Navigating rental automotive insurance coverage within the USA as a foreigner can really feel daunting. Rental automotive insurance coverage in USA for foreigners is essential for a easy and worry-free journey. Understanding the nuances of US insurance coverage insurance policies, evaluating protection choices, and securing applicable documentation are key steps to guard your self from sudden prices and potential authorized points. This complete information will equip you with the information it’s worthwhile to confidently hire a automotive within the USA, regardless of your nationality.

From legal responsibility and collision protection to complete insurance coverage and supplemental journey insurance coverage, we delve into the important facets of rental automotive insurance coverage tailor-made for worldwide guests. This information gives a sensible strategy to understanding and securing the absolute best safety to your journey. Learn to navigate the often-complex panorama of US rental automotive insurance coverage, making certain your journey expertise stays stress-free and pleasurable.

Rental Automobile Insurance coverage within the USA for Foreigners

Navigating the US roads as a customer could be a breeze, however rental automotive insurance coverage isn’t any stroll within the park for foreigners. Figuring out the ropes is essential to avoiding nasty surprises and protecting your journey easy. This information breaks down the important information on rental automotive insurance coverage, highlighting the variations between home and worldwide renters, frequent misconceptions, and the potential pitfalls of skimping on protection.Rental automotive insurance coverage is not simply a good suggestion; it is typically a necessity.

Home renters may need totally different insurance coverage necessities, however foreigners face additional complexities as a result of differing insurance coverage legal guidelines and procedures. Understanding these intricacies can prevent a variety of problem and potential monetary woes.

Insurance coverage Necessities for Overseas Guests

Overseas guests renting automobiles within the USA usually want extra complete protection than home renters. Rental firms typically have larger requirements for overseas drivers, requiring the next stage of insurance coverage to guard their pursuits. That is very true if your own home nation’s insurance coverage does not absolutely cowl you within the US. Failing to satisfy these necessities can result in hefty expenses and problems, probably affecting your journey plans.

Variations in Insurance coverage Necessities

Home renters within the USA typically depend on their private insurance coverage insurance policies to cowl rental automotive incidents. Nonetheless, this is not at all times the case for worldwide renters. Your property nation’s insurance coverage won’t lengthen to the US, or may need limitations. This implies you may must buy further protection from the rental firm. The important thing distinction lies within the protection and limits supplied by your own home nation’s insurance coverage coverage.

Frequent Misconceptions

A typical false impression is {that a} bank card’s insurance coverage routinely covers rental automotive incidents. Whereas some playing cards provide restricted safety, it typically does not meet the requirements required by US rental firms. Moreover, many assume their present journey insurance coverage covers rental automotive damages. Nonetheless, checking the particular phrases of your journey insurance coverage coverage is essential to know the scope of its rental automotive safety.

Typically, it is inadequate or has vital exclusions.

Monetary Dangers for Foreigners With out Sufficient Insurance coverage

Driving with out enough insurance coverage can expose you to vital monetary dangers. Damaging one other particular person’s car or property may end up in substantial legal responsibility prices. Injury to the rental automotive itself, or any accident involving private damage, may end in vital out-of-pocket bills. You might face authorized problems, potential courtroom charges, and even difficulties returning the car. This might severely disrupt your journey plans and funds.

Rental Automobile Insurance coverage Choices

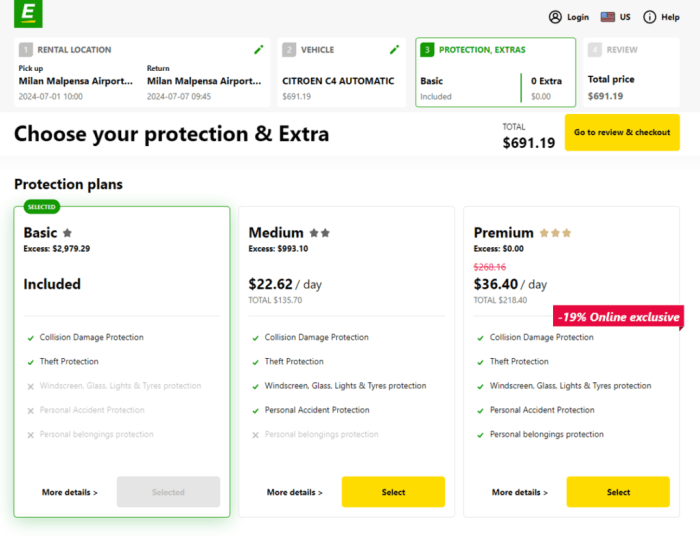

- Rental Firm’s Insurance coverage: That is the commonest choice, offering numerous ranges of protection. This typically contains collision, legal responsibility, and complete insurance coverage. Overview the small print fastidiously, as some choices is likely to be bundled or have further prices.

- Third-Get together Insurance coverage: Think about choices from suppliers specializing in worldwide journey insurance coverage. This will cowl you in case of damages, accidents, or different liabilities, even when your own home insurance coverage does not cowl you within the US. This would possibly provide a extra tailor-made strategy to your particular wants.

- Private Insurance coverage: Some private insurance coverage insurance policies would possibly lengthen protection to rental automobiles. Nonetheless, it’s worthwhile to test the coverage phrases to see if it contains rental automobiles and the constraints or exclusions.

Desk of Rental Automobile Insurance coverage Choices

| Insurance coverage Sort | Description | Execs | Cons |

|---|---|---|---|

| Rental Firm’s Insurance coverage | Supplied by the rental company; numerous ranges of protection | Handy, available | Might be costly, might have limitations |

| Third-Get together Insurance coverage | Bought from an organization specializing in worldwide journey insurance coverage | Tailor-made to worldwide journey, broader protection | Is likely to be extra expensive than rental firm’s insurance coverage |

| Private Insurance coverage | Protection extending to rental automobiles underneath particular circumstances | Probably cheaper if relevant | Requires coverage evaluate, won’t cowl all conditions |

Protection Choices for Overseas Vacationers

Navigating US rental automotive insurance coverage can really feel like a dodgy backstreet. Foreigners renting within the States have to be additional cautious, making certain they are not caught quick with insufficient safety. Figuring out your rights and the totally different choices out there is essential to avoiding nasty surprises.Normal rental insurance coverage insurance policies typically have blind spots, significantly for guests from abroad. They may not cowl every little thing you want, and the effective print could be a actual maze.

This information cuts by the jargon, highlighting important protection varieties and essential add-ons.

Legal responsibility Protection

Legal responsibility insurance coverage is the bedrock of any rental coverage. It protects you in the event you trigger injury or damage to others. Overseas vacationers ought to guarantee their coverage covers them for incidents that might come up, from minor fender benders to severe accidents. Understanding the boundaries of this protection is essential, because it typically will not cowl damages to your personal car.

Collision Protection

Collision protection steps in in case your car is broken in an accident, no matter who’s at fault. That is important for overseas guests, because it safeguards your rental in the event you’re concerned in an accident, even when it isn’t your fault. This safety is particularly pertinent whenever you’re unfamiliar with native visitors legal guidelines and driving situations.

Complete Protection

Complete protection is sort of a security web for unexpected occasions past accidents. It covers damages from issues like vandalism, theft, climate occasions, and even hitting an animal. This can be a important ingredient for vacationers who is likely to be parking in less-than-ideal areas or travelling by areas with larger crime charges. It is like having a back-up plan towards sudden mishaps.

Limitations of Normal Insurance policies for Overseas Guests

Normal insurance policies typically have limitations for overseas guests. Deductibles is likely to be larger, and protection for particular conditions like these arising from unfamiliar native situations is likely to be restricted. Overseas guests ought to fastidiously evaluate the coverage particulars, making certain it addresses their explicit wants.

Particular Conditions Requiring Extra Protection

Sure eventualities require further safety. Injury to your personal car, even in the event you’re not at fault, or accidents involving your rental whereas driving by unfamiliar or dangerous areas, are examples the place further protection turns into important.

Add-on Choices for Enhanced Protection

Varied add-on choices can be found for enhanced protection. These can embody supplementary collision and complete protection, larger legal responsibility limits, and even safety towards injury from pure disasters. Overseas guests ought to assess their journey itinerary and potential dangers to tailor their add-ons accordingly.

Comparability of Protection Ranges

| Protection Stage | Value | Advantages | Limitations |

|---|---|---|---|

| Primary Legal responsibility | Lowest | Covers damages to others | Does not cowl your car |

| Collision & Complete | Mid-range | Covers injury to your car, no matter fault, and lots of different incidents | Might need larger deductibles |

| Enhanced Protection (Add-ons) | Highest | Broader protection, larger limits | Costlier |

Insurance coverage Suppliers and Insurance policies: Rental Automobile Insurance coverage In Usa For Foreigners

Navigating the rental automotive insurance coverage jungle can really feel like a dodgy again alley at 3 AM. Foreigners renting within the US face distinctive challenges, needing greater than only a cursory look on the effective print. Understanding the totally different insurance policies provided by main gamers, and the way journey insurance coverage suits in, is essential to avoiding a sticky state of affairs on the open highway.Main rental firms typically provide numerous ranges of protection, every with its personal price ticket and limitations.

It is a sport of cat and mouse, looking for the appropriate stability between safety and value. Do not simply blindly settle for the primary coverage you see; analysis and evaluate, similar to you’d try totally different offers for a depraved new journey.

Evaluating Rental Firm Insurance policies

Rental firms, from the large manufacturers to the smaller gamers, tailor their insurance coverage packages to draw totally different prospects. Every coverage has a distinct scope and exclusions, so an intensive comparability is essential. For instance, Hertz would possibly provide a primary bundle with restricted legal responsibility safety, whereas Enterprise would possibly embody roadside help as normal.

Understanding Coverage Phrases and Situations

Studying the effective print is a ceremony of passage for any rental automotive buyer. The satan is usually within the particulars. It is not simply in regards to the protection quantity, but additionally the exclusions and limitations. Insurance policies typically have clauses about pre-existing injury, particular kinds of accidents, and even the age of the driving force. Be sure you’re conscious of the constraints earlier than hitting the highway.

The Function of Journey Insurance coverage

Journey insurance coverage acts as an important complement to rental automotive protection. Whereas rental insurance policies typically cowl injury, theft, or accidents, journey insurance coverage can present broader safety. It will possibly typically cowl medical bills, misplaced baggage, journey cancellations, and even authorized prices. That is particularly vital for foreigners, who might face further challenges in case of unexpected circumstances. Consider it as having a security web in case issues go sideways.

Acquiring Supplementary Protection, Rental automotive insurance coverage in usa for foreigners

Supplementary protection, typically from journey insurance coverage suppliers, gives additional layers of safety. This might embody larger legal responsibility limits or complete protection for sure conditions. It’s worthwhile to test the particular coverage phrases and situations to your rental and journey insurance coverage to find out the precise particulars of supplementary protection. It is not rocket science; simply make sure you’ve received the mandatory safeguards in place.

Insurance coverage Supplier Comparability Desk

| Insurance coverage Supplier | Typical Coverage Phrases | Extra Protection Choices |

|---|---|---|

| Hertz | Primary legal responsibility protection; larger deductible; restricted roadside help | Non-compulsory add-ons for complete protection, larger legal responsibility limits, and supplemental safety |

| Enterprise | Complete protection with larger legal responsibility limits; roadside help included | Non-compulsory extras for injury waivers and enhanced protection |

| Avis | Just like Hertz; various ranges of protection relying on the rental bundle | Non-compulsory extras for injury waivers and enhanced protection |

| Funds | Decrease premiums than main gamers; typically contains primary legal responsibility and injury waivers | Restricted further protection choices |

Documentation and Procedures

Navigating the US rental automotive scene as a foreigner could be a little bit of a maze, however finding out insurance coverage is essential to a easy journey. Understanding the documentation and procedures required for securing rental automotive insurance coverage is essential for avoiding any potential complications on the counter. This part lays out the necessities, from the usual paperwork to these additional bits you would possibly want.

Required Paperwork for Overseas Guests

Getting your wheels rolling within the States requires greater than only a legitimate driver’s license. Overseas guests must current particular paperwork to show their id, residency standing, and driving privileges. This ensures the rental firm can assess danger and supply applicable protection.

- Passport: Important for verifying your id and nationality. It is a important piece of ID, and with out it, securing insurance coverage will be tough.

- Driver’s License: A sound driver’s license from your own home nation, together with an Worldwide Driving Allow (IDP) if required, is required to display your driving credentials. It is a must-have to show you are legally allowed to function a car within the US.

- Proof of Handle: This would possibly embody a lodge affirmation, or a letter out of your host if relevant. This verifies your present location within the US, which is crucial for insurance coverage functions.

- Credit score Card: A significant bank card is usually required for a safety deposit, which acts as a assure for the rental. This can be a normal process within the trade, because it ensures the rental firm can get well any potential damages.

Procedures on the Rental Counter

The method for securing rental automotive insurance coverage on the counter is pretty easy, however understanding the steps is important. Be ready to current your paperwork and have them checked.

- Presentation of Paperwork: Current all required paperwork to the rental agent on the counter. They are going to confirm their authenticity and guarantee every little thing is so as.

- Insurance coverage Choices Overview: The agent will evaluate the out there insurance coverage choices with you. Talk about your wants and any particular necessities you will have. Be sure you perceive the phrases and situations earlier than signing something.

- Settlement and Signature: As soon as you’ve got chosen your insurance coverage protection, signal the related paperwork. This confirms your settlement to the phrases of the insurance coverage coverage.

- Insurance coverage Affirmation: Request affirmation of your insurance coverage protection. This might be included in your rental settlement. This can be a essential step to keep away from any points in a while.

Function of Driver’s License and Passport

Your driver’s license and passport are central to the insurance coverage course of. They function important items of proof, establishing your id and driving credentials.

“A sound driver’s license and passport are important to confirm your id and driving privileges, and they’re foundational to the insurance coverage course of.”

Extra Paperwork

Some conditions might require further paperwork. For instance, in the event you’re renting a car for a particular objective (like a enterprise journey), or when you have a historical past of accidents or visitors violations, you could want to offer additional documentation.

- Enterprise Letterhead: If the rental is for enterprise functions, you could want to offer letterhead confirming your organization’s title and handle.

- Earlier Rental Historical past: In case you have a historical past of accidents or violations, the rental firm might ask for particulars, probably requiring you to clarify any previous incidents.

- Proof of Monetary Stability: In sure circumstances, the rental firm might request further documentation to evaluate your monetary stability, which may embody financial institution statements or different monetary data.

Documentation Necessities and Procedures Desk

This desk summarizes the paperwork and procedures for securing rental automotive insurance coverage.

| Doc | Process |

|---|---|

| Passport | Current on the counter for verification. |

| Driver’s License | Current and test validity. |

| Proof of Handle | Present proof of your present location within the US. |

| Credit score Card | Required for safety deposit. |

| Insurance coverage Choices | Overview and select desired protection. |

| Rental Settlement | Signal to verify settlement with phrases. |

Claims and Disputes

Navigating the rental automotive insurance coverage panorama can really feel like navigating a dodgy again alley at night time. Foreigners renting within the States face a singular set of challenges, and understanding claims and disputes is essential. Figuring out the ropes can prevent an entire heap of problem and potential heartache.

Declare Submitting Process

Submitting a declare is like following a set of directions to get a refund from a dodgy takeaway. It is a course of that, whereas typically irritating, is crucial. Guarantee you might have all the mandatory documentation prepared – your rental settlement, insurance coverage coverage particulars, and police report (if relevant). Contact your insurance coverage supplier instantly after an accident or injury.

Observe their particular declare procedures Artikeld in your coverage. This usually includes offering detailed details about the incident, together with witness statements if out there. Immediate and correct reporting is essential to a smoother declare course of.

Frequent Causes of Disputes

Disputes typically come up from misunderstandings, or when one occasion’s expectations aren’t met. Frequent points embody disagreements over the extent of harm, conflicting statements from witnesses, and disagreements over legal responsibility. Renting a automotive will be disturbing sufficient; keep away from including gas to the fireplace with disputes over who’s at fault. Clarifying expectations and documenting every little thing is essential to stopping these points.

Insurance coverage suppliers have particular standards for evaluating claims. Unclear documentation or an absence of immediate communication can result in delays and problems.

Dealing with a Declare if at Fault

Being at fault in an accident is rarely excellent. Nonetheless, it is a part of life. Honesty and transparency are your greatest weapons. Contact the rental firm and your insurance coverage supplier instantly. Cooperate absolutely with the investigation and supply correct data.

Settle for accountability to your actions, and perceive that insurance coverage suppliers have particular standards for evaluating claims. Be ready to debate the incident and the injury triggered. Do not attempt to disguise something, as this could make the declare course of much more complicated.

Profitable Declare Decision Methods

Profitable declare resolutions typically contain clear communication, correct documentation, and a willingness to barter. Hold meticulous data of all communications with the insurance coverage supplier. When you really feel you are not getting a good deal, search recommendation from a lawyer specializing in insurance coverage claims. They will help you navigate the method and signify your pursuits. Typically, a transparent and concise presentation of your case, backed by proof, can result in a extra favorable end result.

Negotiating with the insurance coverage firm will be useful, but it surely’s vital to stay skilled and preserve a optimistic angle.

Desk of Declare Submitting Steps and Potential Disputes

| Step | Description | Potential Dispute Factors |

|---|---|---|

| 1. Quick Reporting | Contact insurance coverage supplier and rental firm instantly. | Failure to report promptly, incomplete preliminary data. |

| 2. Documentation Gathering | Gather all related paperwork: rental settlement, coverage particulars, police report. | Lacking or inaccurate documentation, conflicting statements. |

| 3. Declare Submission | Submit an in depth declare type with supporting proof. | Disagreement on the extent of harm, legal responsibility evaluation. |

| 4. Investigation and Analysis | Insurance coverage supplier investigates the declare. | Delayed investigation, differing interpretations of proof. |

| 5. Decision | Negotiation or settlement. | Unacceptable compensation, dissatisfaction with decision course of. |

Suggestions and Suggestions for Overseas Renters

Navigating US rental automotive insurance coverage can really feel like a maze for worldwide travellers. This part gives essential intel to keep away from getting misplaced within the paperwork and insurance policies. Understanding the nuances is essential to securing the appropriate protection and avoiding hefty prices down the road.

Deciding on the Proper Rental Automobile Insurance coverage

Overseas renters ought to meticulously assess their present journey insurance coverage, as it would provide some protection. Rental firms typically have numerous add-on packages. Do not routinely settle for the most affordable choice; fastidiously look at the inclusions and exclusions. A coverage with complete protection, together with injury to the car and legal responsibility for accidents, is extremely really helpful.

Understanding US Insurance coverage Insurance policies for Foreigners

US insurance policies for overseas vacationers typically have particular stipulations and situations. Insurance policies might require proof of enough legal responsibility insurance coverage or a particular deductible quantity. Foreigners want to know these phrases and situations totally. Some insurance policies won’t cowl pre-existing situations or accidents from prior journey.

Evaluating Quotes and Protection

Evaluating quotes from totally different rental firms and insurance coverage suppliers is crucial. This course of lets you scrutinize the particular particulars of every coverage, making certain you get the absolute best worth to your cash. Websites providing comparative quotes for automotive leases can streamline this course of. Be cautious of hidden prices or exclusions.

Getting ready Earlier than Arriving within the USA

Thorough pre-trip planning is essential. Overview your worldwide driver’s license validity and any vital endorsements to your residence nation. Analysis and ensure if your own home nation insurance coverage coverage extends to the USA, and what the constraints could also be. Examine native visitors legal guidelines and rules earlier than your journey to familiarise your self with the driving norms.

Understanding Native Visitors Legal guidelines and Laws

US visitors legal guidelines and rules can differ from these in your house nation. Familiarising your self with these variations, together with velocity limits, parking rules, and right-of-way guidelines, is essential for a easy and secure driving expertise. Figuring out the penalties for violating these legal guidelines can be important. Seek the advice of on-line assets for particular native legal guidelines earlier than travelling. Native authorities’ web sites often include data on visitors rules.

Comparability of Insurance coverage Prices Throughout States

Rental automotive insurance coverage charges within the US ain’t no uniform factor, mate. They shift just like the wind, relying on the place you are clockin’ in. Completely different states have totally different rules and danger profiles, which immediately influence the costs you may pay for a rental automotive coverage. So, in the event you’re a foreigner hittin’ the highway, understanding these regional variations is essential.This part breaks down the components affecting insurance coverage prices, from location-based variations to seasonal spikes.

We’ll additionally provide you with a snapshot of typical insurance coverage prices for frequent automobiles throughout numerous states, making it simpler to check and price range.

Elements Influencing Insurance coverage Prices

State-specific rules play an enormous position in shaping rental automotive insurance coverage costs. For instance, some states may need larger insurance coverage necessities for overseas guests, probably impacting your prices. Additionally, the typical accident fee in a given state will affect the chance evaluation and, subsequently, the insurance coverage premiums. These premiums are calculated based mostly on the chance of a declare in that particular location.

Sure states recognized for high-risk driving situations, like these with mountainous terrain or high-speed highways, may need larger insurance coverage prices in comparison with others.

Impression of Location and Seasonality

Location, location, location – it is a biggie within the insurance coverage sport. Coastal areas with excessive vacationer visitors would possibly see premiums bumped up because of the elevated danger of accidents involving rental automobiles. Conversely, rural areas with decrease visitors volumes would possibly see extra aggressive charges. Additionally, vacationer seasons typically coincide with a spike in demand for rental automobiles, which might drive up insurance coverage prices.

Consider summer season months in common locations – you may probably discover charges are larger than through the low season.

Comparability of Typical Insurance coverage Prices

The price of rental automotive insurance coverage is not a hard and fast quantity; it varies considerably based mostly on the car kind, rental length, and particular insurance coverage bundle. For example, a luxurious SUV will usually command larger premiums in comparison with a compact automotive. Additionally, longer rental durations typically result in larger prices. So, when evaluating throughout states, at all times test for particular particulars like protection ranges and deductibles.

Comparative Prices Throughout US States

| State | Typical Value (Estimated) for Compact Automobile (3-day rental) | Typical Value (Estimated) for SUV (5-day rental) |

|---|---|---|

| California | $30-45 | $45-60 |

| Florida | $25-40 | $40-55 |

| Texas | $28-42 | $42-57 |

| New York | $35-50 | $50-70 |

| Hawaii | $40-55 | $55-70 |

Notice: These are estimated prices and may fluctuate considerably relying on the particular rental firm, protection choices, and particular person circumstances. All the time test with the rental firm immediately for correct pricing.

Illustrative Eventualities and Examples

Navigating the US rental automotive scene as a foreigner will be tough, particularly with regards to insurance coverage. Understanding the nuances of various insurance policies and coverages is essential to avoiding hefty payments down the road. This part delves into real-world eventualities for example when complete insurance coverage is a must have, and when you’ll be able to most likely skip it.

Complete Insurance coverage: A Foreigner’s Protect

Overseas renters can profit considerably from complete insurance coverage in conditions involving unexpected injury or accidents. Think about this: you are cruising down a scenic freeway, when a rogue deer darts into your lane, inflicting vital injury to your rental. With out complete protection, you would be on the hook for repairs, probably going through a considerable out-of-pocket expense. Complete insurance coverage would cowl the injury, saving you from a severe monetary blow.

This additionally applies to theft, vandalism, or different unexpected incidents.

When Further Insurance coverage is a Waste of Dough

Generally, additional insurance coverage is not definitely worth the premium. Think about a state of affairs the place you are renting a automotive for a brief journey by a well-maintained metropolis with glorious roads. The danger of main accidents or injury is considerably decrease than in a extra rural or mountainous space. On this state of affairs, the bottom insurance coverage supplied by the rental firm would possibly suffice, saving you cash with out sacrificing peace of thoughts.

That is significantly true when you have a sturdy journey insurance coverage coverage that covers potential losses.

Declare Decision: A Clean Course of

Claims can occur, however a well-defined course of ensures a smoother decision. When you’re concerned in an accident, comply with these steps: Report the incident to the police and the rental firm instantly. Collect all vital documentation, together with police reviews, witness statements, and medical data. Cooperate absolutely with the insurance coverage firm through the declare course of, offering any requested data promptly.

Speaking successfully with all events concerned will expedite the declare course of.

Extra Journey Insurance coverage: A Security Internet

Past rental automotive insurance coverage, having further journey insurance coverage can present an additional layer of safety. Think about your flight getting delayed, requiring you to increase your keep and probably incurring additional prices. Your journey insurance coverage may cowl these unexpected bills, protecting your journey on monitor with out draining your pockets. In case your belongings are misplaced or broken, your journey insurance coverage may enable you get well the prices.

Eventualities and Options

| Situation | Answer |

|---|---|

| Driving by a rural space with a historical past of wildlife encounters, and the automotive sustains injury from a hit-and-run. | Complete insurance coverage is extremely really helpful. |

| Quick metropolis journey by a well-maintained city space with glorious infrastructure. | Base insurance coverage probably ample. Think about journey insurance coverage for added safety. |

| Accident involving damage to your self or others. | Instantly contact the police, rental firm, and your insurance coverage supplier. Collect all related documentation. |

| Flight delay extending your keep, resulting in additional lodging prices. | Journey insurance coverage can cowl unexpected bills. |

Epilogue

In conclusion, securing the appropriate rental automotive insurance coverage within the USA as a foreigner is paramount. This information has illuminated the varied choices, concerns, and procedures concerned within the course of. By fastidiously evaluating insurance policies, understanding your particular wants, and proactively addressing potential points, you’ll be able to confidently take pleasure in your journey whereas safeguarding your self towards monetary dangers. Keep in mind to totally evaluate all insurance policies, perceive the documentation necessities, and contemplate supplemental protection choices to make sure a safe and stress-free driving expertise.

Your preparation is essential to a secure and pleasurable journey.

Detailed FAQs

What kinds of paperwork are often required to safe rental automotive insurance coverage within the USA as a foreigner?

Legitimate driver’s license, passport, and proof of journey insurance coverage or rental insurance coverage from the house nation are sometimes vital. Particular necessities might fluctuate relying on the rental firm.

What are the frequent causes of disputes between renters and insurance coverage suppliers within the USA?

Misunderstandings about coverage protection, insufficient documentation, and discrepancies in injury assessments are frequent causes for disputes. Clarifying particulars and reviewing the coverage totally can stop these points.

How can I put together for the rental automotive insurance coverage course of earlier than arriving within the USA?

Analysis totally different rental firms, evaluate their insurance policies, and get pre-approved for insurance coverage if doable. Familiarize your self with native visitors legal guidelines and rules to keep away from misunderstandings. Overview your journey insurance coverage choices to see in the event that they cowl rental automotive insurance coverage.

How does journey insurance coverage complement rental automotive insurance coverage for foreigners?

Journey insurance coverage can present further protection that is not included in normal rental insurance policies, akin to medical bills, misplaced baggage, and even journey cancellations. It is typically a invaluable addition for a complete security web.