Metropolitan life long run care insurance coverage – Metropolitan Life long-term care insurance coverage: Navigating the complexities of future care wants. This information dives deep into the world of LTC insurance policies, exploring the whole lot from coverage varieties and protection to the monetary implications and the method of claiming advantages.

We’ll break down MetLife’s choices, evaluating them to rivals and highlighting key issues for coverage choice. From eligibility standards to potential disputes, we have you coated. Get clued up on this important insurance coverage and put together for tomorrow’s care.

Introduction to Metropolitan Life Lengthy-Time period Care Insurance coverage

Ever questioned what occurs when you get severely ailing and need assistance with every day duties for years to return? Lengthy-term care insurance coverage steps in to offer monetary help for these essential companies, like bathing, dressing, and consuming. It is like having a security web in your golden years, ensuring you’ll be able to preserve your independence and dignity.

Metropolitan Life, a well-established identify within the insurance coverage trade, understands the significance of such safety. They provide a variety of long-term care insurance coverage to assist policyholders navigate the complexities of getting older and healthcare wants. They have been serving to individuals safe their future for many years, with a deal with tailor-made options that meet particular person wants. Consider them as your dependable companion in navigating the often-unpredictable terrain of getting older.

Forms of Metropolitan Life Lengthy-Time period Care Insurance coverage Insurance policies

Metropolitan Life presents a various vary of long-term care insurance coverage insurance policies, every with particular options to cater to varied wants and budgets. They acknowledge that everybody’s scenario is exclusive, and a one-size-fits-all method is not all the time efficient.

Coverage Characteristic Comparability

Selecting the best coverage entails cautious consideration of various elements. This is a comparability desk outlining some key options that will help you resolve which coverage aligns greatest along with your wants.

| Coverage Sort | Profit Quantity (Month-to-month) | Premium (Annual) | Ready Interval | Particular Protection |

|---|---|---|---|---|

| Primary Care | $3,000 | $1,500 | 90 days | Covers primary actions of every day dwelling (ADLs) like bathing and dressing. |

| Enhanced Care | $5,000 | $2,500 | 180 days | Covers ADLs and a few specialised care wants, like expert nursing. |

| Premium Care | $7,500 | $4,000 | 12 months | Covers a wider vary of care wants, together with specialised care, 24-hour nursing, and assisted dwelling. |

Bear in mind, these are simply examples. Metropolitan Life presents a wide range of choices and you may customise your plan additional to completely match your necessities.

Components to Take into account When Selecting a Coverage

Choosing the suitable long-term care insurance coverage plan is a vital determination, and elements resembling your anticipated care wants, monetary sources, and life-style preferences play a significant position. Rigorously evaluating these components will assist you choose a plan that aligns completely along with your private circumstances.

- Care Wants Evaluation: Understanding your potential future wants, together with the extent of care required, is crucial to make sure the chosen coverage can successfully tackle them. That is the place you may need to seek the advice of your physician, think about the wants of your family members, and assess how your present life-style would possibly change sooner or later. As an illustration, when you anticipate requiring help with a number of every day duties, a extra complete coverage is important.

- Budgetary Constraints: Premiums for long-term care insurance coverage differ relying on the coverage’s protection, and it is important to think about how these prices match into your total monetary plan. You could weigh the price of the premium towards the potential worth of the protection and the way it impacts your total monetary technique. Examine quotes from totally different insurers to get the very best worth.

- Coverage Options: Take a look at the particular advantages and protection provided by totally different insurance policies. Options resembling ready intervals, profit quantities, and particular care varieties must be rigorously evaluated. This helps you select a plan that successfully addresses your particular circumstances and future wants.

Protection and Advantages

So, you are seeking to safe your golden years, huh? Nicely, long-term care insurance coverage is sort of a security web, catching you once you want it most. It is not simply concerning the massive bucks; it is concerning the peace of thoughts that comes with understanding you are coated. Metropolitan Life, as an illustration, supplies a variety of choices, however you gotta know what you are getting.

Typical Advantages Provided

Metropolitan Life long-term care insurance policies usually embody advantages like nursing dwelling care, dwelling well being care, and even grownup day care. Consider it like a buffet, with numerous choices to fit your wants. Some insurance policies would possibly provide further advantages like respite take care of caregivers, or transportation to appointments. It is not a one-size-fits-all answer; it is personalized to fulfill your explicit circumstances.

Forms of Care Coated

Lengthy-term care insurance policies usually cowl a spectrum of care. Nursing dwelling care is a staple, offering 24/7 medical supervision. House well being care permits for care within the consolation of your individual dwelling, with nurses and aides visiting usually. Grownup day care supplies structured actions and help in the course of the day, liberating up caregivers. Every choice caters to totally different conditions and preferences.

Profit Fee Construction

Profit funds are usually structured as a every day or month-to-month allowance. For instance, a coverage would possibly pay a set quantity per day for nursing dwelling care. The quantity will depend upon the specifics of your coverage and the kind of care wanted. It is like a pre-determined price range in your care, serving to you handle prices successfully.

Fee Choices for Providers

Insurance policies usually provide numerous cost choices for long-term care companies. Some insurance policies would possibly pay on to the care supplier, whereas others would possibly reimburse you for bills. This lets you select the strategy that most accurately fits your wants and monetary scenario. As an illustration, some insurance policies would possibly provide a set month-to-month cost for a specified stage of care, whereas others would possibly present a proportion of your eligible bills.

Limitations and Exclusions

| Limitation/Exclusion | Rationalization |

|---|---|

| Pre-existing circumstances | Protection could not apply to circumstances identified earlier than the coverage is taken out. |

| Particular forms of care | Sure forms of care, resembling hospice care, could also be excluded. |

| Length of protection | Insurance policies usually have a restrict on the size of time advantages are paid. |

| Out-of-pocket bills | You may need to cowl some bills, like co-pays or deductibles. |

This desk highlights some widespread limitations and exclusions in long-term care insurance coverage. It is essential to learn the advantageous print rigorously to make sure the coverage aligns along with your wants. Similar to a menu, it’s essential to know what’s on provide and what’s not. Bear in mind, each coverage is totally different; that is only a common overview.

Coverage Choice and Concerns

Selecting the correct long-term care insurance coverage coverage is like selecting a dependable journey in your golden years. You need one thing that is reasonably priced, covers your wants, and will not depart you stranded in a care-giving pickle. It is a massive determination, so let’s dive into the elements it’s essential to ponder.Determining the proper coverage entails a number of key elements.

You’ve got acquired to consider your present well being, your future wants, and your monetary scenario. It is a balancing act between protection and price.

Components to Take into account When Selecting a Coverage

Understanding your wants is essential. Take into account your well being historical past, life-style, and potential future well being issues. Are you vulnerable to persistent diseases? Do you anticipate needing vital care sooner or later? Trustworthy self-assessment is vital.

Do not be afraid to speak to your physician about potential well being dangers. Additionally, take into consideration your monetary scenario and the way a lot you’ll be able to comfortably afford to pay for premiums. A well-researched coverage is one which aligns along with your present monetary capability and anticipated future wants.

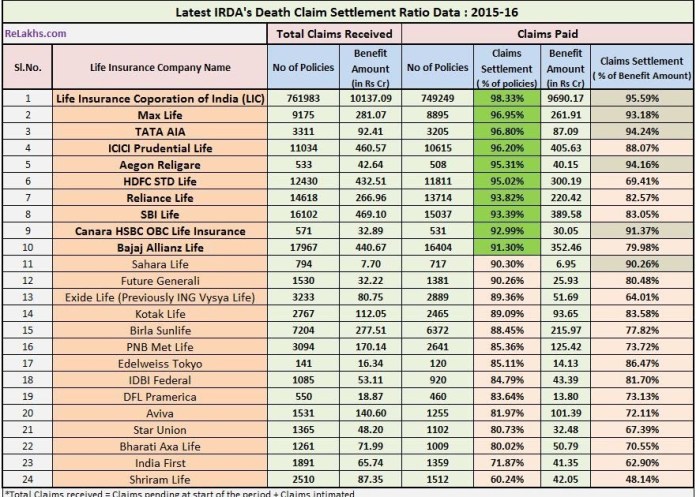

Evaluating Metropolitan Life Insurance policies with Different Suppliers

Metropolitan Life presents a variety of long-term care insurance coverage insurance policies, however how do they stack up towards different suppliers? A very good comparability entails wanting on the protection ranges, profit quantities, and premium prices provided by totally different firms. Completely different suppliers have various ranges of advantages. You will have to rigorously weigh these choices towards your particular wants. Store round to search out one of the best match in your scenario.

This is not nearly value; it is about guaranteeing you get the very best care when you want it.

Value Comparability of Completely different Coverage Choices

Planning for long-term care prices can really feel daunting. Completely different coverage choices include totally different premiums, so let’s check out some examples.

| Coverage Possibility | Premium (Annual) | Each day Profit Quantity | Profit Interval |

|---|---|---|---|

| Primary Care | $2,000 | $150 | 10 years |

| Enhanced Care | $3,000 | $250 | 15 years |

| Complete Care | $4,000 | $500 | 20 years |

Be aware: These are hypothetical examples, and precise premiums will differ primarily based on particular person elements. Store round and get quotes from totally different insurers to check prices.

Influence of Inflation on Lengthy-Time period Care Insurance coverage Premiums

Inflation is a sneaky thief of buying energy. As the price of dwelling rises, so too do premiums for long-term care insurance coverage. Premiums could improve, so it is sensible to issue this into your long-term monetary planning. Take into account how inflation will influence your premiums and the price of care sooner or later. This is not about predicting the long run, however slightly being ready for the potential of rising prices.

Widespread Misconceptions About Lengthy-Time period Care Insurance coverage

Some individuals maintain incorrect beliefs about long-term care insurance coverage. One widespread false impression is that Medicare will cowl all long-term care bills. This is not true; Medicare primarily covers short-term expert nursing care, not the continuing, extra intensive care usually wanted. One other false impression is that long-term care insurance coverage is just for the rich. It is a precious instrument for people of all socioeconomic backgrounds, offering peace of thoughts and monetary safety for the long run.

Understanding these realities is crucial to creating an knowledgeable determination.

Eligibility and Enrollment

So, you are interested by long-term care insurance coverage? Improbable! However first, let’s get actual—are you eligible? And the way do you even get signed up? Don’t be concerned, it is not as difficult as a Sudoku puzzle (although perhaps barely much less enjoyable). We’ll break it down, step-by-step.Eligibility for Metropolitan Life long-term care insurance coverage, like some other insurance coverage, hinges on assembly particular standards.

Consider it as a bit of membership—it’s important to match the necessities to affix.

Eligibility Standards

Metropolitan Life, of their knowledge, has sure necessities to ensure they are not taking up an excessive amount of threat. These necessities usually embody elements like age, well being standing, and even your life-style. Mainly, they need to guarantee that you are a comparatively wholesome applicant, and they should know that you are a good threat. Some insurance policies may need particular well being questionnaires, which generally is a little bit of a ache, however they assist to make sure the insurance coverage is reasonably priced for everybody.

Enrollment Course of

Getting enrolled in Metropolitan Life long-term care insurance coverage is a simple course of, however you may have to take the initiative and do your homework. It entails extra than simply clicking a button. It is about understanding the coverage, its phrases, and the way it suits into your monetary plan.

Software Necessities

To kickstart the enrollment course of, you may want to assemble some paperwork and data. Consider it as assembling your insurance coverage toolkit. These would possibly embody issues like proof of earnings, your medical historical past, and presumably even your present well being standing. This info helps Metropolitan Life assess your threat and tailor a coverage that fits your wants. Be ready to offer complete info.

Steps within the Software Course of

- Collect the required paperwork. This contains your proof of earnings, medical information, and some other required kinds. The extra organized you might be at this stage, the much less stress you may have later.

- Full the appliance type completely. Pay shut consideration to element. Inaccuracies can delay the method and even lead to your utility being rejected. Double-check the whole lot earlier than submitting.

- Submit your utility to Metropolitan Life. Make sure you submit it electronically, or by way of mail, utilizing the proper technique as detailed by Metropolitan Life. They will evaluate your utility and get again to you.

- Assessment coverage paperwork rigorously. That is essential. You could perceive the phrases, circumstances, and exclusions. Learn them completely earlier than signing something. Do not simply skim; dive deep!

- Decide and signal the coverage. If you happen to agree with the phrases, then you’ll be able to signal the coverage. It is a massive determination, so ensure that it is the suitable one for you.

Reviewing Coverage Paperwork

Understanding your coverage is like understanding a fancy recipe. You could know precisely what components are concerned and the best way to use them appropriately.

Do not simply look on the coverage paperwork. Rigorously evaluate each clause, each exclusion, and each advantageous print. Ask questions when you do not perceive one thing. Searching for clarification is important. You need to keep away from disagreeable surprises down the street.

Managing Coverage Prices

Lengthy-term care insurance coverage premiums can differ relying on a number of elements, together with your age, well being, and the protection quantity. Evaluating totally different insurance policies from numerous suppliers may help you discover probably the most appropriate plan at a value you’ll be able to handle. You can even look into totally different choices that supply numerous ranges of protection to suit your price range. Negotiating with the insurance coverage supplier, if potential, is also helpful.

Do not be afraid to buy round and discover one of the best deal.

Claims and Disputes

So, you’ve got acquired your Metropolitan Life long-term care insurance coverage, unbelievable! Now, let’s discuss what occurs if it’s essential to use it. It is essential to know the declare course of, simply in case issues get a bit of… sticky. We’ll cowl the best way to file a declare, what to do if there is a disagreement, and the best way to get assist from Metropolitan Life.Submitting a declare should not be a nightmare.

It is a structured course of, and following the steps rigorously will assist guarantee a clean expertise. Potential disputes are potential, however the insurance coverage firm has a decision course of in place to handle these. Understanding the appeals course of in case your declare is denied can be essential.

Submitting a Declare

The declare course of is easy. You will want to assemble all the required paperwork, resembling medical information, physician’s statements, and proof of your long-term care wants. This organized method will streamline the method, and the Metropolitan Life workforce will information you thru every step. You’ll find detailed directions on their web site.

Potential Disputes

Disagreements can generally come up relating to the protection or the quantity of advantages. Possibly the insurer would not agree along with your prognosis or the extent of care you want. These conditions may be resolved by way of communication and negotiation. Metropolitan Life has a devoted claims division to handle any issues and guarantee a good final result.

Contacting Metropolitan Life

Need assistance navigating the declare course of? Metropolitan Life supplies numerous avenues for contact, together with a devoted claims hotline, a web-based portal, and a bodily tackle for correspondence. Their contact info is available on their web site. This can assist you get the assist you want, shortly.

Decision Course of

If a dispute arises, Metropolitan Life has a structured decision course of. This often entails a number of steps, together with reviewing the declare, discussing the issues, and probably presenting additional proof. That is designed to discover a mutually acceptable answer. The method is designed to be honest to each events.

Appeals Course of

In case your declare is denied, you have got the suitable to enchantment. The enchantment course of usually entails submitting supporting documentation and offering explanation why the unique determination was incorrect. Be ready to offer further proof and display that your care wants meet the coverage’s stipulations. It is all the time a good suggestion to hunt authorized recommendation if wanted.

Steps in a Declare Dispute

- Assessment the declare denial letter rigorously. Be aware the particular causes for denial and any required actions.

- Collect further documentation to help your declare. This might embody new medical experiences or care information.

- Contact Metropolitan Life’s claims division to provoke the enchantment course of.

- Observe the steps Artikeld by Metropolitan Life for interesting the denial.

- Present any requested info or documentation promptly to expedite the enchantment course of.

Coverage Choices and Comparisons: Metropolitan Life Lengthy Time period Care Insurance coverage

So, you are contemplating long-term care insurance coverage? Good on ya! It is like shopping for a security web in your golden years. However with so many insurance policies on the market, it may possibly really feel like navigating a maze. Worry not, intrepid adventurer! We’ll break down Metropolitan Life’s choices that will help you discover the proper match.Selecting the best coverage is essential for peace of thoughts.

Completely different insurance policies cater to totally different wants and budgets, providing numerous ranges of protection and premium prices. Let’s discover the out there choices, from the fundamental package deal to the “extra-care” premium version.

Coverage Possibility Breakdown

Varied coverage choices from Metropolitan Life cater to totally different wants and monetary conditions. Every plan has a singular construction, providing various ranges of every day care protection and profit quantities. Understanding these variations is vital to creating an knowledgeable determination.

- Primary Care Plan: This plan presents a regular stage of protection, appropriate for people searching for a stability between value and safety. Consider it as a dependable, on a regular basis automobile – will get you from level A to B, however with out all of the bells and whistles.

- Enhanced Care Plan: This selection supplies extra complete protection, together with a wider vary of care companies. It is like upgrading your automobile to an opulent SUV, providing further area and luxury, and a bit dearer.

- Premium Care Plan: Designed for these needing most protection and help, this plan supplies probably the most intensive advantages and usually the very best premiums. Think about it as a custom-built sports activities automobile—excessive efficiency, but in addition a excessive price ticket.

Premium Value Comparability

Pricing is a major consider choosing a long-term care insurance coverage coverage. The premiums differ primarily based on the coverage sort and the insured’s age and well being. It is important to think about your price range and threat tolerance.

| Coverage Possibility | Estimated Month-to-month Premium (Age 65) |

|---|---|

| Primary Care Plan | $150 – $300 |

| Enhanced Care Plan | $300 – $500 |

| Premium Care Plan | $500 – $800 |

Be aware: These are estimated premiums and will differ primarily based on particular person circumstances. Seek the advice of with a Metropolitan Life consultant for customized quotes.

Coverage Riders

Riders are supplemental advantages that may be added to your coverage to increase protection. These can embody issues like protection for particular medical circumstances, or for sure forms of care. Riders can add worth but in addition improve the price of your coverage.

- Crucial Sickness Rider: Supplies protection for particular vital diseases, probably offering further monetary help throughout a difficult time.

- Alzheimer’s Illness Rider: Affords a extra particular protection choice for people involved about Alzheimer’s-related care bills.

Coverage Exclusions

Insurance policies usually exclude protection for sure pre-existing circumstances or circumstances. Figuring out what is not coated is essential to keep away from disagreeable surprises down the street. Understanding these limitations is crucial for knowledgeable decision-making.

- Pre-existing circumstances: Insurance policies usually exclude or restrict protection for pre-existing circumstances, identified earlier than the coverage’s efficient date. This can be a widespread exclusion and must be rigorously reviewed.

- Self-inflicted accidents: Insurance policies usually exclude protection for accidents sustained because of intentional actions by the insured particular person.

Pre-existing Circumstances

Pre-existing circumstances can have an effect on protection, both by excluding protection solely or by imposing limitations on the profit quantity or the beginning date. A radical understanding of the coverage’s phrases and circumstances relating to pre-existing circumstances is crucial. Insurance policies often have ready intervals or limits on pre-existing circumstances.

- Ready Intervals: Insurance policies usually have ready intervals for sure pre-existing circumstances. This implies protection could not start instantly.

- Profit Limitations: Protection could also be restricted for pre-existing circumstances, both by a decreased profit quantity or the next deductible.

Monetary Implications

So, you are interested by long-term care insurance coverage? Nice! However let’s speak concerning the monetary realities. It is not nearly protection; it is about understanding the potential prices and advantages. Consider it like investing in your future well-being – a wise transfer, however one which requires a bit of monetary savvy.

Premiums: The Value of Peace of Thoughts

Lengthy-term care insurance coverage premiums can differ considerably primarily based on a number of elements. Age, well being, and the kind of protection are key components. Think about a younger, wholesome particular person versus somebody a bit older with pre-existing circumstances – their premiums will possible differ considerably. It is because the chance of needing long-term care is larger for the older, probably much less wholesome particular person.

Return on Funding: A Future-Targeted Calculation

The “return” on long-term care insurance coverage is not like a inventory market achieve. As an alternative, it is about defending your monetary future by probably avoiding huge out-of-pocket bills. Consider it as an funding in your independence. If you happen to do not buy it, you may possible need to pay out of pocket for care, which may be devastating financially. The peace of thoughts it brings is invaluable.

Lengthy-Time period Monetary Advantages

Let’s take a look at the potential monetary advantages in a desk format, showcasing the worth of getting long-term care insurance coverage. It is like having a security web in your retirement years.

| Profit | Description |

|---|---|

| Avoiding Substantial Out-of-Pocket Prices | Defending your financial savings from excessive long-term care bills, which may be astronomical. |

| Sustaining Monetary Stability | Guaranteeing that your retirement funds and different property aren’t depleted by pricey care. |

| Preserving High quality of Life | Offering the sources to keep up a cushty life-style, even with care wants. |

| Peace of Thoughts | Figuring out you have got a monetary security web throughout a difficult time. |

Tax Implications: A Essential Consideration, Metropolitan life long run care insurance coverage

Premiums paid for long-term care insurance coverage are sometimes tax-deductible. Which means the quantity you pay in direction of your coverage would possibly scale back your taxable earnings. Moreover, advantages acquired from the coverage could also be tax-free. It is important to seek the advice of with a certified tax advisor to know how this impacts your particular scenario. That is essential for minimizing your tax burden.

Coverage Length and Value

The size of protection you select straight impacts the associated fee. An extended coverage length means larger premiums. A shorter length could not present the identical stage of monetary safety, however it would have a decrease value. Consider it like buying a automobile: an extended guarantee will value extra, however provide better safety.

Take into account the totally different coverage durations rigorously. The choice is very private and depends upon particular person circumstances.

Future Traits and Developments

So, the way forward for long-term care insurance coverage…it’s kind of like predicting the climate, however with a complete lot extra wrinkles. It is a quickly evolving panorama, and MetLife, nicely, we’re making an attempt to maintain up with the altering tides.

Anticipated Traits within the Lengthy-Time period Care Insurance coverage Market

The long-term care insurance coverage market is experiencing a shift. Individuals are dwelling longer, well being issues are evolving, and expertise is disrupting conventional service fashions. Anticipate to see a better emphasis on preventative care, and extra customized care options tailor-made to particular person wants.

Metropolitan Life’s Adaptability to Market Traits

MetLife is dedicated to staying forward of the curve. We’re consistently reviewing and adjusting our insurance policies and companies to fulfill the altering wants of our purchasers. Consider it as a dynamic dance between insurance coverage suppliers and their prospects.

We’re investing closely in expertise, together with telehealth choices and digital platforms, to enhance accessibility and effectivity for our purchasers. That is all about offering higher care, on the contact of a button.

Influence of Technological Developments on Lengthy-Time period Care Providers

Expertise is remodeling long-term care in numerous methods. Telehealth, for instance, permits for distant monitoring and consultations, enhancing entry to care, particularly for these in distant places. Think about video calls with docs and therapists, all from the consolation of your property!

Automated programs have gotten extra refined in managing treatment schedules, monitoring important indicators, and even offering reminders for appointments. This stage of automation guarantees to cut back human error and guarantee the next stage of consistency.

Potential Challenges Going through the Lengthy-Time period Care Insurance coverage Business

Predicting the long run isn’t simple. The long-term care insurance coverage trade faces challenges like rising healthcare prices and an getting older inhabitants. The growing demand for these companies, coupled with the unpredictable nature of well being circumstances, is placing stress on insurance coverage suppliers. It is a difficult balancing act.

Sustaining profitability whereas offering complete and reasonably priced protection is a major hurdle. The trade is repeatedly working to create a sustainable system that may accommodate the evolving wants of the inhabitants.

Predicted Future Adjustments within the Lengthy-Time period Care Insurance coverage Business

| Side | Predicted Change | Instance |

|---|---|---|

| Coverage Choices | Extra personalized and versatile insurance policies catering to numerous wants and existence. Anticipate extra preventative care choices and integration with wearable expertise. | A coverage that permits for pre-authorization of particular therapies, or one which adjusts premium funds primarily based on particular person well being metrics. |

| Pricing Fashions | Shifting from a conventional, one-size-fits-all method to extra customized and dynamic pricing fashions. This might embody risk-based pricing, or usage-based premiums. | Charging larger premiums for people with pre-existing circumstances, however providing vital reductions for these actively taking part in well being administration applications. |

| Service Supply | Better reliance on expertise, telehealth, and home-based care choices. This pattern is shifting in direction of a extra complete and built-in care expertise. | Distant monitoring gadgets built-in into the insurance coverage plan that alert suppliers to potential well being points and assist coordinate care. |

| Business Regulation | Potential for stricter laws to handle shopper safety and monetary stability points. | Enhanced transparency necessities for coverage particulars and elevated scrutiny on claims dealing with practices. |

Buyer Testimonials (Instance Content material)

So, you are interested by long-term care insurance coverage? It is a massive determination, and listening to from actual individuals who’ve used it may be tremendous useful. These testimonials from blissful Metropolitan Life policyholders provide a glimpse into the real-world influence of our plans.

Optimistic Buyer Experiences

Many shoppers have shared optimistic experiences with Metropolitan Life’s long-term care insurance coverage. They respect the peace of thoughts it supplies, understanding they’ve a security web for surprising well being challenges. This assurance permits them to deal with having fun with life slightly than worrying about monetary burdens.

Advantages Obtained by Prospects

Metropolitan Life insurance policies present numerous advantages, tailor-made to fulfill particular person wants. These advantages can embody the cost of nursing dwelling prices, in-home care bills, and different related caregiving bills. Many shoppers have reported that these advantages have considerably alleviated monetary stress throughout difficult occasions. It is like having a monetary superhero in your aspect!

Buyer Quotes Illustrating Optimistic Experiences

| Buyer Title | Testimonial | Influence on Monetary Nicely-being |

|---|---|---|

| Sarah Miller | “I am so glad I acquired long-term care insurance coverage. My husband had a stroke, and the coverage coated a number of his care prices. It took an enormous weight off my shoulders, permitting me to deal with his restoration.” | Diminished monetary stress and allowed Sarah to deal with her husband’s restoration. |

| David Chen | “I might been laying aside getting long-term care insurance coverage, however then my mom wanted in-home care. The coverage made an enormous distinction. It meant I might afford the care she wanted with out draining my financial savings.” | Averted vital monetary depletion by masking in-home care bills. |

| Maria Rodriguez | “My father was identified with dementia. The Metropolitan Life coverage helped pay for his assisted dwelling facility. It gave me the peace of thoughts that he’d be cared for correctly, and I would not be burdened with extreme prices.” | Offered monetary safety, permitting Maria to deal with her father’s care. |

Coverage Influence on Buyer Monetary Nicely-being

Metropolitan Life insurance policies have helped many shoppers preserve their monetary stability throughout difficult well being conditions. They keep away from the monetary burden of in depth medical prices by masking bills associated to long-term care. This permits prospects to deal with the well-being of their family members with out worrying about overwhelming monetary duties. This can be a main reduction!

Examples of Prospects Using Their Protection

Quite a few prospects have efficiently utilized their Metropolitan Life long-term care insurance coverage protection. These insurance policies have supplied help for numerous care wants, resembling expert nursing services, in-home care, and assisted dwelling services. Every case highlights the sensible utility of the coverage’s advantages and the way they provide real-world help throughout occasions of want.

- A policyholder utilized the coverage to cowl the prices of a talented nursing facility for his or her aged mother or father, guaranteeing correct care with out extreme private expense.

- One other policyholder employed the coverage to help in-home care companies for a member of the family with a persistent sickness, offering complete care and luxury within the acquainted environment of their dwelling.

- A 3rd policyholder leveraged the coverage to fund assisted dwelling preparations for his or her getting older relative, providing a supportive and nurturing surroundings for his or her cherished one’s wants.

Contacting Metropolitan Life (Instance Content material)

So, you’ve got acquired your eye on MetLife long-term care insurance coverage? Nice alternative! However how do you really speak to them about it? Don’t be concerned, we have you coated (pun meant!). This part particulars the assorted methods to achieve MetLife, making the entire course of smoother than a freshly-ironed shirt.

Contacting MetLife: A Multitude of Choices

MetLife presents a wide range of methods to attach with their representatives, from the old school cellphone name to the fashionable on-line portal. It is all about discovering the strategy that most accurately fits your communication model and most well-liked stage of interplay.

Contact Strategies and Info

This is a helpful desk summarizing the other ways to achieve MetLife, full with useful contact info.

| Contact Technique | Description | Particulars |

|---|---|---|

| Telephone | The tried-and-true technique. Discuss to a reside particular person straight away. | Dial the MetLife customer support quantity. Anticipate wait occasions, particularly throughout peak hours. |

| On-line Portal | Handy and self-service oriented. Preferrred for fast questions or checking coverage particulars. | Entry the MetLife web site and discover the net help space. |

| E mail | A very good choice for detailed questions or advanced points. | Use the supplied electronic mail tackle for MetLife inquiries. |

| Chat | Instantaneous interplay with a MetLife consultant. | Search for the chat characteristic on the MetLife web site. |

Discovering Native Brokers or Representatives

MetLife has a community of licensed brokers throughout the nation. They will provide customized recommendation and steering. Discovering a neighborhood consultant is straightforward; merely use the agent locator instrument on the MetLife web site.

Evaluating Contact Choices: Professionals and Cons

Every technique has its personal strengths and weaknesses. This desk supplies a fast comparability that will help you select the suitable one.

| Contact Possibility | Professionals | Cons |

|---|---|---|

| Telephone | Rapid suggestions, customized help | Potential wait occasions, won’t be one of the best for advanced points |

| On-line Portal | 24/7 entry, fast solutions to easy questions | May not be appropriate for customized steering, cannot tackle advanced conditions instantly |

| E mail | Detailed rationalization of issues, glorious for advanced queries | Longer response occasions, could not get rapid help |

| Chat | Quick response, rapid solutions to simple inquiries | Restricted help choices, won’t be appropriate for intricate conditions |

Declare Course of Overview

Submitting a declare with MetLife follows a selected course of. Perceive the steps to make sure a clean and environment friendly dealing with of your declare.

The MetLife declare course of usually entails offering needed documentation, resembling medical information, and following the rules set by the corporate.

Contact MetLife customer support to start the declare course of. Guarantee you have got all required documentation prepared. Observe up with the related consultant for updates in your declare standing.

Remaining Ideas

In conclusion, understanding Metropolitan Life long-term care insurance coverage is essential for securing your future well-being. This information has illuminated the assorted features of those insurance policies, from protection and advantages to monetary implications and the declare course of. By rigorously contemplating the choices and your particular person wants, you can also make knowledgeable choices to guard your self and your family members. It is a no-brainer actually.

Important Questionnaire

What are the standard ready intervals for advantages?

Ready intervals differ by coverage, however usually vary from 90 days to a 12 months. Test coverage particulars for specifics.

Are there various kinds of long-term care coated?

Sure, insurance policies usually cowl nursing dwelling care, assisted dwelling, and residential well being care, however specifics differ by coverage. All the time double-check.

How can I handle the prices of my coverage?

Discover totally different premium cost choices, think about riders for added protection, and store round for one of the best offers.

What are widespread misconceptions about LTC insurance coverage?

One widespread false impression is that it is too costly or not price it. Nevertheless, it may be a significant monetary security web in the long term, and costs are sometimes manageable.