Suppose that you simply work for Gecko Automotive Insurance coverage. This in-depth look reveals the intricacies of Gecko’s insurance policies, customer support, pricing, and declare course of. From understanding their distinctive promoting propositions to navigating the newest trade developments, this unique interview-style exploration affords a complete perspective.

This evaluation delves into Gecko’s target market, evaluating their choices with a number one competitor, and outlining varied coverage sorts and coverages. We’ll discover their customer support channels, pricing methods, and the steps concerned in submitting and resolving claims. Lastly, we’ll study Gecko’s method to security options and driving habits, highlighting their modern methods within the dynamic insurance coverage market.

Gecko Automotive Insurance coverage Overview: Suppose That You Work For Gecko Automotive Insurance coverage

A nimble gecko, swift and certain, embodies the spirit of Gecko Automotive Insurance coverage. This modern firm affords a refreshing method to auto insurance coverage, specializing in tailor-made options for drivers of every kind. Its user-friendly on-line platform and dedication to clear pricing set it aside within the aggressive market.Gecko Automotive Insurance coverage prioritizes proactive customer support, fostering a way of neighborhood and belief amongst its policyholders.

This dedication to particular person wants, mixed with aggressive charges, makes Gecko a compelling alternative for these in search of each affordability and safety on the street.

Distinctive Promoting Propositions (USPs)

Gecko Automotive Insurance coverage distinguishes itself by way of a mix of modern options. Its dedication to customized pricing fashions, based mostly on particular person driving behaviors and car specifics, permits for personalized protection. Moreover, Gecko makes use of cutting-edge know-how to streamline the claims course of, offering a seamless expertise for policyholders.

Goal Viewers

The target market for Gecko Automotive Insurance coverage spans a broad spectrum of drivers. From younger, tech-savvy millennials to seasoned, value-conscious drivers, Gecko’s complete and adaptable insurance policies cater to numerous wants and life. Emphasis is positioned on accessibility and ease of use, making the insurance coverage course of much less daunting and extra empowering for all.

Key Options and Advantages

Gecko Automotive Insurance coverage insurance policies supply a spread of advantages designed to reinforce the driving expertise. Complete protection, together with legal responsibility, collision, and complete safety, ensures peace of thoughts on the street. Versatile protection choices cater to various budgets and driving habits. This customized method permits policyholders to tailor their insurance coverage to particular wants. The web platform gives 24/7 entry to coverage data and claims administration.

- Customized Pricing: Gecko’s dynamic pricing mannequin adjusts premiums based mostly on elements equivalent to driving historical past, car kind, and placement. This ensures drivers pay just for the protection they want.

- Straightforward On-line Platform: A user-friendly on-line portal streamlines the whole insurance coverage course of, from coverage buy to assert submitting. Policyholders can entry data, handle their accounts, and monitor claims progress effortlessly.

- Proactive Buyer Service: Gecko Automotive Insurance coverage fosters a powerful relationship with its prospects by way of responsive and useful assist channels. This dedication to buyer satisfaction gives a way of safety and reliability.

Model Identification and Values

Gecko Automotive Insurance coverage cultivates a model id rooted in innovation, accessibility, and transparency. The corporate values buyer empowerment and strives to offer a streamlined, user-friendly expertise. This emphasis on simplicity and effectivity is a core tenet of their model ethos.

Comparability with State Farm

| Characteristic | Gecko | State Farm | Abstract |

|---|---|---|---|

| Pricing | Dynamic, customized, based mostly on particular person elements | Conventional, standardized charges | Gecko affords tailor-made pricing, whereas State Farm makes use of a extra normal method. |

| Platform | Consumer-friendly, online-centric | Mixture of on-line and conventional channels | Gecko prioritizes a digital expertise, whereas State Farm makes use of a broader array of strategies. |

| Buyer Service | Proactive, responsive, simply accessible | Usually dependable, however could have various response occasions | Gecko emphasizes proactive assist, whereas State Farm operates on a extra conventional mannequin. |

| Protection Choices | Versatile, adaptable to particular person wants | Complete, however could not supply as a lot customization | Gecko affords tailor-made choices, whereas State Farm gives a wider vary of complete protection. |

Coverage Varieties and Protection

A tapestry of safety, woven from threads of numerous protection, awaits those that search solace in Gecko’s embrace. Understanding the nuances of every coverage kind is vital to securing the optimum safeguard to your cherished car. From the common-or-garden commuter automotive to the spirited sports activities machine, Gecko affords tailor-made insurance policies to swimsuit each want.Gecko’s insurance coverage insurance policies are designed to be extra than simply monetary devices; they’re shields towards life’s sudden turns.

Every coverage kind fastidiously balances complete safety with affordability, permitting you to navigate the roads with confidence. The next sections will element the varied insurance policies and their respective protection, empowering you to make knowledgeable choices about your car’s safety.

Coverage Variations

Gecko affords a spectrum of coverage sorts, every meticulously crafted to deal with distinctive circumstances. These insurance policies are categorized to cater to the distinct wants of varied drivers and car sorts. Totally different coverage sorts will embody completely different ranges of safety and premiums.

Protection Choices

Gecko’s complete protection choices present a spread of safety to your car. These coverages are designed to deal with potential dangers related to possession and use. Protection choices can differ in scope and monetary burden, relying on the chosen coverage kind. These insurance policies could be personalized to suit particular wants.

Illustrative Coverage Situations

Think about a younger skilled, commuting every day of their sedan. A normal coverage would probably cowl injury from collisions and theft. Alternatively, a coverage tailor-made to a classic sports activities automotive fanatic would possibly embody further coverages for restoration and restore. The premiums and protection ranges will differ relying on the coverage kind and particular person circumstances.

Coverage Protection Desk

| Protection Kind | Description | Instance State of affairs | Price/Premium |

|---|---|---|---|

| Collision | Covers injury to your car brought on by a collision with one other car or object. | Your automotive is rear-ended in site visitors. | Variable, depending on coverage kind and deductible. |

| Complete | Covers injury to your car from occasions aside from collisions, equivalent to fireplace, vandalism, or climate occasions. | Your automotive is broken in a hailstorm. | Variable, depending on coverage kind and deductible. |

| Legal responsibility | Covers the monetary accountability for damages you trigger to different individuals’s property or accidents to others in an accident. | You trigger an accident and injury one other automotive. | Variable, depending on coverage limits. |

| Uninsured/Underinsured Motorist | Protects you in case you are concerned in an accident with a driver who doesn’t have insurance coverage or whose insurance coverage is inadequate to cowl your losses. | You’re hit by a driver with no insurance coverage, inflicting substantial injury to your automotive. | Variable, depending on coverage limits. |

Declare Dealing with

Gecko’s declare course of is designed to be swift and environment friendly. A devoted claims crew works diligently to evaluate the validity of a declare and expedite the settlement course of. The crew will consider the injury and supply a good settlement throughout the stipulated timeframe. The effectivity of the method depends upon elements such because the readability of the declare documentation and the completeness of the data offered.

Buyer Service and Help

A tapestry of care, Gecko’s customer support weaves a path of ease and understanding. From the preliminary inquiry to the ultimate decision, every interplay is meticulously crafted to satisfy and exceed expectations. The seamless journey by way of Gecko’s assist channels is a testomony to their dedication to consumer satisfaction.Gecko’s customer support channels supply a various vary of choices to make sure accessibility for each consumer.

Whether or not in search of fast help or preferring a extra customized method, the choices are plentiful and cater to varied preferences. The streamlined course of ensures a swift decision, minimizing frustration and maximizing the worth of the consumer expertise.

Buyer Service Channels

Gecko’s dedication to accessibility manifests in a plethora of channels for buyer interplay. This multifaceted method ensures shoppers can join in a manner that most closely fits their wants and preferences. The number of strategies empowers shoppers to navigate their insurance coverage journey with confidence.

- Cellphone Help: A direct line to knowledgeable advisors, telephone assist gives fast options for urgent considerations. Skilled representatives, well-versed in coverage intricacies, supply customized help and deal with complicated conditions promptly.

- On-line Portal: A digital sanctuary for coverage administration, the net portal empowers shoppers to entry their account particulars, monitor claims, and submit inquiries 24/7. This self-service possibility affords a handy various to conventional strategies.

- E-mail Help: A devoted e-mail channel facilitates communication relating to particular coverage particulars or requests. Responses are usually offered inside a specified timeframe, guaranteeing well timed communication and environment friendly problem-solving.

- Chat Help: Actual-time interplay by way of chat assist permits fast decision of straightforward inquiries. This dynamic method permits for fast suggestions and addresses simple points effectively.

Response Time and Decision Course of

Gecko strives to offer immediate and efficient responses to buyer inquiries. The response time for varied assist channels is meticulously tracked and optimized to make sure well timed help. A streamlined decision course of ensures environment friendly dealing with of each buyer interplay.

- Cellphone assist usually responds inside 1-2 enterprise days for normal inquiries, with complicated points doubtlessly taking as much as 3-5 days for full decision.

- On-line portal inquiries are usually answered inside 24 hours, with most points resolved inside 2-3 enterprise days. The web portal permits for monitoring of declare standing and progress, offering clear and environment friendly updates.

- E-mail assist usually responds inside 24-48 hours, with decision occasions relying on the complexity of the problem. A devoted e-mail thread ensures all correspondence is organized and simply accessible.

- Chat assist goals for fast responses and resolutions. Nearly all of easy inquiries are addressed and resolved throughout the interplay, minimizing wait occasions and enhancing the real-time expertise.

Comparability to Different Insurance coverage Suppliers

Gecko’s customer support distinguishes itself by way of its dedication to client-centric options. Whereas different suppliers could prioritize effectivity over personalization, Gecko focuses on a harmonious mix of each. This dedication to care differentiates Gecko’s service from the competitors. A dedication to understanding particular person consumer wants units a brand new normal.

Profitable Buyer Service Interactions

Quite a few constructive experiences illustrate Gecko’s dedication to excellence in customer support. A typical thread woven by way of these interactions is a demonstrable understanding of the consumer’s wants, together with the proactive decision of any challenges encountered.

- A buyer experiencing a declare delay acquired common updates and clear explanations, demonstrating proactive communication and a dedication to transparency.

- One other buyer in search of help with a coverage change acquired customized steerage and assist all through the whole course of, highlighting a tailor-made method to customer support.

- A 3rd buyer with a fancy coverage state of affairs was supplied with a devoted assist consultant who patiently defined varied choices and in the end resolved the problem to the client’s satisfaction, showcasing the flexibility to navigate complicated circumstances.

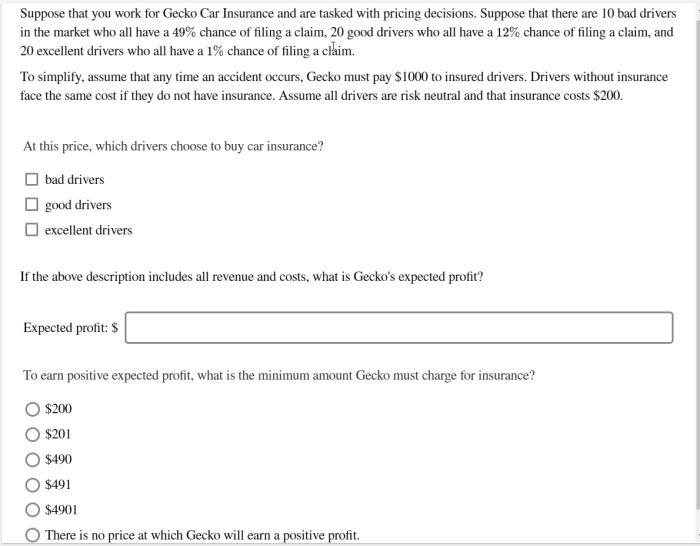

Pricing and Worth Proposition

Gecko’s pricing, a symphony of calculated worth, orchestrates a compelling proposition for discerning drivers. It is a delicate stability, harmonizing elements from threat evaluation to market developments, leading to a tailor-made insurance coverage expertise. The method is just not arbitrary; it is a meticulously crafted providing that resonates with the wants of the trendy driver.

Components Influencing Gecko’s Pricing Technique

Gecko’s pricing technique is a classy dance, meticulously choreographed by a constellation of things. These embody, however usually are not restricted to, the driving force’s historical past, car kind, location, and driving habits. Subtle algorithms, analyzing a mess of knowledge factors, type the muse of this calculated method. The aim is to offer a good and clear premium that displays the particular threat profile of every policyholder.

This technique, like a well-honed instrument, ensures aggressive pricing whereas sustaining monetary stability for the corporate.

Gecko’s Pricing Construction vs. Rivals

Gecko’s pricing construction stands aside from its opponents. It differs in its clear and data-driven method. In contrast to some opponents that depend on opaque pricing fashions, Gecko’s pricing is demonstrably tied to the person dangers related to every coverage. This transparency fosters belief and empowers prospects with a transparent understanding of their premiums. The method emphasizes tailor-made options, quite than one-size-fits-all packages.

Worth Proposition of Gecko’s Pricing

Gecko’s pricing affords a singular worth proposition: reasonably priced premiums whereas sustaining a sturdy degree of protection. It is a compelling proposition that targets the trendy driver in search of each monetary accountability and complete safety. By leveraging superior know-how and actuarial science, Gecko goals to ship a premium that aligns with particular person wants, thereby reaching a harmonious stability between price and protection.

Worth Tiers and Corresponding Protection Ranges

Gecko affords tiered pricing plans, every reflecting a special degree of protection and advantages. The tiers are designed to cater to a wide range of wants and budgets. This method is just like a spectrum, with every tier offering a definite and well-defined degree of safety.

| Tier | Premium | Protection Abstract | Extra Advantages |

|---|---|---|---|

| Primary | $500-$1000 | Legal responsibility protection, complete safety towards minor damages. | Accident forgiveness program for minor violations. |

| Commonplace | $1000-$2000 | Full legal responsibility protection, complete safety towards reasonable damages, and better deductible choices. | Accident forgiveness program for minor violations, roadside help. |

| Premium | $2000-$4000 | Complete protection, high-value safety, and enhanced collision protection. | Accident forgiveness program for minor violations, roadside help, reductions on different companies like rental vehicles. |

| Luxurious | $4000+ | Complete protection, top-tier safety towards in depth damages, and customised protection choices. | Accident forgiveness program for minor violations, roadside help, premium concierge companies, and better declare limits. |

Low cost Applications Supplied by Gecko

Gecko acknowledges and rewards accountable driving habits. To additional improve the worth proposition, Gecko affords varied low cost packages designed to decrease premiums. These packages, like a constellation of rewards, are meant to inspire and incentivize protected driving practices.

- Protected Driving Reductions: Encourages protected driving habits by way of usage-based packages and accident-free data.

- Multi-Automobile Reductions: Supplies reductions for patrons insuring a number of autos below one coverage.

- Bundled Providers Reductions: Gives reductions when bundling insurance coverage with different companies like house or renters insurance coverage.

- Scholar Reductions: Supplies reductions to college students who meet particular standards, recognizing the worth of accountable younger drivers.

Claims Course of and Settlement

A tapestry of belief weaves by way of the material of insurance coverage, and Gecko Automotive Insurance coverage meticulously crafts a seamless claims course of. From the preliminary whisper of injury to the ultimate, satisfying decision, each step is designed to be environment friendly and equitable, a testomony to our dedication to our valued prospects.

Declare Submitting Process

The method of submitting a declare with Gecko is easy, like navigating a well-marked path. First, contact us by way of our devoted channels – on-line portal, telephone, or e-mail – to provoke the method. A transparent and concise description of the incident, together with any supporting documentation, will expedite the declare evaluation. Thorough documentation is paramount; a meticulous report ensures a swift and correct decision.

Declare Documentation and Submission

Totally documenting the injury is essential for a swift and correct declare settlement. This contains images or movies of the injury, copies of any related police stories, witness statements, and restore estimates. The readability and completeness of the documentation instantly impression the pace and accuracy of the settlement. Presenting complete documentation ensures a smoother path to assert decision.

Declare Situations and Settlement Course of

Think about a situation the place a fender bender ends in minor injury. The declare course of would possibly contain a fast inspection, approval, and a direct cost to the restore store. Alternatively, a extra vital accident would possibly necessitate an in depth investigation, appraisal, and doubtlessly a alternative car. In every occasion, Gecko meticulously adheres to established procedures, guaranteeing equity and transparency all through the settlement course of.

The intricate dance of evaluation, analysis, and cost culminates in a decision that honors each the client’s wants and the insurer’s tasks.

Gecko Declare Course of Phases

| Stage | Description | Paperwork Required | Timeframe |

|---|---|---|---|

| Declare Initiation | Contacting Gecko and offering preliminary particulars of the incident. | Coverage particulars, transient description of the incident. | Inside 24 hours (on-line) or 48 hours (telephone/e-mail) |

| Evaluation | Gecko’s analysis of the declare based mostly on offered data and documentation. | Supporting documentation (photographs, movies, police stories). | 2-5 enterprise days |

| Settlement Approval | Determination on the declare’s approval or denial, together with the phrases of settlement. | Detailed restore estimates, approval of restore store. | 3-7 enterprise days (minor injury); 7-14 enterprise days (main injury) |

| Cost Processing | Finalization of cost to the restore store or direct cost to the client, relying on the declare kind. | Financial institution particulars, restore store data. | 1-3 enterprise days (relying on cost methodology). |

Declare Dispute Decision

If a buyer disagrees with the declare settlement, Gecko affords a structured dispute decision course of. This entails a overview of the preliminary evaluation and settlement, with the chance for added documentation and proof. Gecko strives to resolve disputes pretty and effectively, using a impartial method to make sure mutual satisfaction. Communication and collaboration are key to navigating any disagreements, guaranteeing a passable end result for all events concerned.

Insurance coverage Business Developments and Improvements

The automotive insurance coverage panorama, a tapestry woven with threads of threat and reward, is continually evolving. New applied sciences and shifting societal norms reshape the trade, demanding agility and innovation from suppliers like Gecko. This transformation, a dance between the established and the rising, presents each challenges and alternatives.The way forward for automotive insurance coverage, a symphony of knowledge and digital options, is taking form.

Gecko, a pioneer on this evolving ecosystem, embraces these developments, guaranteeing continued excellence in offering reasonably priced and complete protection.

Latest Developments and Developments

The automotive insurance coverage trade is present process a interval of serious evolution. Telematics, leveraging driver habits information, is turning into more and more prevalent. Utilization-based insurance coverage, customized based mostly on driving habits, is reworking the way in which premiums are calculated. Moreover, the rise of autonomous autos and related automotive know-how presents each thrilling prospects and complicated challenges for threat evaluation and protection. The trade is adjusting to those improvements by incorporating data-driven fashions to refine pricing and improve claims administration.

Revolutionary Approaches by Gecko, Suppose that you simply work for gecko automotive insurance coverage

Gecko, a nimble innovator, actively embraces cutting-edge applied sciences to stay aggressive. Its dedication to user-friendly digital platforms and intuitive cellular apps permits prospects seamless entry to their insurance policies, claims, and assist. Harnessing the facility of predictive analytics, Gecko tailors protection to particular person wants, optimizing worth and cost-effectiveness. By way of strategic partnerships with know-how suppliers, Gecko expands its technological capabilities and enhances its buyer expertise.

Gecko’s Response to Rising Challenges

The rise of autonomous autos necessitates a reevaluation of legal responsibility and accountability. Gecko anticipates these developments by investing in analysis and growth to adapt its protection fashions to embody the distinctive dangers introduced by self-driving vehicles. The evolving nature of cyber dangers and their potential impression on car operations is one other necessary facet of consideration. Gecko proactively addresses these considerations by staying knowledgeable concerning the newest trade requirements and technological developments.

The corporate’s dedication to adaptation and resilience ensures its continued relevance within the ever-changing insurance coverage market.

Gecko’s Use of Know-how and Digital Instruments

Gecko leverages a sturdy technological infrastructure to offer prospects with a streamlined expertise. The corporate’s cellular app facilitates coverage administration, declare reporting, and buyer assist, making a extra handy and accessible service. Knowledge analytics instruments enable Gecko to refine pricing fashions, establish potential dangers, and optimize its total operations. These instruments present a big benefit by providing predictive capabilities and permitting Gecko to stay proactive in its method.

Impression of New Applied sciences on the Insurance coverage Sector

New applied sciences, equivalent to synthetic intelligence and machine studying, are reshaping the insurance coverage sector. AI algorithms can course of huge quantities of knowledge, enabling insurers to evaluate threat extra precisely and personalize pricing. The usage of machine studying permits for predictive modeling, figuring out developments and patterns in claims information to proactively deal with potential points. These applied sciences have the potential to dramatically improve the effectivity and effectiveness of insurance coverage operations, in the end benefiting each prospects and suppliers.

Security Options and Driving Habits

Gecko Automotive Insurance coverage understands that accountable driving is a cornerstone of street security. We imagine in rewarding drivers who prioritize security, each of their autos and their habits. This dedication displays our dedication to fostering a safer driving surroundings for everybody on the roads.Our method to incentivizing protected driving habits is multifaceted, encompassing a spectrum of packages and initiatives.

We acknowledge that accountable driving is just not merely a matter of adhering to guidelines however a proactive alternative for a safer journey.

Gecko’s Incentives for Protected Driving

Gecko fosters a tradition of protected driving by way of varied initiatives. These vary from providing reductions for autos outfitted with superior security options to selling protected driving practices by way of academic campaigns. Our aim is to empower drivers to make acutely aware selections that contribute to a safer street surroundings.

- Security Characteristic Reductions: Autos outfitted with superior driver-assistance techniques (ADAS) equivalent to automated emergency braking (AEB), lane departure warning, and adaptive cruise management, reveal a dedication to security. Gecko rewards drivers for this proactive method by providing reductions on their premiums.

- Protected Driving Applications: Gecko companions with native driving faculties and organizations to conduct workshops and academic periods on protected driving strategies. These packages equip drivers with sensible abilities and insights for avoiding accidents and bettering their driving habits.

- Rewarding Accountable Driving: Drivers who keep a persistently protected driving report by way of utilization of security options and applicable driving habits earn reductions on their premiums. This reinforces constructive driving habits and motivates drivers to undertake a extra proactive method to security.

Position of Security Options in Pricing

Security options play a big position in figuring out automotive insurance coverage premiums. Autos with superior security options are sometimes perceived as much less susceptible to accidents, resulting in decrease premiums for his or her house owners. This isn’t solely based mostly on empirical proof but in addition on the truth that these options usually mitigate the severity of collisions.

“Autos outfitted with superior security options, equivalent to airbags, anti-lock brakes, and digital stability management, demonstrably scale back the chance and severity of accidents.”

Correlation Between Protected Driving Scores and Premiums

A direct correlation exists between a driver’s security rating and their insurance coverage premium. The next security rating usually interprets to a decrease premium, reflecting the driving force’s dedication to protected driving practices.

| Security Rating | Low cost Share | Instance Driving Habits | Security Suggestions |

|---|---|---|---|

| Wonderful (90-100) | 15-20% | Adheres to hurry limits, maintains protected following distances, makes use of security options, and avoids aggressive maneuvers. | Recurrently overview your car’s security options and keep them. |

| Good (80-89) | 10-15% | Usually follows site visitors guidelines, retains a protected distance from different autos, and makes use of security options as wanted. | Take part in protected driving workshops or on-line programs. |

| Truthful (70-79) | 5-10% | Occasional lapses in protected driving practices, however usually follows site visitors guidelines. | Observe defensive driving strategies. |

| Poor (Beneath 70) | No low cost or potential surcharge | Frequent violations of site visitors legal guidelines, aggressive driving, and unsafe maneuvers. | Search skilled assist for driver enchancment. |

Components Influencing Premiums Primarily based on Driving Conduct

Insurance coverage premiums are influenced by varied elements associated to driving habits. These embody the driving force’s age, driving historical past, the car’s make and mannequin, and the driving force’s location. A driver’s historical past of accidents or site visitors violations considerably impacts their premium charges.

- Driving Historical past: A clear driving report, devoid of accidents or site visitors violations, usually results in decrease premiums. Conversely, a historical past of accidents or site visitors violations could lead to increased premiums.

- Automobile Kind: Sure car fashions are inherently safer than others, and these security options and design are mirrored in insurance coverage premiums.

- Location: Areas with increased accident charges usually have increased insurance coverage premiums because of the elevated threat of collisions.

- Driving Habits: Aggressive driving, rushing, or reckless maneuvers will lead to increased insurance coverage premiums. Conversely, accountable driving practices like adhering to hurry limits and sustaining protected following distances lead to decrease premiums.

Wrap-Up

In conclusion, suppose that you simply work for Gecko Automotive Insurance coverage, understanding their operational specifics is vital for efficient engagement with their clientele. This detailed exploration gives insights into their insurance policies, customer support, pricing methods, and claims processes. By understanding their aggressive place and dedication to innovation, one can higher admire Gecko’s place within the insurance coverage market. This overview empowers knowledgeable decision-making, whether or not as a potential buyer, a competitor, or an trade observer.

Solutions to Widespread Questions

What’s Gecko Automotive Insurance coverage’s distinctive promoting proposition (USP)?

Gecko emphasizes customer-centric service and aggressive pricing. Their method combines modern applied sciences with a dedication to clear communication.

How does Gecko deal with claims disputes?

Gecko employs a multi-step course of, involving mediation and negotiation, aiming for a good and environment friendly decision for all events concerned.

What are the everyday response occasions for buyer inquiries?

Gecko strives for well timed responses. Response occasions depend upon the character of the inquiry and present workload.

Does Gecko supply reductions for protected driving?

Sure, Gecko incentivizes protected driving with reductions for drivers with a clear driving report and adherence to protected driving practices.