverage (TDI) is a vital useful resource for shoppers experiencing issues with their insurance coverage suppliers. Submitting a proper grievance with the TDI can provoke an investigation and probably resolve the difficulty by mediation or different regulatory motion.

- Small Claims Court docket: For comparatively smaller claims or disputes, submitting a declare in small claims court docket can present an economical decision. This selection typically supplies a much less formal and extra accessible authorized route than conventional litigation.

- Authorized Counsel: In search of authorized counsel from an lawyer specializing in insurance coverage disputes can present useful help and steerage, particularly for complicated circumstances or when dealing with vital monetary losses.

Authorized Protections for Low-Revenue Drivers

Texas regulation, together with federal rules, supplies varied protections for low-income drivers. These protections goal to stop discrimination and guarantee truthful entry to insurance coverage.

- Anti-Discrimination Legal guidelines: Texas and federal legal guidelines prohibit discrimination in insurance coverage primarily based on elements like race, faith, gender, or nationwide origin. Insurance coverage corporations can’t use these traits to disclaim protection or cost increased premiums.

- Client Safety Statutes: Texas has varied shopper safety statutes that present avenues for redress if shoppers really feel they’ve been misled or taken benefit of in an insurance coverage transaction.

- Inexpensive Care Act (ACA): Whereas circuitously associated to automotive insurance coverage, the ACA, in some cases, can not directly impression automotive insurance coverage charges. For instance, the ACA has had a major impression on the supply of medical insurance choices, and this has not directly influenced the general price and availability of insurance coverage merchandise.

Key Client Rights and Protections Desk

| Client Proper | Description | Enforcement Mechanism |

|---|---|---|

| Truthful Software Practices | Insurance coverage corporations can’t discriminate primarily based on protected traits when evaluating functions. | Grievance to Texas Division of Insurance coverage (TDI) and/or authorized motion. |

| Coverage Transparency | Insurance policies have to be clear, comprehensible, and freed from deceptive language. | Grievance to TDI and/or authorized motion. |

| Truthful Claims Dealing with | Claims have to be dealt with promptly and pretty, with clear communication. | Grievance to TDI and/or authorized motion. |

| Anti-Discrimination Legal guidelines | Insurance coverage can’t discriminate primarily based on protected traits. | Grievance to TDI, authorized motion, and/or state/federal businesses. |

| Client Safety Statutes | Protects shoppers from unfair insurance coverage practices. | Grievance to TDI, authorized motion, and/or state businesses. |

Finish of Dialogue

In conclusion, securing inexpensive automotive insurance coverage in Texas for low-income people requires a multifaceted method. This information has supplied useful insights into the challenges, options, and sources accessible. By understanding the assorted choices, from conventional insurance coverage corporations to authorities help packages and various suppliers, low-income Texans can navigate the complexities of the insurance coverage market and acquire the protection they want.

In the end, this data empowers them to prioritize their monetary well-being and highway security.

FAQ Abstract

What are some frequent misconceptions about low-income automotive insurance coverage choices in Texas?

A typical false impression is that inexpensive automotive insurance coverage is barely accessible by specialised corporations. Many conventional insurance coverage suppliers provide reductions and choices, however you will need to store round. One other false impression is that authorities help packages are just for the really impoverished. The eligibility standards could differ, and there are sometimes avenues for help past quick want.

What are the eligibility standards for presidency help packages in Texas for automotive insurance coverage?

Eligibility necessities for presidency help packages differ. Usually, revenue ranges, family dimension, and particular monetary circumstances are thought-about. People ought to seek the advice of the precise program’s tips for exact necessities.

How can I examine varied insurance coverage quotes successfully?

Make the most of on-line comparability instruments to collect quotes from totally different insurers. Enter your particular particulars and necessities to obtain correct estimates. Evaluate not solely the premiums but in addition the protection particulars, reductions, and providers supplied by every firm.

What are some various insurance coverage choices past conventional corporations?

Neighborhood-based packages, non-profit initiatives, and government-backed packages can provide tailor-made choices for low-income Texans. Analysis and get in touch with these organizations to study extra about accessible protection.