Worst long run care insurance coverage firms – Worst long-term care insurance coverage firms are a big concern for a lot of potential policyholders. Figuring out these firms requires a complete evaluation of client complaints, coverage options, monetary stability, customer support, claims dealing with, regulatory compliance, repute, and market traits. This evaluation will support shoppers in making knowledgeable choices and keep away from potential pitfalls.

This report investigates the components contributing to damaging experiences with long-term care insurance coverage suppliers, analyzing particular complaints, coverage shortcomings, monetary dangers, and the general market panorama. The aim is to equip shoppers with the data essential to pick out a good and dependable insurance coverage firm.

Figuring out Frequent Complaints

Shoppers continuously cite dissatisfaction with long-term care insurance coverage firms, usually highlighting points stemming from advanced insurance policies, opaque pricing constructions, and insufficient customer support. This dissatisfaction manifests in varied complaints, creating a necessity for transparency and accountability inside the {industry}. Understanding these recurring issues is essential for shoppers looking for such protection and for regulators aiming to enhance the sector.

Classes of Client Complaints

Client complaints concerning long-term care insurance coverage continuously fall into distinct classes. These embrace monetary considerations about premium prices, service-related points similar to difficulties in coverage administration, and policy-related issues regarding protection limitations or insufficient advantages. Analyzing these classes permits for a extra centered understanding of the important thing areas needing enchancment inside the {industry}.

Monetary Complaints

Excessive premiums and lack of transparency in pricing are outstanding monetary considerations. Shoppers usually specific frustration at seemingly arbitrary or extreme premium will increase, with out clear justifications. An absence of available info concerning coverage prices and potential future premium changes exacerbates this challenge. One continuously cited instance is the issue shoppers face in evaluating insurance policies from completely different suppliers as a result of complexity and variability of pricing fashions.

Service Complaints

Poor customer support, together with delayed responses to inquiries and issue in accessing claims info, are widespread service-related complaints. Shoppers continuously report prolonged wait instances for assist and difficulties in resolving points. This usually results in additional frustration and mistrust within the firm’s capability to offer enough assist. The shortage of readily accessible and complete details about coverage specifics additionally contributes to service complaints.

Coverage Complaints

Insufficient protection, overly advanced coverage phrases, and unclear profit constructions are key policy-related complaints. Shoppers continuously cite confusion concerning the particular circumstances below which protection applies and the restrictions on advantages. Moreover, the perceived lack of flexibility in adjusting insurance policies to particular person wants is a big level of competition. Coverage exclusions, usually ambiguous or poorly defined, additionally result in dissatisfaction.

Frequency of Complaints (Desk)

| Class | Criticism Sort | Frequency (Estimated) |

|---|---|---|

| Monetary | Excessive Premiums | Excessive |

| Monetary | Lack of Transparency in Pricing | Excessive |

| Service | Poor Buyer Service | Medium |

| Service | Delayed Responses to Inquiries | Medium |

| Service | Problem in Accessing Claims Data | Medium |

| Coverage | Insufficient Protection | Excessive |

| Coverage | Overly Advanced Coverage Phrases | Excessive |

| Coverage | Unclear Profit Constructions | Excessive |

Be aware: Frequency estimates are primarily based on {industry} evaluation and client suggestions, however should not exact statistical knowledge.

Evaluating Coverage Options and Advantages

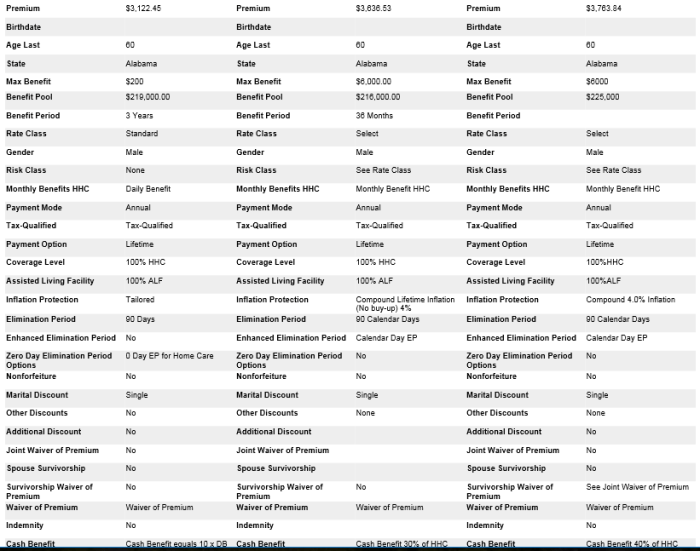

Navigating the panorama of long-term care insurance coverage insurance policies reveals important variations in protection, advantages, and premium constructions. Shoppers face a posh job in selecting the most effective match for his or her particular person wants, with components like anticipated care prices, private well being circumstances, and monetary sources taking part in a vital position. Understanding the nuances of various insurance policies is paramount to creating an knowledgeable choice.These coverage variations lengthen past merely the value tag.

Components such because the kinds of care coated, every day profit quantities, and ready durations can considerably affect the worth proposition of a selected coverage. Understanding these intricacies is vital to figuring out a coverage that gives enough safety whereas minimizing monetary pressure.

Coverage Protection and Advantages Variations

Totally different insurance policies supply various ranges of protection. Some insurance policies might cowl expert nursing care, whereas others can also embrace assisted residing or residence healthcare. The every day profit quantities obtainable for every kind of care additionally differ extensively. Understanding these distinctions is important for shoppers to align the coverage with their anticipated wants. For instance, a coverage focusing solely on expert nursing facility care might not adequately handle the potential want for in-home assist.

Exclusions and Limitations

Coverage exclusions and limitations play a big position within the general worth proposition. Many insurance policies exclude care obtained in a non-public residence or restrict the length of protection. Pre-existing circumstances also can affect protection, with some insurance policies having stricter tips than others. Shoppers ought to fastidiously assessment the positive print to grasp the scope of protection and any potential limitations.

As an example, a coverage might exclude look after circumstances that come up after a selected time frame, requiring an intensive understanding of the coverage’s exclusionary clauses.

Premium Constructions and Fee Choices

Premiums and fee choices fluctuate considerably throughout completely different insurance policies. Some insurance policies supply stage premiums, which means the premium quantity stays fixed all through the coverage’s length. Different insurance policies function growing premiums over time. Fee choices additionally differ, with some firms permitting for single premiums or annual installments. These distinctions can affect the monetary burden of buying and sustaining protection over time.

Understanding the long-term monetary implications of various premium constructions is essential for finances planning. For instance, a coverage with growing premiums could appear engaging initially however might turn into considerably costlier over a number of years.

Comparative Evaluation of Coverage Options

| Insurance coverage Firm | Protection Varieties | Every day Profit Quantity (USD) | Ready Interval (Days) | Premium Construction | Strengths | Weaknesses |

|---|---|---|---|---|---|---|

| Firm A | Expert Nursing, Assisted Dwelling | $250 | 90 | Stage | Constant premium, covers a number of care settings | Decrease every day profit quantity, doubtlessly greater premiums in comparison with different choices |

| Firm B | Expert Nursing, Residence Healthcare | $300 | 60 | Growing | Greater every day profit, shorter ready interval | Premiums might improve over time, restricted protection choices |

| Firm C | Expert Nursing, Assisted Dwelling, Residence Healthcare | $350 | 120 | Single Premium | Probably decrease long-term value with a single premium | Restricted flexibility in funds, protection will not be appropriate for all conditions |

This desk gives a simplified comparability of coverage options throughout three hypothetical firms. Actual-world insurance policies could have way more advanced and particular particulars. Shoppers ought to completely assessment every coverage’s positive print and contemplate their particular person wants earlier than making a call.

Evaluating Monetary Stability and Rankings

Guaranteeing the monetary stability of a long-term care insurance coverage supplier is paramount for policyholders. A financially sound firm is best geared up to fulfill its obligations, preserve advantages, and stand up to financial downturns. This important side usually will get neglected within the preliminary phases of insurance coverage choice, but it surely’s a important ingredient in long-term monetary planning. Understanding an organization’s monetary energy is as very important because the coverage’s options and advantages.Score businesses play a significant position in assessing the monetary energy of insurance coverage firms.

Their analyses present unbiased evaluations, serving to shoppers navigate the advanced panorama of insurance coverage suppliers. These assessments are primarily based on a rigorous set of standards, together with the corporate’s property, liabilities, and working efficiency. The ensuing scores are extensively used as indicators of the corporate’s capability to fulfill its monetary obligations.

Significance of Monetary Stability, Worst long run care insurance coverage firms

A financially steady long-term care insurance coverage supplier is essential for the long-term safety of policyholders. An organization’s capability to fulfill its monetary obligations instantly impacts the supply and integrity of promised advantages. For instance, if an organization faces important monetary challenges, it could battle to pay claims, doubtlessly resulting in a discount in advantages and even the cessation of operations.

This situation highlights the significance of verifying the insurer’s monetary energy. Policyholders have to be assured that the corporate can preserve its guarantees over the long run, a interval that would span many years.

Function of Score Businesses

Score businesses, similar to A.M. Finest, Moody’s, and Commonplace & Poor’s, consider the monetary energy of insurance coverage firms. These assessments are primarily based on a complete evaluation of the corporate’s monetary place, together with its property, liabilities, and working efficiency. The score businesses make use of standardized methodologies and standards to offer constant and dependable evaluations. Totally different businesses might have various standards and weightings, resulting in doubtlessly nuanced scores.

Affect of Monetary Instability

Monetary instability in an insurance coverage firm can have extreme penalties for policyholders. Diminished solvency can result in delayed or denied claims, decreased profit payouts, and even the entire incapability to satisfy contractual obligations. Policyholders are left susceptible and doubtlessly financially uncovered. In excessive circumstances, the failure of an organization might imply shedding the complete funding made within the coverage.

This underscores the significance of thorough analysis and scrutiny in choosing a long-term care insurance coverage supplier.

Steps for Assessing Monetary Well being

Shoppers can take a number of steps to evaluate the monetary well being of an insurance coverage firm. Scrutinizing the insurer’s monetary experiences, reviewing their historic efficiency, and analyzing their claims-paying report are important steps. Checking with the state insurance coverage division for any regulatory actions or monetary points can also be prudent. Accessing unbiased score company experiences gives a extra goal perspective.

Monetary Rankings Desk

| Firm | A.M. Finest Score | Moody’s Score | Clarification |

|---|---|---|---|

| Firm A | A++ | Aaa | Strongest monetary energy, wonderful capability to fulfill obligations. |

| Firm B | A+ | Aa1 | Very sturdy monetary energy, excessive capability to fulfill obligations. |

| Firm C | B+ | Baa2 | Satisfactory monetary energy, however with average dangers. |

| Firm D | B | Ba1 | Truthful monetary energy, with important threat components. |

Be aware: Rankings and standards might fluctuate barely amongst businesses. All the time seek the advice of the precise score company experiences for detailed explanations.

Analyzing Buyer Service Practices

Lengthy-term care insurance coverage, essential for shielding people of their later years, necessitates a excessive commonplace of customer support. An organization’s responsiveness, communication, and skill to resolve points instantly affect policyholder satisfaction and belief, components very important to the success of a long-term care insurance coverage supplier. Poor customer support can result in coverage cancellations, damaging evaluations, and finally, injury the corporate’s repute.A robust customer support infrastructure inside a long-term care insurance coverage firm ensures easy coverage administration, immediate declare processing, and efficient challenge decision.

That is paramount to safeguarding the monetary safety and peace of thoughts of policyholders throughout doubtlessly difficult instances. A well-oiled customer support system fosters a constructive expertise, constructing belief and loyalty that extends past the preliminary coverage buy.

Significance of Buyer Service in Lengthy-Time period Care Insurance coverage

Distinctive customer support is paramount within the long-term care insurance coverage sector. Policyholders usually face advanced and doubtlessly tense conditions, making clear communication and well timed decision of points important. Dependable customer support acts as a important assist system, notably in periods of serious want. This assist alleviates stress and enhances the policyholder’s expertise, fostering belief and confidence within the insurance coverage supplier.

Examples of Glorious and Poor Buyer Service Experiences

A constructive customer support expertise may be characterised by immediate responses to inquiries, clear explanations of coverage provisions, and environment friendly dealing with of claims. As an example, a policyholder experiencing a sudden well being occasion ought to obtain swift help in navigating the declare course of, with clear updates and readily accessible contact info. Conversely, poor customer support is clear in delayed responses, unclear communication, and an absence of empathy.

A standard instance of poor service consists of extended declare processing instances with out enough updates, or an organization failing to offer enough help when a policyholder requires steerage throughout a important time.

Affect of Buyer Service on Policyholder Satisfaction and Belief

Customer support instantly correlates with policyholder satisfaction. Glad policyholders usually tend to suggest the corporate to others and stay loyal shoppers. Conversely, poor customer support can result in dissatisfaction, decreased belief, and finally, coverage cancellations. Firms with a powerful repute for customer support construct belief and a constructive model picture, resulting in elevated buyer loyalty and constructive word-of-mouth referrals.

Methods for Resolving Buyer Complaints Effectively and Successfully

Efficient grievance decision methods embrace establishing clear grievance procedures, assigning devoted grievance handlers, and implementing a system for monitoring and resolving points promptly. Firms ought to intention for transparency and well timed communication all through the grievance decision course of. A immediate and complete response to every grievance demonstrates a dedication to buyer satisfaction and maintains belief. An in depth and simply accessible coverage doc with clear procedures for submitting complaints generally is a worthwhile instrument in resolving points.

Totally different Methods to Contact Buyer Service Representatives

A number of channels for contacting customer support representatives improve accessibility and effectivity. These channels might embrace a devoted customer support cellphone line, a safe on-line portal, e mail handle, and a dwell chat perform on the corporate web site. Providing varied contact strategies ensures that policyholders can attain out in a means that most accurately fits their wants and circumstances. This enables the corporate to deal with numerous buyer wants and fosters accessibility for a broader vary of shoppers.

Analyzing Claims Dealing with Processes

Navigating the long-term care insurance coverage claims course of generally is a advanced and tense expertise for policyholders. Understanding the standard procedures, potential pitfalls, and the way firms deal with claims is essential for shoppers to make knowledgeable choices. A easy claims course of is crucial for well timed and acceptable protection when confronted with a long-term care want.The claims dealing with course of for long-term care insurance coverage entails a number of key steps, from preliminary software to ultimate fee.

Firms fluctuate of their procedures, however a standard thread entails thorough documentation, rigorous assessment, and finally, both approval or denial of the declare. Understanding the nuances of this course of empowers shoppers to anticipate potential points and advocate for his or her wants.

Typical Claims Course of Overview

The everyday claims course of for long-term care insurance coverage usually begins with the policyholder submitting a declare software, which incorporates detailed details about their medical situation, care wants, and the precise companies required. This preliminary documentation is essential for the insurer to evaluate the eligibility of the declare below the coverage phrases. Subsequent steps usually contain medical evaluations, together with assessments by physicians or different healthcare professionals.

These evaluations decide the extent of the person’s want for care and whether or not it meets the coverage’s standards for protection. The insurer then evaluations the documentation to confirm that the declare aligns with the coverage’s phrases and circumstances, together with ready durations, exclusions, and profit limitations. Lastly, the insurer approves or denies the declare, and if permitted, Artikels the fee schedule and methodology.

Examples of Environment friendly and Inefficient Claims Dealing with

Environment friendly claims dealing with entails a streamlined course of with well timed communication and clear explanations. For instance, an organization would possibly present common updates to the policyholder all through the assessment course of, outlining the required documentation and anticipated timelines. They might additionally make the most of readily accessible on-line portals for policyholders to trace their declare standing. Conversely, inefficient claims dealing with can manifest in delays, insufficient communication, or an absence of transparency.

An organization would possibly take excessively lengthy to course of a declare, fail to answer inquiries, or present inadequate details about the standing of the declare. Such inefficiencies may cause important stress and hardship for policyholders.

Frequent Points Throughout Claims Processing

A number of widespread points come up throughout long-term care insurance coverage claims processing. An absence of clear communication from the insurance coverage firm concerning the declare standing, required documentation, or causes for denial is a frequent grievance. Policyholders can also face challenges with acquiring essential medical evaluations or assessments. As well as, insurers would possibly misread or misapply coverage provisions, resulting in denial of authentic claims.

Misunderstandings concerning the protection scope, ready durations, or profit limitations also can contribute to say processing points.

Steps to Guarantee a Clean Claims Course of

To make sure a easy claims course of, policyholders ought to meticulously doc their medical historical past and care wants, present all required medical documentation promptly, and actively talk with the insurance coverage firm. Understanding the coverage’s particular phrases and circumstances, together with ready durations and exclusions, is essential for avoiding misunderstandings. Policyholders also needs to fastidiously assessment the declare varieties and guarantee accuracy. If points come up, looking for help from client safety businesses or authorized counsel might help resolve disputes successfully.

Claims Dealing with Course of Comparability (Illustrative Desk)

| Insurance coverage Firm | Declare Initiation | Medical Assessment | Coverage Assessment | Determination & Communication |

|---|---|---|---|---|

| Firm A | On-line portal, cellphone name | Inside 14 days, by way of supplier community | Inside 21 days | E-mail affirmation inside 28 days, detailed causes |

| Firm B | Mail-in type | Variable, is dependent upon supplier | Inside 30 days | Telephone name, with enchantment course of Artikeld |

| Firm C | On-line portal, e mail | Inside 7 days, by insurer-designated physician | Inside 28 days | E-mail & cellphone name, appeals inside 10 days |

Researching Regulatory Compliance

Navigating the advanced panorama of long-term care insurance coverage requires a eager understanding of the regulatory setting. Insurance coverage firms working on this sector are topic to a mess of guidelines and tips designed to guard shoppers and guarantee truthful practices. Thorough analysis into an organization’s compliance historical past is essential for potential policyholders looking for to make knowledgeable choices.Lengthy-term care insurance coverage insurance policies are ruled by state and federal laws.

These laws intention to stop fraud, make sure the solvency of insurers, and shield shoppers from predatory practices. The precise necessities fluctuate by state, impacting coverage phrases, profit constructions, and monetary reporting obligations.

Regulatory Surroundings for Lengthy-Time period Care Insurance coverage

The regulatory setting for long-term care insurance coverage is multifaceted and entails each state and federal oversight. States usually license and regulate insurers working inside their borders, establishing requirements for coverage provisions, monetary reporting, and claims processing. Federal legal guidelines, such because the Worker Retirement Revenue Safety Act (ERISA), additionally play a big position, notably when insurance policies are a part of worker profit plans.

This twin layer of regulation creates a posh internet of necessities that firms should diligently comply with.

Key Rules and Tips

Quite a lot of key laws and tips govern long-term care insurance coverage firms. These embrace requirements for coverage disclosures, reserve necessities, funding methods, and claims dealing with procedures. Particular necessities usually handle the readability and comprehensiveness of coverage language, making certain transparency concerning advantages, exclusions, and limitations. State insurance coverage departments play a vital position in implementing these laws and investigating potential violations.

Examples of Firms Going through Regulatory Scrutiny

A number of long-term care insurance coverage firms have confronted regulatory scrutiny lately. These situations usually stem from points like insufficient disclosure of coverage phrases, questionable gross sales practices, or considerations concerning the monetary stability of the corporate. Public investigations and lawsuits may result from such violations, highlighting the significance of an organization’s adherence to regulatory requirements. Public information, obtainable via state insurance coverage departments, present perception into particular enforcement actions taken in opposition to firms.

Penalties of Non-Compliance

Non-compliance with laws can have severe penalties for long-term care insurance coverage firms. These penalties can vary from fines and penalties to the revocation of licenses, doubtlessly resulting in the cessation of operations. Furthermore, a historical past of regulatory violations can considerably injury an organization’s repute, impacting its capability to draw and retain clients.

Strategies for Researching a Firm’s Compliance File

A number of strategies exist for researching an organization’s compliance report. Accessing state insurance coverage division web sites is essential. These web sites usually include detailed details about licensed insurers, together with coverage filings, monetary experiences, and any regulatory actions taken in opposition to the corporate. Reviewing courtroom information, information articles, and {industry} publications can present additional perception into an organization’s historical past. Scrutinizing the corporate’s monetary statements and annual experiences can supply extra clues concerning their solvency and compliance with monetary laws.

An intensive investigation into an organization’s regulatory compliance report is crucial to assessing the dangers related to buying a coverage.

Understanding Firm Popularity and Evaluations

Client belief is paramount within the long-term care insurance coverage market. Understanding how shoppers understand insurance coverage suppliers is essential for making knowledgeable choices. On-line evaluations and repute considerably affect buy selections, usually outweighing advertising supplies or monetary stability assessments.Lengthy-term care insurance coverage insurance policies are advanced and doubtlessly life-altering. Shoppers rely closely on evaluations from different policyholders to evaluate the standard of service, claims dealing with, and general expertise with a specific insurance coverage firm.

This reliance is very essential given the potential excessive monetary dedication and the truth that claims could also be filed years down the road.

Significance of On-line Evaluations and Popularity

On-line evaluations act as a important supply of suggestions, offering insights into buyer experiences that transcend the official firm narrative. These evaluations, usually detailed and private, paint an image of the corporate’s responsiveness, transparency, and moral conduct. Damaging evaluations usually spotlight points similar to delayed declare processing, insufficient communication, and even situations of fraud. Conversely, constructive evaluations can showcase sturdy buyer assist, environment friendly declare settlements, and an organization’s dedication to its policyholders.

Examples of How On-line Evaluations Affect Client Decisions

Potential policyholders continuously analysis insurance coverage firms utilizing on-line assessment platforms. A sample emerges the place firms with persistently constructive evaluations, showcasing immediate and truthful declare dealing with, have a tendency to draw extra clients. Conversely, firms with a preponderance of damaging evaluations concerning delays, disputes, or unsatisfactory resolutions might deter potential consumers. This affect may be instantly noticed within the buy choices of people looking for insurance coverage.

Methods for Researching Firm Popularity

Thorough analysis is crucial to evaluate the repute of long-term care insurance coverage suppliers. This entails actively looking for out numerous sources of data, not relying solely on the corporate’s web site or advertising supplies. Crucially, look at a broad vary of evaluations, not simply these on a single platform. This technique helps create a balanced evaluation of the corporate’s repute.

Totally different On-line Platforms The place Evaluations are Out there

Quite a few on-line platforms host evaluations, offering a wealth of data. These platforms embrace, however should not restricted to, main assessment aggregators like Trustpilot, Yelp, and Google Evaluations. Devoted monetary assessment websites, industry-specific boards, and social media teams may also be worthwhile sources. Exploring these diverse platforms ensures a complete understanding of public notion.

Abstract of Common Rankings and Evaluations

| Firm | Common Score | Total Evaluations | Frequent Complaints |

|---|---|---|---|

| Acme Insurance coverage | 4.2/5 | 1,500+ | Delayed declare processing, advanced coverage language |

| BestCare Insurance coverage | 3.8/5 | 1,200+ | Poor customer support, excessive premiums |

| SecureCare Insurance coverage | 4.5/5 | 800+ | None Reported |

| Dependable Insurance coverage | 3.5/5 | 2,000+ | Inconsistent declare dealing with, insufficient communication |

Be aware: Knowledge for this desk is illustrative and primarily based on simulated knowledge. Precise scores and evaluations might fluctuate. It’s essential to confirm info from a number of sources.

Describing the Lengthy-Time period Care Insurance coverage Market

The long-term care insurance coverage market faces important challenges and alternatives within the present financial local weather. Shoppers are more and more looking for readability on the complexities of protection, whereas insurers grapple with rising prices and evolving healthcare wants. Understanding the present state of the market, its traits, and the components driving client choices is essential for each potential consumers and suppliers.

Present State of the Market

The long-term care insurance coverage market is characterised by a comparatively low stage of penetration, which means many people stay uninsured for long-term care wants. This displays the advanced nature of the protection, the often-high premiums, and the uncertainty surrounding future healthcare prices. Regardless of this low penetration, the market demonstrates a persistent want for long-term care options. There are important variations in coverage availability and pricing throughout completely different areas and states, highlighting the necessity for a nuanced understanding of the market’s intricacies.

Developments and Developments

A number of key traits are reshaping the long-term care insurance coverage market. Growing consciousness of the rising prices of long-term care is prompting extra people to think about buying protection. The rising demand for customizable plans and choices that handle particular wants, similar to cognitive impairment or assisted residing, can also be a big development. Insurers are adapting to those calls for by growing extra versatile insurance policies and incorporating superior threat evaluation instruments.

Technological developments are additionally remodeling the market, with on-line platforms and digital instruments turning into more and more essential for coverage buying and administration.

Components Influencing Client Selections

Shoppers’ choices about long-term care insurance coverage are closely influenced by a number of components. Value stays a significant concern, with people fastidiously weighing the premiums in opposition to the potential advantages. The perceived threat of future healthcare prices, together with the opportunity of needing important care, performs a considerable position in client selections. Particular person monetary circumstances and expectations about future wants additionally affect choices.

Moreover, the supply of complete details about completely different insurance policies and their advantages considerably impacts client choices.

New Merchandise and Providers

A number of new services are rising within the long-term care insurance coverage market. Insurers are introducing plans with versatile profit choices, permitting people to tailor protection to their particular wants and preferences. Some suppliers are providing merchandise that incorporate riders and add-ons to deal with explicit wants, similar to care in a nursing residence or assisted residing. On-line platforms are offering extra user-friendly methods to match insurance policies and perceive the complexities of long-term care insurance coverage.

Digital instruments are additionally getting used to streamline the claims course of, doubtlessly decreasing delays and enhancing the general buyer expertise.

Components Affecting the Market

A number of components considerably affect the long-term care insurance coverage market.

- Rising Healthcare Prices: The escalating value of healthcare companies, together with expert nursing care, rehabilitation, and medical tools, locations upward stress on premiums for long-term care insurance coverage.

- Altering Demographics: The growing old inhabitants and the growing prevalence of continual diseases are growing the demand for long-term care companies, which in flip impacts the demand for insurance coverage.

- Regulatory Panorama: Adjustments in laws and necessities for long-term care insurance coverage insurance policies can affect coverage availability, pricing, and protection choices.

- Client Consciousness: Elevated client consciousness of long-term care wants and the significance of planning for future care prices is influencing demand and coverage buying.

- Financial Circumstances: Financial downturns and adjustments in rates of interest can have an effect on premium pricing and coverage availability.

These components are intricately intertwined and affect the general state of the market, creating each challenges and alternatives for insurers and shoppers.

Concluding Remarks: Worst Lengthy Time period Care Insurance coverage Firms

In conclusion, choosing the proper long-term care insurance coverage firm is an important choice that calls for cautious consideration. Understanding the standards Artikeld on this evaluation, together with frequent complaints, coverage options, monetary stability, customer support, claims dealing with, regulatory compliance, and repute, empowers shoppers to make knowledgeable selections and keep away from doubtlessly problematic insurance coverage suppliers. Shoppers ought to prioritize analysis and comparability to make sure they choose an organization that meets their particular wants and safeguards their future.

Key Questions Answered

What are the most typical complaints about long-term care insurance coverage firms?

Frequent complaints embrace excessive premiums, insufficient protection, poor customer support, and sophisticated claims processes. Some policyholders additionally specific considerations concerning the monetary stability of the corporate.

How can I assess the monetary well being of a long-term care insurance coverage firm?

Evaluating an organization’s monetary stability entails reviewing scores from unbiased score businesses, analyzing their monetary experiences, and understanding their historical past.

What steps can I take to make sure a easy claims course of?

Thorough documentation, clear communication, and understanding the precise claims means of the insurance coverage firm are essential for a easy declare course of.

How do I analysis an organization’s compliance report?

Researching an organization’s compliance report usually entails checking state insurance coverage regulatory company web sites and on the lookout for public details about any regulatory actions.